Global Palmitic Acid Market - Key Trends & Drivers Summarized

Why Is the Demand for Palmitic Acid Increasing Across Industries?

The palmitic acid market is experiencing strong growth due to its widespread application in food, cosmetics, pharmaceuticals, and industrial manufacturing. As a key component of fats and oils, palmitic acid is extensively used as an emulsifier, surfactant, and thickening agent in processed foods, personal care products, and pharmaceuticals. The rising demand for functional ingredients in food formulations and skincare products is fueling market expansion.Additionally, the growing industrial application of palmitic acid in lubricants, detergents, and bio-based chemicals is driving further demand. With increasing interest in sustainable and plant-based raw materials, manufacturers are sourcing palmitic acid from palm oil, animal fats, and other vegetable sources, influencing market dynamics.

How Are Sustainability and Alternative Sourcing Transforming the Palmitic Acid Market?

Sustainability concerns surrounding palm oil production, a primary source of palmitic acid, are reshaping industry trends. The environmental impact of palm oil farming has led to the development of sustainable and RSPO-certified (Roundtable on Sustainable Palm Oil) production methods, encouraging responsible sourcing. Additionally, research into alternative sources such as microbial fermentation and algae-based lipids is gaining traction as industries seek eco-friendly substitutes.Another key innovation is the increasing use of palmitic acid derivatives in biodegradable surfactants and bio-lubricants. As industries transition toward greener formulations, demand for sustainably produced palmitic acid is expected to rise.

Is the Expansion of the Pharmaceutical and Cosmetics Sectors Fueling Market Growth?

The pharmaceutical and cosmetics industries are emerging as major growth drivers for the palmitic acid market. In pharmaceuticals, palmitic acid serves as an excipient in drug formulations, enhancing solubility and absorption. Its role in lipid-based drug delivery systems is gaining prominence, particularly in cancer treatments and controlled-release medications.In the cosmetics sector, palmitic acid is widely used in moisturizers, soaps, and cleansing products due to its emollient properties. With increasing consumer preference for natural and organic skincare formulations, demand for plant-derived palmitic acid is on the rise, influencing production and market expansion.

What’ s Driving the Growth of the Palmitic Acid Market?

The growth in the palmitic acid market is driven by increasing demand from the food, cosmetics, pharmaceutical, and industrial sectors. Sustainability concerns are prompting shifts toward certified sustainable sourcing and alternative production methods. The expanding applications of palmitic acid in bio-based chemicals, lubricants, and emulsifiers are further contributing to market growth.Additionally, regulatory frameworks promoting sustainable palm oil sourcing and innovations in lipid-based drug delivery are shaping market dynamics. As industries continue to explore eco-friendly solutions, the demand for palmitic acid is expected to see steady expansion.

Report Scope

The report analyzes the Palmitic Acid market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Soap & Detergent End-Use, Greases & Lubricants End-Use, Personal Care & Cosmetics End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Soap & Detergent End-Use segment, which is expected to reach US$228.7 Million by 2030 with a CAGR of a 3%. The Greases & Lubricants End-Use segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $112.7 Million in 2024, and China, forecasted to grow at an impressive 4.5% CAGR to reach $90.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Palmitic Acid Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Palmitic Acid Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Palmitic Acid Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as African Palliative Care Association (APCA), Asia Pacific Hospice Palliative Care Network (APHN), Canadian Hospice Palliative Care Association (CHPCA), Chinese Association for Life Care, European Association for Palliative Care (EAPC) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Palmitic Acid market report include:

- Acme Synthetic Chemicals

- Akzo Nobel N.V.

- Ashland Global Holdings Inc.

- BASF SE

- Cargill Incorporated

- Croda International Plc

- Dow Chemical Company

- Eastman Chemical Company

- Emery Oleochemicals

- Guangzhou Tosun Pharmaceutical

- IOI Oleochemicals

- Kao Chemicals

- KLK Oleo

- Novaphene Specialities

- Oleon N.V.

- PMC Group

- PT. Cisadane Raya Chemicals

- SAFC (a business unit of Merck KGaA)

- Sri Vyjayanthi Labs

- Vantage Specialty Chemicals

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acme Synthetic Chemicals

- Akzo Nobel N.V.

- Ashland Global Holdings Inc.

- BASF SE

- Cargill Incorporated

- Croda International Plc

- Dow Chemical Company

- Eastman Chemical Company

- Emery Oleochemicals

- Guangzhou Tosun Pharmaceutical

- IOI Oleochemicals

- Kao Chemicals

- KLK Oleo

- Novaphene Specialities

- Oleon N.V.

- PMC Group

- PT. Cisadane Raya Chemicals

- SAFC (a business unit of Merck KGaA)

- Sri Vyjayanthi Labs

- Vantage Specialty Chemicals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

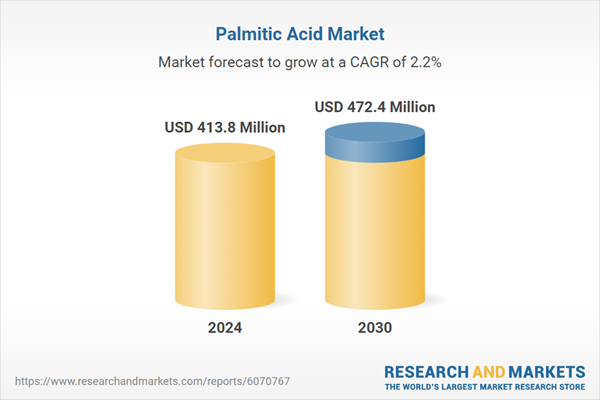

| Estimated Market Value ( USD | $ 413.8 Million |

| Forecasted Market Value ( USD | $ 472.4 Million |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |