Massive infrastructure investments worldwide are fueling the growing demand for off-highway vehicles. China’s Belt and Road Initiative (BRI) has provided USD 679 billion for global projects in transportation and energy, boosting the need for construction & mining machinery. Similarly, in January 2025, the U.S. RAISE program allocated USD 1.32 billion to modernize roads and bridges, increasing demand for earthmoving and material-handling equipment. These initiatives highlight the growing reliance on off-highway vehicles to support large-scale infrastructure expansion.

The industry is driven by the need for more efficient and technologically advanced mining equipment as global mineral extraction intensifies. For instance, India is a major producer of coal, iron ore, and bauxite and relies heavily on open-pit mining, which makes up 90% of its mining operations. This has led to a surging demand for high-performance haul trucks, excavators, and drilling machines to improve efficiency and reduce costs. Additionally, India’s 100% FDI policy in mining is accelerating investment in automated and fuel-efficient mining equipment, further boosting the adoption of next-generation off-highway vehicles for large-scale extraction activities.

Rising labor shortages, increasing food demand, and government incentives are driving rapid mechanization in agriculture. For instance, India’s Sub-Mission on Agricultural Mechanization (SMAM) provides up to 50% financial assistance for purchasing equipment and setting up Custom Hiring Centres to improve small farmers’ access to machinery. Similarly, China has achieved a 72% mechanization rate in crop cultivation and harvesting, reflecting a global push toward automation. Advanced off-highway agricultural vehicles, including tractors, harvesters, and autonomous planting systems, are needed to improve efficiency, increase yields, and reduce costs. This shift is supporting demand for mechanization, shaping the future of the agricultural equipment market.

High initial costs and strict emission regulations remain key challenges in the off-highway vehicle market. For instance, the European Union's Stage V emission standards impose stringent limits on particulate matter and NOx emissions for non-road mobile machinery, increasing compliance costs for manufacturers. The U.S. Environmental Protection Agency’s (EPA) Tier 4 regulations require advanced exhaust after-treatment systems, adding to equipment costs. Additionally, the transition to electric and hybrid powertrains demands significant investment in R&D and infrastructure, further raising initial expenses.

Global Off-highway Vehicles Market Report: Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, the analyst has segmented the global off-highway vehicles market report based on type, propulsion type, and region.Type Outlook (Revenue, USD Million, 2018-2030)

- Construction

- Mining

- Agriculture

Propulsion Type Outlook (Revenue, USD Million, 2018-2030)

- ICE

- Electric

Regional Outlook (Revenue, USD Million, 2018-2030)

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Why Should You Buy This Report?

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Off-highway Vehicles market report include:- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- CNH Industrial N.V.

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Volvo Group (AB Volvo)

- XCMG Group

- Kubota Corporation

- SANY Group

Table Information

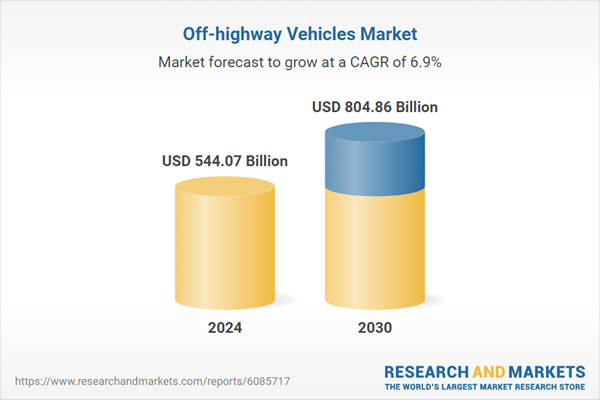

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 544.07 Billion |

| Forecasted Market Value ( USD | $ 804.86 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |