Global Tendon Allografts Market - Key Trends & Drivers Summarized

Why Are Tendon Allografts Gaining Preference in Orthopedic and Sports Injury Repair?

Tendon allografts - transplanted tendons sourced from deceased donors - are increasingly used in reconstructive orthopedic procedures, particularly in cases where autograft harvesting is not feasible or desirable. These grafts offer structural strength, biological compatibility, and reduced surgical morbidity by eliminating the need for a second surgical site. Tendon allografts are particularly valuable in complex or revision procedures where autograft tissue may be insufficient, compromised, or contraindicated.Their application spans a wide range of procedures, including anterior cruciate ligament (ACL) reconstruction, rotator cuff repair, and multi-ligament knee injuries. In sports medicine, allografts allow surgeons to address high-performance injury scenarios with reduced operative time and faster rehabilitation. As demand for minimally invasive, high-efficiency surgical interventions rises among athletes, elderly patients, and physically active individuals, tendon allografts offer a viable and increasingly accepted alternative to autograft-based repair.

How Are Processing Technologies and Biocompatibility Standards Enhancing Graft Performance and Safety?

Modern tissue banks employ advanced sterilization and decellularization protocols - such as gamma irradiation, ethylene oxide treatment, and proprietary chemical rinsing - to ensure that tendon allografts meet stringent safety and biocompatibility benchmarks. These techniques aim to eliminate pathogens while preserving the mechanical integrity and collagen architecture essential for graft incorporation and function. Innovations in cryopreservation and lyophilization are also enhancing shelf life and surgical readiness.Tissue engineering advancements are leading to the development of pre-treated or bio-enhanced allografts that may include growth factors, scaffolds, or stem cell compatibility to accelerate healing and integration. Regulatory frameworks from bodies like the FDA, AATB (American Association of Tissue Banks), and EATB (European Association of Tissue Banks) are reinforcing clinical confidence through rigorous quality control and traceability. These safety and performance improvements are key to expanding clinical adoption and supporting outcomes on par with, or superior to, traditional grafting techniques.

Which Clinical Segments and Healthcare Settings Are Driving Demand for Tendon Allografts?

The highest demand for tendon allografts is seen in sports medicine, trauma surgery, and joint reconstruction segments. Patients undergoing ACL repair, multiligament knee reconstructions, or revision surgeries often benefit from the reduced morbidity and operative efficiency associated with allograft use. Surgeons also prefer allografts in pediatric or geriatric populations where tissue harvesting may pose additional risks or recovery challenges.Ambulatory surgical centers (ASCs), orthopedic specialty hospitals, and tertiary care facilities are the primary end-users of tendon allografts. The growth of outpatient and same-day surgery models is reinforcing demand for grafts that reduce surgical time, blood loss, and postoperative complications. In addition, broader access to tissue banks and improved logistics are enabling smaller or rural healthcare centers to utilize allograft solutions that were previously restricted to major urban hospitals. This geographic democratization is contributing to overall market expansion.

How Are Reimbursement Policies, Supply Logistics, and Ethical Sourcing Influencing Market Evolution?

Reimbursement structures vary by region and are a critical factor in allograft utilization. In countries with established public health systems or private insurance support, reimbursement for biologic implants like tendon allografts is often bundled within surgical procedure codes. However, variability in tissue classification - as either implantable medical devices or biologics - can influence coding, billing, and cost-effectiveness assessments, impacting adoption across healthcare systems.Ethical sourcing and donor consent protocols remain under continuous scrutiny, driving the need for transparent supply chains and verified donor screening processes. Leading tissue banks maintain full traceability, from donor screening and graft harvesting to processing and final distribution, ensuring compliance with both legal and ethical standards. Logistics, including cold chain integrity and rapid delivery, are also being optimized to support timely surgical scheduling and minimize wastage - factors that are increasingly important as demand outpaces supply in high-volume orthopedic centers.

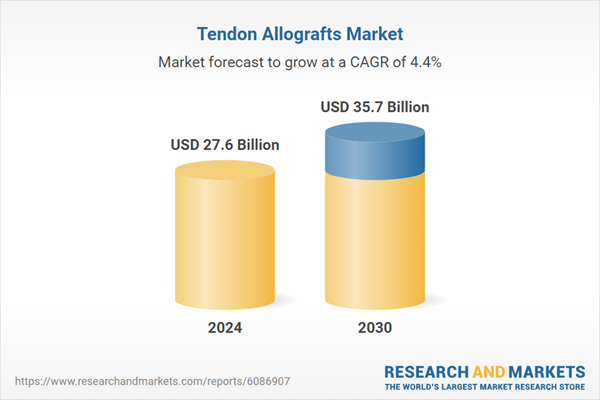

What Are the Factors Driving Growth in the Tendon Allografts Market?

The tendon allografts market is growing steadily, driven by the rise in orthopedic surgeries, sports injuries, and demand for biologic graft alternatives that reduce surgical invasiveness and recovery time. Innovations in graft processing, expanding tissue bank networks, and evolving reimbursement structures are reinforcing clinical adoption across a broader range of procedures and healthcare settings. As the focus on functional recovery and patient quality of life intensifies, tendon allografts are emerging as a strategic solution in modern musculoskeletal repair.Looking ahead, market expansion will depend on how effectively stakeholders address graft availability, ethical sourcing, and surgeon training while integrating bio-enhanced and next-generation allograft solutions. Whether tendon allografts can continue to deliver scalable, reproducible outcomes across diverse surgical applications will determine their role in shaping the future of biologic orthopedic interventions.

Report Scope

The report analyzes the Tendon Allografts market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Tibialis, Patellar Tendon, Achilles Tendon, Other Product Types); End-Use (Hospitals, Orthopedic Clinics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tibialis segment, which is expected to reach US$20.5 Billion by 2030 with a CAGR of a 5.3%. The Patellar Tendon segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.5 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $7.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Tendon Allografts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Tendon Allografts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Tendon Allografts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, AMETEK Land, Axis Communications AB, BAE Systems plc, Cadi Scientific Pte Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Tendon Allografts market report include:

- AlloSource

- Arthrex, Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- Bone Bank Allografts

- CONMED Corporation

- DePuy Synthes

- Integra LifeSciences

- JRF Ortho

- Lattice Biologics Ltd.

- LifeNet Health

- Medtronic plc

- MiMedx Group, Inc.

- Organogenesis Holdings Inc.

- Orthofix Medical Inc.

- RTI Surgical Holdings, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Xtant Medical Holdings, Inc.

- Zimmer Biomet Holdings, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AlloSource

- Arthrex, Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- Bone Bank Allografts

- CONMED Corporation

- DePuy Synthes

- Integra LifeSciences

- JRF Ortho

- Lattice Biologics Ltd.

- LifeNet Health

- Medtronic plc

- MiMedx Group, Inc.

- Organogenesis Holdings Inc.

- Orthofix Medical Inc.

- RTI Surgical Holdings, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Xtant Medical Holdings, Inc.

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.6 Billion |

| Forecasted Market Value ( USD | $ 35.7 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |