Global Striking Tools Market - Key Trends and Drivers Summarized

Why Are Striking Tools Indispensable in Construction and Demolition?

Striking tools are robust hand tools designed to deliver forceful impacts, making them indispensable for tasks such as driving nails, breaking hard materials, shaping metal, and performing demolition work. These tools encompass a variety of types, including hammers, sledges, mallets, axes, and chisels, each suited for specific applications based on the nature of the task and the materials involved. For instance, claw hammers are a staple in carpentry for driving and removing nails, while sledgehammers are used in demolition work to break through concrete, stone, or masonry. Mallets, with their softer, broader heads, are perfect for tapping joints together without causing surface damage, making them ideal for woodworking and delicate assembly tasks. Striking tools are not only defined by their ability to deliver powerful blows but also by their ergonomics and safety features, which are crucial for user comfort and injury prevention. Modern striking tools often include shock-absorbing handles, anti-slip grips, and forged steel heads designed to withstand heavy use without deforming or shattering. Whether for small household repairs or large-scale construction projects, striking tools are foundational instruments that enable users to shape, fasten, and dismantle materials with precision and controlled force.How Are Striking Tools Adapting to the Modern Needs of Users?

The design and functionality of striking tools have advanced significantly to cater to the varying needs of professionals and DIY enthusiasts alike, reflecting a focus on enhanced performance, user safety, and ergonomic comfort. One of the most notable trends in striking tools is the incorporation of shock-absorbing and vibration-dampening technologies, such as handle cores made of fiberglass or composite materials, which reduce the physical strain on users during repetitive striking. Additionally, the introduction of anti-slip and textured grips has improved tool control and minimized the risk of accidents, even in wet or oily conditions. In the realm of sledgehammers and axes, manufacturers are employing advanced forging techniques and using heat-treated, high-carbon steel to create heads that are harder and more resistant to chipping and wear. Another area of innovation is the development of multi-functional striking tools, like combination hammers that integrate a nail puller, pry bar, or chisel into a single unit, providing versatility for complex tasks and reducing the need to carry multiple tools. The adoption of lightweight yet durable materials, such as carbon fiber and reinforced polymers, is also contributing to the evolution of striking tools by making them easier to handle without compromising strength. Furthermore, adjustable or interchangeable heads are being introduced, allowing users to switch between different weights and profiles, thereby tailoring the tool to specific jobs. These advancements are transforming traditional striking tools into high-performance, user-centric instruments that can tackle a wider range of tasks with greater efficiency and comfort.Which Cutting-Edge Innovations Are Shaping the Next Generation of Striking Tools?

The future of striking tools is being shaped by a combination of material science, smart technology, and advanced manufacturing techniques that are enhancing their durability, functionality, and ease of use. One of the most significant advancements is the use of composite materials and advanced alloys, which are making striking tools lighter, stronger, and more resistant to wear and tear. High-strength titanium and carbon-fiber-reinforced polymers are being incorporated into tool handles and heads, offering a unique combination of reduced weight and increased impact resistance. This is particularly beneficial in high-frequency tasks like carpentry, where lighter tools can reduce fatigue over long working hours. Another major innovation is the integration of smart technology into striking tools. For example, some modern sledgehammers and hammers are equipped with digital impact counters that record the number of strikes, force applied, and even provide feedback on technique, helping professionals maintain consistency and efficiency. Additionally, advancements in 3D printing and computer-aided design (CAD) are enabling manufacturers to produce customized striking tools with unique handle shapes and grip patterns tailored to individual user preferences. These tools can also feature modular components, such as replaceable heads or handles, extending the life of the tool and allowing for easy upgrades. Moreover, surface treatments such as anti-corrosion coatings and anti-magnetic properties are being explored to increase tool longevity and performance in harsh environments, such as demolition sites and industrial plants. These innovations are not only improving the physical properties of striking tools but are also paving the way for smarter, more adaptable tools that cater to the specific needs of modern users.What Market Forces Are Driving the Expansion of the Striking Tools Industry?

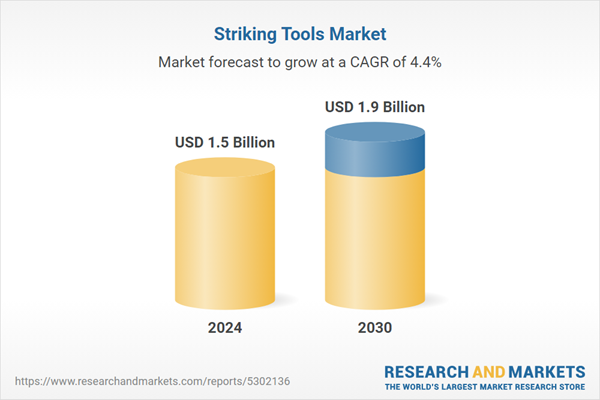

The growth in the striking tools market is driven by several factors, including the booming construction and renovation sectors, rising demand for high-performance tools, and the increasing focus on worker safety and ergonomic design. One of the primary drivers is the surge in residential and commercial construction projects, which rely heavily on a variety of striking tools for framing, demolition, and finishing tasks. As global infrastructure development continues to accelerate, particularly in emerging economies, the need for durable and efficient striking tools is expected to grow significantly. In addition, the growing trend of home improvement and DIY projects, spurred by an increasing number of homeowners taking on their own renovations, is boosting demand for user-friendly hammers, mallets, and multi-functional striking tools. This trend was further amplified by the COVID-19 pandemic, as more people spent time at home and turned to DIY projects as a productive hobby. Moreover, professional users in the construction and manufacturing sectors are seeking tools that offer superior performance and longevity, driving demand for premium products with enhanced features like vibration reduction and anti-fatigue handles. The rising emphasis on safety in the workplace is also influencing the market, as companies invest in ergonomic tools that reduce the risk of repetitive strain injuries and enhance user comfort during long-term use. Furthermore, technological advancements, such as the development of shock-absorbing materials and smart tool designs, are creating new opportunities in the market by addressing the specific needs of both professional contractors and casual users. With these factors converging, the striking tools market is poised for robust growth, supported by innovations that prioritize efficiency, safety, and user satisfaction across a range of applications.Report Scope

The report analyzes the Striking Tools market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Residential, Commercial).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Residential End-Use segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of a 4.1%. The Commercial End-Use segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $392.2 Million in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $400.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Striking Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Striking Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Striking Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Armstrong, Bostitch, Bully Tools, Estwing, Fiskars and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Striking Tools market report include:

- Armstrong

- Bostitch

- Bully Tools

- Estwing

- Fiskars

- HART

- HDX

- Husky

- Klein Tools

- Ludell

- Nupla

- POWERNAIL

- QEP

- Razor-Back

- ROCKFORGE

- Silky

- Smith's

- SOG

- TEKTON

- URREA

- Whetstone

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Armstrong

- Bostitch

- Bully Tools

- Estwing

- Fiskars

- HART

- HDX

- Husky

- Klein Tools

- Ludell

- Nupla

- POWERNAIL

- QEP

- Razor-Back

- ROCKFORGE

- Silky

- Smith's

- SOG

- TEKTON

- URREA

- Whetstone

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |