Global Term Life Insurance Market - Key Trends and Drivers Summarized

Why Is Term Life Insurance Gaining Popularity Among Modern Consumers?

Term life insurance is experiencing a surge in popularity as more consumers prioritize financial security and seek straightforward, cost-effective ways to protect their families. But what exactly makes term life insurance so appealing, and why is it becoming a preferred choice? Unlike whole or universal life insurance, which build cash value and come with higher premiums, term life insurance provides pure life coverage for a specified period, such as 10, 20, or 30 years, making it a simpler and more affordable option for many. This type of insurance is designed to cover policyholders during their most financially vulnerable years - when they have dependents, mortgages, or other significant financial responsibilities. If the policyholder dies within the term, the beneficiaries receive a death benefit, which can be used to replace lost income, pay off debts, or fund future needs such as college education. The straightforward nature of term life insurance, combined with lower premium costs, allows policyholders to purchase larger coverage amounts compared to other life insurance products. As a result, it is particularly popular among young families, middle-income households, and first-time buyers looking to ensure that their loved ones are financially protected in the event of an untimely death. The growing awareness of financial planning and the increased availability of online comparison tools are making term life insurance more accessible and easier to understand, further contributing to its rising popularity in the broader insurance market.What Are the Major Trends Shaping the Term Life Insurance Market?

The term life insurance market is evolving rapidly, driven by shifts in consumer behavior, technological advancements, and changing economic conditions. One of the most notable trends is the increasing adoption of digital platforms for purchasing life insurance. Insurtech companies and traditional insurers alike are leveraging digital tools to streamline the buying process, offering online applications, instant approvals, and direct-to-consumer models that eliminate the need for face-to-face interactions. This digital transformation is attracting younger, tech-savvy customers who prefer a seamless, paperless experience and value transparency in pricing and product features. Another key trend is the rise of personalized policies that cater to specific life stages and individual needs. Insurers are increasingly offering flexible term lengths, convertible options, and add-ons such as critical illness riders or disability income protection, allowing consumers to customize their coverage based on their evolving financial goals and health conditions. Additionally, the use of advanced data analytics and artificial intelligence (AI) in underwriting is transforming how risk is assessed. By incorporating non-traditional data points such as lifestyle factors, social media activity, and wearable health data, insurers can provide more accurate risk assessments, leading to faster approvals and potentially lower premiums for low-risk individuals. Furthermore, the growing focus on diversity and inclusion is prompting insurers to develop products that address the needs of underserved segments, such as women, minorities, and the LGBTQ+ community, creating a more inclusive market landscape. These trends are not only reshaping how term life insurance is sold and marketed but are also making it more personalized, accessible, and aligned with the expectations of modern consumers.How Are Technological Advancements Transforming the Term Life Insurance Industry?

Technological advancements are revolutionizing the term life insurance industry, making it more efficient, consumer-friendly, and adaptable to changing market needs. One of the most significant innovations is the use of artificial intelligence (AI) and machine learning to enhance the underwriting process. Traditionally, life insurance underwriting has been a lengthy and cumbersome procedure, requiring detailed medical exams, paperwork, and weeks of waiting for approval. AI is streamlining this process by analyzing a wide range of data, including electronic health records, pharmacy histories, and even biometric data from wearable devices, to generate instant underwriting decisions. This not only accelerates the application process but also improves the accuracy of risk assessments, enabling insurers to offer more competitive premiums. Another major technological development is the integration of digital platforms and online marketplaces that allow consumers to compare policies, receive quotes, and complete purchases in a matter of minutes. This digital shift is empowering consumers by providing greater transparency and control over the buying process, as they can now research, customize, and purchase policies without the pressure of traditional sales tactics. Additionally, the rise of predictive analytics is helping insurers better understand consumer behavior and preferences, leading to more targeted marketing strategies and personalized product offerings. Insurers are also utilizing blockchain technology to enhance data security and streamline policy administration, ensuring that sensitive customer information is protected and transactions are transparent. These advancements are not only transforming the operational efficiency of insurers but are also reshaping the customer experience, making term life insurance more accessible, reliable, and aligned with the expectations of a digital-first consumer base.What Factors Are Driving the Growth of the Term Life Insurance Market?

The growth in the term life insurance market is driven by several factors, primarily influenced by evolving consumer preferences, technological innovations, and changing economic dynamics. One of the main drivers is the rising awareness of the need for financial protection, especially among millennials and younger generations who are entering key life stages such as starting families and purchasing homes. This demographic is increasingly seeking affordable and flexible life insurance solutions that can adapt to their changing needs, making term life insurance an ideal option. Another critical factor is the ongoing digitalization of the insurance industry, which is making it easier for consumers to research, compare, and purchase policies online. The proliferation of insurtech platforms and the availability of online comparison tools have reduced barriers to entry, enabling more people to access and understand life insurance products. Additionally, the impact of the COVID-19 pandemic has heightened the awareness of financial vulnerability, prompting many individuals to re-evaluate their financial planning strategies and seek out life insurance as a means of securing their families' futures. This has led to a spike in demand for term life policies, which offer straightforward coverage without the complexities associated with permanent life insurance options. The increased adoption of simplified underwriting methods, such as accelerated and algorithmic underwriting, is further driving market growth by reducing approval times and making the process more convenient for consumers. Moreover, the rising cost of living and economic uncertainty are influencing consumers to seek cost-effective solutions, making term life insurance an attractive option due to its lower premiums and high coverage value. These factors, combined with the growing emphasis on personalized policies and customer-centric approaches, are propelling the growth of the term life insurance market, making it one of the fastest-growing segments in the broader life insurance industry.Report Scope

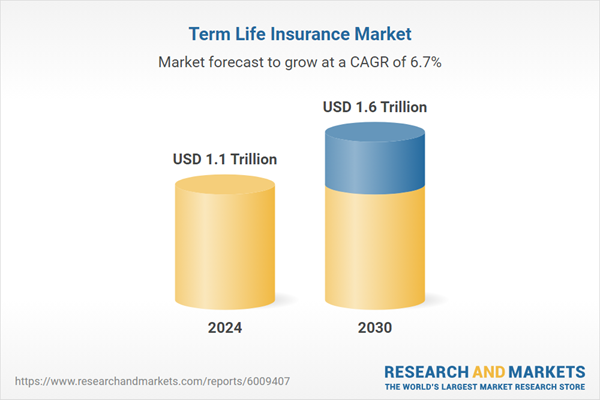

The report analyzes the Term Life Insurance market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Individual Level Insurance, Group Level Insurance, Decreasing Term Life Insurance); Distribution Channel (Tied Agents & Branches Distribution Channel, Brokers Distribution Channel, Other Distribution Channels).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Individual Level Insurance segment, which is expected to reach US$1.2 Trillion by 2030 with a CAGR of a 6.6%. The Group Level Insurance segment is also set to grow at 7.2% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Term Life Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Term Life Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Term Life Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allianz Life Insurance, American International Group, Inc., Bajaj Allianz Life Insurance Co. Ltd., China Life Insurance Company Ltd, Guardian Life and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Term Life Insurance market report include:

- Allianz Life Insurance

- American International Group, Inc.

- Bajaj Allianz Life Insurance Co. Ltd.

- China Life Insurance Company Ltd

- Guardian Life

- ICICI Prudential Life Insurance

- John Hancock

- Lincoln National Corporation

- MassMutual

- Maxlife Insurance

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allianz Life Insurance

- American International Group, Inc.

- Bajaj Allianz Life Insurance Co. Ltd.

- China Life Insurance Company Ltd

- Guardian Life

- ICICI Prudential Life Insurance

- John Hancock

- Lincoln National Corporation

- MassMutual

- Maxlife Insurance

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Trillion |

| Forecasted Market Value ( USD | $ 1.6 Trillion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |