The COVID-19 pandemic significantly impacted the market studied. Initially, the pandemic hampered the market due to the cancellation of surgeries. However, to effectively handle the surgical procedures during the pandemic, the country used critical and valuable steps to mitigate the pandemic during the later phases. In addition, as per a research published in September 2022 in the JKNS journal, when the number of spine surgeries was analyzed by hospital size, the proportion of general tertiary hospitals in 2021 increased compared to those in prior years. Thus, the demand for surgeries fueled the concentration of spinal surgical devices. As spinal surgeries and elective procedures are resumed in current times, it is likely to contribute to the growth of the spinal surgery devices market in South Korea in the post-pandemic era.

Factors such as the rising geriatric population and increasing demand for minimally invasive devices also drive the market study's growth.

Endoscopic spine surgery may increase the risk of neurological or vascular harm due to the lack of stereoscopic vision. Thus, the scientists at South Korean research centers focus more on developing advanced technologies for improving the MISS pattern. This is further expected to create opportunities for spine surgery devices market growth in the country.

According to an article published in the ONS Journal in April 2022, a group of scientists in South Korea developed a 3D bi-portal endoscopic approach for treating lumbar degenerative disease and studied 38 patients. When the patients were analyzed with the new approach, the 3D bi-polar endoscopic imaging displayed surgical anatomy and accurately represented pathologic lesions, such as bony osteophytes and ruptured disc herniation. Thus, such developments and research in spinal surgery devices are predicted to contribute to the studied market growth over the forecast period.

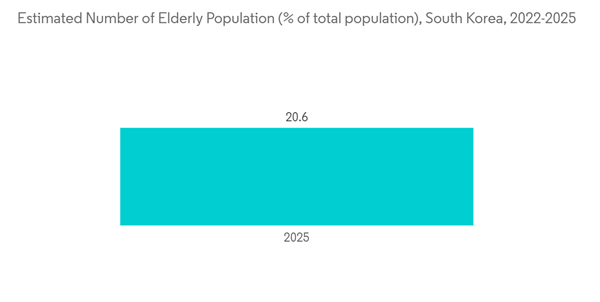

Moreover, degenerative lumbar spine disease is increasingly prevalent in the aging population. South Korea has been experiencing a rapidly aging population, so the demand for spine surgeries is also increasing. For instance, the September 2022 report published by Statistics Korea shows that the population aged 65 years or over is expected to reach 17.5% of the total population by the end of 202. The country is predicted to become one of the most aged societies by 2025 when the elderly population reaches 20.6% of the total population. The growing geriatric population is more prone to spinal and other musculoskeletal diseases. It is expected to drive the demand for the availability of innovative spinal surgery devices or equipment for treatment fueling the market growth in the country.

Therefore, owing to the above-mentioned growth factor,s the studied market is anticipated to grow over the forecast period. However, the high cost of the treatments is predicted to hamper the market growth during the analysis period.

South Korea Spinal Surgery Devices Market Trends

Discectomy under Spinal Decompression Segment Expected to Witness Growth

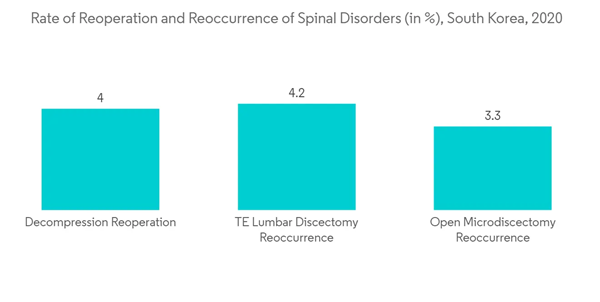

Discectomy is the medical term for the surgical removal of a herniated disc's damaged area in the spine. When a portion of the disc's softer interior material pushes through a tear in its harder outside, the result is a herniated disc. This may aggravate or pressure surrounding nerves, resulting in discomfort, numbness, or weakening. Thus, the segment is anticipated to witness growth owing to an increased incidence of herniated discs in South Korea.The demand for discectomy is increasing in South Korea, creating opportunities for spine surgery devices. According to an article published in BMC journal in February 2022, bi-portal endoscopic discectomy has been frequently performed in current years in lumbar discectomy, with advantages over conventional surgery. That has shown acceptable clinical outcomes for herniated discs or lumbar disc herniation. Thus, technological advancements are one of the significant factors that contribute to the growth of the segment.

As per an article published in the Spine Journal in September 2022, when a group of researchers studied 64 patients with low back and leg pain with a single-level herniated lumbar disc and required discectomy, bi-portal endoscopic discectomy showed positive results and was suggested by the scientists to be a safe and effective surgical technique which has a slight advantage of reduced muscle damage. Hence, owing to such instances, the demand for discectomy among patients in South Korea is increasing. Consequently, segment growth is anticipated. Therefore, owing to the increased demand for discectomy, the segment of the studied market is expected to grow over the forecast period.

Thoracolumbar Segment Expected to Witness Significant Growth

The thoracolumbar spinal fusion devices provide conventional yet effective treatments to patients suffering from lumbar spinal stenosis and advanced alternative treatments for decompression spine surgery. The major market players manufacture anterior and posterior dynamic stabilization devices for the lumbar spine. Moreover, many clinical trials are in the process of further development. Thus, it will likely create demand for the thoracolumbar spinal fusion segment, fueling its growth.The number of people affected by thoracolumbar injuries in the nation is an essential factor fueling the segment's growth. For instance, according to an article published in JKNS in December 2021, thoracolumbar fractures account for approximately 90% of all spinal column fractures, and nearly 10% to 20% of thoracolumbar fractures are burst fractures. In addition, as per the source above, when a group of patients with posttraumatic kyphosis (PTK) and burst fractures were observed in a healthcare setting in South Korea, all patients achieved solid fusion at the osteotomy site, in both groups, and 40% of each group of patients showed improved postoperative neurological status. Thus, such instances show that thoracolumbar fusion is a successful technique due to its high success rate. This creates demand for the devices used for thoracolumbar fusion procedures, thereby driving the segment's growth.

Thoracolumbar fractures are usually seen among the elderly and are the common osteoporotic fractures among elderly patients. According to the 2022 update by UNFPA, 17% of the total population in South Korea accounts for the elderly population. As South Korea has a high burden of the aging population, a more significant increase in thoracolumbar fusions is expected to be performed in the country. In addition, thoracolumbar fractures are treated with percutaneous fusion since they support the reduction of operative time and blood loss, as well as less soft tissue trauma. The considerable prevalence of thoracolumbar fractures in the nation increases the number of thoracolumbar spinal fusion surgeries performed. Therefore, owing to the increase in the majority of thoracolumbar spine injuries, segment growth is anticipated to grow over the analysis period.

South Korea Spinal Surgery Devices Market Competitor Analysis

The South Korean spinal surgery devices market is competitive and consists of a few market players. The market players are adopting various business growth strategies, which are increasing the number of partnerships, agreements, and collaborations and driving the market value. Some of the market players in the market studied are B. Braun SE, Medtronic PLC, Stryker, Johnson & Johnson (Depuy Synthes), Globus Medical Inc., and Zimmer Biomet, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- B. Braun SE

- Johnson & Johnson (Depuy Synthes)

- Medtronic PLC

- Styker

- Zimmer Biomet

- Bk Meditech

- GS Medical

- Endovision Co., Ltd

- Genoss

- CORENTEC Co., Ltd