Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Saudi Arabia’s adsorbents market is entering a structurally stronger phase under Vision 2030, supported by sustained hydrocarbon processing activity, accelerated gas development, an expansive water reuse agenda, and local manufacturing localization drives. Adsorbents, spanning molecular sieves, activated alumina, silica gel, activated carbon, bentonite clay, and specialty guard-bed materials, are mission-critical to dehydration, purification, odor/VOC abatement, product quality stabilization, and environmental compliance across the Kingdom’s energy, water, chemicals, food, healthcare, and electronics value chains.

Gas monetization and midstream build-out are gathering momentum through multi-billion-dollar expansions associated with the Jafurah unconventional gas program and the Master Gas System. Public disclosures outline phased contract awards for gas processing, gathering, and transmission assets, indicating higher throughputs for sour gas sweetening, deep dehydration, NGL recovery, and condensate handling, processes where regenerable molecular sieves, activated alumina, and tailored guard beds are standard of care. These developments signal additional stationary bed cycles and inventory turns for adsorbents over the forecast horizon.

The National Water Strategy and 2030 water goals continue to prioritize desalination, wastewater treatment, brackish water polishing, and near-total urban wastewater reuse. In practice, that translates into more pretreatment and polishing steps to protect downstream membranes and equipment, driving the uptake of silica gel, activated alumina, specialty carbons, and hybrid media. Institutional momentum is visible in programmatic upgrades, new plants, and performance contracting, coupled with circularity expectations for reactivation and waste minimization. At the megaproject level, new urban and industrial developments require robust water security, transmission, and storage infrastructure, further underpinning adsorbent use for humidity control, corrosion mitigation, and granular/powder moisture management in storage and logistics.

Industrial diversification and localization, from advanced materials to pharma and medical devices, elevate quality, compliance, and cleanroom-grade packaging standards. Controlled humidity in packaging, moisture scavenging in resins, and odor/VOC capture in process vents are all adsorbent-intensive steps. Local pharmaceutical localization initiatives also point to increased consumption of desiccant sachets, humidity indicators, and, in select sub-segments, chromatographic media and high-purity adsorbents.

Supply dynamics are favorable. Global incumbents with deep portfolios in molecular sieves, aluminas, and carbons are active in Saudi Arabia through local entities, joint ventures, and service footprints. This ecosystem reduces lead times, improves technical support, and enables performance-based service contracts (e.g., guaranteed run-lengths, fixed-fee change-outs, or reactivation credits). On the innovation side, bio-based, plastic-free desiccant packs and higher-capacity carbons for emerging contaminants are diffusing into the Kingdom, aligning with sustainability KPIs.

Cost normalization is visible following the post-pandemic input price spikes in energy, logistics, and minerals. Yet reliability, total life-cycle cost, and environmental footprint increasingly trump lowest unit price, especially in mission-critical refining/gas plants and high-spec water assets. The shift to data-assisted maintenance (predictive change-outs, breakthrough modeling, and real-time dew point monitoring) supports a gradual pivot to service-centric procurement with KPIs around uptime and compliance.

Cycles in petrochemical margins can affect turnaround timing, while project reprioritizations in mega-developments may shift near-term order profiles. Regulatory tightening will continue to recalibrate adsorbent specifications for air and water emissions. Nevertheless, the balance of policy direction, capex visibility, and operational excellence programs indicates a solid growth runway for Saudi Arabia’s adsorbents market through 2030F. Large-scale gas development and midstream financing tied to the Jafurah field and Master Gas System expansion, Vision 2030 documents and National Water Strategy targets driving water reuse and service upgrades, and utility/industrial water project momentum, including brackish water plants and new storage and transmission infrastructure. These themes collectively reinforce the multi-sector pull for adsorbents across hydrocarbon, water, and diversified industry end-uses.

Key Market Drivers

Gas Expansion and Process Intensification

Saudi Arabia’s strategic shift to expand domestic gas supply is a primary structural driver for adsorbents. The Kingdom’s program to raise gas production capacity and optimize midstream assets entails sustained investment in gathering, processing, and transmission. Jafurah, the flagship unconventional gas project, anchors this expansion, with disclosed phases awarding multi-billion-dollar EPC contracts and additional rigs. As midstream assets are monetized and developed through lease-and-leaseback and private capital participation, visibility into long-cycle maintenance and reliability requirements strengthens. Each additional increment of gas processing capacity implies proportional needs for deep dehydration (molecular sieves), CO₂/H₂S removal polishing, mercury and sulfur guard beds, and NGL drying, all adsorbent-intensive.Operationally, higher throughput plants require robust adsorbent selection to maintain dew point specifications, prevent hydrate formation, and protect downstream cryogenic equipment. Refiners and petrochemical complexes across the Kingdom deploy regenerable alumina and zeolitic sieves to safeguard catalyst beds, stabilize product yields, and extend run-lengths between turnarounds. Incremental expansions of the Master Gas System, plus integration projects at refineries and chemical complexes, further multiply applications in cracked gas and olefin dehydration, LPG polishing, and off-gas VOC/odor capture.

Policy signals and corporate disclosures provide supporting context such as the Kingdom’s gas expansion agenda includes large contract packages for Jafurah phases and associated pipelines; asset monetization in midstream underscores the long-term confidence in gas demand; and ongoing agreements with technology licensors and service partners strengthen know-how transfer for high-spec purification trains. These elements collectively favor increasing stock-and-flow of adsorbents in stationary beds, with predictable rebedding cycles and opportunities for performance guarantees.

In parallel, environmental performance expectations raise the bar for emissions control and effluent polishing at energy complexes. Facilities increasingly adopt activated carbon and specialty media for odor/VOC and trace contaminant capture. As Saudi operators embrace predictive maintenance, dew point monitors, breakthrough modeling, and temperature profile analytics, procurement is shifting from unit-price comparisons to total life-cycle value, accelerating the adoption of high-capacity sieves, low-pressure-drop aluminas, and optimized guard beds with verifiable run-lengths under local feed conditions.

Key Market Challenges

Project Timing, Input Volatility, and Procurement Friction

While demand fundamentals are robust, short-term order visibility can be affected by project phasing, megaproject reprioritization, and turnaround scheduling across refineries, gas plants, and large water assets. When EPC packages are rescheduled or scope-adjusted, adsorbent deliveries and rebedding services may shift, creating lumpy quarterly patterns even as the multi-year trajectory remains positive. On the cost side, volatility in freight, energy, and raw materials (e.g., alumina, specialty clays, high-purity silica) can compress margins and force price re-sets. Large operators increasingly request performance-based service models, advantageous in the long run, but they demand rigorous piloting, local stockholding, and rapid technical support.Procurement friction can emerge when specifications are tailored to legacy operating philosophies. For instance, reluctance to switch from incumbent grades, despite modeled run-length gains, can delay adoption of next-generation sieves or low delta-P aluminas optimized for local feed compositions. Documentation and qualification requirements add lead time for new products, especially where critical path equipment protection is involved (e.g., cryogenic exchangers). To mitigate these challenges, suppliers must offer local technical service, robust references, and digital monitoring support, demonstrating risk reduction and total lifecycle savings rather than standalone price advantages. These realities moderate near-term adoption curves even in a fundamentally expanding market.

Key Market Trends

Shift to Service-Centric, Outcome-Based Contracts

A clear trend is the migration from product-only procurement to integrated service models. Operators are contracting for run-length guarantees, dew-point assurance, and breakthrough-time commitments, bundled with monitoring, on-site audits, and rapid change-out crews. This approach aligns incentives, reduces unplanned downtime, and simplifies life-cycle costing. It also favors suppliers with local stockholding, pilot skids, and the ability to tailor layered bed architectures, combining guard beds, co-adsorbents, and high-selectivity sieves. Digital enablement, dew-point sensors, bed temperature profiling, and predictive algorithms, supports optimized regeneration schedules and energy savings. As national programs elevate reliability across energy and water assets, framework agreements with performance KPIs are becoming more prevalent, strengthening demand visibility for top-tier adsorbent platforms.Key Market Players

- BASF Saudi Arabia Co. Ltd.

- Honeywell UOP

- Arkema

- Cabot Corporation

- Axens Catalyst Arabia Ltd (ACAL)

- Sinopec Catalyst Co. Ltd.

- Shell plc (Shell Catalysts & Technologies)

- SABIC Industrial Catalyst Company

- Clariant Speciality Solutions

- AFI Group

Report Scope:

In this report, Saudi Arabia Adsorbents Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Adsorbents Market, By Type:

- Activated Carbon

- Molecular Sieves

- Silica Gel

- Others

Saudi Arabia Adsorbents Market, By Application:

- Petroleum Refining

- Gas Refining

- Water Treatment

- Others

Saudi Arabia Adsorbents Market, By Region:

- Eastern

- Northern & Central

- Western

- Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in Saudi Arabia Adsorbents Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF Saudi Arabia Co. Ltd.

- Honeywell UOP

- Arkema

- Cabot Corporation

- Axens Catalyst Arabia Ltd (ACAL)

- Sinopec Catalyst Co. Ltd.

- Shell plc (Shell Catalysts & Technologies)

- SABIC Industrial Catalyst Company

- Clariant Speciality Solutions

- AFI Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2025 |

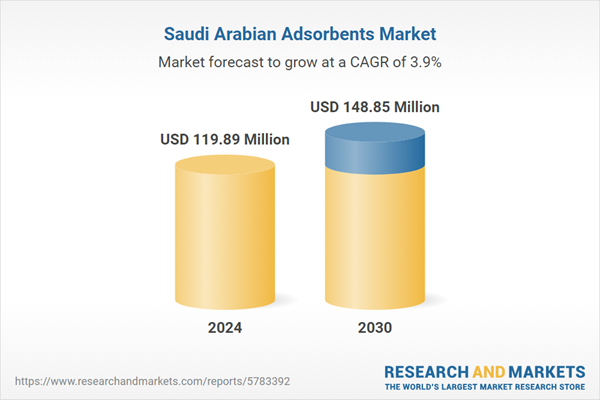

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 119.89 Million |

| Forecasted Market Value ( USD | $ 148.85 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |