Speak directly to the analyst to clarify any post sales queries you may have.

A forward-looking introduction that frames the clinical drivers, patient dynamics, regulatory pressures, and commercial imperatives shaping peptic ulcer therapeutics

Peptic ulcer disease remains a focal point of gastroenterology practice and pharmaceutical development due to its persistent prevalence, the evolving understanding of etiologies, and ongoing shifts in clinical management. Recent advances in diagnostics, growing recognition of Helicobacter pylori contributions, and the sustained preference for acid-suppression therapies have together reshaped prescribing behavior and patient pathways. At the same time, demographic trends-including aging populations and the broader burden of comorbidities-continue to influence demand patterns across care settings.Clinicians and health systems are balancing efficacy, safety, and cost considerations when selecting therapies, which has elevated the importance of comparative effectiveness data and long-term safety profiles. Moreover, the interface between primary care, outpatient clinics, and hospital services increasingly determines where patients initiate and continue therapy, prompting manufacturers to reevaluate distribution strategies and engagement models. Regulatory scrutiny around drug safety, manufacturing quality, and post-marketing surveillance is intensifying, which creates both compliance obligations and market differentiation opportunities for companies that can demonstrate robust pharmacovigilance and supply reliability.

Against this backdrop, pharmaceutical firms are pursuing a mix of incremental innovation, lifecycle management of established molecules, and strategic partnerships to sustain relevance. Formulation improvements, alternative delivery mechanisms, and combination approaches are being explored to optimize adherence and reduce adverse events. Concurrently, payers and procurement entities are accelerating value-based contracting and formulary rationalization, which exerts pressure on pricing and incentivizes stakeholders to demonstrate real-world value. In summary, the current landscape requires integrated strategies that align clinical evidence, manufacturing resilience, and go-to-market agility to meet evolving expectations from providers and patients alike.

How clinical innovation, supply chain modernization, and commercialization shifts are fundamentally reshaping peptic ulcer treatment paradigms and competitive dynamics

The peptic ulcer drugs landscape has experienced transformative shifts driven by technological advances, therapeutic optimization, and changes in the supply chain. Improved diagnostics and H. pylori eradication protocols have altered the incidence curve in some segments, while shifting prescribing patterns have favored proton pump inhibitors for their potency and tolerability. These clinical shifts are accompanied by structural changes in how therapies reach patients, with online pharmacies and integrated care pathways gaining traction and prompting manufacturers to diversify distribution and digital engagement strategies.Simultaneously, manufacturing modernization and the globalization of active pharmaceutical ingredient (API) supply chains have reduced unit costs but introduced concentration risks. Emerging requirements for traceability, serialization, and environmental compliance have led many manufacturers to invest in upgraded facilities and closer supplier oversight. Regulatory expectations for quality and transparency have risen in parallel, driving companies to strengthen quality assurance and to pursue dual sourcing for critical APIs. In response, more agile contract manufacturing organizations and strategic outsourcing models have emerged, enabling firms to maintain supply continuity while controlling capital expenditures.

Another critical shift involves the balance between branded innovation and generic competition. While newer formulations and proprietary delivery systems pursue premium positioning, the maturation of generic alternatives exerts downward pressure on pricing and encourages therapeutic differentiation through services, patient support programs, and bundled offerings. In addition, payer-driven demand for cost containment has prompted manufacturers to justify premiums through demonstrable improvements in adherence, safety, or reduced downstream healthcare utilization. Taken together, these dynamics require companies to adopt multi-dimensional strategies that integrate clinical evidence generation, supply chain resilience, and commercial adaptability to sustain competitive advantage.

Assessment of the cumulative operational and commercial repercussions of the 2025 United States tariff measures on peptic ulcer drug supply chains and strategic positioning

The introduction of United States tariff adjustments in 2025 has created a ripple effect across pharmaceutical supply chains, with particular implications for sourcing, manufacturing, and pricing strategies in the peptic ulcer drugs segment. Tariff policy has influenced the cost profile of imported APIs and intermediates, prompting manufacturers to reassess sourcing decisions and to weigh the economics of nearshoring versus maintaining global supplier relationships. As a result, companies with vertically integrated operations or diversified sourcing strategies have demonstrated greater ability to absorb incremental cost pressures while preserving supply continuity.In addition to direct cost impacts, tariff-driven shifts have accelerated conversations around strategic inventory management and buffer capacity. Firms have responded by optimizing safety stock levels, renegotiating supplier contracts to include tariff pass-through clauses, and pursuing contractual hedges that mitigate exposure to sudden policy changes. Regulatory compliance and customs-related documentation have also become more prominent operational challenges, increasing administrative overhead for firms that rely on cross-border supply chains.

Moreover, tariff dynamics have influenced competitive positioning between branded and generic manufacturers. Generic producers that operate large-scale, low-cost manufacturing footprints in tariff-affected geographies have faced margin compression, while originator companies with diversified international manufacturing have sought to protect market access through local production or licensing arrangements. These developments have translated into strategic investments in manufacturing relocation, contract manufacturing partnerships, and enhanced supplier due diligence. Ultimately, the cumulative impact of tariff measures in 2025 underscores the necessity for companies to align commercial, procurement, and regulatory teams to navigate policy volatility and protect product availability for patients.

Segment-level analysis revealing actionable distinctions across administration routes, channels, brand types, dosage forms, end-users, distribution routes, and therapeutic classes

A granular segmentation lens reveals differentiated opportunities and risks across administration routes, channels, and therapeutic classes that together shape strategic priorities for developers and distributors. Route of administration considerations distinguish between oral therapies, which remain the predominant mode due to convenience and adherence, and parenteral options that serve acute or hospital-based indications; these differences influence formulation priorities, cold chain needs, and inventory management. Sales channel segmentation separates over-the-counter availability from prescription-only modalities, with OTC pathways emphasizing patient self-care, consumer marketing, and point-of-sale visibility, while prescription channels rely on physician engagement, reimbursement pathways, and clinical evidence.Brand type segmentation highlights the strategic choices between branded and generic positioning. Branded products can command premium pricing through perceived efficacy, patient support programs, and patent-protected formulations, whereas generic competitors focus on cost efficiency, scale manufacturing, and distribution breadth. Dosage form segmentation across capsules, injections, and tablets drives manufacturing complexity and regulatory scrutiny, and it also affects patient acceptability and adherence patterns. End-user segmentation underscores the need for differentiated service models for home care patients, hospitals, and outpatient clinics, each presenting unique procurement cycles, clinical protocols, and inventory stewardship practices.

Distribution channel distinctions among hospital pharmacies, online pharmacies, and retail pharmacies necessitate tailored logistics, pricing policies, and promotion strategies. Hospital pharmacies prioritize formulary alignment and bulk procurement agreements, online pharmacies require digital marketing and verification mechanisms, and retail pharmacies emphasize shelf visibility and consumer-facing education. Finally, drug class segmentation between H2 receptor antagonists and proton pump inhibitors reveals distinct therapeutic and commercial dynamics; H2 receptor antagonists encompass cimetidine, famotidine, nizatidine, and ranitidine and remain relevant where cost or specific tolerability profiles are decisive, while proton pump inhibitors such as esomeprazole, lansoprazole, omeprazole, pantoprazole, and rabeprazole dominate where sustained acid suppression and robust clinical evidence drive choice. Collectively, these segmentation dimensions inform prioritization of R&D investment, commercial tactics, and supply chain configurations to address the diverse needs of providers and patients.

Regional differentiation across the Americas, Europe-Middle East-Africa, and Asia-Pacific that dictates tailored commercialization, regulatory, and supply strategies

Regional dynamics in the peptic ulcer drugs space vary according to healthcare system structure, regulatory regimes, and patient demographics, producing unique imperatives for commercial and operational strategies. In the Americas, centralized reimbursement decision-making in some jurisdictions coexists with more fragmented private payer landscapes in others, thereby creating both opportunities for premium positioning and challenges in achieving broad formulary access. Manufacturers focusing on these markets routinely prioritize payer engagement, pharmacoeconomic evidence, and robust post-marketing safety data to secure inclusion and favorable positioning.Across Europe, the Middle East, and Africa, heterogeneity in regulatory frameworks and procurement mechanisms requires nuanced market entry plans that accommodate country-level variations in pricing, registration timelines, and local partnership expectations. Some markets in this region emphasize cost containment and generics uptake, whereas others prioritize access to innovative formulations and differentiated service models. Therefore, tailored regulatory strategies and local partnerships often deliver faster traction and sustainable access.

In the Asia-Pacific region, high population density, diverse healthcare delivery models, and rapidly evolving private pay markets create both scale opportunities and operational complexity. Rapid adoption of digital health channels and maturing generic industries in several countries have reshaped competitive dynamics, while governmental procurement reforms and capacity-building initiatives influence long-term demand patterns. Consequently, companies operating in Asia-Pacific commonly combine localized manufacturing, regional distribution hubs, and country-specific clinical or pharmacovigilance investments to maintain regulatory compliance and market responsiveness.

Company-level competitive patterns that prioritize lifecycle innovation, operational resilience, and collaborative partnerships to secure therapeutic and commercial advantages

Competitive dynamics among companies active in peptic ulcer therapeutics are defined by portfolios that balance legacy acid-suppression agents with formulations and service enhancements designed to protect margins. Some firms prioritize incremental innovation-such as improved-release coatings and gastro-resistant matrices-to prolong product lifecycles and differentiate against commoditized generics. Others focus on operational excellence, investing in resilient supply chains and cost-efficient manufacturing to sustain competitiveness in price-sensitive channels.Partnerships and alliances are increasingly prevalent as companies seek to complement internal capabilities with external expertise. Licensing agreements, contract manufacturing arrangements, and strategic distribution partnerships enable firms to accelerate market entry, mitigate capacity constraints, and navigate local regulatory environments more effectively. Companies that demonstrate agility in commercial execution-by integrating digital health initiatives, patient support programs, and evidence generation-tend to capture more favorable positioning with key stakeholders, including prescribers and payers. In short, the competitive landscape rewards organizations that marry clinical credibility with operational reliability and channel-sensitive commercial strategies.

Actionable, integrated recommendations for industry leaders to strengthen evidence, supply resilience, channel strategies, and partnership-driven growth

Industry leaders should pursue integrated strategies that align clinical value, supply robustness, and commercial agility to remain competitive in the evolving peptic ulcer drugs market. First, prioritize evidence generation that addresses comparative effectiveness, long-term safety, and real-world outcomes to support formulary negotiations and prescriber confidence. Complement these data investments with targeted patient support and adherence programs that demonstrably reduce downstream healthcare utilization and enhance perceived value.Second, strengthen supply chain resilience through diversified sourcing, strategic inventory policies, and selected nearshoring where feasible. This approach reduces exposure to trade policy volatility and supports continuity of supply during disruptions. Third, segment go-to-market strategies by channel and end user: design tailored value propositions for hospital pharmacies, online platforms, and retail outlets, and adapt promotional messaging to the needs of home care, hospital, and outpatient clinic stakeholders. Fourth, leverage partnerships to accelerate access and capacity-engage contract manufacturers, local distributors, and clinical research organizations to speed regulatory approvals and scale distribution efficiently. Finally, invest in digital engagement and commercialization tools that enable better demand prediction, patient support, and remote adherence monitoring. By executing these priorities in a coordinated fashion, companies can improve resilience, enhance patient outcomes, and sustain commercial performance despite market headwinds.

Transparent research methodology combining stakeholder interviews, regulatory analysis, pharmacovigilance review, and supply chain evaluation to validate findings

The research underpinning these insights synthesized primary interviews with clinical experts, commercial leaders, and supply chain practitioners, supplemented by secondary sources including regulatory guidance, pharmacovigilance reports, and peer-reviewed clinical literature. Qualitative inputs were triangulated with operational and policy data to create a holistic view of therapeutic, commercial, and manufacturing dynamics. Analysts prioritized contemporary regulatory developments, recent tariff policy changes, and observable shifts in distribution channels when constructing scenario narratives and strategic implications.Methodologically, the approach emphasized stakeholder validation to ensure that interpretations aligned with frontline realities. Interviews captured perspectives across prescribers, hospital pharmacists, retail pharmacy managers, and digital channel operators to reflect the diversity of decision-making influences. Supply chain assessments relied on trade flow data and expert appraisal to identify vulnerabilities and resilience measures. Together, these methods produced a balanced analysis that integrates clinical context with commercial and operational considerations, enabling actionable recommendations for practitioners and executives.

Concluding synthesis of strategic priorities that connect clinical value, operational resilience, and channel innovation to navigate emerging market challenges

In conclusion, the peptic ulcer drugs arena is at an inflection point where clinical advancements, distribution innovation, and policy developments converge to reshape stakeholder expectations. Companies that align robust evidence generation with resilient sourcing strategies and channel-differentiated commercialization will be better positioned to navigate regulatory scrutiny, tariff-induced cost pressures, and intensifying competition. The interplay between branded differentiation and generic efficiency requires careful portfolio management to preserve margins while meeting payer demands for cost-effectiveness.Looking ahead, sustained focus on patient-centric outcomes, digital engagement, and operational agility will determine which organizations capture long-term value. By integrating clinical, commercial, and supply chain strategies, industry participants can mitigate risk, capitalize on emerging channels, and deliver improved care for patients affected by peptic ulcer disease. The insights presented here are intended to inform immediate strategic choices and to catalyze deeper analysis tailored to specific corporate objectives and regional priorities.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Peptic Ulcer Drugs Market

Companies Mentioned

The key companies profiled in this Peptic Ulcer Drugs market report include:- Abbott Laboratories

- AbbVie Inc.

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Cadila Healthcare Ltd.

- Century Pharmaceuticals Ltd.

- Daewoong Pharmaceutical Co. LTD.

- Dr. Reddy’s Laboratories Ltd

- Eisai Co. Ltd.

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline PLC

- Hikma Pharmaceuticals PLC

- Medopharm Pvt Ltd

- Merck KGaA

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Pharmanova India Drugs Pvt. Ltd.

- Redhill Biopharma Ltd

- Rosemont Pharmaceuticals Limited

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

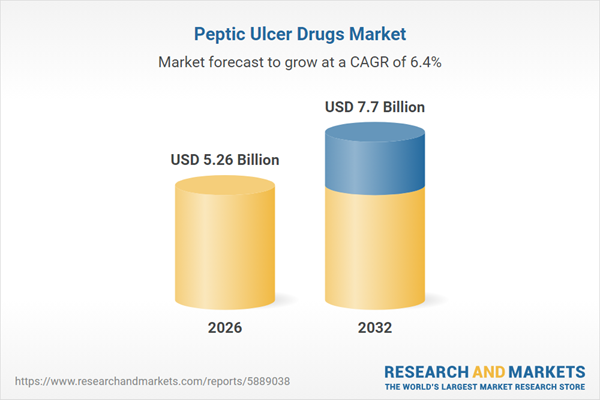

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 5.26 Billion |

| Forecasted Market Value ( USD | $ 7.7 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |