Global Screw Chillers Market - Key Trends & Drivers Summarized

What Are Screw Chillers and How Are They Manufactured?

Screw chillers are a type of refrigeration system used to cool water or other fluids, primarily in commercial and industrial applications. These chillers utilize a screw compressor, a key component that compresses refrigerant gas through a rotary motion of twin helical screws. This design ensures efficient, continuous, and high-capacity cooling for a wide range of processes, making screw chillers particularly valuable in industries such as manufacturing, food and beverage, pharmaceuticals, data centers, and large commercial spaces like shopping malls and office buildings. Screw chillers are available in both water-cooled and air-cooled configurations, with water-cooled units generally offering higher efficiency due to their ability to reject heat through a cooling tower.The manufacturing of screw chillers involves a complex process of assembling various components, including the screw compressor, evaporator, condenser, and control systems. The key differentiator of screw chillers is the use of screw compressors, which are precision-engineered for maximum performance and reliability. These compressors are typically manufactured from high-strength steel to withstand the high pressures and mechanical stresses involved in compressing refrigerant gases. Modern manufacturing processes include advanced machining and testing techniques to ensure the screws maintain precise tolerances, which are essential for efficient and reliable operation. Additionally, chillers are designed with control systems that allow operators to optimize performance, monitor energy consumption, and ensure precise temperature control.

Recent advancements in screw chiller manufacturing have focused on improving energy efficiency and reducing the environmental impact of these systems. This includes the integration of variable-speed drives (VSDs), which allow the compressor to adjust its speed based on cooling demand, reducing energy consumption during periods of low load. Additionally, manufacturers are increasingly using eco-friendly refrigerants with lower global warming potential (GWP), which helps reduce the environmental impact of these systems. Smart technology integration is another growing trend, enabling operators to monitor and control chillers remotely, improving operational efficiency and reducing maintenance costs.

What Are the Primary Applications of Screw Chillers Across Industries?

Screw chillers are widely used across various industries due to their ability to provide efficient, reliable cooling in large-scale operations. In the manufacturing sector, screw chillers are essential for maintaining controlled temperatures in processes such as plastic molding, metalworking, chemical production, and pharmaceutical manufacturing. These industries rely on precise temperature control to ensure product quality and consistency, and screw chillers provide the stable, high-capacity cooling required for these processes. For instance, in the plastics industry, screw chillers cool down molds and equipment, preventing overheating and ensuring the smooth production of high-quality plastic products. Similarly, in the pharmaceutical industry, screw chillers maintain critical temperature ranges required for the production and storage of drugs.The data center and IT industry is another major consumer of screw chillers. As data centers house a vast amount of electronic equipment that generates significant heat, effective cooling systems are necessary to prevent overheating and ensure uninterrupted operation. Screw chillers are frequently used in large data centers to maintain optimal operating temperatures, improve energy efficiency, and reduce downtime. Given the rapid growth of cloud computing, artificial intelligence, and big data, the demand for screw chillers in the data center sector continues to rise. Their ability to handle large cooling loads and offer scalable solutions makes them the preferred choice for cooling high-density server environments.

In commercial and residential applications, screw chillers are employed in large-scale air conditioning systems for buildings such as hotels, hospitals, shopping malls, and office complexes. These chillers are crucial for maintaining indoor air quality and comfort, especially in regions with hot climates. They ensure efficient cooling for large spaces and can handle variable loads throughout the day, making them suitable for environments with fluctuating occupancy levels. Additionally, screw chillers are used in district cooling systems, where centralized cooling is provided to multiple buildings in a given area, further demonstrating their importance in modern urban infrastructure.

Why Is Consumer Demand for Screw Chillers Increasing?

The demand for screw chillers is on the rise due to several key factors, including the growing need for energy-efficient cooling solutions, the rapid expansion of data centers, and the increasing adoption of industrial processes requiring precise temperature control. One of the primary drivers behind this demand is the growing emphasis on energy efficiency, both in commercial and industrial sectors. As energy costs rise and sustainability becomes a priority, businesses are seeking HVAC systems that provide effective cooling while minimizing energy consumption. Screw chillers, particularly those equipped with variable-speed drives (VSDs), offer significant energy savings by adjusting compressor speeds to match cooling demand, reducing energy waste and operational costs.The rapid growth of the global IT and data center industry is another major factor fueling demand for screw chillers. As the reliance on cloud computing, e-commerce, and digital services grows, data centers are expanding globally to meet the increasing demand for processing power and data storage. These facilities require robust, efficient, and scalable cooling systems to prevent overheating and maintain continuous operation of critical equipment. Screw chillers, with their high cooling capacity and ability to handle variable loads, are well-suited to meet the cooling needs of data centers, driving demand in this rapidly growing industry.

Additionally, the industrial sector's increasing focus on operational efficiency and product quality is contributing to the rise in demand for screw chillers. Industries such as plastics, chemicals, pharmaceuticals, and food and beverage production require precise temperature control to ensure the consistency and quality of their products. Screw chillers provide the reliable, high-capacity cooling necessary to maintain optimal temperatures in these processes. Moreover, as global industries become more regulated, particularly in terms of environmental impact and energy efficiency, businesses are investing in advanced cooling solutions that meet both their operational needs and regulatory standards. This has led to increased demand for screw chillers, which are known for their durability, energy efficiency, and low maintenance requirements.

What Factors Are Driving the Growth of the Screw Chillers Market?

The growth in the screw chillers market is driven by several key factors, starting with the increasing demand for energy-efficient HVAC systems across both commercial and industrial sectors. As businesses and governments place greater emphasis on reducing energy consumption and minimizing environmental impact, screw chillers have emerged as a preferred solution for efficient cooling. These chillers, particularly when integrated with variable-speed drives (VSDs) and eco-friendly refrigerants, can significantly reduce energy costs by optimizing compressor performance based on real-time cooling demand. This focus on energy savings is driving adoption across industries that require continuous or large-scale cooling.Another major growth driver is the rapid expansion of data centers globally. With the rise of cloud computing, artificial intelligence, e-commerce, and the Internet of Things (IoT), data centers are proliferating at an unprecedented rate. These centers require robust and scalable cooling solutions to maintain operational efficiency and prevent equipment failure due to overheating. Screw chillers, with their high cooling capacity and adaptability to fluctuating loads, are particularly well-suited for large-scale data centers. As the global digital economy grows, the demand for screw chillers in this sector is expected to rise in tandem.

Technological advancements in screw chiller design and manufacturing are also fueling market growth. Manufacturers are increasingly focused on improving the energy efficiency, sustainability, and ease of maintenance of screw chillers. Innovations such as smart controls, advanced monitoring systems, and remote operation capabilities are making screw chillers more attractive to businesses looking for cutting-edge cooling solutions. These smart systems allow operators to optimize chiller performance, predict maintenance needs, and reduce downtime, ultimately improving operational efficiency. Additionally, the growing use of environmentally friendly refrigerants, which have a lower global warming potential (GWP), is driving the adoption of screw chillers that comply with stringent environmental regulations.

The expansion of industries such as pharmaceuticals, food and beverage, and plastics - each of which requires precise temperature control during production processes - is another critical factor driving the growth of the screw chillers market. As these industries grow and modernize, they are increasingly turning to screw chillers to provide reliable, high-capacity cooling that ensures product quality and operational efficiency. Additionally, the rising demand for district cooling systems, particularly in urban areas with high population density and warm climates, is further contributing to the growing adoption of screw chillers as a centralized, efficient cooling solution. These factors, combined with the global focus on energy efficiency and sustainability, are expected to drive significant growth in the screw chillers market in the years to come.

Report Scope

The report analyzes the Screw Chillers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Plastics, Food & Beverage, Chemicals & Petrochemicals, Rubber, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plastics Application segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 6.3%. The Food & Beverage Application segment is also set to grow at 5.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $924.9 Million in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Screw Chillers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Screw Chillers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Screw Chillers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Carrier, Dunham Bush, EUROKLIMAT S.P.A., Haier Group, Johnson Controls and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Screw Chillers market report include:

- Carrier

- Dunham Bush

- EUROKLIMAT S.P.A.

- Haier Group

- Johnson Controls

- LG Electronics

- McQuay Air-conditioning Ltd.

- Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A.

- Robert Bosch GmbH

- Trane

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Carrier

- Dunham Bush

- EUROKLIMAT S.P.A.

- Haier Group

- Johnson Controls

- LG Electronics

- McQuay Air-conditioning Ltd.

- Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A.

- Robert Bosch GmbH

- Trane

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | February 2026 |

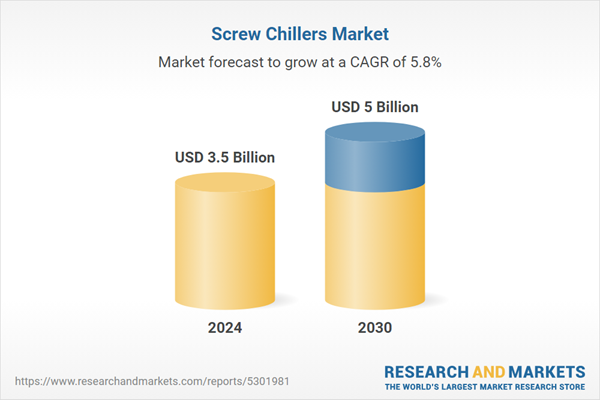

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 5 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |