Global Organic Substrates Market - Key Trends & Drivers Summarized

What Are Organic Substrates & Why Are They Essential in Electronics Manufacturing?

Organic substrates are base materials used in the manufacturing of semiconductor devices, microelectronic components, and printed circuit boards (PCBs). These substrates are typically made from organic compounds, such as polyimide, epoxy resin, or other polymer materials, and serve as the foundation for mounting and interconnecting electronic components. Organic substrates offer advantages like flexibility, lightweight design, cost-effectiveness, and good electrical insulation, making them a preferred choice in a wide range of electronic applications, including smartphones, tablets, wearables, automotive electronics, and telecommunications equipment. These substrates are critical in advanced packaging technologies such as chip-on-board (COB), flip-chip, ball grid array (BGA), and surface-mount devices (SMD), supporting the miniaturization, performance enhancement, and reliability of electronic devices.The demand for organic substrates has grown significantly due to the increasing adoption of advanced electronics in consumer, automotive, and industrial sectors. In consumer electronics, organic substrates are used in devices like smartphones, laptops, and wearables, where they support high-density integration and efficient thermal management. In automotive electronics, they are crucial for electronic control units (ECUs), infotainment systems, and sensors, all of which require reliable, lightweight, and cost-effective substrates. As the demand for smaller, more efficient, and higher-performance electronic devices continues to rise, organic substrates play a vital role in meeting the needs of the rapidly evolving electronics industry.

How Do Organic Substrates Enhance Device Performance & Packaging Efficiency?

Organic substrates enhance device performance by providing a reliable and efficient platform for the mounting and interconnection of electronic components. These substrates are known for their excellent electrical insulation properties, which help maintain signal integrity, reduce electromagnetic interference (EMI), and support faster signal transmission in electronic circuits. In semiconductor packaging, organic substrates facilitate high-density integration by enabling fine-pitch connections, which is essential for achieving the compactness and functionality required in modern electronic devices. Their flexibility and adaptability allow for the design of multi-layered substrates, accommodating complex circuits and supporting advanced packaging technologies like system-in-package (SiP) and 3D ICs, where multiple components are stacked vertically to save space and improve performance.Organic substrates also contribute to packaging efficiency by offering lightweight and cost-effective solutions for various electronic applications. The use of organic materials, such as polyimide or epoxy resin, allows for thinner and lighter substrates, which is critical in portable consumer devices like smartphones, tablets, and wearables. Additionally, the compatibility of organic substrates with flexible electronics makes them suitable for foldable displays, flexible circuits, and other next-generation electronic designs. In the automotive sector, organic substrates enhance thermal management, reliability, and durability, which are essential for high-performance applications such as engine control modules, ADAS (advanced driver assistance systems), and battery management systems. By supporting miniaturization, high performance, and cost-efficiency, organic substrates play a crucial role in advancing the capabilities of modern electronics.

How Are Technological Advancements Shaping the Development of Organic Substrates?

Technological advancements have significantly improved the performance, durability, and versatility of organic substrates, making them more suitable for complex electronic applications. One of the key innovations is the development of high-density interconnect (HDI) substrates, which allow for finer circuitry, increased wiring density, and reduced signal loss. HDI technology enables the production of multi-layered substrates that can support the miniaturization of electronic devices, such as smartphones, tablets, and wearable devices, where space and performance are critical. These advancements in organic substrates enhance the capabilities of chip packaging, allowing for more efficient power distribution, faster signal transmission, and better thermal management.Another major advancement is the introduction of flexible organic substrates, which have opened up new possibilities for foldable displays, wearable electronics, and flexible circuits. These substrates are designed to withstand bending, twisting, and other mechanical stresses while maintaining electrical performance, making them ideal for emerging applications like flexible OLED screens, stretchable sensors, and rollable displays. The use of advanced polymer materials, such as liquid crystal polymers (LCPs) and modified polyimides, has improved the thermal stability, moisture resistance, and electrical properties of organic substrates, supporting their use in high-frequency applications like 5G antennas, RF modules, and IoT devices. Additionally, innovations in substrate fabrication techniques, such as laser drilling, precision etching, and advanced photolithography, have enabled the production of finer circuits with better dimensional accuracy and reduced defects, further enhancing the performance and reliability of organic substrates in semiconductor packaging.

What Factors Are Driving Growth in the Organic Substrates Market?

The growth in the organic substrates market is driven by several factors, including the rapid adoption of consumer electronics, the rise of 5G networks, advancements in semiconductor packaging, and increasing demand for lightweight and flexible materials in electronic devices. The consumer electronics sector, which includes smartphones, laptops, tablets, and wearables, has been a major driver of market growth, as these devices rely heavily on compact and efficient substrates for high-density integration and optimal performance. The shift toward 5G technology has created additional demand for organic substrates, as 5G infrastructure and devices require substrates capable of supporting high-frequency signals, improved signal integrity, and faster data transmission.The expanding automotive electronics sector has also contributed to market growth, with increasing use of organic substrates in electric vehicles (EVs), advanced driver assistance systems (ADAS), and in-vehicle infotainment systems. The automotive industry's focus on lightweight materials for better fuel efficiency and performance aligns well with the benefits of organic substrates, which offer both weight reduction and high reliability. Additionally, the growing demand for flexible electronics, including foldable smartphones, stretchable displays, and wearable medical devices, has driven the adoption of flexible organic substrates, which provide the necessary bendability and electrical performance for these applications.

Technological advancements in semiconductor packaging, such as system-in-package (SiP), 3D ICs, and fan-out wafer-level packaging (FOWLP), have further boosted demand for organic substrates, as these packaging technologies require substrates that can support fine-pitch connections, multi-layer designs, and efficient thermal management. Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing rapid growth in electronics manufacturing, driven by increasing consumer demand, rising disposable incomes, and expanding production capabilities, creating new opportunities for organic substrate manufacturers. With continued innovations in materials science, semiconductor technology, and flexible electronics, the organic substrates market is poised for sustained growth, supported by expanding applications, evolving consumer demands, and advancements in electronic device manufacturing.

Report Scope

The report analyzes the Organic Substrates market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Substrate Type (Tape, Rigid); Technology (Small Outline Packages (SOP), GA Packages, Flat No-Leads Packages, Dual In-Line Packages (DIP), Quad Flat Packages (QFP), Other Technologies); Application (Mobile Phones, Flat Panel Displays, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tape Substrate segment, which is expected to reach US$10.7 Billion by 2030 with a CAGR of a 7%. The Rigid Substrate segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 10.1% CAGR to reach $4.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Organic Substrates Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Organic Substrates Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Organic Substrates Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajinomoto Group, Amkor Technology, ASE Kaohsiung, BASF, Dow Chemicals and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Organic Substrates market report include:

- Ajinomoto Group

- Amkor Technology

- ASE Kaohsiung

- BASF

- Dow Chemicals

- Henkel AG

- Hitachi Chemical

- Kyocera

- Mistubishi Electric

- Qualcomm Technologies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Group

- Amkor Technology

- ASE Kaohsiung

- BASF

- Dow Chemicals

- Henkel AG

- Hitachi Chemical

- Kyocera

- Mistubishi Electric

- Qualcomm Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

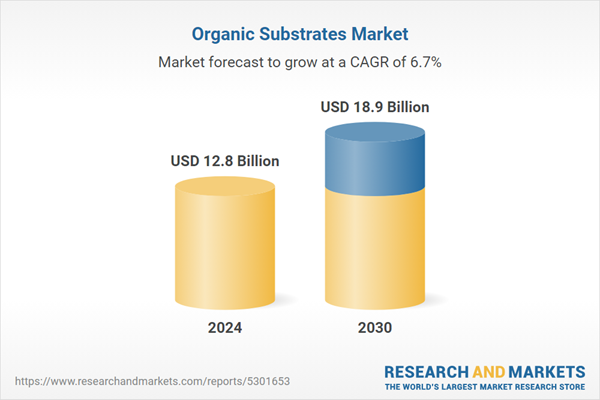

| Estimated Market Value ( USD | $ 12.8 Billion |

| Forecasted Market Value ( USD | $ 18.9 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |