Additionally, the category includes sleep laboratories for diagnostic support and various auxiliary products like sleep trackers, eye masks, white noise machines, aromatherapy diffusers, and smart lighting systems for contributing to a sleep-conducive environment. These aids play a critical role in managing a wide range of sleep disorders, including insomnia, obstructive sleep apnea, restless legs syndrome (RLS), narcolepsy, parasomnias, circadian rhythm disturbances, and hypersomnolence. By enhancing the onset, duration, and quality of sleep, these products enable individuals to achieve more restful and uninterrupted rest. They also help to regulate biological rhythms, reduce daytime fatigue, and prevent long-term health complications associated with chronic sleep deprivation. Additionally, by supporting healthier sleep patterns, sleep aids positively impact cognitive performance, emotional stability, and overall mental and physical well-being.

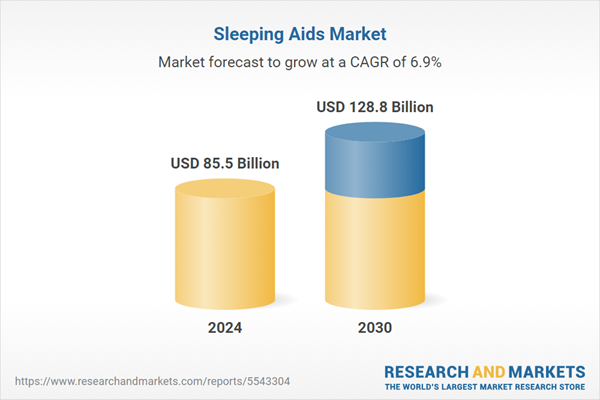

Global Sleeping Aids market is projected to reach US$127.8 billion by 2030, growing from an estimated US$85.5 billion in 2024 at a CAGR of 6.9% during the forecast period 2024-2030. The global sleeping aids market is experiencing steady growth, driven by the rising incidence of sleep disorders such as insomnia, sleep apnea, and restless leg syndrome. Increasing awareness of the significance of quality sleep for overall well-being, along with lifestyle-related stress, anxiety, and irregular routines, has resulted in increased demand for both pharmaceutical and non-pharmaceutical sleep solutions. The growing aging population and rising obesity rates, which both contribute to chronic sleep issues, further enhance the market's progress. Consumers across all age groups actively seek sleep solutions, including prescription medications, over-the-counter (OTC) drugs such as melatonin, herbal supplements, and wearable sleep monitoring devices.

Developments in sleep technologies, such as smart devices and mobile applications, have diversified the range of available products. Market players are making significant R&D investments to create innovative, personalized, and non-invasive sleeping aids, while governments and health organizations are promoting improved diagnostic and treatment methods. Post-pandemic shifts in health awareness and digital health adoption have also accelerated product innovation and usage. Additionally, the adoption of sleeping aids with wellness trends, natural therapies, and mental health care, such as CBD-based products and mindfulness tools, are reshaping consumer preferences. With increased healthcare access, rising disposable incomes, and favorable regulatory support, the sleeping aids market is positioned for continued expansion globally.

Sleeping Aids Regional Market Analysis

North America leads the global sleeping aids market in 2024 with an estimated 39.2% share, supported by the high prevalence of sleep disorders, increasing consumer awareness, and robust healthcare infrastructure. The United States represents the largest share due to a rise in insomnia cases, increased usage of sleep medications, and strong demand for both prescription and over-the-counter products. Contributing factors to regional growth include alcohol and tobacco consumption, obesity, an aging population, and continuous technological advancements. Conversely, the Asia Pacific region is anticipated to experience the fastest growth rate at a CAGR of 8.9% during the forecast period 2024 -2030, spurred by rising stress levels, urban development, changing lifestyles, and increasing disposable incomes. Countries such as China, India, and Japan play a significant role, with a growing reliance on herbal supplements, sleep aid applications, and OTC sleep products. The expanding middle class in this region and increased awareness of sleep health establish it as a crucial emerging market.Sleeping Aids Market Analysis by Product

The mattresses & pillows segment dominates the sleeping aids market in 2024, accounting for 42.7% of the market share, owing to their essential role in delivering comfort and improving sleep quality. These products are widely appealing because they are affordable, accessible, and have a long lifespan. The growth of this segment continues as health awareness rises, lifestyles change, and innovations in manufacturing emerge. Companies are launching advanced, ergonomically designed products for both medical and personal comfort requirements. On the other hand, the sleep apnea devices segment is projected to record the fastest growth with a CAGR of 7.6% from 2024 to 2030, driven by the rising prevalence of obstructive sleep apnea (OSA) and increased use of CPAP and BiPAP machines. Developments such as smart CPAP machines equipped with humidifiers and remote monitoring features, along with expanded insurance coverage and heightened awareness, are propelling the growth of this segment.Sleeping Aids Medication Market by Type

In 2024, prescription-based drugs is the largest segment in the sleeping aids medication market with a 58.6% share, primarily due to their proven efficacy in treating chronic and severe sleep disorders like insomnia and sleep apnea. Healthcare professionals commonly prescribe these medications, bolstered by rising diagnosis rates and an increasing reliance on medical treatments among patients. In contrast, the over-the-counter (OTC) drugs sub-segment is expected to register the fastest CAGR of 8.7% from 2024 to 2030, supported by rising preference for self-medication, ease of accessibility, and increased use of melatonin and antihistamine-based products. The segment's growth is further supported by various user-friendly formats like gummies, capsules, and liquids, catering to evolving consumer preferences and increasing awareness around sleep health.Sleeping Aids Market Analysis by Sleep Disorder

The insomnia segment holds the largest share of the sleeping aids market in 2024, estimated at 31.9%, as its high global prevalence drives substantial demand. Insomnia, often linked to stress, depression, chronic pain, and unhealthy lifestyles, compels individuals to seek medical assistance, resulting in the widespread use of sleeping aids. Its chronic nature sustains long-term demand for treatments ranging from prescription drugs to OTC solutions, wellness programs, and at-home remedies. Health awareness, aging populations, and declining physical activity further reinforce this trend. Conversely, the sleep apnea segment is witnessing a rapid growth rate at a CAGR of around 8% during the forecast period 2024-2030, driven by the growing elderly population, increasing obstructive sleep apnea (OSA) diagnoses, and demand for advanced, user-friendly CPAP/BiPAP devices. Additionally, technological advancements and enhanced diagnosis rates in both developed and emerging markets are driving the demand for sleep apnea solutions.Sleeping Aids Market Report Scope

This global report on Sleeping Aids analyzes the market based on product, sub-type, and sleep disorder for the period 2021-2030 with projections from 2024 to 2030 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.Key Metrics

Historical Period: 2021-2023Base Year: 2024

Forecast Period: 2024-2030

Units: Value market in US$

Companies Mentioned: 25+

Sleeping Aids Market by Geographic Region

- North America (The United States, Canada, and Mexico)

- Europe (Germany, France, United Kingdom, Italy, Spain, and Rest of Europe)

- Asia-Pacific (Japan, China, India, South Korea, and Rest of Asia-Pacific)

- Rest of World

Sleeping Aids Market by Product

- Mattresses & Pillows

- Medications

- Prescription-Based Drugs

- OTC Drugs

- Herbal Drugs

- Sleep Apnea Devices

- Sleep Laboratories

- Other Products (Including Sleep Monitoring Devices, Eye Masks, White Noise Machines, Wearables, Aromatherapy & Essential Oil Diffusers, and Smart Lighting Systems)

Sleeping Aids Market by Sleep Disorder

- Insomnia

- Sleep Apnea

- Restless Leg Syndrome (RLS)

- Narcolepsy

- Sleepwalking

- Other Sleep Disorders (Including Circadian Rhythm Sleep Disorders, Parasomnias, Idiopathic hypersomnia, Sleep paralysis, REM sleep disorder, Delayed sleep phase syndrome (DSPS), and Sleep bruxism)

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Ambulatory Monitoring, Inc.

- Apnea Sciences Corporation

- BMC Medical Co Ltd

- Braebon Medical Corporation

- Breas Medical AB

- Cadwell Industries, Inc.

- Cleveland Medical Devices Inc.

- Compumedics Limited

- Drive DeVilbiss Healthcare

- Eisai Co., Ltd.

- Fisher & Paykel Healthcare Limited

- Prestige Consumer Healthcare Inc.

- Koninklijke Philips N.V.

- Merck and Co. Inc.

- Natus Medical, Inc.

- Pfizer, Inc.

- ResMed, Inc

- Sanofi S.A.

- Scisparc Ltd.

- Serta Simmons Bedding, LLC

- Watermark Medical

- Sommetrics, Inc.

- Takeda Pharmaceutical Company Limited

- Tempur Sealy International, Inc.

- VIVOS Therapeutics, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 85.5 Billion |

| Forecasted Market Value ( USD | $ 128.8 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |