The North America segment garnered 38% revenue share in this market in 2023. North America’s established digital economy and the presence of major tech companies and cloud providers foster a robust demand for this software, especially in sectors like finance, healthcare, and government. A significant increase has been driven by the acceleration of server solution investment across industries due to the surge in remote work and digital transformation initiatives.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2022, IBM collaborated with AWS to offer a wide array of IBM software as Software-as-a-Service (SaaS). This partnership is likely to influence the evolution of server software designed for cloud-based enterprise solutions, enabling improved infrastructure management. Moreover, In May, 2024, Dell Technologies and Ericsson announced a strategic partnership to accelerate telecom network cloud transformation with Open RAN. The collaboration will integrate Ericsson's Cloud RAN software with Dell's PowerEdge servers, focusing on multi-vendor environments, cloud-native networks, and simplified deployment.

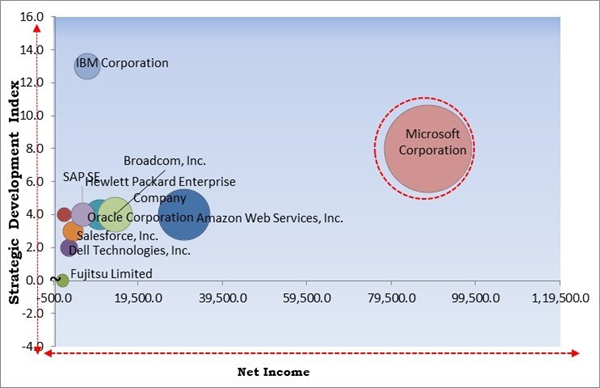

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunners in the Server Software Market. In March, 2022, Microsoft teamed up with FD Technologies to expand the reach of its KX Insights streaming data analytics platform. Combining Microsoft's cloud capabilities with KX technology could drive the development of new server software solutions, particularly for data analytics and financial services. Companies such as IBM Corporation, Amazon Web Services, Inc. and Broadcom, Inc. are some of the key innovators in Server Software Market.Market Growth Factors

The need for dependable, scalable, and effective cloud-based solutions grows as companies and organizations continue to embrace digital transformation. This shift is particularly evident in the expansion of hyperscale data centers designed to handle and process vast amounts of data generated by cloud activities. Hyperscale data centers are large-scale operations that support extensive computing architectures, requiring robust server software to manage and optimize resources effectively. Hence, as the reliance on cloud services grows, so does this market.Additionally, Technological advancements, particularly the integration of artificial intelligence (AI) and machine learning (ML) are revolutionizing this market. These cutting-edge technologies are critical because they significantly enhance the efficiency of server operations. AI and ML help servers interpret data more intelligently, allocate resources more efficiently, and anticipate possible problems before they become serious by optimizing workload management. Thus, the ongoing development and integration of AI and ML into this software represent a significant trend set to expand the market further.

Market Restraining Factors

However, Implementing this software comes with a substantial initial financial burden, often including licenses, specialized hardware, and robust infrastructure expenses. These costs can be prohibitive for small and medium enterprises (SMEs) operating with limited budgets. This software licensing alone can be a major expense, especially when licensing models require per-user or per-device fees, adding up quickly as the business scales.Consequently, many SMEs delay implementing server solutions, opt for minimal solutions, or rely on manual processes and basic applications that do not offer the same level of scalability, efficiency, or security. This can stifle growth, limit productivity, and make it challenging for these businesses to compete with larger companies that can afford more sophisticated software solutions.

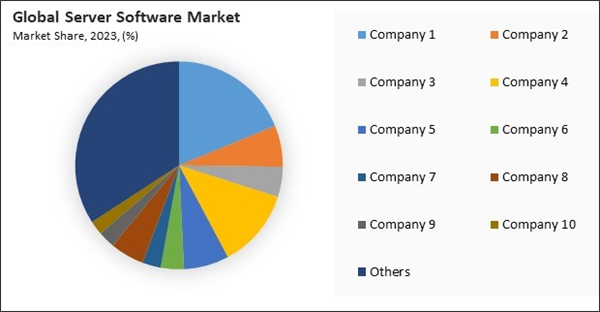

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Increasing Demand For Cloud Services

- Rapid Integration Of Cutting-Edge Technologies

- Growing Sophistication And Frequency Of Cyber Threats

Restraints

- Substantial Initial Financial Burden

- Growing Availability Of Open-Source Server Software

Opportunities

- Digital Transformation Initiatives Across The World

- Stringent Data Protection Regulations

Challenges

- Lack Of Skilled Professionals

- Concerns Of Restricted Flexibility Due To Vendor Lock-In

Server Outlook

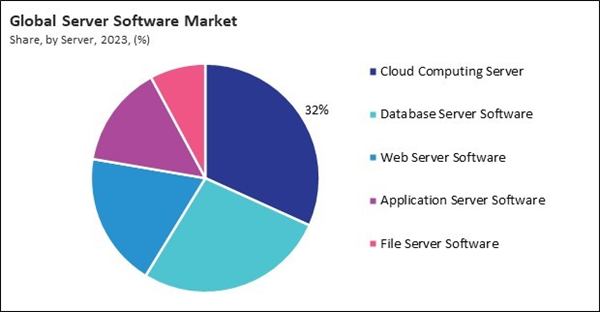

On the basis of servers, this market is classified into cloud computing server, database server software, web server software, application server software, and file server software. The database server software segment recorded 27% revenue share in this market in 2023. Database servers are essential to data management because they enable businesses to effectively store, arrange, and access vast amounts of structured data. With the growth of data-intensive applications and the need for real-time analytics, businesses invest in robust database server solutions to support data-driven decision-making and enhance operational efficiency.Deployment Mode Outlook

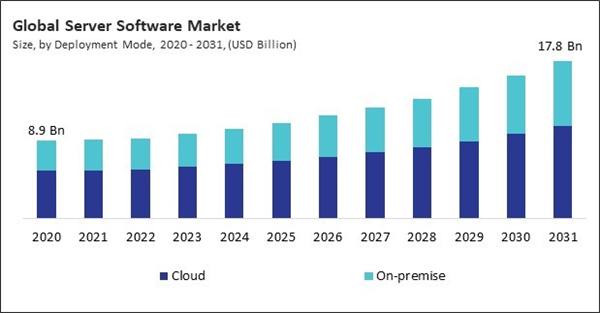

Based on deployment mode, the server software market is bifurcated into cloud and on-premise. The on-premise segment procured 39% revenue share in this market in 2023. It is primarily driven by organizations requiring high data control, customization, and compliance with regulatory standards. Industries such as healthcare, finance, and government often prefer on-premise deployments for enhanced data security and direct control over IT infrastructure, essential for handling sensitive or confidential information.Market Competition and Attributes

The Server Software Market remains highly competitive even without top players, driven by emerging vendors offering specialized, cost-effective, and innovative solutions. Niche players focus on customization, open-source platforms, and cloud-based offerings, catering to diverse industries. Startups and regional providers are gaining traction by addressing specific needs, fostering competition, and fueling innovation in areas like AI, security, and scalability.

By Regional Analysis

Region-wise, the server software market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment procured 30% revenue share in this market in 2023. European companies, particularly in finance, manufacturing, and public sectors, continue to invest heavily in this software to meet stringent GDPR requirements and ensure data sovereignty. Additionally, Europe’s digitalization initiatives and smart city projects create opportunities for this software vendors as governments and enterprises prioritize advanced, secure infrastructure to support these initiatives.Recent Strategies Deployed in the Market

- Apr-2024: Microsoft Corporation and Cloud Software Group have deepened their collaboration through an eight-year partnership, integrating Citrix’s platform with Microsoft Azure for enterprise solutions. The partnership also emphasizes AI innovations and cloud adoption, enhancing productivity with Microsoft 365 and AI tools.

- Mar-2024: SAP and NVIDIA are expanding their partnership to integrate generative AI capabilities into SAP's cloud solutions. The collaboration uses NVIDIA’s AI infrastructure to enhance SAP’s business applications, enabling businesses to automate processes and optimize data integration, boosting cloud performance.

- May-2023: SAP and Intel have announced a strategic collaboration to enhance SAP software landscapes in the cloud, using Intel's 4th Gen Xeon processors. This partnership aims to improve performance, scalability, security, and efficiency for SAP customers, supporting the RISE with SAP solution.

- Nov-2022: IBM launched the Business Analytics Enterprise suite, which helps enterprises break down data and analytics silos to make quick, data-driven decisions. This suite includes business intelligence, reporting, budgeting, and forecasting tools, which are likely built on advanced server software systems for managing and analyzing large datasets.

- Jul-2022: IBM Corporation acquired Databand.ai, a provider of data observability software, expands its software portfolio, particularly in AI, data, and automation. This will likely lead to advancements in server software for managing data observability across hybrid cloud environments.

List of Key Companies Profiled

- Dell Technologies, Inc.

- Oracle Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Hewlett Packard Enterprise Company

- IBM Corporation

- Salesforce, Inc.

- SAP SE

- Microsoft Corporation

- Fujitsu Limited

- Broadcom, Inc.

Market Report Segmentation

By Deployment Mode

- Cloud

- On-premise

By Server

- Cloud Computing Server

- Database Server Software

- Web Server Software

- Application Server Software

- File Server Software

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Dell Technologies, Inc.

- Oracle Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Hewlett Packard Enterprise Company

- IBM Corporation

- Salesforce, Inc.

- SAP SE

- Microsoft Corporation

- Fujitsu Limited

- Broadcom, Inc.