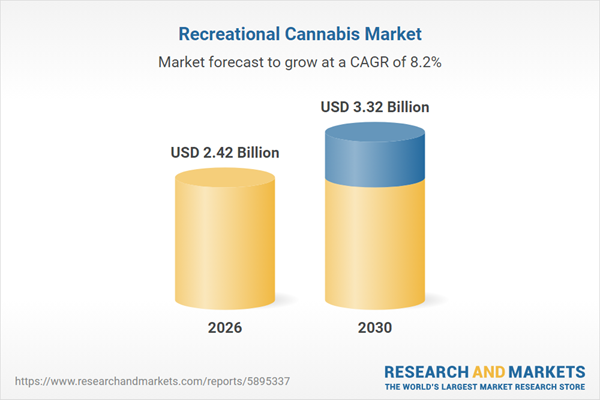

The recreational cannabis market size is expected to see strong growth in the next few years. It will grow to $3.32 billion in 2030 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to growth in premium cannabis product innovation, rising demand for cannabis-infused beverages, increasing shift toward controlled-dosage edible formats, expansion of digital retail and delivery platforms, rising consumer preference for safer non-smoke alternatives. Major trends in the forecast period include growing demand for high-potency thc recreational products, expansion of premium and specialty cannabis edibles, rising popularity of vape and inhalation-based recreational formats, growth in novel cannabis-infused beverages and confectioneries, increasing consumer shift toward flavored and experience-based cannabis products.

The shifting societal attitudes toward cannabis use are expected to drive the growth of the recreational cannabis market in the future. These attitudes reflect the prevailing perceptions, beliefs, and opinions within a community regarding the acceptance, legality, and social norms related to cannabis consumption. For example, in August 2024, the National Institute of Health (NIH), a US-based medical research center, reported that among adults aged 19-30, 42% indicated they used cannabis in 2023, with 29% having used it in the past month and 10% using it daily. Similarly, usage rates were reported among those aged 35 to 50. Therefore, the evolving societal attitudes toward cannabis are propelling the growth of the recreational cannabis market.

Leading companies are strategically focusing on the development of innovative products to reinforce their market standing. Illustratively, in June 2023, Aurora Cannabis Inc., a licensed cannabis producer based in Canada, introduced a range of innovative recreational cannabis products. This lineup includes Lil' Bits Sour Grape and Sour Watermelon (10 x 1mg edibles), Mango XL Vape, Signature Hash, among others. The Lil' Bits Sour Grape and Sour Watermelon Low Dose Edibles offer delectable flavors in a snackable form, catering to novice users or those interested in micro-dosing. These products feature crowd-pleasing, nostalgic flavors with minimal to no aftertaste from cannabis. Mango XL Vape (510-1.2g) utilizes a unique blend of quality resin enriched with botanical terpenes, providing a full-spectrum and full-flavor vaping experience. The Signature Hash (2g) represents a groundbreaking bubble hash blend, setting new standards for malleability and burnability.

In June 2023, Tilray Brands, a prominent cannabis and beverage alcohol company based in the US, completed the acquisition of Hexo Corporation for an estimated $56 million. This strategic move enhances Tilray's market dominance in Canada's cannabis sector, enabling the combined entity to maximize sales, refine marketing strategies, and bolster distribution networks. This acquisition aims to fortify Tilray's commercial presence and expedite its expansion in capturing a larger market share. Hexo Corporation, the acquired entity, is a renowned Canadian recreational cannabis producer.

Major companies operating in the recreational cannabis market are The Cronos Group, Verano Holdings, Cresco Labs Inc., SNDL Inc., Medical Marijuana Inc., Tilray Inc., 22nd Century Group, Aurora Cannabis Inc., Canopy Growth Corporation, Columbia Care, PharmaCann Inc., Village Farms International Inc, Indiva Limited, VIVO Cannabis Inc., TerrAscend Corp., Acreage Holdings, HEXO Corp, 4Front Ventures, C3 Industries, TILT Holdings, Maricann Inc., Organigram Holding Inc., Ascend Wellness Holdings, Curaleaf Holdings Inc., Trulieve Cannabis, Green Thumb Industries.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs on imported cannabis production equipment, vape components, packaging materials, and chemical extraction systems have increased operational costs for recreational cannabis manufacturers, particularly impacting vape, edibles, and oil-based product segments in regions reliant on foreign supply chains such as North America and Europe. These tariffs have slowed product innovation cycles and raised retail prices, especially in dispensary-heavy markets. However, they also stimulate domestic manufacturing, encourage local sourcing of packaging and extraction technologies, and support the long-term development of regionally integrated cannabis supply ecosystems.

The recreational cannabis market research report is one of a series of new reports that provides recreational cannabis market statistics, including recreational cannabis industry global market size, regional shares, competitors with a recreational cannabis market share, detailed recreational cannabis market segments, market trends and opportunities, and any further data you may need to thrive in the recreational cannabis industry. This recreational cannabis market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Recreational cannabis, also referred to as adult-use marijuana, denotes any component of the cannabis plant, whether alive or not, consumed for intoxicating purposes rather than medicinal benefits. Tetrahydrocannabinol (THC) is a compound present in cannabis products responsible for altering mood and impairing cognitive functions and coordination.

The range of products within recreational cannabis includes oils, transdermal patches, tablets, capsules, vapes, suppositories, tinctures, creams, edibles, and more. Oil, in this context, represents a diverse array of compounds characterized by their unctuous, viscous, flammable nature, liquid state at room temperature, and solubility in ether or alcohol but not water. These compounds predominantly contain tetrahydrocannabinol (THC), cannabidiol (CBD), or a balanced combination of both, administered orally, topically, through inhalation, rectally, or sublingually. These applications cover a spectrum including chronic pain, cancer, mental health conditions, sleep management, among others. End users encompass pharmaceuticals, food and beverage, tobacco, personal care, as well as research and development entities.North America was the largest region in the recreational cannabis market in 2025. The regions covered in the recreational cannabis market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the recreational cannabis market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The recreational cannabis market consists of sales of cannabis indica and cannabis sativa. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Recreational Cannabis Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses recreational cannabis market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for recreational cannabis? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The recreational cannabis market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By Product: Oils; Transdermal Patches; Tablets; Capsule; Vape; Suppositories; Tinctures; Creams; Edibles; Other Products2) By Compound: Tetrahydrocannabinol (THC) Dominant; Cannabidiol (CBD) Dominant; Balanced Tetrahydrocannabinol (THC)

3) By Administration: Oral; Topical; Inhalation; Rectal; Sublingual

4) By Application: Chronic Pain; Cancer; Mental Disorder; Sleep Management; Other Applications

5) By End Users: Pharmaceuticals; Food; Beverages; Tobacco; Personal Care; Research And Development Center

Subsegments:

1) By Oils: Cannabis Oil; CBD Oil; THC Oil2) By Transdermal Patches: THC Transdermal Patches; CBD Transdermal Patches

3) By Tablets: THC Tablets; CBD Tablets

4) By Capsules: THC Capsules; CBD Capsules

5) By Vape: Vape Pens; Vape Cartridges; Disposable Vape Devices

6) By Suppositories: THC Suppositories; CBD Suppositories

7) By Tinctures: THC Tinctures; CBD Tinctures

8) By Creams: Topical Creams; Pain Relief Creams

9) By Edibles: Gummies; Chocolates; Beverages

10) By Other Products: Cannabis-Infused Honey; Bath Bombs; Pre-Rolls

Companies Mentioned: The Cronos Group; Verano Holdings; Cresco Labs Inc.; SNDL Inc.; Medical Marijuana Inc.; Tilray Inc.; 22nd Century Group; Aurora Cannabis Inc.; Canopy Growth Corporation; Columbia Care; PharmaCann Inc.; Village Farms International Inc; Indiva Limited; VIVO Cannabis Inc.; TerrAscend Corp.; Acreage Holdings; HEXO Corp; 4Front Ventures; C3 Industries; TILT Holdings; Maricann Inc.; Organigram Holding Inc.; Ascend Wellness Holdings; Curaleaf Holdings Inc.; Trulieve Cannabis; Green Thumb Industries

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Recreational Cannabis market report include:- The Cronos Group

- Verano Holdings

- Cresco Labs Inc.

- SNDL Inc.

- Medical Marijuana Inc.

- Tilray Inc.

- 22nd Century Group

- Aurora Cannabis Inc.

- Canopy Growth Corporation

- Columbia Care

- PharmaCann Inc.

- Village Farms International Inc

- Indiva Limited

- VIVO Cannabis Inc.

- TerrAscend Corp.

- Acreage Holdings

- HEXO Corp

- 4Front Ventures

- C3 Industries

- TILT Holdings

- Maricann Inc.

- Organigram Holding Inc.

- Ascend Wellness Holdings

- Curaleaf Holdings Inc.

- Trulieve Cannabis

- Green Thumb Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 2.42 Billion |

| Forecasted Market Value ( USD | $ 3.32 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |