Global OLED TV Market - Key Trends & Drivers Summarized

What Is Driving the Popularity of OLED TVs in the Global Market?

OLED (Organic Light Emitting Diode) TVs represent one of the most advanced forms of display technology available today, offering superior picture quality, deeper blacks, vibrant colors, and wider viewing angles compared to traditional LED and LCD TVs. Unlike LED-backlit TVs, OLED screens do not require a backlight because each pixel emits its own light. This self-illumination allows OLED TVs to achieve remarkable contrast ratios and makes them ideal for a more immersive viewing experience. With these key attributes, OLED TVs have found increasing applications in both residential and commercial sectors, driving their rapid adoption. However, OLED TVs are not just another premium product; they are at the forefront of innovation in the television market, offering unique features such as ultra-thin displays, flexible screens, and enhanced energy efficiency. The technological superiority of OLED displays sets the stage for significant consumer interest and rising demand globally.How Are Technological Innovations Shaping the OLED TV Market?

OLED TV technology has witnessed continuous improvements, making it more accessible to a broader range of consumers. One of the major breakthroughs has been the development of larger OLED panels, including 77-inch and 83-inch models, catering to the growing demand for home theaters and high-end entertainment systems. Moreover, innovations like 8K OLED displays, which offer even higher resolution and crisper images, are rapidly gaining traction among consumers looking for next-generation viewing experiences. Manufacturers are also increasingly focusing on integrating OLED displays with smart TV features, such as voice assistants, AI-driven picture enhancement, and seamless connectivity with other smart home devices. These technological advancements, along with efforts to reduce production costs through automation and scaling of manufacturing processes, are making OLED TVs more affordable, further driving market penetration. The competition between major OLED TV manufacturers such as LG, Sony, and Samsung is also fostering a cycle of continuous innovation, ensuring that newer models offer enhanced performance with each generation.Why Are Consumer Preferences Shifting Towards OLED TVs?

Changing consumer preferences, especially toward high-quality content consumption and home entertainment, are a major driver of OLED TV demand. As more consumers opt for streaming services like Netflix, Disney+, and Amazon Prime Video, there is growing interest in TV models that can fully capture the visual detail and dynamic range of 4K and HDR content. OLED TVs are particularly well-suited for this, offering the perfect canvas for high-resolution and high-dynamic-range video, making movie nights and binge-watching more immersive than ever. Additionally, as video gaming continues to rise in popularity, OLED's fast response time and low input lag make it a top choice for gamers who prioritize smooth, lag-free gameplay. Furthermore, the rise in remote work and telecommuting has also shifted consumer spending towards home entertainment and multimedia systems, prompting more investment in premium TV models such as OLEDs. The aesthetic appeal of OLED TVs, including their slim profiles and flexible form factors, also resonates with consumers looking to enhance the modern, sleek design of their living spaces.What Factors Are Driving Growth in the OLED TV Market?

The growth in the OLED TV market is driven by several factors, each contributing uniquely to its rapid adoption. First and foremost is the constant technological innovation, with manufacturers continuously improving the performance of OLED panels, such as through higher brightness, improved burn-in prevention, and longer lifespan, all of which enhance the product's reliability. The expanding availability of large-screen OLEDs has also opened new avenues in both residential and commercial markets, from luxury home theaters to professional settings like conference rooms and digital signage. In addition, the rise in 4K and 8K content consumption, coupled with the popularity of streaming services and next-generation gaming consoles, has heightened the demand for OLED displays that can support high-quality visuals. Consumer preferences are also shifting towards premium and eco-friendly electronics, as OLEDs consume less power than traditional LED screens, aligning with the growing global focus on sustainability. Finally, increased competition among key industry players has led to more competitive pricing strategies, which are bringing OLED technology within reach of a wider audience, fueling further market growth.Report Scope

The report analyzes the OLED TV market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (AMOLED (Active Matrix OLED), PMOLED (Passive Matrix OLED)).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the AMOLED (Active Matrix OLED) TV segment, which is expected to reach US$46.7 Billion by 2030 with a CAGR of 16.9%. The PMOLED (Passive Matrix OLED) TV segment is also set to grow at 13.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5 Billion in 2024, and China, forecasted to grow at an impressive 21.1% CAGR to reach $13 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global OLED TV Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global OLED TV Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global OLED TV Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Haier Group, Konka Group Co., Ltd., LG Electronics Inc., Panasonic Corporation, Samsung Electronics Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this OLED TV market report include:

- Haier Group

- Konka Group Co., Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Haier Group

- Konka Group Co., Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

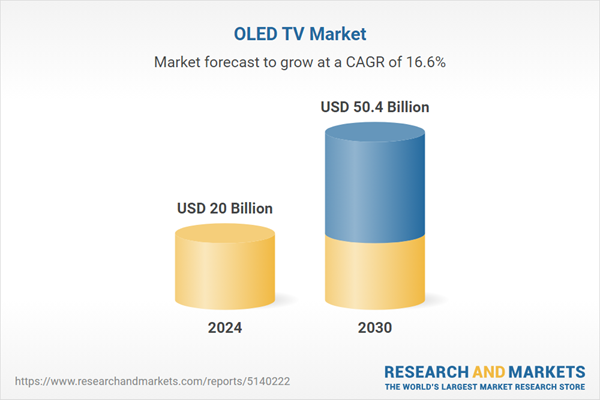

| Estimated Market Value ( USD | $ 20 Billion |

| Forecasted Market Value ( USD | $ 50.4 Billion |

| Compound Annual Growth Rate | 16.6% |

| Regions Covered | Global |