Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Medical images like X-rays, CT scans, and MRIs can be analysed by AI algorithms to help in the detection and diagnosis of a variety of illnesses. Large datasets of annotated medical images can be used to train machine learning models to discover patterns and spot abnormalities. This can make it easier and more accurate for South Korean radiologists and medical professionals to identify illnesses like cancer, cardiovascular issues, and neurological disorders.

Key Market Drivers

Aging Population and Rising Chronic Disease Burden

South Korea is experiencing a rapid demographic shift toward an aging population. According to the Korean Statistical Information Service, individuals aged 65 and over are projected to constitute 40.1% of the population by 2050, positioning South Korea among the countries with the highest elderly population ratios globally. This aging trend correlates with an increased prevalence of chronic diseases, such as cardiovascular ailments and cancers, which necessitate advanced diagnostic imaging for effective management.The National Health Insurance Service reports a 32.5% increase in healthcare spending among the elderly between 2017 and 2022, with diagnostic imaging playing a pivotal role in managing age-related health conditions. Furthermore, the Korea Health Industry Development Institute notes a 28.3% rise in chronic diseases requiring advanced imaging technologies over the past five years. These statistics underscore the growing demand for sophisticated diagnostic imaging solutions to address the healthcare needs of an aging population.

Key Market Challenges

Shortage of Skilled Radiologists and Technicians

A significant challenge facing the diagnostic imaging market in South Korea is the shortage of skilled radiologists and technicians. Despite a 1.3-fold increase in the number of radiologists from 2013 to 2023, the volume of radiological examinations has increased tenfold during the same period. This disparity leads to increased workloads, with radiologists performing an average of 47 examinations daily, contributing to burnout and reduced job satisfaction.The shortage of qualified professionals hampers the efficiency and effectiveness of diagnostic services, potentially impacting patient care. Addressing this issue requires strategic workforce planning, including training programs and incentives to attract and retain skilled personnel in the radiology field.

Key Market Trends

Integration of AI and Automation in Diagnostic Imaging

The integration of AI and automation into diagnostic imaging is transforming the healthcare landscape in South Korea. AI algorithms enhance image accuracy and processing speed, enabling automatic abnormality detection and more informed decision-making. This technological advancement improves patient outcomes and operational efficiency.The South Korean government supports this transformation through initiatives like the AI Open Data Project, which promotes AI development in medical diagnostics. Moreover, collaborations between domestic and international companies are accelerating the adoption of AI-powered diagnostic tools in hospitals. These developments signify a shift towards more precise and efficient diagnostic practices in the country.

Key Market Players

- FUJIFILM Holdings Corporation

- GE Healthcare Korea Co Ltd

- Koninklijke Philips N.V

- Siemens Healthineers

- Canon Medical Systems Korea

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- Abbott Korea Ltd.

- Thermo Fisher Scientific, Inc.

- DR TECH CORP

Report Scope:

In this report, the South Korea Diagnostic Imaging Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:South Korea Diagnostic Imaging Market, By Type:

- X-Ray Imaging Solution

- Ultrasound Systems

- MRI Systems

- CT Scanner

- Nuclear Imaging Solutions

South Korea Diagnostic Imaging Market, By Mobility:

- Portable

- Standalone

South Korea Diagnostic Imaging Market, By Source:

- Domestic

- Import

South Korea Diagnostic Imaging Market, By Application:

- Cardiology

- Oncology

- Neurology

- Orthopaedics

- Gastroenterology

- Gynaecology

South Korea Diagnostic Imaging Market, By End User:

- Hospitals & Clinics

- Diagnostic Centers

- Ambulatory Care Centers

- Others

South Korea Diagnostic Imaging Market, By Region:

- Northern

- Southern

- Central

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the South Korea Diagnostic Imaging Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this South Korea Diagnostic Imaging market report include:- FUJIFILM Holdings Corporation

- GE Healthcare Korea Co Ltd

- Koninklijke Philips N.V

- Siemens Healthineers

- Canon Medical Systems Korea

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- Abbott Korea Ltd.

- Thermo Fisher Scientific, Inc.

- DR TECH CORP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | September 2025 |

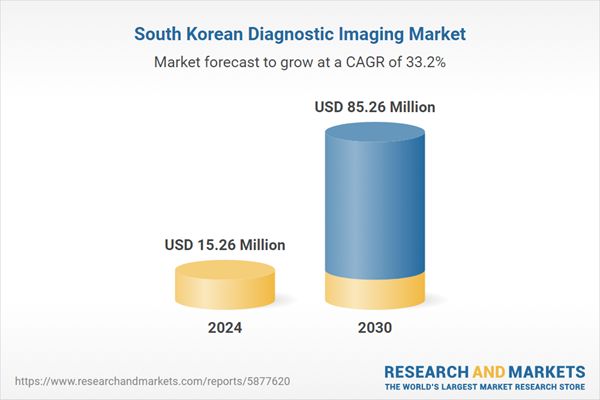

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.26 Million |

| Forecasted Market Value ( USD | $ 85.26 Million |

| Compound Annual Growth Rate | 33.2% |

| Regions Covered | South Korea |

| No. of Companies Mentioned | 11 |