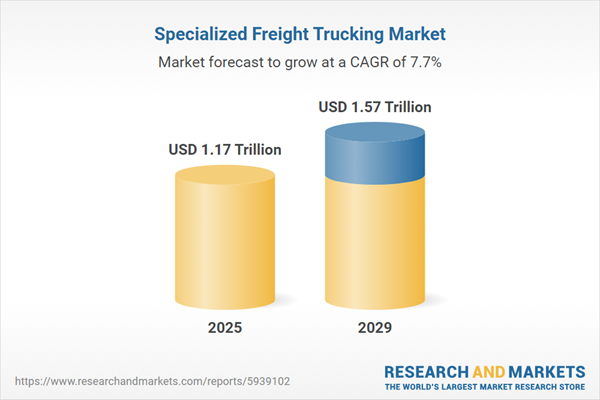

The specialized freight trucking market size is expected to see strong growth in the next few years. It will grow to $1.57 trillion in 2029 at a compound annual growth rate (CAGR) of 7.7%. The growth in the forecast period can be attributed to rising demand for raw materials from the manufacturing industries and rising urbanization will drive the market growth. Major trends in the forecast period include rising demand for raw materials from the manufacturing industries and rising urbanization will drive the market growth.

The forecast of 7.7% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Due to tariffs on temperature control systems and cargo monitoring tech, specialized freight trucking - especially for pharmaceuticals and perishables - may encounter increased shipping costs and regulatory compliance hurdles. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The growth of the specialized freight trucking market is supported by stable economic growth projected in many developed and developing countries. For example, in April 2024, the International Monetary Fund (IMF), a US-based government organization, reported that the global economy is expected to grow at a rate of 3.2 percent in both 2024 and 2025, consistent with the growth observed in 2023. Advanced economies are predicted to experience a slight increase, with growth rising from 1.6 percent in 2023 to 1.7 percent in 2024, reaching 1.8 percent in 2025. Additionally, recovering commodity prices, following a significant decline in previous years, are expected to contribute to the market's growth. Developed economies are anticipated to maintain stable growth throughout the forecast period, while emerging markets are likely to continue growing at a slightly faster pace than their developed counterparts. This stable economic growth is expected to boost investments in end-user markets, further driving the specialized freight trucking market during the forecast period.

The specialized freight trucking market is expected to experience growth propelled by the expansion of the E-commerce industry. E-commerce involves the online trading of products, services, and the exchange of money and data. Specialized freight trucking plays a crucial role in the last-mile delivery of goods to customers' homes, ensuring faster delivery by bringing inventory closer to the end-users. As an example, data from the United States Census Bureau reveals a 6.6% increase in retail e-commerce sales, reaching $269.5 billion in Q2 2023 in the United States. Consequently, the growth of the E-commerce industry becomes a driving force for the specialized freight trucking market.

Truck transportation companies are increasingly adopting collision mitigation technology to mitigate the loss of lives and damage associated with accidents. The collision mitigation system is designed to identify potential collisions and promptly alert the driver, providing an opportunity for preventive action. These systems are integrated into the vehicles and can automatically intervene in the event of an impending accident, acting without requiring input from the driver. Many countries globally are incorporating these systems as standard features in new trucks. For example, data from the US Department of Transportation reveals that twenty automakers committed to equipping nearly all new passenger vehicles with a low-speed Automatic Emergency Braking (AEB) system, including forward collision warning (FCW), by 2022. This technology has proven effective in preventing and mitigating front-to-rear crashes, potentially averting nearly 2000 crashes annually. Key companies manufacturing these collision mitigation systems for trucks include Delphi Automotive LLP, Robert Bosch GmbH, Denso Corporation, Autoliv, Inc., and General Electric Company.

Major companies are actively developing innovative solutions, including proprietary technology, to offer reliable services to customers. Proprietary technology encompasses a combination of processes, tools, or interconnected systems. For instance, in September 2023, WARP, a US-based provider of a tech-powered freight network, introduced gLTL. This technology allows shippers to access a wide range of vehicle sizes, from sedans to SUVs and sprinter vans, and unlock additional capacity at accelerated rates. The new service covers various delivery and logistics options, such as direct-to-store delivery, inventory transfers to fulfillment centers, warehouse-to-warehouse transfers, and last-mile delivery.

Major companies operating in the specialized freight trucking market include Old Dominion Freight Line, J.B. Hunt Transport Services, Knight-Swift Transportation Holdings, XPO Logistics, FedEx Freight, Schneider National, Saia Inc., Landstar System, YRC Worldwide, R+L Carriers, Estes Express Lines, Averitt Express, CRST International, AAA Cooper Transportation, Southeastern Freight Lines, ArcBest Corporation, Forward Air Corporation, Roadrunner Transportation Systems, Dayton Freight Lines, Central Transport, Pitt Ohio Express, Holland Regional, Old Dominion Truck Leasing, Ward Transport and Logistics, A. Duie Pyle, Wilson Trucking Corporation, Bennett International Group, Black Horse Carriers, Hub Group.

Asia-Pacific was the largest region in the specialized freight trucking market in 2024. North America was the second largest region in the specialized freight trucking market. The regions covered in the specialized freight trucking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the specialized freight trucking market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The specialized freight trucking market includes revenues earned by entities by providing transportation services for specialized goods that must be delivered to customers quickly. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and the resulting trade tensions in spring 2025 are having a considerable impact on the transport services sector by increasing the costs of vehicles, spare parts, and fuel - critical inputs frequently imported from tariff-affected regions. Freight operators, logistics companies, and public transportation providers are experiencing margin pressures as elevated equipment and maintenance expenses coincide with limited flexibility to pass these costs on to customers due to intense market competition. This climate of uncertainty has also led to delays in fleet upgrades and the adoption of greener, more energy-efficient vehicles, hindering progress toward sustainability objectives. In response, transport firms are enhancing route optimization, investing in fuel-efficient technologies, renegotiating supplier agreements, and adopting collaborative logistics strategies to share resources and cushion the financial impact of rising tariffs.

The specialized freight truckingmarket research report is one of a series of new reports that provides specialized freight truckingmarket statistics, including global market size, regional shares, competitors with a specialized freight truckingmarket share, detailed specialized freight truckingmarket segments, market trends and opportunities, and any further data you may need to thrive in the specialized freight truckingindustry. This specialized freight truckingmarket research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Specialized freight trucking refers to the transportation of unique cargo that necessitates special handling and equipment. This includes items such as heavy machinery, hazardous materials, temperature-sensitive goods, and oversized products. Companies operating in this sector employ specialized vehicles, including flatbeds, tankers, and refrigerated trailers, as well as trained personnel to ensure adherence to safety regulations and facilitate efficient delivery.

The primary categories within specialized freight trucking encompass automobiles and heavy equipment, bulk liquids, dry bulk materials, forest products, and refrigerated goods. Automobiles refer to passenger vehicles designed for public road use, featuring four wheels and powered by a gasoline or diesel internal-combustion engine. Heavy equipment includes robust machines utilized in construction, forestry, agriculture, and mining, capable of tasks such as earth movement, drilling, lifting, grading, suction, plowing, and compaction.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Specialized Freight Trucking Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on specialized freight trucking market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for specialized freight trucking? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The specialized freight trucking market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Automobiles and Heavy Equipment, Bulk Liquids, Dry Bulk Materials, Forest Products, Refrigerated Goods2) by Size: Heavy Trucks, Medium Trucks, Light Trucks

3) by Application: Oil and Gas, Industrial and Manufacturing, Energy and Mining, Food and Beverages, Pharmaceuticals and Healthcare, Other Applications

Subsegments:

1) by Automobiles and Heavy Equipment: Transportation of Cars, Trucks, and Motorcycles; Hauling of Construction and Agricultural Machinery2) by Bulk Liquids: Transport of Chemicals and Petrochemicals; Delivery of Food-Grade Liquids; Transport of Hazardous Materials

3) by Dry Bulk Materials: Hauling of Grains, Powders, and Granules; Transport of Construction Materials; Delivery of Recycled Materials

4) by Forest Products: Transportation of Lumber and Wood Products; Delivery of Paper Products and Wood Chips

5) by Refrigerated Goods: Transport of Perishable Food Items; Delivery of Pharmaceuticals and Temperature-Sensitive Products

Companies Mentioned: Old Dominion Freight Line; J.B. Hunt Transport Services; Knight-Swift Transportation Holdings; XPO Logistics; FedEx Freight; Schneider National; Saia Inc.; Landstar System; YRC Worldwide; R+L Carriers; Estes Express Lines; Averitt Express; CRST International; AAA Cooper Transportation; Southeastern Freight Lines; ArcBest Corporation; Forward Air Corporation; Roadrunner Transportation Systems; Dayton Freight Lines; Central Transport; Pitt Ohio Express; Holland Regional; Old Dominion Truck Leasing; Ward Transport and Logistics; a. Duie Pyle; Wilson Trucking Corporation; Bennett International Group; Black Horse Carriers; Hub Group

Countries: Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Specialized Freight Trucking market report include:- Old Dominion Freight Line

- J.B. Hunt Transport Services

- Knight-Swift Transportation Holdings

- XPO Logistics

- FedEx Freight

- Schneider National

- Saia Inc.

- Landstar System

- YRC Worldwide

- R+L Carriers

- Estes Express Lines

- Averitt Express

- CRST International

- AAA Cooper Transportation

- Southeastern Freight Lines

- ArcBest Corporation

- Forward Air Corporation

- Roadrunner Transportation Systems

- Dayton Freight Lines

- Central Transport

- Pitt Ohio Express

- Holland Regional

- Old Dominion Truck Leasing

- Ward Transport and Logistics

- A. Duie Pyle

- Wilson Trucking Corporation

- Bennett International Group

- Black Horse Carriers

- Hub Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.17 Trillion |

| Forecasted Market Value ( USD | $ 1.57 Trillion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |