Phenolic insulation is a stiff, closed-cell insulation product that performs efficiently, due to its low thermal conductivity. It is produced in big buns, which are further then constructed into pipe covers, curved segments, tank heads, and sheets. The three major components used for the production of phenolic insulation are phenolic resin, a blowing agent, and an acid catalyst; additional additives may be used to give the insulation particular characteristics.

Phenolic insulations are widely used in the building and construction industry, petrochemicals, refineries, pharmaceutical plants, and many other industries. In addition, an increase in the use of ducts and pipes in the industrial sector is anticipated to boost the growth of the market for phenolic insulations, as they ensure high thermal insulation. Moreover, phenolic insulations are high thermal insulations, which are fireproof, with good chemical resistance, and showcase better environmental performance. These factors are expected to drive the demand for phenolic insulations during the forecast period.

However, there are some disadvantages associated with phenolic insulations. These include higher toxicity and high TVOC concentration. Furthermore, an extended amount of petroleum and natural gas are burnt for the production of phenolic insulation. These factors restrain customers from buying phenolic insulations; thus, hampering the growth of the phenolic insulation market.

On the contrary, China has developed a wide range of distinctive energy-saving materials and technologies and actively promotes their use in home construction. For instance, the use of fire-resistant polystyrene insulation plates or polyurethane insulation plates contributed to both the CCTV building fire and the Shanghai residential building fire, both of which had terrible outcomes. the phenolic formaldehyde insulation exhibits minimum water absorption and exceptional age resistance, making it an excellent choice for use in wall insulation systems. Thus, phenolic insulation innovation and development are opening up a promising growth opportunity for the expansion of the global market.

The phenolic insulation market is segmented on the basis of application, end-use industry, and region. On the basis of application, the market is categorized into duct, pipe, wall, floor, roof, and others. On the basis of end-use industry, the market is classified into HVAC systems, building & construction, industrial, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the global phenolic insulation market include Armacell, Asahi Kasei Corporation, BASF SE, Beijing Coowor Network Technology Co., Ltd., Covestro AG, Dow Inc, Guibao, Huntsman Corporation, Johns Manville, Kingspan Group, LX Hausys, Owens Corning, Saint-Gobain, Sekisui Chemicals Co., Ltd, SQ Group.

Other players operating in the phenolic insulation market are Jinan Shengquan Group, Unilin(Xtratherm), Lapolla Industries, Inc., Recticel Group.

COVID-19 impact analysis on the global phenolic insulation market.

COVID-19 has spread across the globe and affected almost all aspects of life.

Some major economies that have suffered severely from the COVID-19 crisis include Germany, France, Italy, Spain, and the UK.

There is an uneven impact of the COVID-19 pandemic on the phenolic insulation market, owing to the implementation of lockdowns worldwide to halt the spread of the virus. This resulted in the shutting off of almost all operations, manufacturing, and distribution of all industries.

This has resulted in a decrease in demand from the construction industry which, in turn, has led to sluggish growth of the market.

The demand-supply gap, disruptions in raw material procurement, price volatility, and many other factors are expected to hamper the growth of the chemical industry during the COVID-19 pandemic.

The COVID-19 crisis has affected the chemical industry supply chain to a major extent; thus, having a major impact on raw material procurement.

However, with the lifting of the lockdown, governments around the world are encouraging businesses in the construction, and industrial industries to resume operations, and these businesses are attempting to recover the market in anticipation of a gradual increase in sales in 2021.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the phenolic insulation market analysis from 2021 to 2031 to identify the prevailing phenolic insulation market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the phenolic insulation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global phenolic insulation market trends, key players, market segments, application areas, and market growth strategies.

Key Market Segments

By Application

- Duct

- Pipe

- Wall

- Roof

- Floor

- Others

By End-Use Industry

- HVAC system

- Industrial

- Building and construction

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Spain

- Itlay

- Rest Of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest Of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest Of LAMEA

Key Market Players

- armacell

- Asahi Kasei Corporation

- BASF SE

- Beijing Coowor Network Technology Co., Ltd.

- covestro ag

- DOW INC

- Guibao

- Huntsman Corporation

- johns manville

- Kingspan Group

- LX Hausys

- Owens Corning

- Saint-Gobain

- Sekisui Chemicals Co., Ltd

- sq group

Please note:

- Online Access price format is valid for 60 days access. Printing is not enabled.

- PDF Single and Enterprise price formats enable printing.

Table of Contents

CHAPTER 1: INTRODUCTION1.1. Report description

1.2. Key market segments

1.3. Key benefits to the stakeholders

1.4. Research Methodology

1.4.1. Secondary research

1.4.2. Primary research

1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Key findings of the study

2.2. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key findings

3.2.1. Top investment pockets

3.3. Porter’s five forces analysis

3.4. Top player positioning

3.5. Market dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunities

3.6. COVID-19 Impact Analysis on the market

3.7. Value Chain Analysis

3.8. Key Regulation Analysis

3.9. Patent Landscape

CHAPTER 4: PHENOLIC INSULATION MARKET, BY APPLICATION

4.1 Overview

4.1.1 Market size and forecast

4.2 Duct

4.2.1 Key market trends, growth factors and opportunities

4.2.2 Market size and forecast, by region

4.2.3 Market analysis by country

4.3 Pipe

4.3.1 Key market trends, growth factors and opportunities

4.3.2 Market size and forecast, by region

4.3.3 Market analysis by country

4.4 Wall

4.4.1 Key market trends, growth factors and opportunities

4.4.2 Market size and forecast, by region

4.4.3 Market analysis by country

4.5 Roof

4.5.1 Key market trends, growth factors and opportunities

4.5.2 Market size and forecast, by region

4.5.3 Market analysis by country

4.6 Floor

4.6.1 Key market trends, growth factors and opportunities

4.6.2 Market size and forecast, by region

4.6.3 Market analysis by country

4.7 Others

4.7.1 Key market trends, growth factors and opportunities

4.7.2 Market size and forecast, by region

4.7.3 Market analysis by country

CHAPTER 5: PHENOLIC INSULATION MARKET, BY END-USE INDUSTRY

5.1 Overview

5.1.1 Market size and forecast

5.2 HVAC system

5.2.1 Key market trends, growth factors and opportunities

5.2.2 Market size and forecast, by region

5.2.3 Market analysis by country

5.3 Industrial

5.3.1 Key market trends, growth factors and opportunities

5.3.2 Market size and forecast, by region

5.3.3 Market analysis by country

5.4 Building and construction

5.4.1 Key market trends, growth factors and opportunities

5.4.2 Market size and forecast, by region

5.4.3 Market analysis by country

5.5 Others

5.5.1 Key market trends, growth factors and opportunities

5.5.2 Market size and forecast, by region

5.5.3 Market analysis by country

CHAPTER 6: PHENOLIC INSULATION MARKET, BY REGION

6.1 Overview

6.1.1 Market size and forecast

6.2 North America

6.2.1 Key trends and opportunities

6.2.2 North America Market size and forecast, by Application

6.2.3 North America Market size and forecast, by End-Use Industry

6.2.4 North America Market size and forecast, by country

6.2.4.1 U.S.

6.2.4.1.1 Market size and forecast, by Application

6.2.4.1.2 Market size and forecast, by End-Use Industry

6.2.4.2 Canada

6.2.4.2.1 Market size and forecast, by Application

6.2.4.2.2 Market size and forecast, by End-Use Industry

6.2.4.3 Mexico

6.2.4.3.1 Market size and forecast, by Application

6.2.4.3.2 Market size and forecast, by End-Use Industry

6.3 Europe

6.3.1 Key trends and opportunities

6.3.2 Europe Market size and forecast, by Application

6.3.3 Europe Market size and forecast, by End-Use Industry

6.3.4 Europe Market size and forecast, by country

6.3.4.1 Germany

6.3.4.1.1 Market size and forecast, by Application

6.3.4.1.2 Market size and forecast, by End-Use Industry

6.3.4.2 France

6.3.4.2.1 Market size and forecast, by Application

6.3.4.2.2 Market size and forecast, by End-Use Industry

6.3.4.3 UK

6.3.4.3.1 Market size and forecast, by Application

6.3.4.3.2 Market size and forecast, by End-Use Industry

6.3.4.4 Spain

6.3.4.4.1 Market size and forecast, by Application

6.3.4.4.2 Market size and forecast, by End-Use Industry

6.3.4.5 Itlay

6.3.4.5.1 Market size and forecast, by Application

6.3.4.5.2 Market size and forecast, by End-Use Industry

6.3.4.6 Rest of Europe

6.3.4.6.1 Market size and forecast, by Application

6.3.4.6.2 Market size and forecast, by End-Use Industry

6.4 Asia-Pacific

6.4.1 Key trends and opportunities

6.4.2 Asia-Pacific Market size and forecast, by Application

6.4.3 Asia-Pacific Market size and forecast, by End-Use Industry

6.4.4 Asia-Pacific Market size and forecast, by country

6.4.4.1 China

6.4.4.1.1 Market size and forecast, by Application

6.4.4.1.2 Market size and forecast, by End-Use Industry

6.4.4.2 Japan

6.4.4.2.1 Market size and forecast, by Application

6.4.4.2.2 Market size and forecast, by End-Use Industry

6.4.4.3 India

6.4.4.3.1 Market size and forecast, by Application

6.4.4.3.2 Market size and forecast, by End-Use Industry

6.4.4.4 South Korea

6.4.4.4.1 Market size and forecast, by Application

6.4.4.4.2 Market size and forecast, by End-Use Industry

6.4.4.5 Australia

6.4.4.5.1 Market size and forecast, by Application

6.4.4.5.2 Market size and forecast, by End-Use Industry

6.4.4.6 Rest of Asia-Pacific

6.4.4.6.1 Market size and forecast, by Application

6.4.4.6.2 Market size and forecast, by End-Use Industry

6.5 LAMEA

6.5.1 Key trends and opportunities

6.5.2 LAMEA Market size and forecast, by Application

6.5.3 LAMEA Market size and forecast, by End-Use Industry

6.5.4 LAMEA Market size and forecast, by country

6.5.4.1 Brazil

6.5.4.1.1 Market size and forecast, by Application

6.5.4.1.2 Market size and forecast, by End-Use Industry

6.5.4.2 Saudi Arabia

6.5.4.2.1 Market size and forecast, by Application

6.5.4.2.2 Market size and forecast, by End-Use Industry

6.5.4.3 South Africa

6.5.4.3.1 Market size and forecast, by Application

6.5.4.3.2 Market size and forecast, by End-Use Industry

6.5.4.4 Rest of LAMEA

6.5.4.4.1 Market size and forecast, by Application

6.5.4.4.2 Market size and forecast, by End-Use Industry

CHAPTER 7: COMPANY LANDSCAPE

7.1. Introduction

7.2. Top winning strategies

7.3. Product Mapping of Top 10 Player

7.4. Competitive Dashboard

7.5. Competitive Heatmap

7.6. Key developments

CHAPTER 8: COMPANY PROFILES

8.1 armacell

8.1.1 Company overview

8.1.2 Company snapshot

8.1.3 Operating business segments

8.1.4 Product portfolio

8.1.5 Business performance

8.1.6 Key strategic moves and developments

8.2 Asahi Kasei Corporation

8.2.1 Company overview

8.2.2 Company snapshot

8.2.3 Operating business segments

8.2.4 Product portfolio

8.2.5 Business performance

8.2.6 Key strategic moves and developments

8.3 BASF SE

8.3.1 Company overview

8.3.2 Company snapshot

8.3.3 Operating business segments

8.3.4 Product portfolio

8.3.5 Business performance

8.3.6 Key strategic moves and developments

8.4 Beijing Coowor Network Technology Co., Ltd.

8.4.1 Company overview

8.4.2 Company snapshot

8.4.3 Operating business segments

8.4.4 Product portfolio

8.4.5 Business performance

8.4.6 Key strategic moves and developments

8.5 covestro ag

8.5.1 Company overview

8.5.2 Company snapshot

8.5.3 Operating business segments

8.5.4 Product portfolio

8.5.5 Business performance

8.5.6 Key strategic moves and developments

8.6 DOW INC

8.6.1 Company overview

8.6.2 Company snapshot

8.6.3 Operating business segments

8.6.4 Product portfolio

8.6.5 Business performance

8.6.6 Key strategic moves and developments

8.7 Guibao

8.7.1 Company overview

8.7.2 Company snapshot

8.7.3 Operating business segments

8.7.4 Product portfolio

8.7.5 Business performance

8.7.6 Key strategic moves and developments

8.8 Huntsman Corporation

8.8.1 Company overview

8.8.2 Company snapshot

8.8.3 Operating business segments

8.8.4 Product portfolio

8.8.5 Business performance

8.8.6 Key strategic moves and developments

8.9 johns manville

8.9.1 Company overview

8.9.2 Company snapshot

8.9.3 Operating business segments

8.9.4 Product portfolio

8.9.5 Business performance

8.9.6 Key strategic moves and developments

8.10 Kingspan Group

8.10.1 Company overview

8.10.2 Company snapshot

8.10.3 Operating business segments

8.10.4 Product portfolio

8.10.5 Business performance

8.10.6 Key strategic moves and developments

8.11 LX Hausys

8.11.1 Company overview

8.11.2 Company snapshot

8.11.3 Operating business segments

8.11.4 Product portfolio

8.11.5 Business performance

8.11.6 Key strategic moves and developments

8.12 Owens Corning

8.12.1 Company overview

8.12.2 Company snapshot

8.12.3 Operating business segments

8.12.4 Product portfolio

8.12.5 Business performance

8.12.6 Key strategic moves and developments

8.13 Saint-Gobain

8.13.1 Company overview

8.13.2 Company snapshot

8.13.3 Operating business segments

8.13.4 Product portfolio

8.13.5 Business performance

8.13.6 Key strategic moves and developments

8.14 Sekisui Chemicals Co., Ltd

8.14.1 Company overview

8.14.2 Company snapshot

8.14.3 Operating business segments

8.14.4 Product portfolio

8.14.5 Business performance

8.14.6 Key strategic moves and developments

8.15 sq group

8.15.1 Company overview

8.15.2 Company snapshot

8.15.3 Operating business segments

8.15.4 Product portfolio

8.15.5 Business performance

8.15.6 Key strategic moves and developments

List of Tables

Table 1. Global Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 2. Phenolic Insulation Market, for Duct, by Region, 2021-2031 ($Million)

Table 3. Phenolic Insulation Market for Duct, by Country, 2021-2031 ($Million)

Table 4. Phenolic Insulation Market, for Pipe, by Region, 2021-2031 ($Million)

Table 5. Phenolic Insulation Market for Pipe, by Country, 2021-2031 ($Million)

Table 6. Phenolic Insulation Market, for Wall, by Region, 2021-2031 ($Million)

Table 7. Phenolic Insulation Market for Wall, by Country, 2021-2031 ($Million)

Table 8. Phenolic Insulation Market, for Roof, by Region, 2021-2031 ($Million)

Table 9. Phenolic Insulation Market for Roof, by Country, 2021-2031 ($Million)

Table 10. Phenolic Insulation Market, for Floor, by Region, 2021-2031 ($Million)

Table 11. Phenolic Insulation Market for Floor, by Country, 2021-2031 ($Million)

Table 12. Phenolic Insulation Market, for Others, by Region, 2021-2031 ($Million)

Table 13. Phenolic Insulation Market for Others, by Country, 2021-2031 ($Million)

Table 14. Global Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 15. Phenolic Insulation Market, for HVAC System, by Region, 2021-2031 ($Million)

Table 16. Phenolic Insulation Market for HVAC System, by Country, 2021-2031 ($Million)

Table 17. Phenolic Insulation Market, for Industrial, by Region, 2021-2031 ($Million)

Table 18. Phenolic Insulation Market for Industrial, by Country, 2021-2031 ($Million)

Table 19. Phenolic Insulation Market, for Building and Construction, by Region, 2021-2031 ($Million)

Table 20. Phenolic Insulation Market for Building and Construction, by Country, 2021-2031 ($Million)

Table 21. Phenolic Insulation Market, for Others, by Region, 2021-2031 ($Million)

Table 22. Phenolic Insulation Market for Others, by Country, 2021-2031 ($Million)

Table 23. Phenolic Insulation Market, by Region, 2021-2031 ($Million)

Table 24. North America Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 25. North America Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 26. North America Phenolic Insulation Market, by Country, 2021-2031 ($Million)

Table 27. U.S. Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 28. U.S. Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 29. Canada Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 30. Canada Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 31. Mexico Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 32. Mexico Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 33. Europe Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 34. Europe Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 35. Europe Phenolic Insulation Market, by Country, 2021-2031 ($Million)

Table 36. Germany Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 37. Germany Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 38. France Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 39. France Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 40. UK Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 41. UK Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 42. Spain Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 43. Spain Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 44. Itlay Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 45. Itlay Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 46. Rest of Europe Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 47. Rest of Europe Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 48. Asia-Pacific Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 49. Asia-Pacific Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 50. Asia-Pacific Phenolic Insulation Market, by Country, 2021-2031 ($Million)

Table 51. China Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 52. China Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 53. Japan Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 54. Japan Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 55. India Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 56. India Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 57. South Korea Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 58. South Korea Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 59. Australia Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 60. Australia Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 61. Rest of Asia-Pacific Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 62. Rest of Asia-Pacific Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 63. LAMEA Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 64. LAMEA Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 65. LAMEA Phenolic Insulation Market, by Country, 2021-2031 ($Million)

Table 66. Brazil Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 67. Brazil Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 68. Saudi Arabia Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 69. Saudi Arabia Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 70. South Africa Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 71. South Africa Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 72. Rest of LAMEA Phenolic Insulation Market, by Application, 2021-2031 ($Million)

Table 73. Rest of LAMEA Phenolic Insulation Market, by End-use Industry, 2021-2031 ($Million)

Table 74. Armacell: Company Snapshot

Table 75. Armacell: Operating Segments

Table 76. Armacell: Product Portfolio

Table 77. Armacell: Net Sales

Table 78. Armacell: Key Strategies

Table 79. Asahi Kasei Corporation: Company Snapshot

Table 80. Asahi Kasei Corporation: Operating Segments

Table 81. Asahi Kasei Corporation: Product Portfolio

Table 82. Asahi Kasei Corporation: Net Sales

Table 83. Asahi Kasei Corporation: Key Strategies

Table 84. BASF SE: Company Snapshot

Table 85. BASF SE: Operating Segments

Table 86. BASF SE: Product Portfolio

Table 87. BASF SE: Net Sales

Table 88. BASF SE: Key Strategies

Table 89. Beijing Coowor Network Technology Co. Ltd.: Company Snapshot

Table 90. Beijing Coowor Network Technology Co. Ltd.: Operating Segments

Table 91. Beijing Coowor Network Technology Co. Ltd.: Product Portfolio

Table 92. Beijing Coowor Network Technology Co. Ltd.: Net Sales

Table 93. Beijing Coowor Network Technology Co. Ltd.: Key Strategies

Table 94. Covestro AG: Company Snapshot

Table 95. Covestro AG: Operating Segments

Table 96. Covestro AG: Product Portfolio

Table 97. Covestro AG: Net Sales

Table 98. Covestro AG: Key Strategies

Table 99. Dow Inc.: Company Snapshot

Table 100. Dow Inc.: Operating Segments

Table 101. Dow Inc.: Product Portfolio

Table 102. Dow Inc.: Net Sales

Table 103. Dow Inc.: Key Strategies

Table 104. Guibao: Company Snapshot

Table 105. Guibao: Operating Segments

Table 106. Guibao: Product Portfolio

Table 107. Guibao: Net Sales

Table 108. Guibao: Key Strategies

Table 109. Huntsman Corporation: Company Snapshot

Table 110. Huntsman Corporation: Operating Segments

Table 111. Huntsman Corporation: Product Portfolio

Table 112. Huntsman Corporation: Net Sales

Table 113. Huntsman Corporation: Key Strategies

Table 114. Johns Manville: Company Snapshot

Table 115. Johns Manville: Operating Segments

Table 116. Johns Manville: Product Portfolio

Table 117. Johns Manville: Net Sales

Table 118. Johns Manville: Key Strategies

Table 119. Kingspan Group: Company Snapshot

Table 120. Kingspan Group: Operating Segments

Table 121. Kingspan Group: Product Portfolio

Table 122. Kingspan Group: Net Sales

Table 123. Kingspan Group: Key Strategies

Table 124. Lx Hausys: Company Snapshot

Table 125. Lx Hausys: Operating Segments

Table 126. Lx Hausys: Product Portfolio

Table 127. Lx Hausys: Net Sales

Table 128. Lx Hausys: Key Strategies

Table 129. Owens Corning: Company Snapshot

Table 130. Owens Corning: Operating Segments

Table 131. Owens Corning: Product Portfolio

Table 132. Owens Corning: Net Sales

Table 133. Owens Corning: Key Strategies

Table 134. Saint-Gobain: Company Snapshot

Table 135. Saint-Gobain: Operating Segments

Table 136. Saint-Gobain: Product Portfolio

Table 137. Saint-Gobain: Net Sales

Table 138. Saint-Gobain: Key Strategies

Table 139. Sekisui Chemicals Co. Ltd.: Company Snapshot

Table 140. Sekisui Chemicals Co. Ltd.: Operating Segments

Table 141. Sekisui Chemicals Co. Ltd.: Product Portfolio

Table 142. Sekisui Chemicals Co. Ltd.: Net Sales

Table 143. Sekisui Chemicals Co. Ltd.: Key Strategies

Table 144. Sq Group: Company Snapshot

Table 145. Sq Group: Operating Segments

Table 146. Sq Group: Product Portfolio

Table 147. Sq Group: Net Sales

Table 148. Sq Group: Key Strategies

List of Figures

Figure 1. Phenolic Insulation Market Segmentation

Figure 2. Phenolic Insulation Market, 2021-2031

Figure 3. Phenolic Insulation Market, 2021-2031

Figure 4. Top Investment Pockets, by Region

Figure 5. Porter Five-1

Figure 6. Porter Five-2

Figure 7. Porter Five-3

Figure 8. Porter Five-4

Figure 9. Porter Five-5

Figure 10. Top Player Positioning

Figure 11. Phenolic Insulation Mark.:Drivers, Restraints and Opportunities

Figure 12. Value Chain Analysis

Figure 13. Key Regulation Analysis

Figure 14. Patent Analysis by Company

Figure 15. Patent Analysis by Country

Figure 16. Phenolic Insulation Market, By Application, 2021(%)

Figure 17. Comparative Share Analysis of Duct Phenolic Insulation Market, 2021-2031(%)

Figure 18. Comparative Share Analysis of Pipe Phenolic Insulation Market, 2021-2031(%)

Figure 19. Comparative Share Analysis of Wall Phenolic Insulation Market, 2021-2031(%)

Figure 20. Comparative Share Analysis of Roof Phenolic Insulation Market, 2021-2031(%)

Figure 21. Comparative Share Analysis of Floor Phenolic Insulation Market, 2021-2031(%)

Figure 22. Comparative Share Analysis of Others Phenolic Insulation Market, 2021-2031(%)

Figure 23. Phenolic Insulation Market, By End-Use Industry, 2021(%)

Figure 24. Comparative Share Analysis of Hvac System Phenolic Insulation Market, 2021-2031(%)

Figure 25. Comparative Share Analysis of Industrial Phenolic Insulation Market, 2021-2031(%)

Figure 26. Comparative Share Analysis of Building and Construction Phenolic Insulation Market, 2021-2031(%)

Figure 27. Comparative Share Analysis of Others Phenolic Insulation Market, 2021-2031(%)

Figure 28. Phenolic Insulation Market by Region, 2021

Figure 29. U.S. Phenolic Insulation Market, 2021-2031($Million)

Figure 30. Canada Phenolic Insulation Market, 2021-2031($Million)

Figure 31. Mexico Phenolic Insulation Market, 2021-2031($Million)

Figure 32. Germany Phenolic Insulation Market, 2021-2031($Million)

Figure 33. France Phenolic Insulation Market, 2021-2031($Million)

Figure 34. Uk Phenolic Insulation Market, 2021-2031($Million)

Figure 35. Spain Phenolic Insulation Market, 2021-2031($Million)

Figure 36. Itlay Phenolic Insulation Market, 2021-2031($Million)

Figure 37. Rest of Europe Phenolic Insulation Market, 2021-2031($Million)

Figure 38. China Phenolic Insulation Market, 2021-2031($Million)

Figure 39. Japan Phenolic Insulation Market, 2021-2031($Million)

Figure 40. India Phenolic Insulation Market, 2021-2031($Million)

Figure 41. South Korea Phenolic Insulation Market, 2021-2031($Million)

Figure 42. Australia Phenolic Insulation Market, 2021-2031($Million)

Figure 43. Rest of Asia-Pacific Phenolic Insulation Market, 2021-2031($Million)

Figure 44. Brazil Phenolic Insulation Market, 2021-2031($Million)

Figure 45. Saudi Arabia Phenolic Insulation Market, 2021-2031($Million)

Figure 46. South Africa Phenolic Insulation Market, 2021-2031($Million)

Figure 47. Rest of LAMEA Phenolic Insulation Market, 2021-2031($Million)

Figure 48. Top Winning Strategies, by Year

Figure 49. Top Winning Strategies, by Development

Figure 50. Top Winning Strategies, by Company

Figure 51. Product Mapping of Top 10 Players

Figure 52. Competitive Dashboard

Figure 53. Competitive Heatmap of Top 10 Key Players

Figure 54. Armacel.: Net Sales, ($Million)

Figure 55. Asahi Kasei Corporatio.: Net Sales, ($Million)

Figure 56. Basf S.: Net Sales, ($Million)

Figure 57. Beijing Coowor Network Technology Co. Ltd.: Net Sales, ($Million)

Figure 58. Covestro A.: Net Sales, ($Million)

Figure 59. Dow In.: Net Sales, ($Million)

Figure 60. Guiba.: Net Sales, ($Million)

Figure 61. Huntsman Corporatio.: Net Sales, ($Million)

Figure 62. Johns Manvill.: Net Sales, ($Million)

Figure 63. Kingspan Grou.: Net Sales, ($Million)

Figure 64. Lx Hausy.: Net Sales, ($Million)

Figure 65. Owens Cornin.: Net Sales, ($Million)

Figure 66. Saint-Gobai.: Net Sales, ($Million)

Figure 67. Sekisui Chemicals Co. Lt.: Net Sales, ($Million)

Figure 68. Sq Grou.: Net Sales, ($Million)

Executive Summary

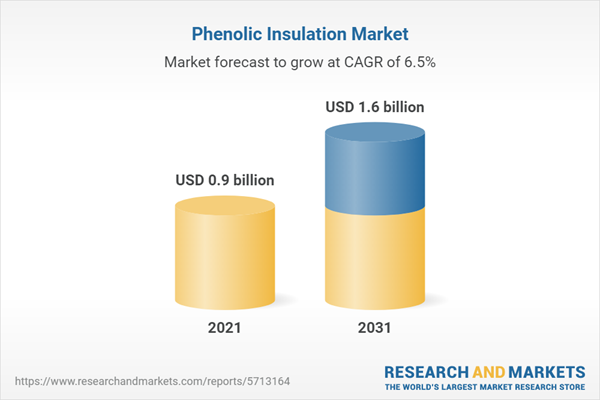

According to the report, “Phenolic Insulation Market," the phenolic insulation market was valued at $0.9 billion in 2021 and is estimated to reach $1.6 billion by 2031, growing at a CAGR of 6.5% from 2022 to 2031.Phenolic insulation is a rigid plastic board composed of phenolic resin and other components. It has characteristics such as high durability, chemical resistance, fire resistance, and low smoke emission at high temperatures, and it may be used in HVAC air ducts as cushioning material for fireproof doors, insulation layer for insulation systems, and many other applications. The definition of phenolic insulation is a closed-cell structure with outstanding thermal characteristics.

Phenolic insulation is an incredibly adaptable material that works well for a wide variety of applications. It is used for heating, ventilation, and air conditioning. In addition, phenolic insulation is also utilized in a variety of construction applications. The continuously laminated phenolic board is commonly used in roofing, cavity board, exterior wall board, plasterboard dry lining systems, wall insulation, floor insulation, and as a sarking board.

The unique characteristics of phenolic insulation such as excellent fire performance gaining traction. These factors are driving the demand for phenolic insulation. Phenolic insulations have applications in factory-engineered composite panels. These composite panels have a steel front on both sides, a high-density structural phenolic insulation core, and a suitable jointing method. Furthermore, phenolic insulation is used in petrochemical and industrial applications to insulate pipework, tanks, and other vessels.

Moreover, the expansion of commercial sectors such as airports, hospitals, movie theatres, public arcades, offices, subterranean train stations, and others act as a driving factor for the global phenolic insulation market since, it is used in the wall, roof, doors, and other applications. High R-values of phenolic insulation can help reduce the build-out depth of residential and commercial wall systems, which could lead to greater internal space that is available for sale or rental. In a simple line, it offers a thin alternative to conventional continuous insulation applications on exterior walls. Insulation is no exception; technical instruments have proliferated in virtually every business. Numerous instances exist in the industrial sector where insulation and technology commonly coexist. The market is constantly in search of ways to improve the processes used to make insulating materials, develop installation solutions, and identify the most advanced materials and technologies.

The phenolic formaldehyde insulation has minimal water absorption and good age resistance, making it an ideal material for use in wall insulation systems. Thus, R&D for phenolic insulation indicates a positive outlook for the advancement of the global market. However, the high cost of phenolic insulation relative to standard plywood may act as a major limitation on the phenolic insulation market's growth rate over the forecast period. In addition, the fast-escalating spending on building interiors such as wall partitions, fake ceilings, and insulating units offers numerous growth opportunities for the phenolic insulation market.

The phenolic insulation market is segmented on the basis of application, end-use industry, and region. On the basis of application, the market is categorized into duct, pipe, wall, floor, roof, and others. On the basis of end-use industry, the market is classified into the HVAC systems, building & construction, industrial, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the global phenolic insulation market include Armacell, Asahi Kasei Corporation, BASF SE, Beijing Coowor Network Technology Co., Ltd., Covestro AG, Dow Inc, Guibao, Huntsman Corporation, Johns Manville, Kingspan Group, LX Hausys, Owens Corning, Saint-Gobain, Sekisui Chemicals Co., Ltd, and SQ Group. Other players operating in the phenolic insulation market are Jinan Shengquan Group, Unilin(Xtratherm), Lapolla Industries, Inc., Recticel Group.

Key Findings of the Study

- By application, the duct segment is expected to grow at a CAGR of 7.0%, in terms of revenue, during the forecast period.

- By end-use industry, the HAVC systems segment is expected to grow at a CAGR of 7.0%, in terms of revenue, during the forecast period.

- Region-wise, Asia-Pacific occupied a share of $428.3millions in 2021 in terms of revenue.

Companies Mentioned

- armacell

- Asahi Kasei Corporation

- BASF SE

- Beijing Coowor Network Technology Co., Ltd.

- covestro ag

- DOW INC

- Guibao

- Huntsman Corporation

- johns manville

- Kingspan Group

- LX Hausys

- Owens Corning

- Saint-Gobain

- Sekisui Chemicals Co., Ltd

- sq group

Methodology

The analyst offers exhaustive research and analysis based on a wide variety of factual inputs, which largely include interviews with industry participants, reliable statistics, and regional intelligence. The in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. The primary research efforts include reaching out participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions.

They are also in professional corporate relations with various companies that allow them greater flexibility for reaching out to industry participants and commentators for interviews and discussions.

They also refer to a broad array of industry sources for their secondary research, which typically include; however, not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic news articles and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecast

Furthermore, the accuracy of the data will be analyzed and validated by conducting additional primaries with various industry experts and KOLs. They also provide robust post-sales support to clients.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | September 2022 |

| Forecast Period | 2021 - 2031 |

| Estimated Market Value ( USD | $ 0.9 billion |

| Forecasted Market Value ( USD | $ 1.6 billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |