Global Plant Biostimulants Market - Key Trends & Drivers Summarized

Plant biostimulants are substances that are distinct from fertilizers and organically promote plant growth if applied in little quantities. Biostimulants are used on leaves or seeds of cereals, soil, fruits, grains, oilseeds, vegetables, ornamentals & turfs, and crop plantations to augment tolerance to environmental stress, nutrient availability, metabolism, chlorophyll production, and water-holding capacity. Furthermore, biostimulants increase antioxidant activity and promote cell enlargement and root development of a plant. Biostimulants are natural and eco-friendly substances that promote plant tolerance towards abiotic stress, uptake of mineral nutrients, and vegetative growth. Biostimulants in an advanced agriculture system are obtained from various communities of microorganisms that occur naturally and biochemical products such as proteins, organic acids, hormones, and enzymes produced by microorganisms. With compelling advantages in terms of crop productivity and yield, biostimulants are set to become a new phenomenon in the field of agriculture. Biostimulants are extensively utilized in global agricultural production and effectively contribute to dealing with the challenges presented by the rise in the global population.The market for plant biostimulants has been expanding significantly, driven by increasing demand for sustainable agricultural practices and the need to meet global food security challenges. Recent advancements in biostimulant formulations and delivery mechanisms have made these products more effective and easier to apply. Innovations in biotechnology and a better understanding of plant physiology have led to the development of highly specific biostimulant products tailored to particular crops and climatic conditions. Companies are not only combining conventional nutrition products with biostimulants, but also offering technological services to deliver added value to growers. The effectiveness of biostimulants depends on specialized and professional support that involves analysis of specific requirements of crops to find appropriate doses and methods for ensuring effective use of solutions to increase production. These approaches can be supported by application of advanced technology, often termed as Agriculture 4.0, representing a sustainable approach due to efficient use of crop inputs.

The growth in the plant biostimulants market is driven by several factors. The market growth is being driven by rising concerns over food security, continuing shift towards sustainable products and favorable government policies. Burgeoning population in countries like India and China along with the resulting demand for food products is one of the primary drivers for the global market. Advances in biotechnology and agricultural sciences have led to the creation of more effective biostimulant products that cater to specific crop needs and environmental conditions. Climate change and the associated increase in abiotic stresses on crops, such as drought and salinity, have made biostimulants an attractive solution for enhancing crop resilience. Future expansion of the global market is anticipated to be facilitated by rising awareness about sustainability benefits of these products along with government policies and guidelines to aid adoption of environmentally-friendly products across agricultural practices. Rising awareness among farmers about the benefits of biostimulants, supported by educational initiatives and positive trial results, is also accelerating their market penetration.

Report Scope

The report analyzes the Plant Biostimulants market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Active Ingredient (Amino Acid, Humic Acid, Fulvic Acid, Seaweed Extracts, Microbial Amendments, Other Active Ingredients); Crop Type (Row Crops & Cereals, Turf & Ornamentals, Fruits & Vegetables, Other Crop Types); Application (Foliar, Soil, Seed).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Amino Acid segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of 9.3%. The Humic Acid segment is also set to grow at 10.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $724.9 Million in 2024, and China, forecasted to grow at an impressive 14.3% CAGR to reach $984.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plant Biostimulants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plant Biostimulants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plant Biostimulants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acadian Seaplants Limited, Agrinos AS, Bayer AG, Biolchim S.p.A, FMC Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 157 companies featured in this Plant Biostimulants market report include:

- Acadian Seaplants Limited

- Agrinos AS

- Bayer AG

- Biolchim S.p.A

- FMC Corporation

- Gowan Company, L.L.C

- Haifa Group

- ILSA S.p.A.

- Koppert B.V.

- Novozymes A/S

- Rovensa Next

- Syngenta Crop Protection AG

- UPL Ltd.

- Yara International ASA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acadian Seaplants Limited

- Agrinos AS

- Bayer AG

- Biolchim S.p.A

- FMC Corporation

- Gowan Company, L.L.C

- Haifa Group

- ILSA S.p.A.

- Koppert B.V.

- Novozymes A/S

- Rovensa Next

- Syngenta Crop Protection AG

- UPL Ltd.

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 652 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

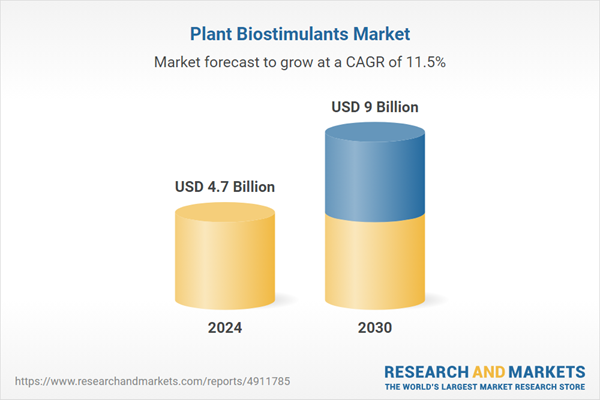

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 9 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |