Speak directly to the analyst to clarify any post sales queries you may have.

Strategic introduction to ready-to-use therapeutic food that frames clinical objectives supply resilience stakeholder responsibilities and policy levers

The landscape of therapeutic nutrition for vulnerable populations is evolving rapidly, driven by a combination of clinical evidence, programmatic needs, and logistics innovations. As the prevalence of acute malnutrition persists in specific contexts, ready-to-use therapeutic food has emerged as a critical intervention that links clinical nutrition science with large-scale delivery systems. This introduction sets the stage by framing the product category within public health objectives and the operational realities that shape procurement, manufacture, and distribution.Across humanitarian and clinical settings, decision-makers increasingly expect products that meet strict safety and efficacy criteria while also accommodating the constraints of field conditions, storage, and distribution. Toward that end, manufacturers and program implementers have sought to balance formulation choices, packaging formats, and channel strategies to match end-user needs. In parallel, regulatory and donor environments have introduced new requirements and programmatic expectations that influence product specifications and supplier selection.

Consequently, the narrative for ready-to-use therapeutic food is no longer limited to nutrient composition alone; it now encompasses supply chain resilience, traceability, and a value proposition that includes cost-effectiveness over the full delivery cycle. This introduction therefore positions the subsequent sections to explore the transformative shifts, policy developments, segmentation nuances, regional considerations, and practical recommendations that leaders will need to navigate in the near term. By contextualizing clinical utility within procurement and operational frameworks, readers will find a coherent foundation for assessing options and prioritizing actions.

Comprehensive view of transformative shifts altering production procurement clinical differentiation and supply chain transparency for therapeutic nutrition

Significant shifts are reshaping how stakeholders conceive, produce, and deliver ready-to-use therapeutic food, and these changes demand adaptive strategies across the value chain. Technological advances in formulation and production have reduced batch variability and enabled more consistent product quality, while process automation has improved throughput and lowered the risk of contamination. At the same time, nutritional science has refined age- and condition-specific formulations, prompting a move away from one-size-fits-all products toward options that reflect clinical differentiation and programmatic intent.Procurement models are evolving from single-source, donor-driven buys to more diversified frameworks that prioritize long-term supplier relationships, local manufacturing capacity, and blended financing arrangements. This evolution aligns with growing expectations for supply chain transparency and traceability, which in turn are supported by digital tools for inventory management and batch tracking. Humanitarian logistics have similarly matured, with cross-sector coordination and prepositioning strategies reducing lead times and improving response flexibility.

Taken together, these transformative shifts are altering the competitive and regulatory landscape. Manufacturers are investing in quality systems and certifications, purchasers are redefining contract terms to include performance metrics, and implementers are exploring hybrid channel strategies that mix clinical distribution with retail and online options for follow-up support. As a result, actors across the ecosystem must adopt an integrative perspective that marries technical product development with robust supply and demand management practices.

Assessment of how changes in United States tariff policy have reshaped sourcing manufacturing choices procurement strategy and supply continuity in 2025

The policy and trade environment influence the cost structure and availability of ready-to-use therapeutic food more than many stakeholders appreciate, and recent tariff changes in the United States have created ripple effects across global supply chains. Tariff adjustments alter the relative economics of importing raw materials and finished products, prompting manufacturers to reassess sourcing strategies and to consider relocating certain activities closer to end markets. In addition, changes to tariff classifications and customs processes can introduce administrative delays that affect lead times and inventory policies.These trade dynamics intersect with program procurement cycles and donor funding cadences, compelling buyers to build greater flexibility into contract terms and inventory buffers. In practice, this means that procurement teams increasingly negotiate clauses that address tariff fluctuations, customs clearance responsibilities, and contingency logistics. For manufacturers, the cumulative impact materializes as adjustments to supplier agreements, increased emphasis on tariff engineering where permissible, and accelerated exploration of alternative feedstock suppliers in geographically diverse locations.

Moreover, tariff shifts influence strategic decisions about where to invest manufacturing capacity. Stakeholders are weighing the benefits of localized production against the efficiencies of concentrated large-scale plants. Local production can mitigate certain tariff exposures and shorten distribution chains, but it also requires predictable demand and supportive regulatory frameworks. In sum, the United States tariff environment in 2025 has reinforced the need for dynamic procurement strategies, deeper scenario planning, and closer alignment between commercial teams and program planners so that supply continuity and product quality remain uncompromised.

Actionable segmentation insights revealing how product type packaging choices and distribution channels interact to determine program fit and operational trade-offs

Segmentation insights reveal how product form, packaging choices, and distribution channels each impose distinct design and operational trade-offs that determine product suitability and program fit. Based on product type, formulations are commonly categorized across cereal blends, lipid nutrient supplements, and milk formulations; within cereal blends the dominant formats include fortified flour and porridge powder, with each option presenting different preparation, acceptability, and storage considerations; lipid nutrient supplements are further divided into compact forms such as bars and semi-solid forms such as pastes, which affect dosage control, portability, and adherence; milk formulations appear in both liquid and powder variants, each balancing cold-chain dependency against reconstitution convenience.Packaging type also shapes cost, usability, and waste profiles, with common choices including bulk jar formats favored for centralized feeding programs, single-serving sachets that support individual distribution and reduce cross-contamination risk, and tubes that offer convenience for outpatient therapeutic feeding where dosing accuracy and convenience are critical. Channel segmentation demonstrates that delivery mechanisms can dramatically influence uptake and continuity of care, as clinical channels have different dispensing protocols compared with hospital settings, while nongovernmental organization programs often integrate distribution with community outreach; online channels introduce new pathways for follow-up and information dissemination, and retail pharmacy presence can support accessibility and continuity beyond programmatic supply windows.

This segmentation matrix has implications for product development, procurement contracts, and last-mile strategies. For example, a program prioritizing rapid household-level deployment may prefer sachets of lipid nutrient paste distributed through NGO networks, while a facility-based therapeutic feeding program with refrigeration capability could opt for liquid milk formulations provided through hospitals and clinics. As stakeholders assess supplier proposals, they should align product specifications with channel capabilities and user behaviors to ensure both clinical effectiveness and operational feasibility.

Key regional insights explaining how supply chains regulatory expectations and production capacity vary across the Americas Europe Middle East & Africa and Asia-Pacific

Regional dynamics matter because they influence sourcing choices, logistical complexity, regulatory pathways, and programmatic priorities, and the patterns vary meaningfully across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, established manufacturing clusters and strong cold-chain infrastructure support a diversity of product formats, enabling both localized production and reliable export. This regional strength allows stakeholders to adopt mixed sourcing approaches and to leverage private-public partnerships for rapid procurement and distribution in both urban and remote settings.In Europe, Middle East & Africa the landscape is more heterogeneous, with advanced regulatory regimes in some markets and fragile supply corridors in others. This diversity compels program designers and suppliers to navigate a patchwork of import rules, quality certifications, and logistics constraints. Consequently, stakeholders operating across this broad region often rely on partnerships with regional manufacturers or use centralized procurement hubs to manage complexity and ensure product consistency.

Asia-Pacific presents a mix of high-volume manufacturing capacity and rapidly developing local markets. Strong ingredient supply chains and a growing set of commercial producers create opportunities for cost-efficient production, but differences in national regulatory expectations and distribution infrastructure require careful planning. Across all regions, successful actors balance global standards with regional adaptation, ensuring that product specifications, packaging formats, and distribution strategies align with local program realities and regulatory expectations.

Key company-level insights on how innovation regulatory compliance manufacturing scale and partnerships define competitive positioning in therapeutic nutrition

Leading companies in the ready-to-use therapeutic food ecosystem are demonstrating a mix of capabilities that combine product innovation, regulatory expertise, scale manufacturing, and partnership-based distribution. Market leaders typically invest in robust quality management systems and third-party certifications to satisfy both clinical requirements and donor procurement criteria, while also leveraging contract manufacturing agreements to expand capacity without diluting core competencies. At the same time, a subset of companies is differentiating through formulation research that adapts macro- and micronutrient profiles to specific age cohorts and clinical indications.Strategic partnerships are another hallmark, as firms collaborate with nongovernmental implementers, public health agencies, and logistics providers to align production schedules with campaign cycles and emergency responses. These partnerships often include shared commitments to prepositioning and rapid mobilization, which in turn require transparent tracking systems and clear governance structures. Commercial dynamics also show a mix of branded offerings and private-label contracts, with some suppliers focusing on direct sales to programs while others specialize in long-term procurement agreements with multilateral purchasers.

Regulatory navigation and product traceability remain differentiators. Companies that demonstrate comprehensive compliance frameworks, from raw material provenance to finished-product testing, command stronger trust among purchasers. Meanwhile, innovation in packaging and shelf-life extension can unlock new distribution channels, and firms that pair technical advances with adaptive commercial models are best positioned to capture sustained procurement relationships and programmatic roles.

Actionable recommendations for industry leaders to align product design procurement resilience regulatory engagement and channel diversification for greater impact

Industry leaders should adopt a series of practical measures to strengthen resilience, improve product fit, and accelerate impact across clinical and humanitarian programs. First, aligning product development with end-user conditions and channel constraints ensures that formulations and packaging match real-world use cases; for instance, selecting single-dose sachets or paste formats for household distribution can reduce wastage and improve adherence, while powder and liquid milk formulations may suit facility-based care where reconstitution and cold-chain capacity exist. Second, procurement strategies must incorporate flexible clauses to address tariff and customs variability, including contingency sourcing options and performance-based incentives tied to delivery timelines.Operationally, manufacturers and purchasers should invest in greater supply chain visibility through digital tools that track inventory, lot numbers, and expiry data. This visibility reduces spoilage risk and enables preemptive replenishment, which is especially important where lead times lengthen due to trade policy shifts. In tandem, stakeholders should expand localized manufacturing partnerships where feasible to mitigate tariff exposure and shorten distribution chains, while ensuring robust quality oversight and technical transfer support. From a commercial perspective, companies should diversify channel strategies by integrating clinical, nonprofit, online, and retail pathways to extend reach and create redundancy.

Finally, industry players must engage proactively with regulators and donors to harmonize standards, accelerate approvals for product innovations, and secure predictable procurement frameworks. Building these relationships helps align expectations around labeling, nutrient composition, and quality assurance, and it also facilitates joint investments in capacity building. Implementing these recommendations requires cross-functional coordination among product development, regulatory affairs, procurement, and distribution teams to translate strategic intent into operational improvements and measurable program outcomes.

Detailed research methodology explaining the mixed-methods approach primary interviews secondary review and triangulation used to derive practical insights

The research underpinning this executive summary employed a mixed-methods approach that combined primary qualitative interviews, systematic secondary review, and rigorous triangulation to ensure validity and relevance. Primary data collection included structured interviews with clinical nutrition specialists, procurement officers, supply chain managers, and program implementers, which provided granular insights into real-world constraints and decision criteria. These interviews were supplemented by expert panel discussions that prioritized areas of strategic uncertainty and informed the development of practical recommendations.Secondary research drew from peer-reviewed clinical literature, regulatory guidance documents, trade and customs publications, and industry technical standards to construct a comprehensive baseline of product specifications, safety requirements, and manufacturing practices. Where possible, trade and logistics datasets were analyzed to identify patterns in lead times, shipping constraints, and regional supply corridors; these quantitative signals were then cross-validated against practitioner accounts to ensure that observed trends reflected operational realities. Throughout the process, results underwent iterative validation with subject-matter experts to resolve inconsistencies and to refine conclusions.

The methodology emphasized transparency in assumptions and limitations. Data gaps were noted and addressed through sensitivity checks and scenario planning, and qualitative findings were contextualized to avoid overgeneralization. By combining multiple source types and stakeholder perspectives, the research delivered a robust, actionable evidence base suitable for informing procurement decisions, policy advocacy, and operational improvements in therapeutic nutrition programs.

Concise concluding synthesis emphasizing the need for operational rigor strategic planning and cross-sector collaboration to sustain therapeutic nutrition outcomes

In closing, ready-to-use therapeutic food occupies a critical nexus between clinical nutrition science and the operational realities of delivering life-saving interventions at scale. The sector is experiencing meaningful change driven by advances in formulation, increasing expectations for supply chain transparency, and the pressures of evolving trade policy. These forces compel stakeholders to rethink procurement models, invest in resilient logistics, and prioritize product designs that align with channel capabilities and user behaviors.Looking ahead, successful actors will be those that combine technical excellence with pragmatic operational models: robust quality assurance systems, flexible sourcing strategies that anticipate tariff and customs variability, and multi-channel distribution approaches that enhance accessibility and continuity of care. Cross-sector collaboration-between manufacturers, implementers, regulators, and funders-will remain essential to harmonize standards and mobilize resources for both routine programming and emergency response.

By integrating the segmentation, regional, and corporate insights presented here and applying the actionable recommendations, leaders can improve program outcomes while strengthening the sustainability and responsiveness of therapeutic nutrition supply chains. The combination of strategic planning and operational rigor will determine the sector’s ability to deliver effective interventions where they are needed most.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Ready to Use Therapeutic Food Market

Companies Mentioned

The key companies profiled in this Ready to Use Therapeutic Food market report include:- Diva Nutritional Products

- Edesia Nutrition, Inc.

- GC Rieber Compact AS

- Hilina Enriched Foods PLC

- InnoFaso

- Insta Products (EPZ) Ltd.

- Mana Nutritive Aid Products, Inc.

- Meds & Food For Kids

- Nuflower Foods & Nutrition Pvt. Ltd.

- Nutriset SAS

- Nutrivita Foods Pvt. Ltd.

- Power Foods Industries / Power Foods Tanzania

- Tabatchnick Fine Foods, Inc.

- Valid Nutrition

Table Information

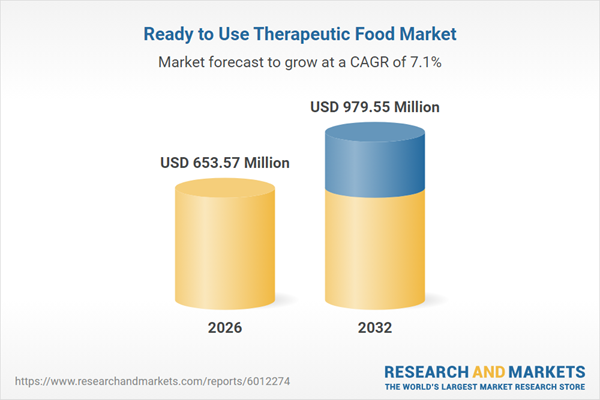

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 653.57 Million |

| Forecasted Market Value ( USD | $ 979.55 Million |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |