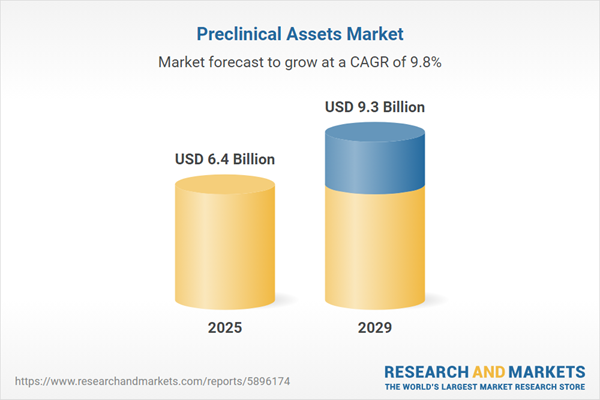

The preclinical assets market size is expected to see strong growth in the next few years. It will grow to $9.3 billion in 2029 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to precision medicine and personalized therapies, ai and machine learning integration, biobanking expansion, focus on rare diseases, government initiatives and funding. Major trends in the forecast period include emergence of advanced imaging techniques, 3d organoid models, multi-omics integration, enhanced predictive models, automation and high throughput screening.

The rising pace of drug discovery is anticipated to boost the growth of the preclinical asset market in the future. Drug discovery is the process of identifying chemical substances that can serve as medicinal agents and involves discovering new candidate medications. Within this framework, preclinical assets play a crucial role by providing essential data and evidence to support the selection of molecules for clinical development as candidates. For example, in June 2023, the European Federation of Pharmaceutical Industries and Associations (EFPIA), a Belgium-based organization representing the pharmaceutical sector, reported significant growth in the European pharmaceutical industry, with production increasing from $352.48 billion in 2021 to $369.95 billion in 2022. Consequently, the increase in drug discovery is driving the growth of the preclinical assets market.

The escalating need to mitigate clinical trial expenditures drives the upward momentum of the preclinical asset market. Clinical trial costs encompass the comprehensive expenses incurred in planning, executing, and managing trials aimed at assessing the safety, efficacy, and potential benefits of novel medical interventions. These trials provide critical insights into the safety, effectiveness, and potential side effects of preclinical assets, validating their therapeutic promise in human subjects. For instance, data sourced from Genetic Engineering and Biotechnology News in February 2023 underscored a substantial rise in the cost of developing new drugs among the top 20 global biopharma companies, soaring by 15% from $298 million in 2022 to approximately $2.3 billion in 2023. This increase encapsulates the expenses incurred throughout the drug development lifecycle, particularly in clinical trial phases. Hence, the mounting emphasis on reducing clinical trial costs propels the expansion of the preclinical asset market.

Product innovation has emerged as a significant trend driving growth within the preclinical assets market. Prominent players in this sector are heavily invested in pioneering new products and solutions to fortify their market position and gain a competitive edge. An illustrative case is the partnership between Charles River Laboratories International and Valo Health Inc. In April 2022, they introduced Logica, an AI-powered drug solution. This innovative offering seamlessly translates biological insights of clients into optimized preclinical assets. By amalgamating Charles River's extensive preclinical expertise with Valo's AI-driven Opal Computational Platform, Logica delivers a unified approach to drug discovery. This transformative partnership ensures the conversion of targets into candidate nominations, enhancing efficiency and yielding highly qualified leads for clients while aligning costs with value creation.

Major companies in the preclinical assets market are concentrating on establishing strategic alliances to enhance their market position. For example, in July 2023, AbbVie, a US-based pharmaceutical company, and Calibr, a leading research and drug development firm based in India, announced an expanded strategic collaboration aimed at advancing several innovative preclinical and early-stage clinical assets. This partnership builds on the previous collaboration between AbbVie and Scripps Research. Additionally, Calibr will provide AbbVie with a specific number of new discovery targets and preclinical assets of mutual interest for consideration of options.

In October 2022, Pfizer Inc., a prominent pharmaceutical and biotechnology corporation based in the United States, completed the acquisition of Biohaven Pharmaceutical Holding Company Ltd. for a total of $11.6 billion. Through this acquisition, Pfizer obtained access to a promising portfolio of calcitonin gene-related peptide (CGRP) receptor antagonists, which encompasses Rimegepant, Zavegepant, and a collection of preclinical CGRP assets. Biohaven Pharmaceutical Holding Company Ltd. is a clinical-stage biopharmaceutical company headquartered in the United States, known for its early-stage discovery program and various preclinical assets.

Major companies operating in the preclinical assets market include Laboratory Corporation of America, IQVIA Inc., ICON PLC, Eurofins Scientific SE, PPD Inc., SGS SA, WuXi AppTec Co. Ltd., Intertrek Group PLC, Charles River Laboratories International Inc., Medpace Inc., Pharmaron Beijing Co. Ltd., Evotec SE, GenScript Biotech Corporation, Inotiv Inc., SRI International Inc., Shanghai Medicilon Inc., Biocytogen Pharmaceuticals Beijing Co. Ltd., AmplifyBio LLC, BioReliance Corporation, Pharmalegacy Laboratories Co. Ltd., Precigen Inc., ReproCELL Incorporated, InSphero AG, Crown Bioscience Inc., Comparative Biosciences Inc., TCG Lifesciences Pvt. Ltd., InVivo Biosystems, Pharmatest Services Ltd, Domainex Limited, Viroclinics Xplore.

North America was the largest region in the preclinical assets market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the preclinical assets market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the preclinical assets market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

A preclinical asset encompasses all clinical trial supplies or equipment utilized during the preclinical development phase, bridging the gap between drug discovery in the laboratory and the commencement of human clinical trials. This preliminary stage involves essential feasibility assessments, iterative evaluations, and the gathering of safety data, primarily conducted on laboratory animals.

The primary categories of preclinical asset services include bioanalysis and DMPK (Drug Metabolism and Pharmacokinetic) studies, toxicology testing, compound management, safety pharmacology, and others. Bioanalysis and DMPK studies play a pivotal role in the drug development process, focusing on evaluating the pharmacokinetic and drug metabolism characteristics of potential new drugs. Various models, such as patient-derived organoid (PDO) models and patient-derived xenograft models, are employed by diverse end-users, including biopharmaceutical companies, government institutes, and others.

The preclinical assets market research report is one of a series of new reports that provides preclinical assets market statistics, including preclinical assets industry global market size, regional shares, competitors with a preclinical assets market share, detailed preclinical assets market segments, market trends and opportunities, and any further data you may need to thrive in the preclinical assets industry. This preclinical assets market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The preclinical assets market consists of revenues earned by entities by providing preclinical assets services such as process research and development, asymmetric synthesis, safety pharmacology, and custom synthesis. The market value includes the value of related goods sold by the service provider or included within the service offering. The preclinical assets market consists of sales of chemical compounds, biological samples, and sample storage systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Preclinical Assets Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on preclinical assets market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for preclinical assets? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The preclinical assets market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service: Bioanalysis and DMPK (Drug Metabolism and Pharmacokinetic) Studies; Toxicology Testing; Compound Management; Safety Pharmacology; Other Services2) By Model Type: Patient Derived Organoid (PDO) Model; Patient Derived Xenograft Model

3) By End User: Biopharmaceutical Companies; Government Institutes; Other End-Users

Subsegments:

1) By Bioanalysis and DMPK (Drug Metabolism and Pharmacokinetic) Studies: Pharmacokinetics (PK) Studies; Pharmacodynamics (PD) Studies; Bioanalytical Method Development2) By Toxicology Testing: Acute Toxicity Testing; Chronic Toxicity Testing; Genotoxicity Testing; Carcinogenicity Testing

3) By Compound Management: Compound Library Management; Sample Storage and Retrieval; High-Throughput Screening Support

4) By Safety Pharmacology: Cardiovascular Safety Assessments; Neurotoxicity Evaluations; Respiratory Safety Evaluations

5) By Other Services: Regulatory Support; Preclinical Study Design and Consulting; Custom Assay Development

Key Companies Mentioned: Laboratory Corporation of America; IQVIA Inc.; ICON PLC; Eurofins Scientific SE; PPD Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Laboratory Corporation of America

- IQVIA Inc.

- ICON PLC

- Eurofins Scientific SE

- PPD Inc.

- SGS SA

- WuXi AppTec Co. Ltd.

- Intertrek Group PLC

- Charles River Laboratories International Inc.

- Medpace Inc.

- Pharmaron Beijing Co. Ltd.

- Evotec SE

- GenScript Biotech Corporation

- Inotiv Inc.

- SRI International Inc.

- Shanghai Medicilon Inc.

- Biocytogen Pharmaceuticals Beijing Co. Ltd.

- AmplifyBio LLC

- BioReliance Corporation

- Pharmalegacy Laboratories Co. Ltd.

- Precigen Inc.

- ReproCELL Incorporated

- InSphero AG

- Crown Bioscience Inc.

- Comparative Biosciences Inc.

- TCG Lifesciences Pvt. Ltd.

- InVivo Biosystems

- Pharmatest Services Ltd

- Domainex Limited

- Viroclinics Xplore

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.4 Billion |

| Forecasted Market Value ( USD | $ 9.3 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |