Online education refers to the form of learning that takes place over the internet, allowing students to access educational content and participate in courses from anywhere in the world. Its rise to popularity has been significant, driven by advancements in technology and the growing availability of the internet.

One primary appeal of online education is its flexibility. Students can learn at their own pace, fitting their studies around personal and professional commitments. This flexibility is especially attractive to working adults, parents, and those in remote locations who might not have access to traditional educational institutions.

Additionally, online education offers a wide range of programs and courses, from certifications to full degree programs, catering to diverse interests and career goals. The COVID-19 pandemic further accelerated its growth, as many educational institutions were forced to move online, showcasing the potential and effectiveness of digital learning environments.

As a result, millions of learners now prefer online education, fostering a global community where knowledge can be shared and acquired without geographical barriers. This shift underscores a significant transformation in how we perceive and engage with education today.

Top Manufacturers

Coursera Inc.

Founded: 2012Headquarters: United States

Coursera Inc (Coursera) is an online learning platform that collaborates with universities and companies to provide access to online courses and degree programs. The company offers educational opportunities, such as hands-on projects, job-ready certificates, and degree programs. It also offers professional certificates, MasterTrack Certificates, and online degrees. Coursera provides recorded video lectures, video quizzes, auto-graded, peer-reviewed assignments, and community discussion forums. The company serves individual learners, businesses, universities, and government organizations.

Instructure Holding Inc.

Founded: 2008Headquarters: United States of America

Instructure Inc (Instructure), a subsidiary of Thoma Bravo LP, is an education technology company that primarily focuses on developing learning management systems. The company's main product is the Canvas Learning Management System (LMS), which is designed to facilitate teaching and learning experiences. Instructure primarily provides learning management applications Canvas, an application designed for kindergarten to grade 12 (K-12) and higher education customers, and Bridge, an application designed for corporate customers.

Adobe Inc.

Founded: 1982Headquarters: United States of America

ADOBE Inc (Adobe) provides products, services, and solutions that enable individuals and enterprises to create, publish and promote their content. The company's products and services are used by creative professionals, knowledge workers, students, marketers, application developers, consumers, and enterprises to create, manage, deliver, measure, optimize, engage, and transact with compelling content and experiences spanning devices, personal computers, and media. The company markets its products and services through its own sales force and local field offices. It distributes products through distributors, mobile app stores, hardware bundle customers, systems integrators, independent software vendors, value-added resellers, software developers, retailers and original equipment manufacturers (OEMs). The company's business operations span the Americas, Europe, the Middle East and Africa and Asia-Pacific.

Alphabet Inc.

Founded: 2015Headquarters: United States of America

Alphabet Inc (Alphabet), the holding company of Google, is a global technology company. It offers a wide range of products and platforms including Google Search, Google Maps, calendar, ads, Gmail, Google Play, Android, Google Cloud, Chrome, Google Display & Video 360, Google Marketing Platform, and YouTube. It also offers hardware products such as Pixel phones, smartwatches, and Google Nest home products. The company offers online advertising services through its Google Network services. Google Network properties include AdSense, Google Ad Manager, and AdMob. It also offers internet services, subscription-based products, apps and in-app purchases, and licensing and research and development services. Alphabet invests in infrastructure, data, machine learning, analytics, and artificial intelligence. The company has business presence across the Americas, Europe, the Middle East, and Africa, and Asia-Pacific.

Udemy

Founded: 2010Headquarters: United States of America

Udemy Inc. (Udemy) is an education and technology company that operates as an online learning platform. The company's main activities include providing a marketplace for educational courses and training programs. The company offers courses across various subjects, including technical, business, soft skills, finance, marketing, lifestyle, photography and video, information technology, and software, among others. It markets its courses under the Udemy brand name. Udemy's courses are utilized by individual students, professionals, and companies. The company operates in the US, Australia, India, Canada, and Mexico.

Product Launches

Pearsons Inc.

June 2023: Pearson, the world's leading learning company, announced today that Connections Academy, its K-12 online school program, will expand its offerings to include more college and career readiness initiatives for middle and high school students. These initiatives will feature partnerships with several organizations, including Coursera, a global online learning platform; Acadeum, the largest course-sharing network in higher education; e-Dynamic Learning, a provider of career technical education for middle and high school students; and Credly, a global leader in digital credentialing.Stride Inc.

Jan 2023, Over a year into the new normal of K-12 education, many families and school leaders in the U.S. are seeing students struggle. Research indicates that learning loss could have long-term effects on student performance and potential earnings. To address this, Stride, Inc. has launched Stride Tutoring, an online platform offering one-on-one academic support. Unique in requiring all tutors to be active, state-certified teachers, Stride Tutoring provides access to hundreds of educators regardless of a student's school or location.SWOT Analysis of Company

Pluralsight Inc.

Strengths: Specialized focus on technology and skill-based learning for professionalsPluralsight Inc.’s greatest strength in the online education market lies in its specialized focus on technology and skill-based learning for professionals. The company has established itself as a global leader in delivering high-quality, expert-led courses in areas such as software development, cloud computing, cybersecurity, and data analytics. Its powerful learning platform and analytics tools enable enterprises to assess, track, and improve employee competencies, making it a preferred partner for corporate training. Pluralsight’s adaptive learning technology and Skill IQ assessments offer personalized learning paths that enhance user engagement and efficiency. The company’s collaborations with major tech firms - such as Microsoft, Google, and AWS - ensure that its content remains current and industry-relevant. Furthermore, its subscription-based business model provides scalability and recurring revenue stability. By combining technical depth, data-driven insights, and corporate partnerships, Pluralsight has built a strong reputation as a trusted provider of professional upskilling in the digital economy.

edX (2U, Inc.)

Strengths: Academic credibility, global reach, and partnerships with leading universities

edX, now part of 2U, Inc., holds a major strength in the online education market through its academic credibility, global reach, and partnerships with leading universities. Founded by MIT and Harvard, edX has earned strong trust for providing high-quality, accredited online learning through collaboration with over 160 top institutions worldwide. Its platform offers diverse learning options - ranging from free MOOCs to professional certificates and full online degrees - catering to learners at every stage of their education and career. The integration with 2U strengthens edX’s technological capabilities, marketing power, and scalability, enabling a seamless blend of academic rigor and digital accessibility. edX’s open-source platform, combined with its mission to expand affordable education globally, enhances inclusivity and impact. Its strong brand equity, academic partnerships, and proven learning outcomes position edX (2U, Inc.) as a global leader driving innovation, accessibility, and credibility in the online higher education ecosystem.

Recent Development in Global Online Education Market

Simplilearn Solutions

Dec 2024, Simplilearn, a global leader in digital upskilling, is proud to announce its recognition in the 2024 Top IT and Technical Training Companies List by Training Industry. This honor highlights Simplilearn's ongoing commitment to providing comprehensive and innovative training solutions that equip professionals and enterprise teams with the skills and expertise needed to succeed in today's rapidly changing tech landscape. For the sixth time since 2017, Simplilearn has been acknowledged for its significant contributions to the e-learning field.Teachable Inc.

Oct. 2025, Teachable, the leading platform for modern education businesses built on real-world expertise, has announced a comprehensive rebrand along with a refined product vision that caters to the evolving ways people learn today. As the company enters its next decade of growth, this new identity and vision underscore Teachable's commitment to providing education that delivers tangible results and aligns with the daily lives of modern learners.Sustainability Goal

Duolingo Inc.

Duolingo Inc. integrates sustainability into its broader mission of accessible education and responsible digital growth. Its sustainability goals focus on reducing the company’s environmental footprint while advancing social sustainability through equitable education. Duolingo’s operations prioritize carbon efficiency, leveraging cloud-based infrastructure and digital delivery to minimize physical resource consumption. The company also emphasizes inclusivity and global access, offering free language learning to millions, thereby promoting social equity and lifelong learning opportunities. Duolingo’s sustainable design approach ensures long-term platform scalability with minimal environmental impact. Internally, the company fosters diversity, ethical governance, and employee well-being, reinforcing its social sustainability commitments. By investing in renewable-powered data systems, remote-first work policies, and community initiatives supporting digital literacy, Duolingo aligns technology innovation with environmental and societal responsibility. Its ultimate goal is to make education both sustainably delivered and universally accessible, creating long-term value for learners and the planet.Byju’s (India)

BYJU’S sustainability goals revolve around educational equity, digital inclusion, and environmentally responsible operations. As one of India’s leading edtech companies, BYJU’S aims to make quality education accessible to all, especially in underserved communities, while minimizing its ecological footprint. The company’s digital learning model inherently supports sustainability by reducing dependence on paper, printed materials, and physical infrastructure. BYJU’S also invests in energy-efficient technologies, cloud optimization, and responsible e-waste management to reduce its operational carbon emissions. Social sustainability is central to its strategy - through initiatives like BYJU’S Education for All, the company provides free learning resources to millions of students from low-income backgrounds. Furthermore, BYJU’S fosters a sustainable workplace culture by promoting diversity, employee growth, and ethical governance. By aligning innovation with responsibility, BYJU’S strives to create a balanced ecosystem that promotes learning, reduces environmental impact, and contributes to a more inclusive and sustainable global education landscape.

Market Segmentation

Online Education Market

- Historical Trends

- Forecast Analysis

Market Share Analysis - Online Education Market

Coursera Inc

Overview

- Company History and Mission

- Business Model and Operations

Workforce

Key Persons

- Executive Leadership

- Operational Management

- Division Leaders

- Board Composition

Recent Development & Strategies

- Mergers & Acquisitions

- Partnerships

- Investments

Sustainability Analysis

- Renewable Energy Adoption

- Energy-Efficient Infrastructure

- Use of Sustainable Packaging Materials

- Water Usage and Conservation Strategies

- Waste Management and Circular Economy Initiatives

Product Analysis

- Product Profile

- Quality Standards

- Product Pipeline

- Product Benchmarking

Strategic Assessment: SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

Revenue Analysis

The above information will be available for all the following companies:

- Coursera Inc

- Instructure Holding Inc.

- Adobe Inc.

- Alphabet Inc.

- Udemy

- Pearsons Inc.

- Stride Inc.

- NetEase Inc.

- LinkedIn Learning (Microsoft)

- Pluralsight Inc.

- edX (2U, Inc.)

- Skillshare Inc.

- Byju’s (India)

- Duolingo Inc.

- Khan Academy

- Blackboard Inc.

- Simplilearn Solutions

- Teachable Inc.

- Thinkific Labs Inc.

- Udacity Inc.

Table of Contents

Companies Mentioned

- Coursera Inc

- Instructure Holding Inc.

- Adobe Inc.

- Alphabet Inc.

- Udemy

- Pearsons Inc.

- Stride Inc.

- NetEase Inc.

- LinkedIn Learning (Microsoft)

- Pluralsight Inc.

- edX (2U, Inc.)

- Skillshare Inc.

- Byju’s (India)

- Duolingo Inc.

- Khan Academy

- Blackboard Inc.

- Simplilearn Solutions

- Teachable Inc.

- Thinkific Labs Inc.

- Udacity Inc.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

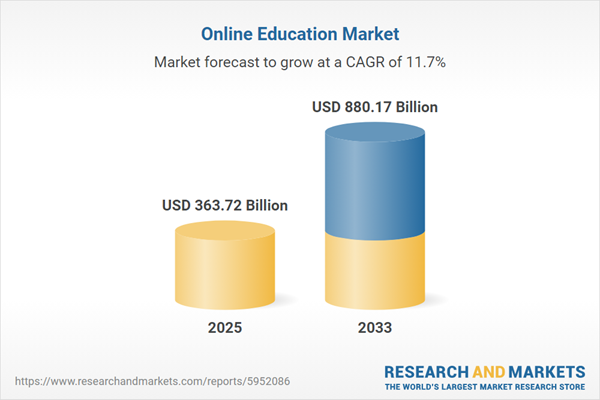

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | December 2025 |

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 363.72 Billion |

| Forecasted Market Value ( USD | $ 880.17 Billion |

| Compound Annual Growth Rate | 11.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |