Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for Smart Grid Solutions

The growing demand for smart grid solutions stands as the primary driver of the Power Line Communication (PLC) market in Saudi Arabia. As the country expands and modernizes its power infrastructure, the need for more efficient and intelligent electricity management and distribution becomes increasingly urgent. Smart grids, reliant on advanced communication technologies like PLC, play a vital role in achieving this objective.Smart grids enable real-time monitoring and control of the electrical grid, empowering utilities to optimize energy distribution, minimize losses, and swiftly respond to faults or outages. The pivotal role of PLC technology lies in facilitating communication between various grid components, including smart meters, sensors, and control systems. This demand is further propelled by the rising adoption of renewable energy sources such as solar and wind, necessitating sophisticated grid management for effective integration.

Furthermore, the Saudi government actively promotes the development of smart cities and smart infrastructure projects, which heavily rely on the deployment of smart grid solutions. These initiatives not only enhance the quality of life for citizens but also contribute to energy efficiency and sustainability, making PLC a critical enabler of their success.

Growing Adoption of Advanced Metering Infrastructure (AMI)

The PLC market in Saudi Arabia is driven by two key factors. One of them is the increasing adoption of Advanced Metering Infrastructure (AMI). This involves the installation of smart meters equipped with PLC technology, enabling two-way communication between utilities and consumers. As a result, accurate and timely billing, remote meter reading, and real-time consumption data provision to consumers become possible.

To enhance billing accuracy and reduce operational costs, utility companies in Saudi Arabia are actively deploying smart meters across the country. Leveraging PLC technology, these meters can transmit data over existing power lines, eliminating the need for additional communication infrastructure. This cost-effective approach ensures reliable communication even in remote or challenging environments.

The adoption of AMI aligns with the government's efforts to promote energy conservation and sustainability. Equipped with PLC technology, smart meters empower consumers with information about their energy consumption patterns. This empowers them to make informed decisions to reduce energy usage and contribute to a more sustainable future.

Increasing Demand for Home Area Networking (HAN)

The Power Line Communication (PLC) market in Saudi Arabia is propelled by several key factors. One of them is the surging demand for Home Area Networking (HAN) solutions, which involve the networking of various smart devices and appliances within a home using PLC technology. This enables homeowners to remotely control and monitor their lighting, heating, cooling, security systems, and other devices.

The increasing adoption of smart home technologies in Saudi Arabia can be attributed to factors such as urbanization, rising disposable incomes, and a growing awareness of energy efficiency and convenience. Among the various HAN solutions available, PLC-based solutions are particularly appealing as they leverage existing electrical wiring, eliminating the need for additional cabling and reducing installation costs.

Saudi consumers are actively seeking ways to enhance the comfort and security of their homes, and PLC-enabled HAN solutions offer them the ability to do so while efficiently managing energy consumption. Consequently, the demand for HAN solutions powered by PLC technology is expected to continue growing in the Saudi Arabian market.

In summary, the Power Line Communication market in Saudi Arabia is driven by the increasing demand for smart grid solutions, the adoption of Advanced Metering Infrastructure, and the growing popularity of Home Area Networking. These factors reflect the country's commitment to modernize its power infrastructure, improve energy efficiency, and enhance the quality of life for its citizens through advanced communication technologies like PLC.

Key Market Challenges

Infrastructure Modernization and Integration

One of the key challenges confronting the Power Line Communication (PLC) market in Saudi Arabia is the imperative for extensive infrastructure modernization and integration. The present power grid infrastructure in the country is relatively aged and not inherently designed to seamlessly support advanced communication technologies like PLC. The upgrade of this infrastructure to accommodate PLC entails intricate complexities and substantial costs.The integration of PLC into the existing power grid necessitates significant investments in equipment, software, and personnel training. Moreover, Saudi Arabia's extensive and diverse geographical landscape poses unique challenges, including remote and harsh environments, that must be effectively addressed throughout the infrastructure upgrade process. These integration challenges can potentially lead to project delays, escalated expenses, and technical intricacies that impede the widespread adoption of PLC technology.

Furthermore, the integration process must ensure compatibility between various generations of equipment, as certain segments of the power grid may still rely on older technology. This interoperability challenge can further compound the implementation of PLC and decelerate its rate of adoption.

Regulatory and Policy Framework

One of the significant challenges faced by the PLC market in Saudi Arabia is the establishment of a comprehensive regulatory and policy framework. The presence of effective regulations and policies is essential to ensure a level playing field for market participants, safeguard consumer interests, and promote investment in PLC infrastructure.The regulatory landscape in Saudi Arabia, like many other countries, is continuously evolving to keep up with technological advancements. Developing regulations specific to PLC technology, encompassing aspects such as data privacy, security, and interoperability standards, can be a complex and time-consuming process.

Furthermore, the regulatory framework should encompass concerns such as pricing, service quality, and infrastructure accessibility, particularly in cases involving multiple utility companies. Establishing fair and transparent pricing models for PLC services is crucial in stimulating competition and fostering innovation within the market.

Additionally, policymakers must consider how to provide incentives for utilities and service providers to invest in PLC infrastructure and offer advanced services to consumers. Striking a regulatory balance that addresses the interests of all stakeholders while promoting the adoption of PLC technology remains a significant challenge.

Cybersecurity and Data Privacy Concerns

Cybersecurity and data privacy concerns present a critical challenge to the Saudi Arabia PLC market. PLC technology relies on data communication over power lines, which can render it vulnerable to cyberattacks and data breaches. As the country embraces more advanced communication solutions in its power grid and smart infrastructure, the importance of robust cybersecurity measures becomes paramount.Saudi Arabia, like many nations, encounters potential cybersecurity threats from various sources, including state-sponsored actors, criminal organizations, and hacktivists. A successful cyberattack on the power grid could have severe consequences, such as power outages, economic disruptions, and even national security threats.

To tackle this challenge, the Saudi government and utility companies must invest in cybersecurity infrastructure, implement stringent data protection measures, and develop incident response plans. Additionally, they should establish partnerships with cybersecurity experts and international organizations to stay ahead of evolving threats.

Maintaining consumer trust is also vital. Ensuring the privacy of consumer data collected through PLC-enabled smart meters and other devices is crucial to avoiding public concerns and regulatory backlash. Striking the right balance between data access for grid management and protecting individual privacy rights is a complex challenge that must be addressed to foster trust in PLC technology.

In conclusion, the Power Line Communication market in Saudi Arabia faces challenges related to infrastructure modernization and integration, regulatory and policy framework development, and cybersecurity and data privacy concerns. Overcoming these challenges will require collaborative efforts from the government, industry stakeholders, and cybersecurity experts to ensure the successful deployment and adoption of PLC technology in the country.

Key Market Trends

Expansion of Smart Grid Infrastructure

One notable trend in the Saudi Arabia Power Line Communication (PLC) market is the rapid expansion of smart grid infrastructure. Smart grids represent the next stage in the evolution of traditional power grids, integrating advanced communication and information technologies to enhance grid management, efficiency, and reliability.Saudi Arabia is actively investing in the modernization of its power grid to accommodate renewable energy sources, improve energy efficiency, and reduce electricity losses. PLC technology plays a crucial role in facilitating communication between various grid components, such as smart meters, sensors, and control systems. This trend is driven by the government's commitment to achieving sustainable energy goals and improving the overall quality of power distribution.

As part of this trend, the deployment of advanced metering infrastructure (AMI) is increasing. Smart meters equipped with PLC capabilities are being installed nationwide, enabling real-time data collection and two-way communication between utilities and consumers. This expansion of smart grid infrastructure empowers utilities with enhanced control and monitoring capabilities, while consumers gain access to more detailed information about their energy consumption, leading to more efficient energy use.

Growth of Smart Home Solutions

Another significant trend in the Saudi Arabian PLC market is the increasing adoption of smart home solutions. As urbanization and economic development continue to progress in the country, there is a growing demand for home automation and connectivity. Smart homes utilize PLC technology to enable the networking and control of various household devices and systems, including lighting, heating, security, and entertainment.Saudi consumers are showing a rising interest in enhancing their quality of life through smart home technologies. PLC-based smart home solutions offer the advantage of leveraging existing electrical wiring, reducing the need for additional infrastructure, and simplifying installation. Homeowners can remotely manage and monitor their connected devices, enhancing convenience, energy efficiency, and security.

This trend aligns with the global movement towards the Internet of Things (IoT) and the integration of smart devices into daily life. The Saudi Arabian market is experiencing a surge in demand for PLC-enabled smart home products and services, creating opportunities for both local and international manufacturers and service providers.

Segmental Insights

Frequency Insights

The Narrowband segment emerged as the dominant player in 2022. Narrowband PLC represents a specialized segment within the broader PLC market. It is characterized by its utilization of lower frequencies (typically below 500 kHz) for transmitting data over power lines. In Saudi Arabia, one of the primary applications of narrowband PLC is in smart metering. This technology is well-suited for transmitting metering data over the power grid, enabling utilities to remotely monitor and manage electricity consumption. The deployment of smart meters equipped with narrowband PLC capabilities is contributing to enhanced billing accuracy and operational efficiency.The adoption of narrowband PLC technology in Saudi Arabia is driven by the government's initiatives to modernize the energy infrastructure and promote energy efficiency. Regulatory policies favoring the deployment of smart meters and smart grid solutions create a conducive environment for the growth of narrowband PLC.

In the development of smart cities in Saudi Arabia, narrowband PLC technology can play a crucial role. It can be leveraged for smart street lighting, environmental monitoring, and infrastructure management, thereby contributing to improved urban living and resource efficiency. With the increasing focus on energy efficiency, narrowband PLC solutions for energy management in residential, commercial, and industrial settings are expected to witness growth. These solutions empower consumers and businesses to optimize their energy consumption.

In conclusion, the narrowband segment of the Power Line Communication market in Saudi Arabia is experiencing growth driven by applications in smart metering, home automation, and lighting control. As the market continues to evolve, there will be further opportunities for smart city integration and energy management, which will drive the adoption of narrowband PLC technology in Saudi Arabia.

Application Insights

The Indoor Networking segment is projected to experience rapid growth during the forecast period. The Indoor Networking segment within the Saudi Arabia PLC market primarily focuses on facilitating data communication and networking within residential, commercial, and industrial indoor environments. Indoor PLC technology is extensively utilized for home networking applications, providing homeowners with a reliable network connection through existing electrical wiring. This application particularly appeals to residential consumers in Saudi Arabia who desire seamless connectivity for smart devices, entertainment systems, and home automation.The increasing trend of smart homes in Saudi Arabia, driven by urbanization and heightened consumer awareness of home automation, serves as a significant driver for indoor PLC networking. Consumers are actively seeking robust and efficient networking solutions to support their smart devices.

As the Internet of Things (IoT) ecosystem continues to expand, indoor PLC networking offers a sturdy and secure communication infrastructure for connecting and managing IoT devices in residential and commercial settings. The concept of smart buildings, leveraging advanced technologies for energy management, security, and occupant comfort, presents substantial opportunities for indoor PLC networking solutions. PLC technology can effectively address the networking requirements of various smart building applications.

In conclusion, the Indoor Networking segment of the Saudi Arabia Power Line Communication market focuses on enabling indoor connectivity and networking solutions. It caters to the growing demand for reliable networking in smart homes, commercial spaces, and industrial environments. While facing challenges related to interference and competition from other technologies, indoor PLC networking is well-positioned to capitalize on opportunities arising from IoT adoption, smart building initiatives, and energy efficiency efforts in Saudi Arabia.

Regional Insights

Riyadh emerged as the dominant player in the Saudi Arabia Power Line Communication market in 2022, holding the largest market share. Riyadh, as the economic hub of Saudi Arabia, boasts a robust economic foundation with a diverse array of industries, encompassing finance, healthcare, and manufacturing. This economic prowess presents ample opportunities for the implementation of PLC technology to optimize operational efficiency and energy management.Riyadh is currently witnessing significant investments in smart grid infrastructure. The Saudi government's unwavering commitment to modernize the power grid, aiming to enhance reliability and efficiency, creates a favorable environment for the adoption of PLC technology. Smart grids in Riyadh rely on PLC communication to facilitate real-time data exchange among grid components, including smart meters, substations, and control systems. The burgeoning urbanization and affluence in Riyadh have fueled the demand for smart home solutions. Through PLC technology, homeowners in Riyadh can centrally control and monitor various aspects of their homes, such as lighting, heating, and security systems. This emerging trend presents promising opportunities for companies offering PLC-enabled smart home products and services.

Riyadh places considerable emphasis on energy efficiency and sustainability. The incorporation of PLC technology in the city contributes to energy conservation endeavors by providing real-time energy consumption data. This valuable information empowers businesses and consumers to make informed decisions regarding energy usage, leading to reduced waste and costs. Riyadh's drive for renewable energy integration, particularly solar power, can leverage PLC technology to ensure the seamless integration of renewable energy sources into the grid. As the Riyadh PLC market continues to expand, there will be a growing demand for skilled professionals capable of designing, implementing, and maintaining PLC systems. Investing in training and skill development programs related to PLC technology can help meet this demand.

In conclusion, the Riyadh PLC market exhibits a rising demand for smart grid solutions, smart homes, and energy efficiency initiatives.

Report Scope:

In this report, the Saudi Arabia Power Line Communication Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Power Line Communication Market, By Offering:

- Hardware

- Software

- Services

Saudi Arabia Power Line Communication Market, By Frequency:

- Narrowband

- Broadband

Saudi Arabia Power Line Communication Market, By Offering:

- Energy Management & Smart Grid

- Indoor Networking

Saudi Arabia Power Line Communication Market, By Frequency:

- Industrial

- Commercial

- Residential

Saudi Arabia Power Line Communication Market, By Modulation Technique:

- Single Carrier

- Multi Carrier

- Spread Spectrum

Saudi Arabia Power Line Communication Market, By Region:

- Riyadh

- Makkah

- Eastern Province

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Power Line Communication Market.Available Customizations:

Saudi Arabia Power Line Communication Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Saudi Electricity Company (SEC)

- STC (Saudi Telecom Company)

- General Electric (GE)

- Siemens

- Schneider Electric

- ABB

- Itron

- Landis+Gyr

- Holley Technology

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | November 2023 |

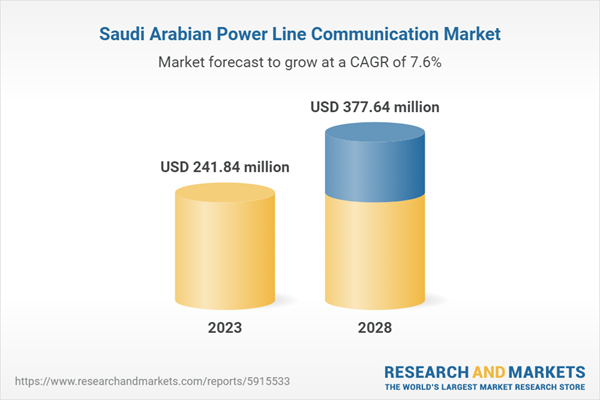

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 241.84 million |

| Forecasted Market Value ( USD | $ 377.64 Million |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |