ed for parenteral nutrition.

The adoption of parenteral nutrition is increasing among the geriatric group, as they are unable to fulfill their nutritional requirements through the enteral route. There is an inverse relationship between nutritional status and complications associated with the length of stay in the hospital and the time to recover after an acute illness among the elderly patient group. The growing geriatric population, surge in demand for fat emulsions among critically ill patients for fulfilling their nutritional requirements, and high prevalence of chronic diseases, including Alzheimer’s, inflammatory bowel disease, and others, are key factors responsible for higher adoption of parenteral lipid emulsions among this patient population.

Furthermore, an increase in the number of strategic initiatives undertaken by leading manufacturers to expand their footprint and product reach is expected to drive the market. Significant investments, the setup of new product lines, and various research initiatives for the development of new lipid emulsions are anticipated to boost the market growth. For instance, in July 2019, Baxter announced the European launch of Finomel to its parenteral nutrition portfolio. Moreover, increasing approvals for innovative products, including hybrid lipid emulsions with a combination of two or more sources such as soybean and olive oil, are likely to fuel market growth.

Europe Parenteral Lipid Emulsion Market Report Highlights

- 1st generation lipid emulsions dominated the market in 2022 owing to the increasing geriatric population and growing burden of non-communicable diseases on healthcare. Also, these lipid emulsion formulation has witnessed a significant demand as it has found its way into lipid rescue during anesthesia toxicity

- Germany dominated the market in 2022 due to a surge in demand from critically ill patients and high prevalence of chronic diseases in the country

Table of Contents

Companies Mentioned

- Baxter

- Braun Melsungen AG

- Fresenius SE & Co. KGaA

- Grifols S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | July 2023 |

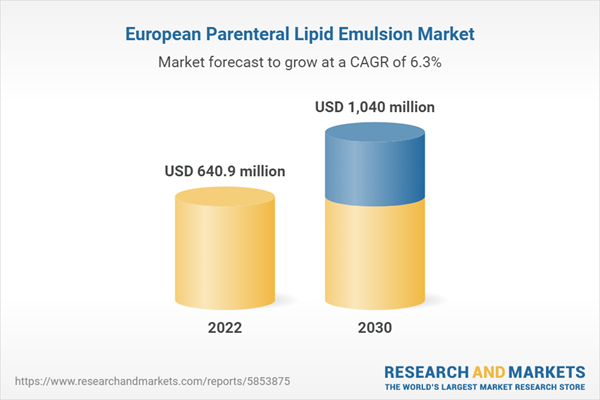

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 640.9 million |

| Forecasted Market Value ( USD | $ 1040 million |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 4 |