Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Additionally, the surge in investments in smart cities and infrastructure development projects in Saudi Arabia has created a growing need for optical sensors in applications like security systems, traffic management, and environmental monitoring. Furthermore, the rising awareness of the advantages offered by optical sensors, including their accuracy and reliability, has stimulated market demand. As a result, the Saudi Arabia Optical Sensors Market is poised for continued expansion, with opportunities for businesses and investors looking to capitalize on the country's evolving technological landscape.

Key Market Drivers

Increasing Adoption in Consumer Electronics

The Saudi Arabia Optical Sensors Market is witnessing a significant surge in demand, primarily driven by the increasing adoption of optical sensors in the consumer electronics industry. These sensors have become integral components in devices such as smartphones, tablets, and wearable gadgets, enabling features like touchscreens, fingerprint recognition, and facial recognition. The relentless quest for more advanced and user-friendly devices has spurred innovation in optical sensor technology, making it a cornerstone of modern consumer electronics. As consumers seek more immersive and interactive experiences, the demand for higher-quality displays and precise gesture recognition is on the rise.Optical sensors, with their ability to detect changes in light and motion with exceptional accuracy, cater to these evolving expectations. Their responsiveness and precision have not only improved the overall user experience but also opened up new possibilities for augmented reality and virtual reality applications. This heightened integration of optical sensors into consumer electronics is expected to continue propelling the Saudi Arabia Optical Sensors Market to new heights. The demand for optical sensors in the industrial sector in Saudi Arabia is rising, driven by smart manufacturing and automation, expected to grow at a CAGR of 8-10% through 2028.

Automotive Industry Integration

The automotive industry plays a vital role in driving the growth of the Saudi Arabia Optical Sensors Market. As vehicles become increasingly connected and automated, the need for advanced sensing technologies has become paramount. Optical sensors are being employed in vehicles for various critical functions, such as adaptive cruise control, lane-keeping assistance, and autonomous driving features. These sensors are adept at recognizing objects, reading road signs, and ensuring the safety of occupants and pedestrians.Moreover, optical sensors are instrumental in enhancing driver assistance systems, which are progressively becoming standard features in modern automobiles. With Saudi Arabia's focus on infrastructure development and smart cities, the demand for optical sensors in the automotive sector is expected to further escalate, contributing significantly to market growth. The demand for optical sensors in security and surveillance systems in Saudi Arabia is growing rapidly, reflecting the broader focus on smart cities and public safety, with an estimated annual growth rate of 7-9%.

Industrial Automation and Industry 4.0

The integration of optical sensors into the realm of industrial automation is another key driver behind the burgeoning Saudi Arabia Optical Sensors Market. Industry 4.0, characterized by the fusion of automation, data exchange, and digital technologies, relies heavily on optical sensors for monitoring and control purposes. These sensors are used in conveyor systems, quality control processes, and robotic applications to ensure precision and efficiency. Their ability to detect objects and materials with high accuracy, even in challenging environments, is essential for optimizing production processes.

Additionally, optical sensors are instrumental in predictive maintenance, helping to prevent costly equipment breakdowns by continuously monitoring machine conditions. As Saudi Arabia embraces Industry 4.0 and seeks to enhance its manufacturing capabilities, the demand for optical sensors in industrial automation is set to escalate further, offering numerous growth opportunities for the market. The adoption of optical sensors in smartphones, tablets, and other consumer electronics in Saudi Arabia is expected to rise by 5-7% annually, as the demand for advanced features like facial recognition, fingerprint sensors, and gesture recognition increases.

Growing Awareness of Benefits

Increasing awareness of the benefits associated with optical sensors is a significant driver in the Saudi Arabia Optical Sensors Market. Businesses and industries are recognizing the advantages of optical sensors, including their high accuracy, reliability, and versatility in various applications. As the awareness of these benefits spreads, companies are more inclined to adopt optical sensor technology to enhance their processes, reduce costs, and improve overall efficiency.The perception of optical sensors as indispensable tools for achieving automation, data collection, and quality control objectives is driving their integration into a wide range of industries, further fueling the market's growth. The clear advantages of optical sensors, coupled with a growing understanding of their potential, are expected to continue driving their adoption across diverse sectors in Saudi Arabia. The integration of autonomous driving technologies in the automotive sector is gaining traction. By 2026, it is expected that over 20 million vehicles globally will be equipped with advanced driver assistance systems (ADAS) that use sensors, cameras, and optical systems to enable features like automatic emergency braking and lane-keeping assistance.

Key Market Challenges

Market Saturation and Competition

The Saudi Arabia Optical Sensors Market faces the challenge of market saturation and increasing competition. As the adoption of optical sensors continues to grow across various industries, the market has become more crowded and competitive. Multiple players, both domestic and international, are vying for a share of the market, leading to pricing pressures and diminishing profit margins for businesses. The saturation of the market can make it challenging for new entrants to establish a foothold, and even established companies must continuously innovate to stay ahead. Additionally, the presence of numerous suppliers can lead to commoditization of optical sensor products, making product differentiation and maintaining profitability more difficult. Companies operating in this market must focus on offering unique value propositions, such as customized solutions or advanced sensor technologies, to remain competitive in this crowded landscape.Technological Advancements and Obsolescence

The rapid pace of technological advancements poses a significant challenge to the Saudi Arabia Optical Sensors Market. While technological innovation is a driver, it can also lead to challenges in terms of sensor obsolescence and the need for continuous upgrades. New, more advanced sensor technologies are continually emerging, rendering existing sensor models outdated.This requires businesses to invest in research and development to stay at the forefront of technology, as outdated sensors can quickly become obsolete and unmarketable. Keeping up with the latest advancements in optical sensor technology can be costly and time-consuming, posing a challenge for companies, especially smaller ones with limited resources. It also necessitates a keen awareness of emerging technologies and trends in the market to ensure that businesses remain competitive and relevant.

Regulatory and Standards Compliance

Compliance with regulatory requirements and industry standards is a significant challenge for the Saudi Arabia Optical Sensors Market. Optical sensors are used in various critical applications, such as automotive safety and healthcare, where precision and reliability are paramount. This necessitates adherence to stringent regulations and standards to ensure the safety and performance of optical sensor-enabled systems.Meeting these requirements can be time-consuming and costly, as businesses must invest in testing, certification, and quality control measures. Additionally, changes in regulations or the introduction of new standards can create challenges for companies to keep their products compliant. Ensuring that products are certified and compliant with the latest industry standards is crucial, as non-compliance can result in legal issues, reputational damage, and market rejection. Companies in the Saudi Arabia Optical Sensors Market must have the necessary resources and expertise to navigate the complex landscape of regulatory and standards compliance.

Supply Chain Disruptions

The Saudi Arabia Optical Sensors Market is susceptible to supply chain disruptions, which can be a major challenge for businesses. Supply chains are often global and intricate, with components sourced from various regions, making them vulnerable to disruptions caused by factors like natural disasters, geopolitical tensions, or unexpected events, such as the COVID-19 pandemic. These disruptions can lead to delays in production and delivery, impacting a company's ability to meet customer demand and fulfill contractual obligations. Moreover, supply chain disruptions can result in increased costs, as companies may need to find alternative suppliers or invest in redundancy measures to mitigate risks. Managing and safeguarding the supply chain against disruptions is a complex task, and businesses operating in the Saudi Arabia Optical Sensors Market must develop strategies to enhance supply chain resilience and adaptability to minimize the impact of unforeseen events and ensure business continuity.Key Market Trends

Integration of Optical Sensors in IoT Devices

A prominent trend in the Saudi Arabia Optical Sensors Market is the increasing integration of optical sensors in Internet of Things (IoT) devices. As the country advances its digital transformation initiatives and smart city projects, the demand for IoT devices has surged. Optical sensors, such as ambient light sensors, proximity sensors, and optical imaging sensors, play a pivotal role in IoT applications, enabling devices to sense and respond to their environment. These sensors are used in smart lighting systems, home automation, and environmental monitoring solutions. The integration of optical sensors in IoT devices allows for improved energy efficiency, user convenience, and data collection capabilities. With the growing adoption of IoT across various sectors, including healthcare, agriculture, and transportation, the demand for optical sensors is set to continue its upward trajectory.Increasing Use of Optical Sensors in Healthcare

Another noteworthy trend is the expanding use of optical sensors in the healthcare sector in Saudi Arabia. Optical sensors are being employed in various medical applications, including patient monitoring, diagnostics, and imaging. For example, pulse oximeters use optical sensors to measure blood oxygen levels, while optical imaging sensors enable medical imaging modalities like endoscopy and retinal scans. The COVID-19 pandemic has further accelerated the adoption of optical sensors in healthcare, with their use in non-contact temperature measurement and diagnostic equipment. As Saudi Arabia continues to invest in healthcare infrastructure and telemedicine services, the demand for optical sensors in the healthcare sector is expected to rise, driven by their accuracy, non-invasiveness, and versatility in medical applications.Focus on Energy-Efficiency and Sustainability

In alignment with global sustainability goals, the Saudi Arabia Optical Sensors Market is witnessing a trend toward energy-efficient and sustainable sensor solutions. Optical sensors are integral to energy-saving technologies, such as smart lighting systems, which adjust illumination based on ambient light levels and occupancy. The adoption of energy-efficient lighting solutions is not only driven by the need to reduce energy consumption but also to comply with environmental regulations and sustainability targets. Additionally, optical sensors are used in green building management systems to optimize resource usage, contributing to the overall sustainability of infrastructure projects. The Saudi government's emphasis on environmental conservation and sustainable practices is further propelling the integration of energy-efficient optical sensors in various applications, making sustainability a key trend in the market.Growing Adoption of LiDAR Technology

LiDAR (Light Detection and Ranging) technology is gaining traction as a market trend in the Saudi Arabia Optical Sensors Market. LiDAR systems use laser-based optical sensors to create high-resolution 3D maps of environments, making them valuable in applications like autonomous vehicles, precision agriculture, and infrastructure development. With Saudi Arabia's investments in smart transportation systems and urban planning, LiDAR technology is increasingly being used for mapping and navigation. Autonomous vehicles, in particular, rely on LiDAR sensors to perceive their surroundings accurately. The need for LiDAR technology is poised to expand as the country progresses toward the implementation of autonomous transportation systems and smart city infrastructure, creating significant opportunities for LiDAR sensor manufacturers and integrators.Advances in Miniaturization and Wearable Technology

The trend toward miniaturization and wearable technology is making its mark on the Saudi Arabia Optical Sensors Market. Optical sensors are being incorporated into smaller and more lightweight devices, such as smartwatches, fitness trackers, and augmented reality glasses. These sensors enable precise tracking of various health and environmental parameters, enhancing the capabilities of wearable devices.As consumer demand for compact and comfortable wearable technology grows, manufacturers are focusing on making optical sensors smaller and more power-efficient while maintaining high performance. The adoption of miniaturized optical sensors is also expanding beyond consumer wearables into professional sectors like sports analytics, where athletes use sensor-equipped wearables to improve their performance. As the Saudi population becomes more health-conscious and tech-savvy, the trend of miniaturization and wearables with optical sensor technology is expected to persist and evolve, opening up opportunities for innovative product offerings.

Segmental Insights

Sensor Type Insights

In 2024, The Fiber Optic sensor type segment dominated the Saudi Arabia Optical Sensors Market, and it is expected to continue maintaining its dominance throughout the forecast period. Fiber optic sensors have become integral in various industrial and commercial applications due to their exceptional sensitivity, immunity to electromagnetic interference, and capability to transmit data over long distances. In the Saudi market, fiber optic sensors have found extensive use in sectors like oil and gas, where they play a crucial role in monitoring pipelines, detecting leaks, and ensuring the integrity of critical infrastructure.Additionally, fiber optic sensors are widely employed in structural health monitoring, providing real-time data on the condition of buildings, bridges, and other assets. The rapid growth of the construction and infrastructure development sector in Saudi Arabia further propels the demand for fiber optic sensors. As the country continues to invest in smart cities and infrastructure projects, the need for reliable and high-performance optical sensors, particularly fiber optic sensors, is expected to remain strong. Their adaptability to a wide range of applications, combined with their accuracy and durability, positions fiber optic sensors to dominate the Saudi Arabia Optical Sensors Market for the foreseeable future.

Regional Insights

The Riyadh region dominated the Saudi Arabia Optical Sensors Market, and it is expected to maintain its dominance during the forecast period. Riyadh, the capital and largest city of Saudi Arabia, serves as the country's economic, industrial, and technological hub, making it a key driver of the optical sensors market. The region's prominence can be attributed to its substantial industrial and commercial activities, extensive infrastructure development, and a burgeoning tech ecosystem.Riyadh's diversified economy includes industries such as automotive, manufacturing, healthcare, and information technology, all of which heavily rely on optical sensors for various applications, from industrial automation to healthcare equipment. Moreover, with numerous smart city initiatives and investment projects underway in Riyadh, the demand for optical sensors in applications like traffic management, security systems, and environmental monitoring is on the rise. As the region continues to lead in economic and technological development, it is well-positioned to maintain its dominance in the Saudi Arabia Optical Sensors Market throughout the forecast period, with growth opportunities stemming from the ongoing expansion of the Riyadh metropolitan area and its associated industries.

Key Market Players

- Honeywell International Inc.

- Texas Instruments Incorporated

- Hamamatsu Photonics K.K.

- Omron Corporation

- STMicroelectronics N.V.

- Vishay Intertechnology, Inc.

- Broadcom Inc.

- Rockwell Automation, Inc.

Report Scope:

In this report, the Saudi Arabia Optical Sensors Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Optical Sensors Market, By Type:

- Wired

- Wireless

Saudi Arabia Optical Sensors Market, By Technology:

- Hyperspectral imaging

- Near IR Spectroscopy

- Photo-Acoustic Tomography

- Optical Coherence Tomography

Saudi Arabia Optical Sensors Market, By Sensor Type:

- Fiber Optic

- Image

- Position

- Ambient Light and Proximity

- Infrared

- Others

Saudi Arabia Optical Sensors Market, By Application:

- Commercial

- Consumer Electronics

- Medical

- Automotive

- Industrial

- Others

Saudi Arabia Optical Sensors Market, By Region:

- Riyadh

- Makkah

- Madinah

- Jeddah

- Tabuk

- Eastern Province

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Optical Sensors Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Honeywell International Inc.

- Texas Instruments Incorporated

- Hamamatsu Photonics K.K.

- Omron Corporation

- STMicroelectronics N.V.

- Vishay Intertechnology, Inc.

- Broadcom Inc.

- Rockwell Automation, Inc.

Table Information

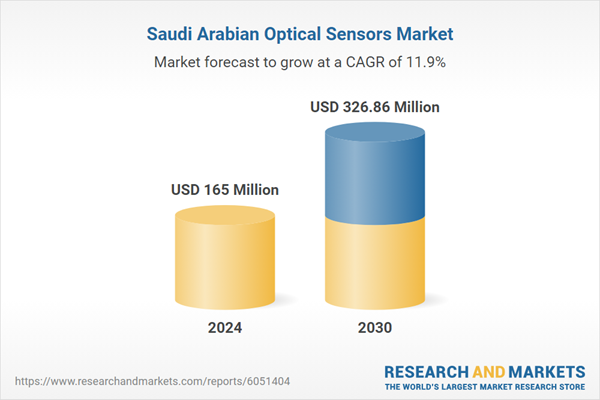

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 165 Million |

| Forecasted Market Value ( USD | $ 326.86 Million |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 8 |