Global Packaged Sour Cream Substitutes Market - Key Trends & Drivers Summarized

Why Are Packaged Sour Cream Substitutes Becoming Popular Among Consumers?

Packaged sour cream substitutes, which include plant-based alternatives made from ingredients such as soy, almond, and cashew, as well as dairy-based low-fat or lactose-free versions, have seen a rise in demand due to the increasing consumer focus on health and dietary restrictions. As more consumers embrace dairy-free, vegan, or lactose-intolerant lifestyles, traditional sour cream is often replaced with these substitutes to meet the demand for alternative options in cooking, baking, and meal preparation. These substitutes provide the same creamy texture and tangy flavor as regular sour cream but cater to a broader audience, particularly those with specific dietary needs. The convenience of packaged sour cream substitutes, which come in resealable tubs, pouches, or squeezable containers, makes them easy to incorporate into everyday cooking while ensuring freshness and shelf life.How Are Health Trends and Dietary Restrictions Driving Demand for Sour Cream Substitutes?

Health and wellness trends, along with rising concerns about lactose intolerance, allergies, and veganism, have been major drivers in the demand for sour cream substitutes. Many consumers are actively seeking plant-based alternatives to dairy products, both for health reasons and ethical concerns related to animal welfare and environmental sustainability. Packaged sour cream substitutes made from cashews, almonds, coconut milk, or soy offer a rich, dairy-free option for consumers avoiding animal products or those looking to reduce their intake of saturated fats. Additionally, these substitutes often come fortified with probiotics, vitamins, or protein, enhancing their appeal as a healthier, functional food choice. This shift towards cleaner, plant-based, and lactose-free products is accelerating as consumers become more informed about the benefits of these alternatives for digestive health and overall wellness.How Are Innovation and Packaging Advancing the Market for Sour Cream Substitutes?

Innovation in product formulation and packaging has been a key factor in expanding the market for packaged sour cream substitutes. Manufacturers are continually developing new plant-based alternatives that mimic the texture and flavor of traditional sour cream without using dairy ingredients. Additionally, the introduction of lactose-free and fat-reduced versions for consumers looking to manage their health while still enjoying the familiar tanginess of sour cream has broadened the market. Packaging innovations, such as resealable tubs, squeezable containers, and smaller portion-controlled packs, have made it easier for consumers to use and store these products, enhancing their convenience and reducing food waste. Many brands are also focusing on eco-friendly and sustainable packaging solutions to cater to environmentally conscious consumers. These advances in product quality and packaging have helped sour cream substitutes gain traction not only among vegans and those with dietary restrictions but also among mainstream consumers seeking healthier alternatives.What Is Driving Growth in the Packaged Sour Cream Substitutes Market?

The growth in the packaged sour cream substitutes market is driven by several factors. The rising prevalence of lactose intolerance, dairy allergies, and the growing adoption of plant-based diets have significantly contributed to the demand for alternative sour cream products. Technological advancements in food science have allowed manufacturers to develop plant-based and lactose-free substitutes that closely replicate the taste and texture of traditional sour cream, appealing to a wider audience. Additionally, the expansion of retail distribution channels, particularly through specialty health food stores and e-commerce platforms, has made sour cream substitutes more accessible to consumers globally. The growing trend towards healthier eating, clean-label products, and sustainability has further fueled market demand, as consumers look for options that align with their health and ethical values. As innovation continues in this space, the market for packaged sour cream substitutes is expected to see continued growth, driven by an increasingly health-conscious and eco-aware consumer base.Report Scope

The report analyzes the Packaged Sour Cream Substitutes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Packaged Greek Yogurt, Packaged Cottage Cheese, Other Products); Application (Cream Sauces & Soups, Baked Products, Chocolates, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Packaged Greek Yogurt segment, which is expected to reach US$20 Billion by 2030 with a CAGR of 7.1%. The Packaged Cottage Cheese segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.1 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $8.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Packaged Sour Cream Substitutes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Packaged Sour Cream Substitutes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Packaged Sour Cream Substitutes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Carl's Jr. Restaurants LLC, Chobani LLC, Daisy Brand, Inc., Euro Foods Group Ltd, Groupe Danone and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 26 companies featured in this Packaged Sour Cream Substitutes market report include:

- Carl's Jr. Restaurants LLC

- Chobani LLC

- Daisy Brand, Inc.

- Euro Foods Group Ltd

- Groupe Danone

- mamasons dirty ice cream .

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Carl's Jr. Restaurants LLC

- Chobani LLC

- Daisy Brand, Inc.

- Euro Foods Group Ltd

- Groupe Danone

- mamasons dirty ice cream .

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 313 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

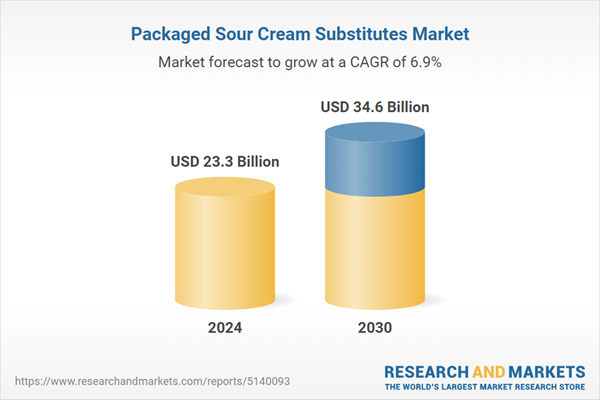

| Estimated Market Value ( USD | $ 23.3 Billion |

| Forecasted Market Value ( USD | $ 34.6 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |