Global Refrigerated Warehousing Market - Key Trends and Drivers Summarized

Refrigerated Warehousing: Essential for the Cold Chain

Refrigerated warehousing plays a pivotal role in maintaining the cold chain for perishable goods, particularly in the food and pharmaceutical industries. These warehouses are designed to store products at specific temperatures to preserve their quality, extend shelf life, and ensure safety until they reach the consumer. For the food industry, refrigerated warehouses are essential for storing items like fresh produce, bakery & dairy products, meat, and seafood, which require consistent low temperatures to prevent spoilage and contamination. In the pharmaceutical sector, temperature-sensitive products, such as vaccines, biologics, and certain medications, rely on refrigerated warehousing to maintain their efficacy and comply with stringent regulatory standards. As global trade expands and consumer demand for fresh and safe products increases, the role of refrigerated warehousing in the supply chain becomes even more critical.What Technological Innovations Are Enhancing Refrigerated Warehousing?

Technological advancements are transforming refrigerated warehousing, making it more efficient, sustainable, and responsive to industry demands. One significant innovation is the integration of IoT (Internet of Things) technology, which enables real-time monitoring of temperature and humidity levels within the warehouse. This ensures that storage conditions remain optimal and allows for immediate adjustments if any deviations occur. Additionally, automation and robotics are increasingly being used to streamline operations, from automated guided vehicles (AGVs) for material handling to advanced warehouse management systems (WMS) that optimize inventory control and order fulfillment. These technologies not only enhance efficiency but also reduce energy consumption and operational costs. Moreover, advances in refrigeration systems, such as the use of natural refrigerants and energy-efficient compressors, are helping to reduce the environmental impact of refrigerated warehouses, aligning with global sustainability goals.What Are the Key Benefits of Refrigerated Warehousing?

Refrigerated warehousing offers numerous benefits that are vital to the integrity of the cold chain and the broader supply chain. One of the primary advantages is the ability to maintain the quality and safety of perishable products over extended periods. By providing a controlled environment, these warehouses prevent spoilage, reduce waste, and ensure that products meet the health and safety standards required for consumer protection. Additionally, refrigerated warehousing supports global trade by enabling the storage and distribution of products across regions and markets, regardless of climate conditions. This is particularly important for industries like food and pharmaceuticals, where timely and safe delivery is critical. Furthermore, the use of advanced technologies in refrigerated warehousing enhances operational efficiency, reduces energy consumption, and lowers overall costs, making it a cost-effective solution for businesses that rely on the cold chain.What Factors Are Driving the Growth in the Refrigerated Warehousing Market?

The growth in the Refrigerated Warehousing market is driven by several factors. The increasing demand for perishable goods, particularly in emerging markets, is a significant driver, as more consumers seek fresh and safe food products and medications. Technological advancements, such as the integration of IoT, automation, and energy-efficient refrigeration systems, are also propelling market growth by improving operational efficiency and sustainability. The expansion of global trade and the growing complexity of supply chains are further boosting demand for refrigerated warehousing, as businesses require reliable cold storage solutions to maintain product quality across long distances. Additionally, regulatory requirements for the storage and transportation of temperature-sensitive products are contributing to market growth, as companies must comply with stringent standards to ensure the safety and efficacy of their products. These factors, combined with the continuous development of new warehousing technologies and practices, are driving the sustained growth of the Refrigerated Warehousing market.Report Scope

The report analyzes the Refrigerated Warehousing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Blast Freezing, Vapor Freezing, Programmable Logic Controller (PLC), Evaporation Cooling); Temperature (Frozen, Chilled); Application (Fruits & Vegetables, Meat & Seafood, Bakery & Confectionary, Dairy Products, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Blast Freezing Technology segment, which is expected to reach US$18 Billion by 2030 with a CAGR of 9.3%. The Vapor Freezing Technology segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.7 Billion in 2024, and China, forecasted to grow at an impressive 12.1% CAGR to reach $7.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Refrigerated Warehousing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Refrigerated Warehousing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Refrigerated Warehousing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agro Merchants Group, Berkshire Transportation, Inc., Burris Logistics, Cold Storage Manufacturing, Inc., Conewago Enterprises, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Refrigerated Warehousing market report include:

- Agro Merchants Group

- Berkshire Transportation, Inc.

- Burris Logistics

- Cold Storage Manufacturing, Inc.

- Conewago Enterprises, Inc.

- Crystal Cold

- Crystal Logistic Cool Chain Ltd.

- Energy Panel Structures, Inc.

- Frialsa FrigorIficos, S.A. De C.V.

- Ice Make Refrigeration Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agro Merchants Group

- Berkshire Transportation, Inc.

- Burris Logistics

- Cold Storage Manufacturing, Inc.

- Conewago Enterprises, Inc.

- Crystal Cold

- Crystal Logistic Cool Chain Ltd.

- Energy Panel Structures, Inc.

- Frialsa FrigorIficos, S.A. De C.V.

- Ice Make Refrigeration Limited

Table Information

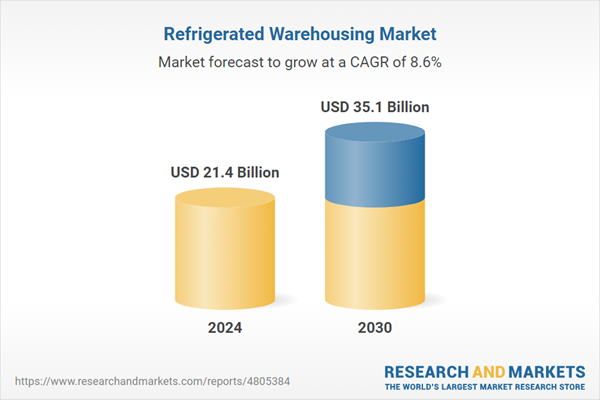

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.4 Billion |

| Forecasted Market Value ( USD | $ 35.1 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |