Palletizing Machinery - Key Trends and Drivers

Palletizing machinery plays a crucial role in modern industrial operations, automating the process of stacking products onto pallets for transportation and storage. These machines are essential in a variety of industries, including food and beverage, pharmaceuticals, chemicals, and consumer goods, where they enhance efficiency, reduce labor costs, and improve workplace safety. Palletizing systems vary from traditional robotic palletizers, which utilize articulated arms to arrange products, to more advanced automated solutions such as gantry palletizers and hybrid systems. These machines are designed to handle a wide array of products, including boxes, bags, drums, and bundles, ensuring consistent and precise stacking on pallets. The flexibility and scalability of palletizing machinery make it an indispensable tool for manufacturers seeking to streamline their supply chain operations and boost overall productivity. Furthermore, the reliability and speed of these machines help in minimizing product damage during handling, thereby ensuring better product integrity and customer satisfaction.Technological advancements have significantly transformed palletizing machinery, introducing features that enhance performance and adaptability. Modern palletizers are now equipped with sophisticated sensors and vision systems that enable real-time monitoring and adjustments, ensuring optimal placement and alignment of products. These advanced technologies also facilitate the handling of a diverse range of product shapes and sizes, reducing downtime and enhancing operational efficiency. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms allows palletizing systems to learn and improve over time, optimizing stacking patterns and processes based on historical data and predictive analytics. Innovations such as collaborative robots (cobots) are becoming increasingly popular, working alongside human operators to boost throughput and flexibility while maintaining high safety standards. The evolution of software and control systems has made it easier to program and reconfigure palletizers, allowing manufacturers to quickly adapt to changing production needs and market demands. Moreover, the development of modular palletizing systems offers greater customization and scalability, enabling businesses to invest in solutions that can grow and evolve with their operational requirements.

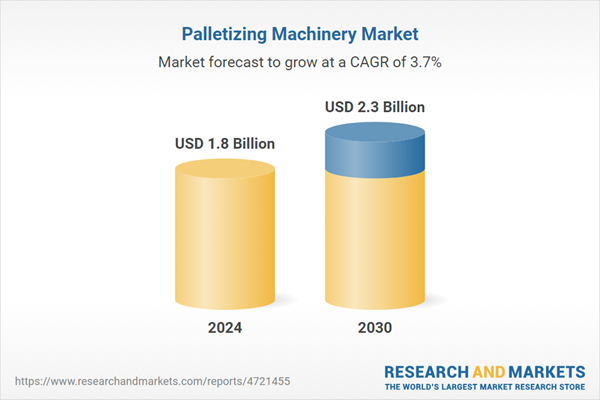

The growth in the palletizing machinery market is driven by several factors. The increasing demand for automation in manufacturing and logistics sectors is a primary driver, as companies seek to enhance efficiency, reduce operational costs, and remain competitive in a rapidly evolving marketplace. The booming e-commerce industry has also spurred the need for efficient packaging and palletizing solutions to handle high volumes of goods and meet fast delivery expectations. Additionally, the adoption of advanced technologies such as AI, IoT, and robotics in palletizing machinery is expanding the addressable market by offering more sophisticated and adaptable solutions. Consumer preference for packaged goods and the stringent safety and hygiene standards in the food and beverage and pharmaceutical industries are further propelling the demand for automated palletizing systems. Government regulations and industry standards mandating safer and more efficient handling of materials are also contributing to market growth. For instance, the need for traceability and compliance with health and safety regulations drives the adoption of advanced palletizing solutions that can ensure consistent quality and safety. Overall, the convergence of technological innovation, market demand for automation, and regulatory compliance are key factors driving the expansion of the palletizing machinery market.

Report Scope

The report analyzes the Palletizing Machinery market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Low Level or Floor Level, High-Level, Robotic); Type (Case, Bulk, Other Types); Application (Food & Beverage, Healthcare & Pharmaceuticals, Cosmetic & Personal Care, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Low Level or Floor Level Machinery segment, which is expected to reach US$966.1 Million by 2030 with a CAGR of a 3.5%. The High-Level Machinery segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $489.3 Million in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $460.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Palletizing Machinery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Palletizing Machinery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Palletizing Machinery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company, Bunge Ltd., Cargill, Inc., E. I. du Pont De Nemours and Company, Elevance Renewable Sciences, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 62 companies featured in this Palletizing Machinery market report include:

- ABB Ltd.

- A-B-C Packaging Machine Corp.

- American-Newlong, Inc.

- Arrowhead Systems Inc.

- Barry-Wehmiller Companies, Inc.

- BEUMER Group GmbH & Co. KG

- Conveying Industries, Inc.

- Emmeti SpA

- FANUC Corp.

- Gebo Cermex

- Honeywell Intelligrated

- Kawasaki Heavy Industries, Ltd.

- KION Group AG

- Krones AG

- KUKA AG

- Maschinenfabrik Möllers GmbH

- Ouelette Machinery Systems, Inc.

- PaR Systems, LLC

- Premier Tech Chronos

- ProMach, Inc.

- Schneider Packaging Equipment Co., Inc.

- Sidel

- Skilled Group

- TopTier, Inc.

- Uhlmann Pac-Systeme GmbH & Co. KG.

- Westfalia Technologies, Inc.

- YASKAWA Electric Corp.

- Yaskawa Motoman

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- A-B-C Packaging Machine Corp.

- American-Newlong, Inc.

- Arrowhead Systems Inc.

- Barry-Wehmiller Companies, Inc.

- BEUMER Group GmbH & Co. KG

- Conveying Industries, Inc.

- Emmeti SpA

- FANUC Corp.

- Gebo Cermex

- Honeywell Intelligrated

- Kawasaki Heavy Industries, Ltd.

- KION Group AG

- Krones AG

- KUKA AG

- Maschinenfabrik Möllers GmbH

- Ouelette Machinery Systems, Inc.

- PaR Systems, LLC

- Premier Tech Chronos

- ProMach, Inc.

- Schneider Packaging Equipment Co., Inc.

- Sidel

- Skilled Group

- TopTier, Inc.

- Uhlmann Pac-Systeme GmbH & Co. KG.

- Westfalia Technologies, Inc.

- YASKAWA Electric Corp.

- Yaskawa Motoman

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 283 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 2.3 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |