Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Rise in Exploration and Drilling Activities for Oil Around Saudi Arabia to Drive the Market

Oil exploration and drilling activities around Saudi Arabia have evolved greatly over the past century as a result of improvements in drilling technology, an increase in demand for fuel for cars, and other similar factors. Additionally, petroleum extraction is becoming more successful, which supports market expansion. When economic competition rises in the oil exploration, drilling, and servicing industries, more oilfield equipment is used, consequently raising its demand. Many oil businesses and governments are focusing on new oil and gas exploration and drilling activities to get a competitive edge over their rivals and meet the expanding worldwide demand for oil. In a similar vein, Saudi Aramco had step up global oil and gas exploration in February 2019. The company aspires to compete with main rivals like Royal Dutch Shell and Exxon Mobil in order to expand into global drilling.Redevelopment of Mature Oil Wells To Drive the Market Growth

Mature fields are also referred to as brownfields. The oil production in the mature fields is currently decreasing. These fields have aged to a point where they are no longer useful. Although fresh developments and discoveries often capture the focus, these industries are regarded as the 'backbone' of the industry. Furthermore, more than 60% of the daily oil production worldwide comes from mature fields. The idea of developing ageing oil fields has also become more and more enticing as a result of developments in oil well and reservoir engineering. Many companies are focusing on creative strategies for redeveloping oil fields due to financial concerns and to sustain existing oil production volumes. Construction of central processing facilities and related infrastructure is part of the renovation. The ability of DGI's CoViz 4D to integrate, visualise, and analyse all pertinent reservoir data, including seismic, geophysical, and petrophysical data as well as reservoir simulations, well logs, completions, and production, aids reservoir teams in jointly evaluating conditions, diagnosing issues, identifying bypassed oil, and starting to investigate and evaluate mature oil field stimulation options.Technological Developments in Oilfield Equipment

Oil and gas production could rise as a result of new technology. The advancement of technology in oilfield equipment also offer benefits including improved safety, cost savings, speeded-up processes, and better efficiency. Modern technology like artificial intelligence, the Internet of Things, and analytics make it possible to digitize oil and gas refineries, pipelines, exploration sites, and infrastructure. This component enables oil and gas companies to compile all pertinent data on a single platform. Oil and gas companies are investing more in innovative technologies in order to increase production, reduce risks, and cut costs. For instance, in September 2019, Imperial and the Alberta Machine Intelligence Institute (Amii) collaborated to provide machine learning and artificial intelligence (AI) capabilities for the oil and gas industry to improve worker safety and mitigate any harmful environmental effects. Schlumberger and Dataiku Technology formed a similar partnership in December 2019 to develop and deploy artificial intelligence solutions for use in oil and gas operations.Increasing Consumption of Oil & Gas in the Country Driving the Market Growth

Saudi Arabia's daily oil consumption was estimated at 3,595.427 barrels in December 2021. This is an increase from the previous number for December 2020 of 3,552.200 barrels/day. The Kingdom reportedly sourced 34.3 percent of its June imports from Egypt, 25.5 percent from the UAE, and 21.1 percent from Estonia, in addition to buying fuel oil from other countries. Future Saudi Arabian oil and gas consumption will increase due to significant factors such a thriving economy, expanding population, and fuel economy. The reliance on oil and gas is expected to increase further as the country's infrastructure continues to be heavily dependent on items made from petroleum.Market Segmentation

The Saudi Arabia Drilling Tools Market is divided into Type, and Application. Based on Type, the market is divided into Drill Bits, Drilling Tubulars, Mud Pumps, Reamers & Stabilizers, Drill Swivels, Drill Collars & Others. Based on Application, the market is segmented into Onshore & Offshore.Market Players

Major market players in the Saudi Arabia Drilling Tools Market are Schlumberger Limited, Baker Hughes, a GE Company, The Halliburton Company, National Oilwell Varco, Weatherford International PLC, Technip FMC, Precision Drilling Corporation, Parker Drilling Company, Gyrodata Incorporated, Dynomax Drilling Tools Inc.Report Scope

In this report, the Saudi Arabia Drilling Tools Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Drilling Tools Market, by Type:

- Drill Bits

- Drilling Tubulars

- Mud Pumps

- Reamers & Stabilizers

- Drill Swivels

- Drill Collars

- Others

Saudi Arabia Drilling Tools Market, by Application:

- Onshore

- Offshore

Saudi Arabia Drilling Tools Market, by Region:

- Eastern Region

- Northern & Central Region

- Western Region

- Southern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Drilling Tools Market.Available Customizations

The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Limited

- Baker Hughes a GE Company

- The Halliburton Company

- National Oilwell Varco

- Weatherford International PLC

- Technip FMC

- Precision Drilling Corporation

- Parker Drilling Company

- Gyrodata Incorporated

- Dynomax Drilling Tools Inc.

Table Information

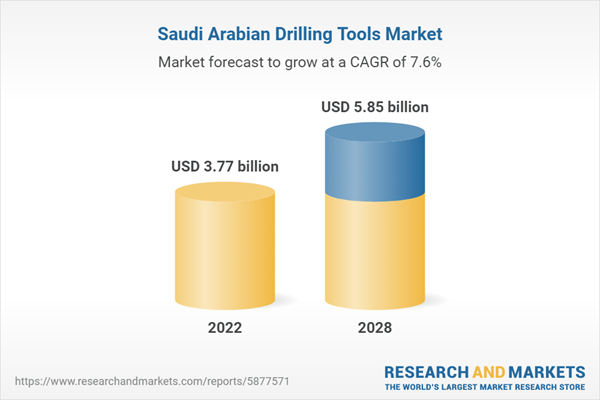

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3.77 billion |

| Forecasted Market Value ( USD | $ 5.85 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |