Global Surgical Booms Market - Key Trends & Drivers Summarized

Why Are Surgical Booms Becoming a Standard Feature in Modern Operating Rooms?

Surgical booms, also known as equipment management systems or ceiling-mounted arms, are rapidly becoming essential components in contemporary operating rooms (ORs) due to their ability to streamline workflow, enhance safety, and optimize space utilization. These systems are designed to suspend surgical tools, medical devices, and gas or electrical outlets above the operating table, thereby eliminating ground-level clutter and reducing the risk of tripping or contamination. As hospitals and surgical centers prioritize efficiency and infection control, surgical booms are being integrated as core infrastructure in new OR builds and retrofits alike. The push for minimally invasive surgeries, where multiple high-tech devices must be coordinated simultaneously, has amplified the demand for equipment that improves accessibility and ergonomics. Additionally, the increasing complexity of surgeries, along with the growing use of imaging and robotic systems, makes centralized and flexible equipment management critical. By allowing surgeons and staff to move freely without obstruction, surgical booms support precision and speed while improving the overall safety and workflow of the operating suite. Their adaptability to different specialties - orthopedics, neurosurgery, cardiovascular, and general surgery - further cements their role as a modern OR necessity.How Are Technological Innovations Enhancing Functionality and Customization?

Advances in design and engineering are significantly enhancing the functionality, modularity, and usability of surgical booms. Manufacturers are now offering highly customizable systems with adjustable arms, integrated video and data ports, gas delivery units, and even touchscreens for intraoperative communication. Modern surgical booms come with smooth articulation, motorized movement, and ergonomic handles, making it easier to position equipment precisely during surgeries without disrupting the sterile field. Innovations in cable management and device integration allow for seamless connectivity with monitors, endoscopes, and imaging tools - all from a single centralized unit. With digitalization becoming a standard in surgical environments, surgical booms are increasingly designed to support video conferencing, live procedure broadcasts, and EMR access, enabling real-time collaboration and documentation. Moreover, lightweight, ceiling-mounted systems reduce floor load and allow for better cleaning access, further contributing to hygiene and infection control. These systems can be integrated with hybrid OR setups and accommodate robotic surgical assistants, ensuring compatibility with evolving medical technologies. As more hospitals demand flexible OR configurations tailored to specific procedural workflows, the availability of modular and future-ready surgical boom solutions is expanding rapidly, driving adoption across geographies.Why Are Healthcare Infrastructure Investments and OR Standardization Fueling Adoption?

Global investments in healthcare infrastructure - especially in emerging markets and developing countries - are accelerating the deployment of technologically advanced operating rooms, where surgical booms are seen as a foundational element. As healthcare systems upgrade facilities to meet international standards and accommodate advanced surgical procedures, demand for ORs with optimized ergonomics, safety, and efficiency is rising. Many hospitals are standardizing their OR layouts to improve staff training, reduce variability in care delivery, and enhance turnover times - objectives that align directly with the benefits of surgical boom systems. In developed markets, aging infrastructure is being modernized with integrated surgical environments where booms play a key role in consolidating equipment and simplifying cable routing. Public-private partnerships, hospital automation projects, and smart hospital developments are further boosting the market, with procurement often tied to multi-system OR upgrades. Additionally, safety regulations, such as those from OSHA and CDC, are influencing design decisions that minimize trip hazards and contamination risks - roles well addressed by ceiling-mounted surgical equipment. As hospitals compete to attract top surgical talent and offer cutting-edge patient care, the adoption of surgical booms is increasingly seen as both a functional necessity and a competitive differentiator.What's Driving the Global Growth of the Surgical Booms Market?

The growth in the surgical booms market is driven by several interconnected factors related to surgical trends, healthcare infrastructure upgrades, technological advancements, and clinical efficiency goals. The global rise in surgical procedures - particularly minimally invasive and image-guided surgeries - requires high-tech, organized ORs that support seamless integration of multiple devices and tools. Surgical booms offer practical solutions for organizing complex OR setups, minimizing floor clutter, and enhancing sterility, making them an indispensable component of surgical planning. The adoption of hybrid operating rooms, where diagnostic imaging and surgery converge, further drives demand for modular and multifunctional equipment management systems. Additionally, growing awareness around healthcare worker safety, infection control, and space optimization is motivating hospitals to replace traditional floor-based equipment stands with ceiling-mounted alternatives. Technological advancements in surgical boom design - such as motorization, touchscreen integration, and compatibility with robotic systems - are expanding their utility across various surgical specialties. Supportive government investments, hospital modernization programs, and international health quality standards are also accelerating procurement in both public and private sectors. Together, these drivers are fueling strong global growth in the surgical booms market, positioning it as a key enabler of smarter, safer, and more efficient surgical environments.Report Scope

The report analyzes the Surgical Booms market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Equipment Boom, Anesthesia Boom, Other Boom); Installation (Floor Mounted, Roof Mounted); End-Use (Hospitals, Ambulatory Surgery Centers, Dental Clinics, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Equipment Boom segment, which is expected to reach US$367.6 Million by 2030 with a CAGR of a 4.9%. The Anesthesia Boom segment is also set to grow at 2.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $121.1 Million in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $116.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Surgical Booms Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Surgical Booms Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Surgical Booms Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

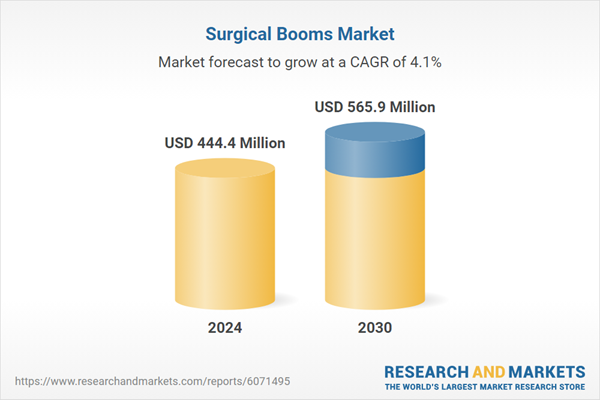

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Astec Industries, Inc., Austin Engineering Ltd, AV Group of Companies, BEML Limited, Boart Longyear and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Surgical Booms market report include:

- ALVO Medical

- Amico Group of Companies

- Baxter International Inc.

- Bender UK

- Berchtold Corporation

- Bovie Medical Corporation

- CV Medical LLC

- Drägerwerk AG & Co. KGaA

- Getinge AB (Maquet Holdings)

- Heraeus Medical

- Hill-Rom Services, Inc.

- KLS Martin Group

- Medical Illumination International

- Medicana

- Merivaara Corp.

- Mindray Medical International

- NUVO Surgical

- Ondal Medical Systems GmbH

- Pratibha Medinox

- Shanghai Wanyu Medical Equipment

- Shenzhen Mindray Bio-Medical

- SIMEON Medical

- Skytron, LLC

- Starkstrom

- STERIS plc

- Stryker Corporation

- Surgiris

- TRUMPF Medical Systems

- Trumpf Medizin Systeme GmbH

- Zimmer Biomet Holdings, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALVO Medical

- Amico Group of Companies

- Baxter International Inc.

- Bender UK

- Berchtold Corporation

- Bovie Medical Corporation

- CV Medical LLC

- Drägerwerk AG & Co. KGaA

- Getinge AB (Maquet Holdings)

- Heraeus Medical

- Hill-Rom Services, Inc.

- KLS Martin Group

- Medical Illumination International

- Medicana

- Merivaara Corp.

- Mindray Medical International

- NUVO Surgical

- Ondal Medical Systems GmbH

- Pratibha Medinox

- Shanghai Wanyu Medical Equipment

- Shenzhen Mindray Bio-Medical

- SIMEON Medical

- Skytron, LLC

- Starkstrom

- STERIS plc

- Stryker Corporation

- Surgiris

- TRUMPF Medical Systems

- Trumpf Medizin Systeme GmbH

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 444.4 Million |

| Forecasted Market Value ( USD | $ 565.9 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |