Thermally Conductive Filler Dispersants Market Trends & Drivers Summarized

How Are Thermally Conductive Filler Dispersants Enhancing Heat Management in Electronics and Industrial Applications?

Thermally conductive filler dispersants play a critical role in heat dissipation across multiple industries, particularly in electronics, automotive, aerospace, and energy storage. These dispersants facilitate the uniform distribution of thermally conductive fillers - such as aluminum oxide, boron nitride, and graphene - in polymer matrices, improving overall thermal conductivity and material stability. With increasing miniaturization in electronics and the growing demand for efficient thermal management solutions, manufacturers are investing in advanced filler dispersant technologies to enhance heat dissipation without compromising mechanical properties. However, challenges related to material compatibility, processing complexity, and cost constraints continue to impact market expansion. As industries push for higher performance and sustainability, how will thermally conductive filler dispersants evolve to meet these demands?What Technological Innovations Are Advancing Thermally Conductive Filler Dispersants?

The development of next-generation thermally conductive filler dispersants focuses on improving dispersion uniformity, reducing viscosity, and enhancing filler-matrix bonding. Innovations in surface-modified fillers are enhancing thermal interface material (TIM) performance, ensuring optimal heat transfer in high-power electronics and electric vehicle (EV) batteries. AI-driven computational material design is accelerating the discovery of novel filler combinations for improved thermal conductivity and mechanical durability. Additionally, nanotechnology is enabling the integration of ultra-thin yet highly efficient dispersants, reducing material usage while maintaining performance. These advancements are making filler dispersants more effective, durable, and environmentally sustainable.Why Is the Demand for Thermally Conductive Filler Dispersants Increasing?

The rapid expansion of the EV market, the proliferation of high-performance computing, and the increasing need for efficient cooling solutions in industrial machinery are driving demand for thermally conductive filler dispersants. As power densities rise in electronic devices and energy storage systems, the importance of effective heat dissipation materials is growing. Additionally, stringent thermal management requirements in aerospace and medical applications are accelerating the adoption of advanced dispersants.What Factors Are Driving the Growth of the Thermally Conductive Filler Dispersants Market?

The market is expanding due to technological advancements in heat dissipation materials, rising investments in next-generation electronics, the growing EV and battery storage sector, and increasing demand for high-performance industrial cooling solutions. As industries seek more efficient and sustainable thermal management approaches, the adoption of innovative filler dispersants is expected to accelerate.Report Scope

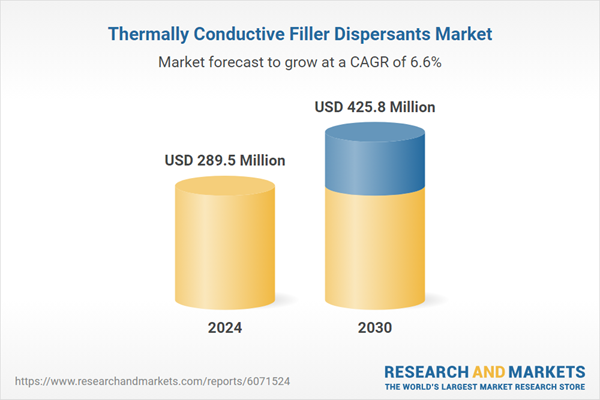

The report analyzes the Thermally Conductive Filler Dispersants market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Dispersant Type (Non-Silicone-based Dispersants, Silicone-based Dispersants); Filler Material (Ceramic Fillers, Metal Fillers, Carbon-based Fillers, Other Filler Materials); Application (Thermal Insulation Glue Application, Potting Glue Application, Plastic Application, Rubber Application, Heat Dissipation Ceramics Application, Other Applications); End-Use (Electronics End-Use, Automotive End-Use, Energy End-Use, Industrial End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Non-Silicone-based Dispersants segment, which is expected to reach US$295 Million by 2030 with a CAGR of a 7.7%. The Silicone-based Dispersants segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $78.9 Million in 2024, and China, forecasted to grow at an impressive 10.6% CAGR to reach $89.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Thermally Conductive Filler Dispersants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Thermally Conductive Filler Dispersants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Thermally Conductive Filler Dispersants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 7132 Thermal Baths, Amanemu, Aquaria Thermal SPA at Terme di Sirmione, Blue Lagoon, Castle Hot Springs Spa and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Thermally Conductive Filler Dispersants market report include:

- 3M Company

- AI Technology, Inc.

- BYK

- Creative Materials Inc.

- Croda International Plc

- DKSH Holding Ltd.

- Dow Inc.

- Evonik Industries AG

- Henan Sanyuan New Materials Co., Ltd.

- Henkel AG & Co. KGaA

- Indium Corporation

- JNC Corporation

- Kusumoto Chemicals, Ltd.

- Laird Performance Materials

- LORD Corporation

- Master Bond Inc.

- Momentive Performance Materials Inc.

- Nusil Technology LLC

- Panacol-Elosol GmbH

- Reade International Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- AI Technology, Inc.

- BYK

- Creative Materials Inc.

- Croda International Plc

- DKSH Holding Ltd.

- Dow Inc.

- Evonik Industries AG

- Henan Sanyuan New Materials Co., Ltd.

- Henkel AG & Co. KGaA

- Indium Corporation

- JNC Corporation

- Kusumoto Chemicals, Ltd.

- Laird Performance Materials

- LORD Corporation

- Master Bond Inc.

- Momentive Performance Materials Inc.

- Nusil Technology LLC

- Panacol-Elosol GmbH

- Reade International Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 488 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 289.5 Million |

| Forecasted Market Value ( USD | $ 425.8 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |