Smart coatings are a cutting-edge innovation in material science that is engineered to offer multifaceted benefits across various industries. They are designed to adapt and respond intelligently to environmental changes and external stimuli. They are widely used as corrosion protection in the automotive and aerospace sectors, self-cleaning properties for architectural surfaces, and even healthcare applications for antimicrobial coatings on medical devices. They provide enhanced durability, as they can heal minor damages, reducing maintenance costs. Additionally, their self-cleaning properties reduce the need for chemical cleaning agents, making them environmentally friendly. In the automotive industry, smart coatings can change color or transparency in response to temperature fluctuations or light, enhancing vehicle aesthetics and safety. There are various types of smart coatings, such as self-healing coatings, photochromic coatings, and hydrophobic coatings, each tailored to specific applications.

The global smart coatings market is influenced by the increasing demand for corrosion-resistant coatings across industries, such as automotive, aerospace, and construction. This is further supported by the growing awareness of environmental concerns, which has led to a surge in the adoption of self-cleaning and anti-fouling coatings. Moreover, the expansion of the healthcare sector is boosting the demand for antimicrobial coatings for medical equipment and surfaces, further boosting the market growth. Additionally, the rise of the Internet of Things (IoT) has spurred interest in smart coatings for sensors and electronics, further propelling the market. In line with this, the automotive industry's pursuit of energy efficiency and improved aesthetics through coatings is contributing to market expansion. Furthermore, smart coatings' role in enhancing energy efficiency in buildings and infrastructure fosters the market growth.

Smart Coatings Market Trends/Drivers:

Increasing demand for corrosion-resistant coatings

The global smart coatings market is experiencing a notable upswing due to the escalating demand for corrosion-resistant coatings. Industries such as automotive, aerospace, and construction rely heavily on coatings to protect their assets from corrosion and degradation. Smart coatings, with their ability to provide real-time corrosion monitoring and self-healing properties, are gaining prominence. In the automotive sector, for instance, smart coatings are employed to extend the lifespan of vehicles and reduce maintenance costs. In aerospace, where extreme environmental conditions pose a challenge, smart coatings play a pivotal role in safeguarding critical components. The construction industry benefits from smart coatings' longevity and ability to protect infrastructure from weathering. This surge in demand for corrosion-resistant smart coatings underscores their importance in ensuring the durability and cost-efficiency of assets across various sectors.Growing awareness of environmental concerns

The global shift towards environmental consciousness is a significant driver for the smart coatings market. Smart coatings offer environmentally friendly solutions by reducing the need for frequent recoating and maintenance. Self-cleaning coatings, for example, enable surfaces to repel dirt and pollutants, resulting in cleaner environments and reduced use of cleaning chemicals. Anti-fouling coatings prevent the accumulation of marine organisms on ships, reducing the release of toxic anti-fouling agents into aquatic ecosystems. Moreover, the adoption of smart coatings can contribute to energy savings by maintaining the efficiency of solar panels and windows. As sustainability becomes a key focus worldwide, the demand for eco-friendly smart coatings is expected to continue rising across industries, making them a vital contributor to the market's growth.Expansion of the healthcare sector

The healthcare sector's expansion is a pivotal driver for the global smart coatings market, particularly the adoption of antimicrobial coatings. These coatings are designed to inhibit the growth of bacteria and pathogens on surfaces, including medical equipment and hospital infrastructure. In an era marked by heightened concerns about healthcare-associated infections, antimicrobial smart coatings offer a proactive approach to infection control. They help maintain a hygienic environment and reduce the risk of cross-contamination. With the continuous growth of the healthcare industry, the demand for antimicrobial smart coatings is on the rise. This driver not only enhances patient safety but also presents a significant market opportunity for smart coatings manufacturers looking to address the unique needs of healthcare facilities.Smart Coatings Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global smart coatings market report, along with forecasts at the global, regional and country levels from 2025-2033. The report categorizes the market based on layer type, function, and end use industry.Breakup by Layer Type:

- Single-Layer

- Multi-Layer

Multi-layer dominates the market

A detailed breakup and analysis of the market based on the layer type has also been provided in the report. This includes single-layer and multi-layer. According to the report, multi-layer represented the largest segment.The growth of the multi-layer segment in the coatings industry is primarily propelled by the increasing demand for advanced protection and performance in various applications. Multi-layer coatings offer a versatile solution by combining different layers with specific functionalities, such as corrosion resistance, ultraviolet (UV) protection, and adhesion enhancement, meeting the diverse requirements of industries like automotive, aerospace, and electronics. Moreover, the ever-evolving regulatory landscape and stringent environmental standards have driven the need for coatings with reduced volatile organic compounds (VOCs) and enhanced durability, making multi-layer coatings an attractive choice. In line with this, technological advancements have enabled the development of complex multi-layer systems with superior properties, catering to specialized markets. Furthermore, the rising trend of customization and tailored solutions has bolstered the adoption of multi-layer coatings to meet specific performance criteria. Additionally, the increasing focus on sustainability and energy efficiency in construction and infrastructure projects has led to the incorporation of multi-layer coatings for thermal insulation and weather resistance.

Breakup by Function:

- Anti-Microbial

- Anti-Corrosion

- Anti-Fouling

- Anti-Icing

- Self-Cleaning

- Self-Healing

- Others

Anti-corrosion dominates the market

The report has provided a detailed breakup and analysis of the market based on the function. This includes anti-microbial, anti-corrosion, anti-fouling, anti-icing, self-cleaning, self-healing, and others. According to the report, anti-corrosion represented the largest segment.The growth of the anti-corrosion segment within the global smart coatings market is primarily driven by the increasing need for durable and long-lasting protection against corrosion across various industries, including automotive, aerospace, and infrastructure. Smart coatings in this segment offer real-time corrosion monitoring and self-healing properties, enhancing the lifespan of critical assets and reducing maintenance costs. Moreover, environmental concerns are pushing industries to seek eco-friendly alternatives, and anti-corrosion smart coatings align with this demand by minimizing the need for frequent recoating and reducing the environmental impact of corrosion-related maintenance. In line with this, stringent regulations and quality standards in sectors, such as aerospace and automotive, are compelling manufacturers to adopt advanced corrosion-resistant solutions, driving the adoption of smart coatings.

Breakup by End Use Industry:

- Building and Construction

- Automotive

- Marine

- Aerospace and Defense

- Others

Building and construction dominate the market

A detailed breakup and analysis of the market based on the end use industry has also been provided in the report. This includes building and construction, automotive, marine, aerospace and defense, and others. According to the report, building and construction represented the largest segment.The growth of the building and construction segment is primarily driven by rapid urbanization and expansion of residential, commercial, and infrastructure projects. This rapid urbanization necessitates the construction of new buildings, roads, bridges, and other structures, fueling the industry's growth. Moreover, the emphasis on sustainable and energy-efficient construction practices is pushing the adoption of innovative materials and technologies, including smart coatings, which enhance energy efficiency, durability, and aesthetics. In line with this, the need for improved infrastructure, especially in emerging economies, is driving significant investments in construction projects. Additionally, government initiatives, such as infrastructure development programs and affordable housing schemes, further stimulate the building and construction sector. Furthermore, the ongoing trend of urban renewal and renovation projects in developed regions contributes to sustained growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest smart coatings market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest segment.The Asia-Pacific region is experiencing significant growth in the smart coatings market, primarily driven by rapid industrialization and infrastructure development in countries like China and India, which have created substantial demand for smart coatings across sectors such as construction, automotive, and electronics. In line with this, increasing awareness of the need for sustainable and eco-friendly solutions aligns with the adoption of smart coatings, which offer energy-efficient and environmentally conscious options. Moreover, the burgeoning automotive industry in the region seeks smart coatings to improve energy efficiency and aesthetics in vehicles, further propelling the market growth. Additionally, investments in research and development (R&D), particularly in countries like South Korea and Japan, have led to technological advancements and innovative smart coating solutions. Furthermore, Asia-Pacific's position as a major electronics manufacturing hub has increased the demand for coatings to protect sensitive electronic components.

Competitive Landscape:

The competitive landscape of the smart coatings market is characterized by a dynamic environment with several key players vying for market share. These companies focus on research and development to create innovative smart coating technologies that cater to various industry needs. The market is highly competitive due to the diverse applications of smart coatings across sectors like automotive, aerospace, healthcare, and construction. Companies often differentiate themselves through product quality, durability, and performance, as well as by offering specialized coatings such as corrosion-resistant, self-cleaning, and antimicrobial variants. Market players also emphasize strategic partnerships with end-users and suppliers to expand their reach and distribution channels. Furthermore, a growing emphasis on sustainability and eco-friendly solutions has led to the development of environmentally conscious smart coatings, further intensifying competition. As the demand for smart coatings continues to rise across the globe, competition among industry players is expected to remain fierce, driving further innovation and technological advancements in the market.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3M Company

- A&K Painting Company

- Ancatt Inc

- BASF SE

- Dupont De Nemours Inc.

- Jotun A/S

- NEI Corporation

- PPG Industries

- RPM International Inc.

- Tesla NanoCoatings Inc.

- The Lubrizol Corporation (Berkshire Hathaway Inc)

- The Sherwin-Williams Company

Key Questions Answered in This Report

1. How big is the smart coatings market?2. What is the future outlook of smart coatings market?

3. What are the key factors driving the smart coatings market?

4. Which region accounts for the largest smart coatings market share?

5. Which are the leading companies in the global smart coatings market?

Table of Contents

Companies Mentioned

- 3M Company

- A&K Painting Company

- Ancatt Inc

- BASF SE

- Dupont De Nemours Inc.

- Jotun A/S

- NEI Corporation

- PPG Industries

- RPM International Inc.

- Tesla NanoCoatings Inc.

- The Lubrizol Corporation (Berkshire Hathaway Inc.) The Sherwin-Williams Company

Table Information

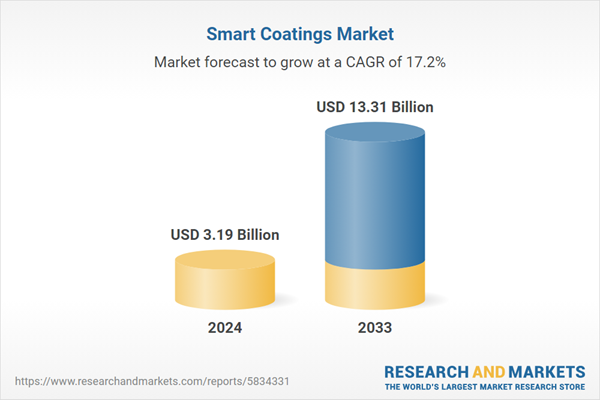

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.19 Billion |

| Forecasted Market Value ( USD | $ 13.31 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |