Planned liquefied natural gas (LNG) refers to the incorporation of regasification and liquefaction capacities at LNG terminals. It involves storing and shipping LNG at high pressures, followed by regasification at the arriving destination for further use. Planned LNG utilize various technologies to deposit, transport, and process LNG, such as compression, refrigeration, heat exchangers, and cryogenic tanks. It is widely used in cooking, residential and commercial heating, electricity production, farm equipment, vehicles, ships, and industrial processes. Planned LNG aids in reducing market volatility, stabilizing prices, preventing sudden spikes, and ensuring a consistent and reliable supply. It is also cost-effective, and environment-friendly, that provides energy security, reduces dependency on oil, and supports diversification of energy sources. As a result, planned LNG finds extensive applications across the automotive, power generation, agriculture, mining, chemical, transportation, marine, and manufacturing industries.

Planned LNG Market Trends:

The rising demand for LNG as a cost-effective, cleaner, and more efficient energy source is one of the key factors propelling the market growth. Along with this, the widespread utilization of LNG in residential and commercial spaces for cooking, heating, lighting, refrigeration, and backup power is providing an impetus to the market growth. Furthermore, the growing demand for LNG as an alternative fuel in the automotive industry to power passenger cars, buses, trucks, and other heavy commercial vehicles is acting as another growth-inducing factor. Besides this, the increasing adoption of LNG as a fuel in power generation, mining, manufacturing, agriculture, and other industries to generate electricity, operate equipment and machinery, and produce fertilizers, chemicals, glass, and steel is providing a thrust to the market growth. Additionally, the introduction of floating LNG facilities which allows production to take place at offshore locations, thus providing easier access to remote and stranded gas reserves and eliminating the need for onshore infrastructures, is positively influencing the market growth. Apart from this, the integration of the Internet of Things (IoT) technology to optimize LNG production, monitor the conditions of storage tanks and cargos, and prevent potential issues, such as leaks, equipment failure, and pressure change, is favoring the market growth. Moreover, the implementation of various government initiatives to boost LNG production and support exploration activities for new reserves is facilitating the market growth. Other factors, including rising energy consumption, extensive research and development (R&D) activities, and the growing consumer awareness regarding the economic and environmental benefits of LNG, are anticipated to drive the market growth.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global planned LNG market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on technology and end use industry.Technology Insights:

- Liquefaction

- Regasification

End Use Industry Insights:

- Residential

- Commercial

- Industrial

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global planned LNG market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Cheniere Energy, Inc, Chevron Corporation, ConocoPhillips Company, Energy Transfer LP, Equinor ASA, Exxon Mobil Corporation, Freeport LNG, Gasum Ltd (Gasonia Oy), PETROBRAS, Sempra Energy, Shell Plc, Venture Global LNG, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global planned LNG market performed so far, and how will it perform in the coming years ?

- What are the drivers, restraints, and opportunities in the global planned LNG market ?

- What is the impact of each driver, restraint, and opportunity on the global planned LNG market ?

- What are the key regional markets ?

- Which countries represent the most attractive planned LNG market ?

- What is the breakup of the market based on technology ?

- Which is the most attractive technology in the planned LNG market ?

- What is the breakup of the market based on the end use industry ?

- Which is the most attractive end use industry in the planned LNG market ?

- What is the competitive structure of the global planned LNG market ?

- Who are the key players/companies in the global planned LNG market ?

Table of Contents

Companies Mentioned

- Cheniere Energy Inc

- Chevron Corporation

- ConocoPhillips Company

- Energy Transfer LP

- Equinor ASA

- Exxon Mobil Corporation

- Freeport LNG

- Gasum Ltd (Gasonia Oy)

- PETROBRAS

- Sempra Energy

- Shell Plc

- Venture Global LNG

Table Information

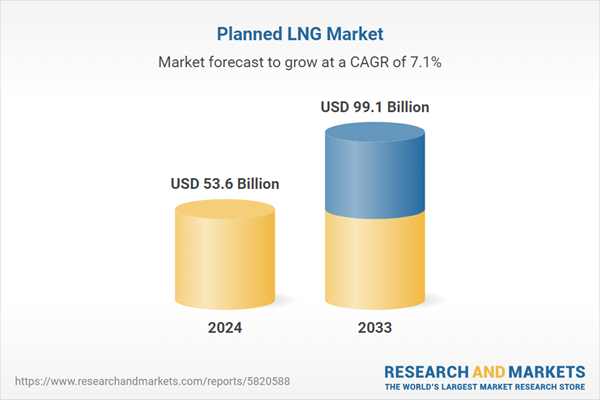

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 53.6 Billion |

| Forecasted Market Value ( USD | $ 99.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |