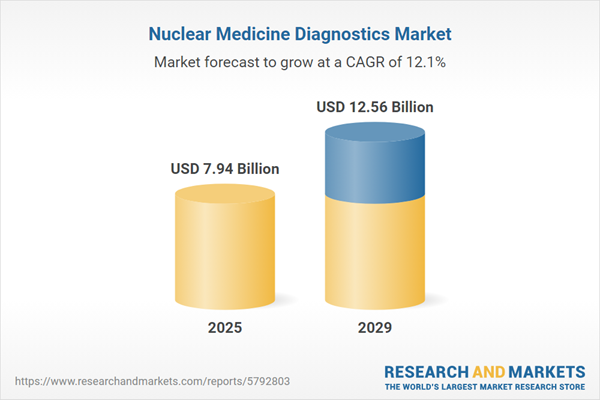

The nuclear medicine diagnostics market size is expected to see rapid growth in the next few years. It will grow to $12.56 billion in 2029 at a compound annual growth rate (CAGR) of 12.1%. The growth in the forecast period can be attributed to expanding applications in neurology, integration with other imaging modalities, precision medicine approaches, rising demand for theranostics, global efforts in disease eradication. Major trends in the forecast period include shift towards small-scale, decentralized radiopharmacy, application of nuclear medicine in neurology, radiomics and quantitative imaging analysis, collaborations for research and development, emphasis on radiation safety and dosimetry.

The anticipated growth of the nuclear medicine diagnostics market is driven by a rising demand for these diagnostic techniques. Nuclear medicine utilizes radioactive substances within the body for diagnosing illnesses and for targeted removal of diseased or damaged organs and tissues during treatment. The applications of nuclear medicine diagnostics are predominantly in radiation and other life-saving treatments. The increasing demand for these diagnostics is attributed to their advantages, including accurate results and enhanced treatment decision-making capabilities. As reported in April 2022 by the World Nuclear Association, a UK-based international organization advocating for nuclear power, the annual number of nuclear medicine treatments surpasses 40 million, with the demand for radioisotopes witnessing a yearly growth rate of up to 5%. Notably, over 90% of procedures involving radioisotopes in medicine are conducted in more than 10,000 hospitals worldwide. This surge in demand underscores the pivotal role of nuclear medicine diagnostics, contributing to the anticipated growth of the nuclear medicine diagnostics market.

The increasing incidence of cancer is anticipated to drive the growth of the nuclear medicine diagnostics market in the coming years. Cancer refers to a collection of diseases characterized by the uncontrolled proliferation and spread of abnormal cells, which can lead to the formation of tumors. Nuclear medicine diagnostics plays a crucial role in detecting, staging, and monitoring various cancer types by using radioactive substances that can be identified by specialized cameras, producing detailed images of the internal structures and functions of organs and tissues. For example, in January 2023, the National Center for Biotechnology Information, a US-based intergovernmental organization, reported that there were 1,958,310 new cancer cases and 609,820 cancer-related deaths in the United States that year. Thus, the rising number of cancer cases is fueling the expansion of the nuclear medicine diagnostics market.

Prominent companies in the nuclear medicine diagnostics market are strategically focusing on the introduction of advanced solutions, particularly advanced medical technologies, to establish a competitive advantage. Advanced medical technologies represent cutting-edge innovations within the medical field, aimed at improving patient outcomes, elevating the standard of care, and fostering overall health improvement. An illustrative example is Gleneagles Hospital, a Malaysia-based company providing medical and healthcare services. In August 2023, the hospital introduced a Nuclear Medicine Unit, showcasing its commitment to advanced medical technologies. This specialized unit, equipped with state-of-the-art technology and staffed by highly skilled professionals, is designed to facilitate early detection, diagnosis, and treatment of diseases through nuclear medicine imaging techniques. Such initiatives by major companies underscore the industry's dedication to advancing technology and enhancing medical capabilities within the nuclear medicine diagnostics market.

Major companies in the nuclear medicine diagnostics market are actively pursuing strategic partnerships as a key approach to securing a competitive edge. Strategic partnerships involve collaborative efforts between two or more entities with the goal of achieving mutually advantageous objectives by combining resources and expertise. A noteworthy example occurred in June 2023, where RLS Inc., a US-based nuclear medicine provider, entered into a strategic partnership with SOFIE, a US-based molecular imaging company. Through this collaboration, RLS Inc. aims to enhance the distribution of nuclear medicine doses to patients, hospitals, teaching institutions, and doctors, thereby improving the overall continuum of care for patients. This strategic partnership will streamline patient dose preparation, capitalizing on the accredited radiopharmacy network and expertise of both entities involved. Such initiatives underscore the industry's commitment to fostering collaboration and leveraging collective strengths to drive advancements in the nuclear medicine diagnostics market.

In January 2022, Eckert & Ziegler, a Germany-based provider of isotope technology for medical, scientific, and industrial applications, successfully acquired Tecnonuclear SA for an undisclosed sum. This strategic acquisition positions Eckert & Ziegler to broaden its footprint and enhance essential healthcare services in Brazil and across South America. Tecnonuclear SA, an Argentina-based specialist in nuclear medicine, brings valuable expertise and resources to strengthen Eckert & Ziegler's presence in the region, aligning with the company's commitment to advancing isotope technology for medical applications.

Major companies operating in the nuclear medicine diagnostics market include Siemens AG, Bayer Aktiengesellschaft, Novartis AG, GE Healthcare Technologies Inc., Perkin Elmer Inc., Mallinckrodt Pharmaceuticals, Bracco Diagnostics Inc., Lantheus Holdings Inc., IBA Radiopharma Solutions, Curium SAS, Cardinal Health Inc., Eckert & Ziegler Strahlen- und Medizintechnik AG, Advanced Accelerator Applications, Telix Pharmaceuticals Limited, Nordion (Canada) Inc., NorthStar Medical Technologies LLC, SHINE Medical Technologies LLC, Navidea Biopharmaceuticals Inc., Cyclopharm Limited, Isologic Innovative Radiopharmaceuticals, Clarity Pharmaceuticals Limited, Actinium Pharmaceuticals Inc., Jubilant DraxImage Inc., PharmaLogic Holdings Corp, Institute of Isotopes Co Ltd., Global Medical Solutions LLC, Theragnostics Ltd., Eczacıbaşı-Monrol Nuclear Products Co.

North America was the largest region in the nuclear medicine diagnostics market in 2024. The regions covered in the nuclear medicine diagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the nuclear medicine diagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Nuclear medicine employs radioactive substances administered internally to diagnose illnesses or selectively target and eliminate diseased or damaged organs and tissues during treatment. This field encompasses the utilization of radioactive drugs for research, therapeutic, and diagnostic objectives. In diagnostic nuclear medicine, radioactive tracers are employed to visualize and/or measure the overall or localized function of specific organs, providing valuable insights for medical diagnosis and treatment planning.

The primary categories of nuclear medicine diagnostics encompass SPECT radiopharmaceuticals and PET radiopharmaceuticals. SPECT Radiopharmaceuticals, or single-photon emission computerized tomography, pertain to gamma-ray tomographic imaging techniques employed in the field of nuclear medicine. These methods find application in diverse medical areas such as cardiology, thyroid, neurology, oncology, among others. End-users of these diagnostic technologies include hospitals, diagnostic centers, and research institutes.

The nuclear medicine diagnostics market research report is one of a series of new reports that provides nuclear medicine diagnostics market statistics, including nuclear medicine diagnostics industry global market size, regional shares, competitors with nuclear medicine diagnostics market share, detailed nuclear medicine diagnostics market segments, market trends, and opportunities, and any further data you may need to thrive in the nuclear medicine diagnostics industry. This nuclear medicine diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The nuclear medicine diagnostics market consists of sales of renal scan, bone scan, gallium scan, heart scan, brain scan and breast scan diagnostics. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Nuclear Medicine Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on nuclear medicine diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for nuclear medicine diagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The nuclear medicine diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: SPECT Radiopharmaceuticals; PET Radiopharmaceuticals2) By Application: Cardiology; Thyroid; Neurology; Oncology; Other Applications

3) By End-User: Hospitals and Diagnostic Centers; Research Institutes

Subsegments:

1) By SPECT Radiopharmaceuticals: Technetium-99m-Based Radiopharmaceuticals; Iodine-123-Based Radiopharmaceuticals; Thallium-201-Based Radiopharmaceuticals; Other SPECT Radiopharmaceuticals2) By PET Radiopharmaceuticals: Fluorine-18-Based Radiopharmaceuticals; Carbon-11-Based Radiopharmaceuticals; Gallium-68-Based Radiopharmaceuticals; Other PET Radiopharmaceuticals

Key Companies Mentioned: Siemens AG; Bayer Aktiengesellschaft; Novartis AG; GE Healthcare Technologies Inc.; Perkin Elmer Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens AG

- Bayer Aktiengesellschaft

- Novartis AG

- GE Healthcare Technologies Inc.

- Perkin Elmer Inc.

- Mallinckrodt Pharmaceuticals

- Bracco Diagnostics Inc.

- Lantheus Holdings Inc.

- IBA Radiopharma Solutions

- Curium SAS

- Cardinal Health Inc.

- Eckert & Ziegler Strahlen- und Medizintechnik AG

- Advanced Accelerator Applications

- Telix Pharmaceuticals Limited

- Nordion (Canada) Inc.

- NorthStar Medical Technologies LLC

- SHINE Medical Technologies LLC

- Navidea Biopharmaceuticals Inc.

- Cyclopharm Limited

- Isologic Innovative Radiopharmaceuticals

- Clarity Pharmaceuticals Limited

- Actinium Pharmaceuticals Inc.

- Jubilant DraxImage Inc.

- PharmaLogic Holdings Corp

- Institute of Isotopes Co Ltd.

- Global Medical Solutions LLC

- Theragnostics Ltd.

- Eczacıbaşı-Monrol Nuclear Products Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.94 Billion |

| Forecasted Market Value ( USD | $ 12.56 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |