Global Polymer Dispersions Market - Key Trends and Drivers Summarized

Polymer Dispersions: Versatile Solutions for Modern Applications

Polymer dispersions, also known as latexes, are stable mixtures of polymer particles in a liquid medium, typically water. These dispersions are created through a process known as emulsion polymerization, where monomers are polymerized in the presence of surfactants that stabilize the polymer particles in the dispersion. The choice of monomers, surfactants, and other additives determines the properties of the polymer dispersion, such as particle size, viscosity, and stability. The result is a versatile material that combines the properties of polymers with the ease of application of liquids. Polymer dispersions can be tailored to specific applications by adjusting the formulation, making them highly adaptable to various industry needs.How Are Polymer Dispersions Utilized Across Different Industries?

Polymer dispersions are extensively used across multiple industries due to their unique properties and ease of application. In the coatings industry, they serve as binders in paints and varnishes, providing durability, flexibility, and resistance to weathering. The adhesives industry utilizes polymer dispersions for their strong bonding capabilities and environmental benefits, as water-based adhesives reduce the need for volatile organic compounds (VOCs). In the textiles sector, polymer dispersions are used in fabric coatings and finishes, enhancing the durability, water resistance, and aesthetic properties of textiles. The paper industry also benefits from polymer dispersions in the form of coatings that improve printability, gloss, and water resistance of paper products. Additionally, these dispersions are used in the construction industry for waterproofing, sealing, and as additives in cement and mortar to improve flexibility and adhesion. These varied applications underscore the versatility and importance of polymer dispersions in enhancing product performance across different sectors.What Are the Current Trends in Polymer Dispersion Technology and Applications?

The technology and applications of polymer dispersions are continually evolving, driven by innovations aimed at improving performance and sustainability. One significant trend is the development of high-solid-content dispersions, which reduce drying times and improve film formation, making them more efficient and environmentally friendly. Advances in nano-technology are enabling the creation of nano-dispersions with enhanced mechanical and barrier properties, expanding their use in high-performance applications such as advanced coatings and packaging. The push towards sustainability is also leading to the development of bio-based and biodegradable polymer dispersions, which offer reduced environmental impact and improved compatibility with green building standards. Another trend is the increasing use of smart polymer dispersions that can respond to environmental stimuli, such as temperature and pH, for applications in advanced coatings and medical devices. These trends reflect the ongoing efforts to innovate and expand the capabilities of polymer dispersions, ensuring they meet the evolving needs of modern industries.What Factors Are Driving the Growth in the Polymer Dispersions Market?

The growth in the polymer dispersions market is driven by several factors, reflecting the increasing demand for high-performance, sustainable materials across various industries. The expansion of the construction industry, particularly the rising demand for eco-friendly and energy-efficient building materials, is a significant driver, as polymer dispersions are key components in waterproofing, sealing, and insulating applications. Technological advancements in polymer science are enhancing the quality and functionality of polymer dispersions, encouraging their adoption in new and existing applications. The growing focus on sustainability and environmental regulations is propelling the development and use of water-based, low-VOC dispersions, supporting market growth. Additionally, the rise in demand for high-quality coatings, adhesives, and textiles in automotive, aerospace, and consumer goods industries is contributing to market expansion. Continuous research and development efforts to create innovative polymer dispersion products with enhanced performance further support market growth. These factors collectively ensure robust growth in the polymer dispersions market, underscoring their essential role in advancing material science and industrial applications.Report Scope

The report analyzes the Polymer Dispersions market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Decorative & Protective Coating, Paper, Carpet & Fabrics, Printing Ink, Adhesives & Sealants, Other Applications); Resin Type (Acrylic Dispersions, Vinyl Dispersions, Polyurethane Dispersions, SB Dispersions, Other Resin Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acrylic Dispersions segment, which is expected to reach US$6 Billion by 2030 with a CAGR of 8.2%. The Vinyl Dispersions segment is also set to grow at 6.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $3.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polymer Dispersions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polymer Dispersions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polymer Dispersions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alberdingk Boley GmbH, Allnex, BASF SE, BIP (Oldbury) Limited, Chase Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Polymer Dispersions market report include:

- Alberdingk Boley GmbH

- Allnex

- BASF SE

- BIP (Oldbury) Limited

- Chase Corporation

- Coim S.p.A (Coim Group)

- Covestro AG

- DIC Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Hexion Inc.

- Huntsman International LLC

- Icap-Sira Chemicals and Polymers S.P.A.

- Kamsons Chemicals Pvt., Ltd.

- Lamberti SpA

- Lanxess AG

- Michelman, Inc.

- Mitsui Chemicals, Inc.

- Solvay SA

- Synthomer PLC

- The Lubrizol Corporation

- Vinavil S.P.A.

- Wacker Chemie AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alberdingk Boley GmbH

- Allnex

- BASF SE

- BIP (Oldbury) Limited

- Chase Corporation

- Coim S.p.A (Coim Group)

- Covestro AG

- DIC Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Hexion Inc.

- Huntsman International LLC

- Icap-Sira Chemicals and Polymers S.P.A.

- Kamsons Chemicals Pvt., Ltd.

- Lamberti SpA

- Lanxess AG

- Michelman, Inc.

- Mitsui Chemicals, Inc.

- Solvay SA

- Synthomer PLC

- The Lubrizol Corporation

- Vinavil S.P.A.

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

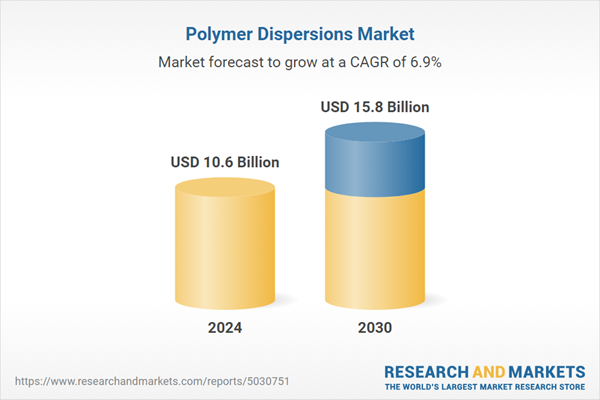

| Estimated Market Value ( USD | $ 10.6 Billion |

| Forecasted Market Value ( USD | $ 15.8 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |