Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Smart Cable Guard Systems market refers to the global industry centered around the development, manufacturing, deployment, and maintenance of advanced technologies designed for the continuous monitoring and fault detection of power cables and transmission lines within electrical distribution and transmission networks. These systems are integral components of modern electricity infrastructure, offering utilities, grid operators, and industrial facilities the capability to enhance the reliability, efficiency, and safety of their power distribution systems.

Smart Cable Guard Systems utilize a combination of cutting-edge sensors, communication networks, and data analytics to continuously assess the condition of power cables. They detect early signs of degradation, weaknesses, or faults in the cables, enabling proactive maintenance and the prevention of potentially disruptive or hazardous cable failures. This technology-driven market is characterized by its focus on improving grid resilience, accommodating the integration of renewable energy sources, and complying with stringent safety and environmental regulations.

The Smart Cable Guard Systems market is dynamic, driven by a growing awareness of the importance of robust electrical infrastructure, increasing energy demands, and the imperative to optimize grid performance in an era of evolving energy landscapes. As such, it represents a critical sector within the broader energy industry, with innovations and advancements playing a pivotal role in ensuring the reliable and sustainable delivery of electricity to consumers worldwide.

Key Market Drivers

Aging Power Infrastructure and Grid Modernization

The global Smart Cable Guard Systems market is being driven by the urgent need to address aging power infrastructure. Many countries around the world are grappling with power grids that have been in operation for decades and are in dire need of upgrades. These aging systems are susceptible to faults, outages, and inefficiencies. Smart Cable Guard Systems offer a solution by providing real-time monitoring and fault detection capabilities. Utilities and grid operators are increasingly investing in these systems to enhance the reliability and efficiency of their power networks.As power grids age, the risk of cable failures and outages increases. This not only disrupts power supply but also results in significant economic losses. Smart Cable Guard Systems use advanced technologies such as Partial Discharge (PD) monitoring and Distributed Temperature Sensing (DTS) to detect potential issues before they escalate into major failures. This proactive approach to maintenance reduces downtime, saves costs, and ensures a more reliable power supply, which is a key driver for the market's growth.

Renewable Energy Integration

The integration of renewable energy sources into the existing power grid is another significant driver of the global Smart Cable Guard Systems market. As the world transitions towards a more sustainable energy mix, the complexity of power distribution systems increases. Renewable sources like wind and solar are often located in remote areas, requiring extensive transmission and distribution networks. Smart Cable Guard Systems play a crucial role in ensuring the reliable transmission of power from these sources to urban centers.Renewable energy generation can be intermittent and unpredictable, making grid stability a challenge. Smart Cable Guard Systems help mitigate this challenge by continuously monitoring the transmission lines and identifying potential issues. By providing real-time data on the condition of cables and power lines, these systems enable grid operators to manage fluctuations in renewable energy generation more effectively, reducing the risk of grid instability and blackouts.

Regulatory Mandates and Safety Concerns

Increasing regulatory mandates and safety concerns are driving the adoption of Smart Cable Guard Systems globally. Governments and regulatory bodies are imposing stringent standards and regulations to ensure the safety and reliability of power distribution networks. These regulations often require utilities and grid operators to implement advanced monitoring and fault detection systems.The safety aspect is particularly crucial, as cable failures can lead to hazardous situations, including fires and environmental damage. Smart Cable Guard Systems help prevent such incidents by detecting cable faults and weaknesses early on, allowing for timely repairs or replacements. Compliance with these regulations not only ensures public safety but also helps utilities avoid costly penalties, making the adoption of these systems a strategic imperative.

Increasing Energy Demand

The ever-increasing global energy demand is an undeniable driver of the Smart Cable Guard Systems market. As populations grow, industries expand, and urbanization continues, the demand for electricity continues to surge. To meet this growing demand, utilities are under pressure to optimize their existing infrastructure and reduce downtime.Smart Cable Guard Systems enable utilities to maximize the lifespan of their cables and transmission lines by identifying potential issues before they cause failures. This proactive approach to maintenance ensures a more reliable power supply and minimizes disruptions in the face of rising energy consumption. As a result, utilities worldwide are investing in these systems to meet the escalating energy demand efficiently.

Technological Advancements

The rapid advancement of technology is a compelling driver for the Smart Cable Guard Systems market. The development of more sophisticated sensors, communication networks, and data analytics tools has significantly enhanced the capabilities of these systems. Utilities and grid operators are keen to leverage these technological advancements to gain better insights into the health and performance of their power distribution networks.Advanced sensors and analytics enable Smart Cable Guard Systems to provide more accurate and real-time data, improving fault detection capabilities. Moreover, the integration of artificial intelligence and machine learning algorithms allows these systems to predict potential issues with greater accuracy, further reducing the risk of outages. As the technology continues to evolve, the demand for smarter and more efficient cable monitoring solutions is expected to grow.

Cost Savings and Return on Investment

The pursuit of cost savings and a strong return on investment (ROI) is a fundamental driver of the global Smart Cable Guard Systems market. While these systems require an initial investment, their long-term benefits far outweigh the costs. By preventing cable failures and reducing downtime, utilities can save substantial amounts of money in repair and maintenance expenses.Furthermore, the improved reliability of power grids leads to increased customer satisfaction and reduced revenue losses due to outages. These financial incentives are compelling utilities and grid operators to invest in Smart Cable Guard Systems as a strategic measure to optimize their operations and enhance their financial performance. The ability to demonstrate a clear ROI is a powerful motivator for market growth, and as more success stories emerge, adoption rates are likely to increase across the globe.

In conclusion, the global Smart Cable Guard Systems market is being driven by a combination of factors, including the need to address aging infrastructure, the integration of renewable energy sources, regulatory mandates, increasing energy demand, technological advancements, and the pursuit of cost savings and ROI. These drivers collectively underscore the importance of these systems in ensuring the reliability and efficiency of power distribution networks, making them a critical component of the modern energy landscape.

Government Policies are Likely to Propel the Market

Grid Modernization Initiatives

Grid modernization initiatives are at the forefront of government policies driving the global Smart Cable Guard Systems market. Many governments recognize the importance of upgrading and enhancing their power grids to meet the increasing demands for electricity, improve grid reliability, and incorporate renewable energy sources efficiently. To achieve these goals, governments are implementing policies that encourage utilities and grid operators to adopt advanced technologies like Smart Cable Guard Systems.These policies often come in the form of financial incentives, grants, or regulatory requirements. Governments may offer financial support to utilities that invest in grid modernization projects, including the installation of Smart Cable Guard Systems. In some cases, regulatory bodies mandate the integration of these systems to ensure the safety and reliability of the power grid. These initiatives create a favorable environment for the growth of the Smart Cable Guard Systems market, as utilities strive to comply with government guidelines and secure funding for their projects.

Renewable Energy Integration Mandates

As the world shifts towards cleaner and more sustainable energy sources, government policies promoting the integration of renewable energy play a pivotal role in driving the Smart Cable Guard Systems market. Many governments have set ambitious renewable energy targets and enacted policies that encourage the adoption of renewable technologies, such as wind and solar power.To accommodate the intermittent nature of renewable energy sources, governments often require utilities to invest in advanced monitoring and grid management solutions like Smart Cable Guard Systems. These policies aim to ensure the seamless integration of renewables into the existing power grid, minimize grid instability, and enhance energy reliability. Smart Cable Guard Systems, with their real-time monitoring and fault detection capabilities, enable utilities to manage the challenges posed by renewable energy variability, making them a crucial component of renewable energy integration strategies.

Energy Efficiency Regulations

Energy efficiency regulations are another driver of the global Smart Cable Guard Systems market. Governments worldwide are committed to reducing energy consumption and greenhouse gas emissions. To achieve these objectives, they introduce policies that mandate utilities to implement energy-efficient technologies and practices throughout their operations.Smart Cable Guard Systems contribute to energy efficiency by minimizing cable failures and outages. When power lines are well-maintained and free from defects, the energy losses associated with downtime and repairs are significantly reduced. Governments recognize the role of Smart Cable Guard Systems in improving the overall efficiency of power distribution networks, and as a result, they may offer incentives, tax breaks, or regulatory requirements to encourage their adoption.

Safety and Environmental Regulations

Safety and environmental regulations are paramount in driving the adoption of Smart Cable Guard Systems globally. Governments are committed to ensuring the safety of their citizens and protecting the environment from hazards related to power distribution systems. Cable failures can result in fires, environmental damage, and public safety risks, making it imperative for governments to enforce strict safety and environmental standards.Smart Cable Guard Systems contribute to safety and environmental protection by continuously monitoring cables and identifying potential faults or weaknesses. This proactive approach enables utilities to address issues before they escalate into hazardous situations. Governments often require utilities to comply with safety and environmental regulations by implementing advanced monitoring systems like Smart Cable Guard Systems. Non-compliance can lead to penalties and legal consequences, motivating utilities to adopt these systems to safeguard both people and the environment.

Research and Development Funding

Government policies that promote research and development (R&D) funding are instrumental in advancing the capabilities of Smart Cable Guard Systems. Many governments recognize the importance of innovation in the energy sector and allocate resources to support R&D efforts aimed at improving the performance and efficiency of these systems.Through grants, subsidies, and partnerships with research institutions, governments encourage the development of cutting-edge technologies in cable monitoring and fault detection. This not only spurs innovation but also leads to the creation of more sophisticated and cost-effective Smart Cable Guard Systems. As these systems evolve and become more capable, their adoption in the global market is accelerated, driven by the competitive advantage they offer in terms of reliability and efficiency.

Export Promotion and Trade Agreements

Government policies related to export promotion and international trade agreements also influence the global Smart Cable Guard Systems market. Governments often engage in initiatives to promote the export of domestically developed technologies, including Smart Cable Guard Systems. These initiatives include trade missions, financial incentives, and the negotiation of favorable trade agreements.By supporting the export of Smart Cable Guard Systems, governments stimulate economic growth and job creation in their domestic industries. They also help expand the global market reach of these systems, making them more accessible to utilities and grid operators worldwide. Additionally, international trade agreements can reduce trade barriers and facilitate the exchange of technology and expertise, further driving the adoption of Smart Cable Guard Systems on a global scale.

In conclusion, government policies, encompassing grid modernization, renewable energy integration, energy efficiency, safety and environmental regulations, research and development funding, and export promotion, are significant drivers of the global Smart Cable Guard Systems market. These policies create a conducive environment for the adoption and growth of these systems, aligning with governments' objectives of enhancing energy reliability, sustainability, and safety.

Key Market Challenges

High Initial Investment Costs

One of the primary challenges facing the global Smart Cable Guard Systems market is the high initial investment costs associated with deploying these advanced monitoring and fault detection systems. While Smart Cable Guard Systems offer numerous benefits, including enhanced grid reliability, reduced downtime, and improved safety, the upfront expenses can be substantial, especially for utilities and grid operators with extensive networks.The costs associated with implementing Smart Cable Guard Systems encompass various components, including:

Hardware and Sensors: The purchase and installation of sensors, data acquisition equipment, and communication devices add to the initial investment. These components are crucial for collecting real-time data from the power cables and transmitting it to monitoring stations.Software and Data Analytics: Smart Cable Guard Systems rely on sophisticated software and data analytics tools to process and interpret the data collected from the sensors. Developing or acquiring this software can be expensive, as it needs to be tailored to the specific needs of each utility or grid operator.

Installation and Integration: Deploying Smart Cable Guard Systems requires skilled technicians to install the sensors and set up the communication infrastructure. Integration with existing grid management systems can also be complex and costly.

Maintenance and Training: Ongoing maintenance and training of personnel to operate and maintain the systems are additional expenses that utilities must consider.

For many utilities, especially those with limited budgets, these upfront costs can be a significant barrier to adoption. The challenge lies in finding the financial resources necessary to make the initial investment while ensuring that the long-term benefits, such as reduced operational costs and improved reliability, outweigh the initial capital outlay.

To address this challenge, governments, industry associations, and financial institutions may need to provide incentives, grants, or financing options to encourage utilities to invest in Smart Cable Guard Systems. Additionally, technology providers can work on developing more cost-effective solutions to make these systems more accessible to a broader range of utilities and grid operators.

Integration with Legacy Infrastructure

Another significant challenge in the global Smart Cable Guard Systems market is the integration of these advanced technologies with legacy infrastructure. Many power distribution networks around the world have been in operation for decades and were not originally designed to accommodate the sophisticated monitoring capabilities offered by Smart Cable Guard Systems.The integration challenge encompasses several aspects:

Compatibility: Legacy infrastructure may use outdated communication protocols or equipment that is not easily compatible with modern Smart Cable Guard Systems. Ensuring seamless communication between new monitoring equipment and existing grid components can be technically complex.Data Integration: Smart Cable Guard Systems generate vast amounts of data, and integrating this data into existing grid management systems can be challenging. Utilities need to develop data integration strategies to make sense of the information collected and use it effectively for decision-making.

Cybersecurity: As Smart Cable Guard Systems are connected to communication networks, they become potential targets for cyberattacks. Ensuring the cybersecurity of these systems when integrated into legacy infrastructure is a critical concern.

Operational Changes: Integrating new technologies often requires changes in operational processes and workflows. Utility personnel need to be trained to use the systems effectively, and operational practices may need to be adjusted to leverage the capabilities of Smart Cable Guard Systems fully.

Cost of Retrofitting: Retrofitting legacy infrastructure to accommodate Smart Cable Guard Systems can be expensive and time-consuming. This cost can be a barrier for utilities with limited budgets or tight operational schedules.

Addressing the integration challenge requires careful planning, collaboration between technology providers and utilities, and the development of standardized protocols and interfaces to ensure compatibility. Utilities must also consider the long-term benefits of integration, such as improved grid reliability and reduced maintenance costs, to justify the investments required. Additionally, governments and industry stakeholders can play a role in providing guidance, standards, and incentives to facilitate the integration of Smart Cable Guard Systems with legacy infrastructure, ultimately advancing the adoption of these systems on a global scale.

Segmental Insights

Sensor Injector Unit Insights

The Sensor Injector Unit segment held the largest market share in 2022 & expected to maintain it in the forecast period. The Sensor Injector Unit is responsible for physically placing sensors on power cables and transmission lines. These sensors continuously collect data related to cable conditions, including temperature variations and the detection of partial discharges. The quality and accuracy of data collection are essential for the overall effectiveness of Smart Cable Guard Systems. Therefore, the Sensor Injector Unit serves as the backbone of data acquisition. Smart Cable Guard Systems rely on real-time data to monitor the health and condition of power cables. The Sensor Injector Unit's ability to provide continuous, up-to-date information is crucial for early fault detection and timely maintenance. Real-time monitoring is highly valued by utilities and grid operators as it enables them to respond quickly to potential issues, minimizing downtime and improving grid reliability. By continuously monitoring cable conditions, Sensor Injector Units enable utilities to adopt a proactive approach to maintenance. This proactive maintenance can help prevent cable failures and reduce repair costs, making it a cost-effective solution for grid operators. Preventive measures based on accurate data can extend the lifespan of cables, reducing the need for costly replacements. Smart Cable Guard Systems with effective Sensor Injector Units can provide utilities with actionable insights, allowing them to allocate resources more efficiently. Utilities can prioritize maintenance efforts based on the data collected, focusing on cables and transmission lines that require immediate attention. This approach optimizes resource utilization and enhances overall grid management.Telecommunication Insights

The Telecommunication segment held the largest market share in 2022 and is projected to experience rapid growth during the forecast period. Telecommunication companies rely heavily on a dependable and uninterrupted network infrastructure to provide communication services to their customers. Any downtime or service interruption can result in significant financial losses and damage to their reputation. Smart Cable Guard Systems offer real-time monitoring and fault detection capabilities, allowing telecom companies to proactively address cable issues before they lead to service disruptions. The quality and performance of communication cables are critical to ensuring the delivery of high-speed internet, voice, and data services. Smart Cable Guard Systems can continuously monitor cable conditions, detecting potential faults or degradation. This proactive approach helps telecom companies maintain cable quality and minimize service outages, improving customer satisfaction. Cable failures and service disruptions can be costly for telecom operators in terms of repair and maintenance expenses, as well as potential revenue losses due to customer dissatisfaction. By investing in Smart Cable Guard Systems, telecom companies can reduce the frequency and duration of network outages, resulting in cost savings and improved operational efficiency. Telecom networks often span large geographical areas, and managing the condition of their extensive cable networks can be challenging. Smart Cable Guard Systems can scale to accommodate networks of various sizes and complexities, making them suitable for telecom companies with diverse infrastructure needs. In some regions, telecom companies may be subject to regulatory requirements related to network reliability and service uptime. Smart Cable Guard Systems can help telecom operators meet these regulatory standards by providing continuous monitoring and data-driven insights to support compliance efforts.Regional Insights

North America

North America held the largest market for Smart Cable Guard Systems, accounting for over 35% of the global market share in 2022. The growth of the market in North America is being driven by the increasing adoption of smart grid technologies and the rising demand for uninterrupted power supply in critical industries.The North American Smart Cable Guard Systems market is dominated by the United States, which accounts for over 90% of the regional market share. The growth of the market in the United States is being driven by the increasing adoption of smart grid technologies by utilities and the rising demand for uninterrupted power supply in critical industries such as healthcare, IT, and telecom.

Europe

Europe held the second-largest market for Smart Cable Guard Systems, accounting for over 25% of the global market share in 2022. The growth of the market in Europe is being driven by the growing aging electrical network infrastructure and the increasing investments in smart grid technologies.The European Smart Cable Guard Systems market is led by Germany, the United Kingdom, and France. The growth of the market in Europe is being driven by the growing aging electrical network infrastructure and the increasing investments in smart grid technologies by utilities.

Asia-Pacific

Asia-Pacific held the third-largest market for Smart Cable Guard Systems, accounting for over 20% of the global market share in 2022. The growth of the market in Asia-Pacific is being driven by the rapid growth of the power and telecommunications sectors and the increasing investments in smart grid technologies.The Asia-Pacific Smart Cable Guard Systems market is dominated by China, Japan, and India. The growth of the market in Asia-Pacific is being driven by the rapid growth of the power and telecommunications sectors and the increasing investments in smart grid technologies by utilities.

Report Scope:

In this report, the Global Smart Cable Guard Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Smart Cable Guard Systems Market, By Type:

- Sensor Injector Unit

- Control Unit

- Software

Smart Cable Guard Systems Market, By Application:

- Healthcare

- Electric Power

- Telecommunication

- Small Industries

- Transportation

- Mining

- Agriculture

Smart Cable Guard Systems Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Smart Cable Guard Systems Market.Available Customizations:

Global Smart Cable Guard Systems market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB Ltd

- Siemens Ag

- GE Grid Solutions

- Schneider Electric Company

- DNV Group AS

- OMICRON electronics

- Prysmian S.p.A.

- Nexans S.A.

- NKT A/S

Table Information

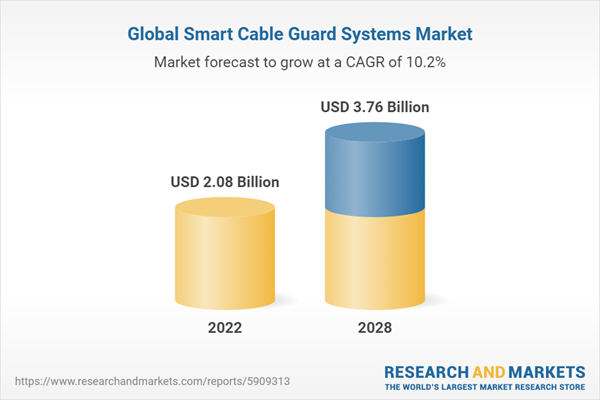

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2.08 Billion |

| Forecasted Market Value ( USD | $ 3.76 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |