The COVID-19 pandemic affected the office real estate market in South Korea due to restrictions, social distancing policies, and work-from-home culture. Though the market is in a recovery phase, it is yet to reach the pre-pandemic levels. The growth of the sector is driven by increasing office space absorption, growth in leasing activities, declining vacancy rates, etc.

Seoul is emerging as a leader in the office real estate sector. Office buildings accounted for more than 70% of commercial property transactions in Seoul during Q2 2021. In addition, office building prices in Seoul experienced robust growth in Q2 2021, driven by increasing investments from domestic investors. Take-up of prime office spaces remained high in the country during Q3 2021. Most of the prime office spaces are absorbed by new organizations (with 27% absorption), secondary to prime (with 35% absorption), prime to prime (19%), and expanding existing organizations (20%).

South Korea Office Real Estate Market Trends

Increasing Demand for Prime Office Spaces

Most of the demand for prime office spaces is observed in Seoul. In Q3 2021, the prime office vacancy rate fell by 1.9 ppts quarter-on-quarter to 9.9%. Also, net absorption increased by 163,200 sq.m on higher demand across all districts. Major business districts such as Central Business District (CBD), Gangnam Business District (GBD), and Yeouido Business District (YBD) absorbed most of the prime office spaces in the city.In Central Business District, the vacancy rate fell by 1.1 ppts quarter-on-quarter to 11.2% in Q3 2021. In addition, net absorption rose by 66,700 sq.m despite the supply of 41,700 sq.m from K-Square Citi. However, high tenant preferences in GBD resulted in increasing net absorption space by 28,400 sq.m, and the vacancy rate declined by 8% in Q3 2021. Moreover, net absorption increased to 66,800 sq.m in YBD as tenants continued to move into new buildings supplied last year, further reducing vacancy by 4.0 ppts quarter-on-quarter to 11.9%.

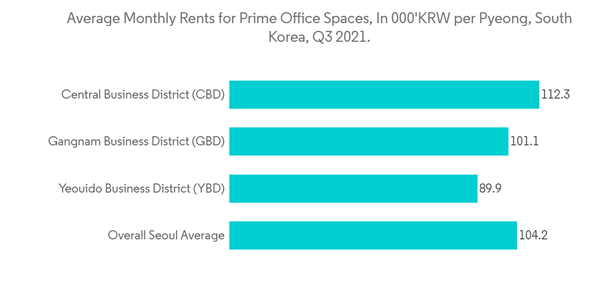

However, in Q3 2021, the new office space supply increased as K-Square Citi finished remodeling in CBD, adding 41,700 sq.m of new supply. Meanwhile, Woongjin Group and Loca Mobility moved into K-Square after preleasing 40% of the building in Q2. Furthermore, average annual rents in CBD, GBD, and YBD experienced annual growth rates of 1.3%, 1.5%, and 2.7%, respectively.

Increasing Rental Prices of Office Spaces

The pandemic significantly impacted the South Korean office market. However, the market is recovering, with significant growth observed in office absorption in 2021. Rental prices for office spaces have been witnessing positive growth after the pandemic. Rising rental prices are driven by declining vacancy rates and increasing demand for office spaces from tech tenants, which are mainly expanding in the Gangnam area, the CBD, and Yeouido Business District.Moreover, in Gangnam Business District, Grade A office spaces recorded a low vacancy rate in Q3 2021, as Centerfield, which was completed in Q1 2021, leased out its available space, signing a contract with Amazon. In addition, 10 floors vacated by Samsung Fire & Marine Insurance in The Asset Gangnam Tower were filled by PeopleFund and Naver. In the GBD area, not many options are available for tech tenants looking for Grade A office space, resulting in rising rental prices.

According to the Korea Real Estate Board statistics, Seoul and Gyeonggi provinces are leading in South Korea in terms of office space rental prices. In Q3 2021, the rental prices of office buildings in Seoul and Gyeonggi amounted to around KRW 22,400 per sq.m and KRW 11,800 per sq.m, respectively.

South Korea Office Real Estate Market Competitive Analysis

The office real estate market is fragmented. Large companies have advantages in terms of financial resources, while small companies can compete effectively by developing expertise in local markets. Some major companies include Hines, Brookfield Asset Management Inc., and Keangnam Enterprises Ltd.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Brookfield Asset Management Inc.

- Hines

- Arup

- Keangnam Enterprises Ltd

- SK D&D Co. Ltd

- Hanwha Group

- HYOSUNG

- FIDES Development

- Lotte Property & Development

- Regus Group Companies*