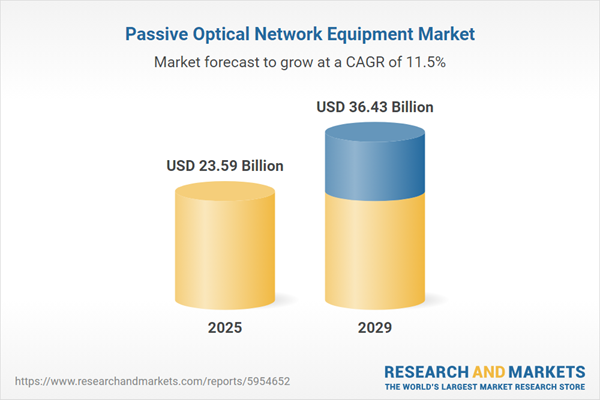

The passive optical network equipment market size has grown rapidly in recent years. It will grow from $20.76 billion in 2024 to $23.59 billion in 2025 at a compound annual growth rate (CAGR) of 13.6%. The growth in the historic period can be attributed to bandwidth demand, increased data security, demand for triple play services, telecommunications services, fiber optic communications.

The passive optical network equipment market size is expected to see rapid growth in the next few years. It will grow to $36.43 billion in 2029 at a compound annual growth rate (CAGR) of 11.5%. The growth in the forecast period can be attributed to increasing adoption of cloud services, remote work and learning, rising internet penetration rates, urbanization, telecommunications networks. Major trends in the forecast period include fiber optic advancements, technological standardization, 5G integration, smart cities and IoT, software defined networking (SDN), green and energy-efficient solutions.

The increasing demand for high-speed broadband networks is expected to drive the growth of the passive optical network equipment market. These networks, crucial for fast and reliable internet access, are becoming more essential due to the rising reliance on digital services, remote work, online education, and the growing number of connected devices in modern lifestyles. Passive optical network equipment plays a crucial role in facilitating efficient and high-speed broadband connectivity by utilizing fiber-optic technology for reliable and fast data transmission between service providers and end-users. For example, in July 2023, the Organization for Economic Co-operation and Development (OECD) reported a 17% increase in data consumption per mobile broadband subscription in 2022, with the overall mobile data usage doubling in four years from 4.7 gigabytes per month to 10.4 GB in 2022. This surge in demand for high-speed broadband networks is a key driver for the growth of the passive optical network equipment market.

Major players in the passive optical network equipment market are actively developing innovative network solutions, such as XGS-PON (10 gigabit symmetrical passive optical network), to maintain a competitive edge. XGS-PON, an updated standard for passive optical networks, supports high-speed symmetrical data transfers at 10 gigabits per second (Gbps). For instance, in February 2024, Precision Optical Technologies Inc., a US-based system engineering and integration company, announced the availability of OpenPath, a turnkey solution for a more open passive optical network (PON) ecosystem. OpenPath simplifies and accelerates PON deployments, addressing challenges for multiple system operators (MSOs), service providers, and access network operators. It offers a robust platform for evolving networks with future PON technologies, supporting 10 gigabit symmetrical passive optical networks (XGS-PON). Furthermore, it enables the convergence of residential, commercial, and wireless services over a single infrastructure, allowing the reuse of existing ODN/passive resources.

In November 2022, Ciena Corporation, a US-based networking systems and software company, made strategic acquisitions to enhance its broadband access solutions with passive optical network (PON) capabilities and reinforce its subscriber management technology. Ciena acquired Tibit Communications Inc., a US-based network equipment manufacturer, for $210 million, and Benu Networks Inc., a US-based software company specializing in providing passive optical network (PON) equipment, for an undisclosed amount. These acquisitions are aimed at strengthening Ciena's position in the market and expanding its offerings in the passive optical network equipment sector.

Major companies operating in the passive optical network equipment market are Verizon Communications Inc., AT & T Inc., Huawei Technologies Co. Ltd., Intel Corporation, Cisco Systems Inc., Qualcomm Incorporated, Mitsubishi Electric Corporation, Broadcom Ltd., Fujitsu Limited, Telefonaktiebolaget LM Ericsson, Nokia Corporation, NEC Corp., ZTE Corp., NXP Semiconductors, Motorola Solutions, Marvell Technology Group, FiberHome Telecommunication Technologies Co. Ltd., Realtek Semiconductor Corp., Molex LLC, Tellabs Inc., Zyxel Communications Corp., Adtran Inc., Calix Inc., Dasan Zhone Solutions, Allied Telesis Inc., Ubiquoss Inc., Alphion India Pvt. Ltd.

North America was the largest region in the passive optical network equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the passive optical network equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the passive optical network equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The passive optical network equipment market consists of revenues earned by entities by providing services such as installation services, network optimization, troubleshooting, ongoing support, and remote management and monitoring. The market value includes the value of related goods sold by the service provider or included within the service offering. The passive optical network equipment market also includes sales of optical connectors and adapters, wavelength division multiplexing (WDM) components, optical distribution frames, and measurement equipment. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Passive optical network (PON) equipment comprises the elements and devices employed in a passive optical network, a fiber-optic telecommunications technology designed for providing broadband network access to end-users. PONs utilize a point-to-multipoint topology and optical splitters to transmit signals in both upstream and downstream directions.

The primary components of passive optical network equipment encompass wavelength division multiplexers and demultiplexers, optical filters, optical power splitters, optical cables, optical line terminal (OLT), and optical network terminal (ONT). Wavelength division multiplexer and demultiplexer (WDM) denote a technology employed in optical fiber communications, enabling the simultaneous transmission of multiple optical signals over a single fiber optic cable. Ethernet passive optical network (EPON) equipment and gigabit passive optical network (GPON) equipment constitute various structures. These find application in diverse contexts, predominantly in fiber to the home (FTTH), fiber to the building (FTTB), fiber to the curb (FTTC), and others, catering to a range of end users, including residential, commercial, industrial, and government and education.

The passive optical network equipment market research report is one of a series of new reports that provides passive optical network equipment market statistics, including passive optical network equipment industry global market size, regional shares, competitors with a passive optical network equipment market share, detailed passive optical network equipment market segments, market trends and opportunities, and any further data you may need to thrive in the passive optical network equipment industry. This passive optical network equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Passive Optical Network Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on passive optical network equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for passive optical network equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The passive optical network equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Wavelength Division Multiplexer And De-Multiplexer; Optical Filters; Optical Power Splitters; Optical Cables; Optical Line Terminal (OLT); Optical Network Terminal (ONT)2) By Structure: Ethernet Passive Optical Network (EPON) Equipment; Gigabit Passive Optical Network (GPON) Equipment

3) By Application: Fiber To The Home (FTTH); Fiber To The Building (FTTB); Fiber To The Curb (FTTC); Other Applications

4) By End-use: Residential; Commercial; Industrial; Government And Education

Subsegments:

1) By Wavelength Division Multiplexer and De-Multiplexer: Coarse Wavelength Division Multiplexer (CWDM); Dense Wavelength Division Multiplexer (DWDM)2) By Optical Filters: Bandpass Filters; Edge Filters; Gain Flattening Filters

3) By Optical Power Splitters: Fused Biconical Taper (FBT) Splitters; Planar Lightwave Circuit (PLC) Splitters

4) By Optical Cables: Single-Mode Fiber; Multi-Mode Fiber

5) By Optical Line Terminal (OLT): GPON OLT; EPON OLT; WDM-PON OLT

6) By Optical Network Terminal (ONT): GPON ONT; EPON ONT; XGS-PON ONT

Key Companies Mentioned: Verizon Communications Inc.; AT & T Inc.; Huawei Technologies Co. Ltd.; Intel Corporation; Cisco Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Passive Optical Network Equipment market report include:- Verizon Communications Inc.

- AT & T Inc.

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Cisco Systems Inc.

- Qualcomm Incorporated

- Mitsubishi Electric Corporation

- Broadcom Ltd.

- Fujitsu Limited

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- NEC Corp.

- ZTE Corp.

- NXP Semiconductors

- Motorola Solutions

- Marvell Technology Group

- FiberHome Telecommunication Technologies Co. Ltd.

- Realtek Semiconductor Corp.

- Molex LLC

- Tellabs Inc.

- Zyxel Communications Corp.

- Adtran Inc.

- Calix Inc.

- Dasan Zhone Solutions

- Allied Telesis Inc

- Ubiquoss Inc

- Alphion India Pvt. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 23.59 Billion |

| Forecasted Market Value ( USD | $ 36.43 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |