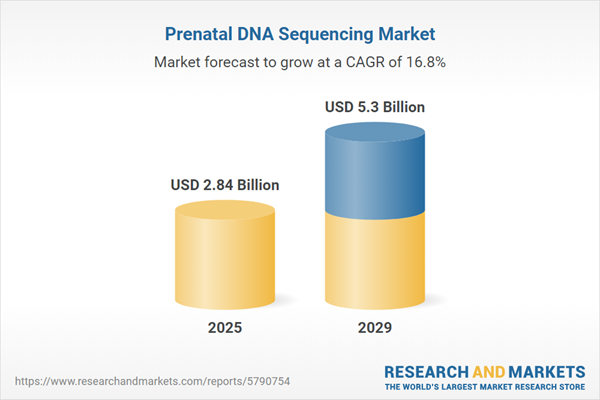

The prenatal DNA sequencing market size is expected to see rapid growth in the next few years. It will grow to $5.3 billion in 2029 at a compound annual growth rate (CAGR) of 16.8%. The growth in the forecast period can be attributed to consumer demand for early detection, rising maternal age and pregnancy risks, public health initiatives, regulatory support and guidelines, advancements in data analysis. Major trends in the forecast period include research and development efforts, ethical and regulatory considerations, improved data interpretation tools, precision medicine integration, prenatal genetic counseling.

The anticipated rise in cancer prevalence is set to drive the growth of the prenatal DNA sequencing market. Cancer, characterized by uncontrolled cell growth and spread, prompts the use of prenatal DNA sequencing to detect fetal aneuploidy and identify cancer in the fetus. This sequencing method unveils inherited or germline DNA changes influencing a person's cancer susceptibility. For example, data from the American Cancer Society in January 2023 showed an increase in cancer cases from 1,898,160 in 2021 to 1,958,310 in 2023, reflecting a growth rate of 3.16%. Consequently, the prevalence of cancer acts as a driving force for the prenatal DNA sequencing market.

The increasing birth rate is anticipated to drive the growth of the prenatal DNA sequencing market in the coming years. The birth rate refers to the number of live births per 1,000 individuals in a specific population over a defined period, typically reported annually. Prenatal DNA sequencing is instrumental in detecting genetic abnormalities in unborn fetuses, facilitating informed reproductive choices during childbirth through selective interventions. For example, in January 2023, a report from the Centers for Disease Control and Prevention, a U.S.-based national public health organization, indicated that the United States experienced a 1% rise in registered births, amounting to 3,664,292, compared to the previous year. Consequently, the increasing birth rate is propelling the prenatal DNA sequencing market.

Product innovation is a prominent trend in the prenatal DNA sequencing market, with major companies concentrating on developing innovative solutions to enhance their market standing. Juno Diagnostics, Inc., a U.S.-based health technology company, introduced the noninvasive prenatal screening test 'Hazel' in November 2022. Designed with no risk of miscarriage, the test can be performed as early as 9 weeks into pregnancy using a small blood sample. It screens for common genetic conditions such as Down syndrome, Edwards syndrome, and Patau syndrome.

Major companies in the prenatal DNA sequencing market are pursuing a strategic partnership approach to improve technology integration and broaden their market presence. A strategic partnership generally involves a collaborative relationship among two or more organizations that combine their resources, expertise, and efforts to achieve shared goals or objectives. For example, in December 2023, BillionToOne, a U.S.-based precision diagnostics company, teamed up with a Johnson & Johnson subsidiary, a U.S.-based pharmaceutical firm, for the AZALEA Phase 3 clinical trial of nipocalimab. This trial focuses on pregnancies at risk for severe hemolytic disease of the fetus and newborn (HDFN). BillionToOne will supply its UNITY Fetal Antigen Non-invasive Prenatal Test (UNITY Fetal Antigen CTA) to screen and determine participant eligibility. HDFN is a rare condition resulting from blood type incompatibility between the pregnant individual and the fetus, which can lead to life-threatening anemia.

In November 2022, Myriad Genetics, Inc., a U.S.-based provider of genetic testing and precision medicine, acquired Gateway Genomics, LLC, a personal genomics and prenatal DNA company. The undisclosed acquisition is expected to enhance Myriad's women's health product portfolio and provide access to personalized genetic tests, strengthening its position in the market.

Major companies operating in the prenatal DNA sequencing market include Agilent Technologies Inc., BGI Group, F. Hoffmann-La Roche Ltd, Illumina Inc., Laboratory Corporation of America Holdings, Natera Inc., Myriad Genetics Inc., Invitae Corporation, PerkinElmer Inc., Macrogen Inc., Pacific Biosciences of California Inc., Genewiz LLC, 10x Genomics Inc., Oxford Nanopore Technologies Limited, Thermo Fisher Scientific Inc., Berry Genomics Co. Ltd., Centrillion Technology Holdings Corp., Cynvenio Biosystems Inc., Eurofins LifeCodexx AG, GeneDx Inc., Genoma SA, Helix OpCo LLC, Igenomix S.L., Integrated DNA Technologies Inc.

North America was the largest region in the prenatal DNA sequencing market in 2024. The regions covered in the prenatal dna sequencing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the prenatal dna sequencing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Prenatal DNA sequencing is a method employed to sequence the DNA of an unborn baby, utilizing a blood sample from the mother to unveil the complete genetic code of the fetus. This technique is instrumental in detecting fetal disorders or diseases.

The primary types of prenatal DNA sequencing encompass genetic diseases and nonhereditary diseases. Genetic diseases refer to disorders or diseases caused by mutations in one or more genes. DNA sequencing plays a crucial role in determining whether a gene carries a mutation leading to a specific disorder. Applications of prenatal DNA sequencing include conditions such as hemophilia, Down syndrome, cystic fibrosis, autism, DiGeorge syndrome, AIDS, cancer, and others. Various users, including academic research, clinical research, hospitals and clinics, as well as pharmaceutical and biotechnology companies, employ this technology.

The prenatal DNA sequencing market research report is one of a series of new reports that provides prenatal DNA sequencing market statistics, including the prenatal DNA sequencing industry global market size, regional shares, competitors with a prenatal DNA sequencing market share, detailed prenatal DNA sequencing market segments, market trends and opportunities, and any further data you may need to thrive in the prenatal DNA sequencing industry. This prenatal DNA sequencing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The prenatal DNA sequencing market includes revenues earned by entities by provide services such as prenatal next-generation sequencing, whole genome sequencing, DNA extraction, DNA fragmentation, and data collection and sequence analysis. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Prenatal DNA Sequencing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on prenatal dna sequencing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for prenatal dna sequencing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The prenatal dna sequencing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Genetic Diseases; Nonhereditary Diseases2) by Application: Hemophilia; Down Syndrome; Cystic Fibrosis; Autism; DiGeorge Syndrome; AIDS (Acquired Immunodeficiency Syndrome); Cancer; Other Applications

3) by End User: Academic Research; Clinical Research; Hospitals and Clinics; Pharmaceutical and Biotechnology Companies; Other End Users

Subsegments:

1) by Genetic Diseases: Monogenic Disorders; Chromosomal Abnormalities2) by Nonhereditary Diseases: Infectious Diseases; Maternal Health Conditions

Key Companies Mentioned: Agilent Technologies Inc.; BGI Group; F. Hoffmann-La Roche Ltd; Illumina Inc.; Laboratory Corporation of America Holdings

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Prenatal DNA Sequencing market report include:- Agilent Technologies Inc.

- BGI Group

- F. Hoffmann-La Roche Ltd

- Illumina Inc.

- Laboratory Corporation of America Holdings

- Natera Inc.

- Myriad Genetics Inc.

- Invitae Corporation

- PerkinElmer Inc.

- Macrogen Inc.

- Pacific Biosciences of California Inc.

- Genewiz LLC

- 10x Genomics Inc.

- Oxford Nanopore Technologies Limited

- Thermo Fisher Scientific Inc.

- Berry Genomics Co. Ltd.

- Centrillion Technology Holdings Corp.

- Cynvenio Biosystems Inc.

- Eurofins LifeCodexx AG

- GeneDx Inc.

- Genoma SA

- Helix OpCo LLC

- Igenomix S.L.

- Integrated DNA Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.84 Billion |

| Forecasted Market Value ( USD | $ 5.3 Billion |

| Compound Annual Growth Rate | 16.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |