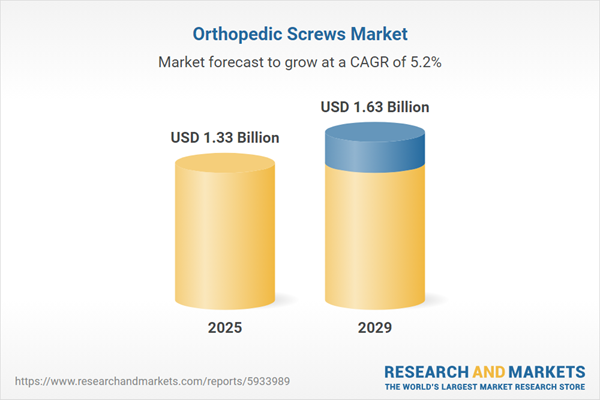

The orthopedic screws market size has grown strongly in recent years. It will grow from $1.26 billion in 2024 to $1.33 billion in 2025 at a compound annual growth rate (CAGR) of 5.6%. The growth in the historic period can be attributed to aging population and orthopedic conditions, sports injuries and trauma cases, increasing awareness and patient demand, prevalence of degenerative bone diseases.

The orthopedic screws market size is expected to see strong growth in the next few years. It will grow to $1.63 billion in 2029 at a compound annual growth rate (CAGR) of 5.2%. The growth in the forecast period can be attributed to customization and patient-specific solutions, rise in minimally invasive surgeries, global increase in orthopedic procedures, expansion of sports medicine. Major trends in the forecast period include regulatory compliance and standardization, global market expansion, collaborations and partnerships, orthopedic tourism, environmentally sustainable practices.

The rising frequency of road accidents is expected to drive the growth of the orthopedic screw market in the future. A road accident refers to an incident on a public road involving at least one vehicle, leading to injury or death of at least one individual. The main reasons for orthopedic implant surgeries, which include screws and plates, are accidents or traumatic events such as road accidents and sports-related injuries. For example, in 2023, the Transport Accident Commission, an Australia-based government agency, reported that 295 people lost their lives on Victorian roads, a 22.4% increase (54 more fatalities) compared to 2022. Additionally, there were 261 fatal crashes, up by 22 (9%) from the previous year’s total of 239. Consequently, the rising number of road accidents is expected to boost the growth of the orthopedic screw market.

The increasing number of orthopedic surgeries is anticipated to propel the growth of the orthopedic screws market. Orthopedic surgeries focus on diagnosing, treating, and preventing conditions and injuries related to the musculoskeletal system. Orthopedic screws are vital instruments used in these surgeries to stabilize and secure bone fragments, implants, or other orthopedic devices in various procedures. For example, in May 2022, the British Orthopaedic Association, a UK-based body, reported that over 42,000 orthopedic surgeries were performed in England in March 2022, the highest total since June 2021. Therefore, the rising number of orthopedic surgeries is fueling the growth of the orthopedic screw market.

Key industry players within the orthopedic screw market are strategically focusing on the development of sustainable and innovative offerings, notably bioresorbable implants, to gain a competitive edge. These bioresorbable implants significantly contribute to improved recovery and reduced invasiveness in procedures, eliminating the necessity for implant removal surgeries. For instance, in March 2023, Bioretec Inc., a Finland-based manufacturer specializing in pediatric and adult orthopedic implants, received approval from the U.S. Food and Drug Administration for the RemeOs trauma screw. This orthopedic screw, made from bioresorbable metal, has undergone successful clinical trials and previously gained recognition as a breakthrough device from the FDA. The incorporation of bioresorbable metals merges the surgical techniques of traditional metal implants with the patient-centric advantages offered by recent bioresorbable polymer implants, ultimately obviating the need for implant removal surgeries.

In February 2024, Zeda, Inc., a US-based healthcare solutions provider, acquired The Orthopaedic Implant Company (OIC) for an undisclosed amount. This acquisition aims to expand Zeda, Inc.'s product offerings and make high-quality orthopedic care more accessible worldwide. The Orthopaedic Implant Company (OIC) is a US-based medical device firm specializing in orthopedic implants.

Major companies operating in the orthopedic screws market report are Johnson and Johnson, Medtronic PLC, Stryker Corporation, Solvay S.A., Zimmer Biomet Holdings Inc., Smith & Nephew PLC, Arthrex Inc., Teleflex Incorporated, Integra LifeSciences Corporation, Wright Medical Group N.V., Tecomet Inc., Exactech Inc., Leistritz Advanced Technologies, Paragon 28 Inc., Acumed LLC, DJO Global, Elos Medtech, Precipart Inc., Royal Oak Medical Devices Inc., AccuRounds Inc., TYBER MEDICAL LLC, GPC Medical Ltd., Unity Precision Manufacturing, Hammill Medical Inc., Advanced Orthopaedic Solutions, Extremity Medical LLC, High Tech Turning Co, The Orthopaedic Implant Company, Diamond Orthopedic, Vilex Inc.

North America was the largest region in the orthopedic screws market in 2024. The regions covered in the orthopedic screws market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the orthopedic screws market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The orthopedic screws market consists of sales of cannulated orthopedic screws, locking orthopedic screws, and non-locking orthopedic screws. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Orthopedic screws, made from materials such as titanium or stainless steel, play a crucial role in surgical procedures for bone repair. These screws are designed to provide compression within the bone, facilitating the healing process after a fracture.

Orthopedic screws come in various types, with applications for both upper and lower extremities. In the upper extremity, which comprises the upper arm, forearm, and hand, totaling 30 bones, orthopedic screws are employed to stabilize fractures and osteotomies in areas such as the elbow, wrist, carpal, metacarpal, and phalangeal regions. These screws are crafted from materials such as stainless steel, titanium, and bioabsorbable substances. They find applications in hospitals, ambulatory surgical centers (ASCs), and other medical facilities, serving end-users ranging from pediatrics and adults to geriatrics.

The orthopedic screws market research report is one of a series of new reports that provides orthopedic screws market statistics, including orthopedic screws industry global market size, regional shares, competitors with an orthopedic screws market share, detailed orthopedic screws market segments, market trends and opportunities, and any further data you may need to thrive in the orthopedic screws industry. This orthopedic screws market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future- scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Orthopedic Screws Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on orthopedic screws market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for orthopedic screws? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The orthopedic screws market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Upper Extremity; Lower Extremity2) By Material: Stainless Steel; Titanium; Bioabsorbable

3) By Application: Hospitals; Ambulatory Surgical Centers (ASCs); Other Applications

4) By End User: Pediatrics; Adults; Geriatrics

Subsegments:

1) By Upper Extremity: Humeral Screws; Clavicle Screws; Scapula Screws2) By Lower Extremity: Femoral Screws; Tibial Screws; Ankle Screws

Key Companies Mentioned: Johnson and Johnson; Medtronic plc; Stryker Corporation; Solvay S.A.; Zimmer Biomet Holdings Inc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Orthopedic Screws market report include:- Johnson and Johnson

- Medtronic plc

- Stryker Corporation

- Solvay S.A.

- Zimmer Biomet Holdings Inc

- Smith & Nephew plc

- Arthrex Inc

- Teleflex Incorporated

- Integra LifeSciences Corporation

- Wright Medical Group N.V.

- Tecomet Inc

- Exactech Inc.

- Leistritz Advanced Technologies

- Paragon 28 Inc

- Acumed LLC

- DJO Global

- Elos Medtech

- Precipart Inc

- Royal Oak Medical Devices Inc

- AccuRounds Inc

- TYBER MEDICAL LLC

- GPC Medical Ltd

- Unity Precision Manufacturing

- Hammill Medical Inc

- Advanced Orthopaedic Solutions

- Extremity Medical LLC

- High Tech Turning Co

- The Orthopaedic Implant Company

- Diamond Orthopedic

- Vilex Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.33 Billion |

| Forecasted Market Value ( USD | $ 1.63 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |