Speak directly to the analyst to clarify any post sales queries you may have.

The thoracic surgery devices market is evolving in response to innovation, regulatory demands, and changing clinical practices, presenting significant opportunities and challenges for stakeholders evaluating technology investments and strategic positioning.

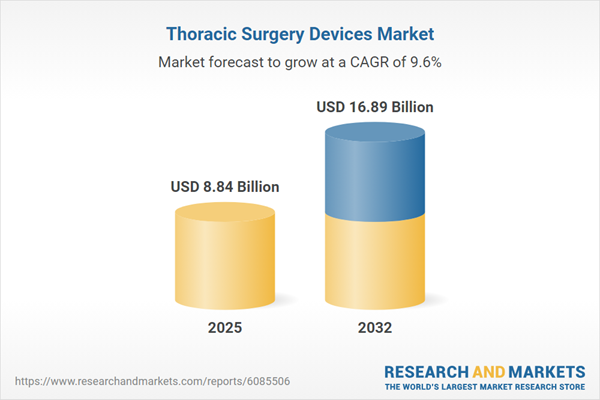

Market Snapshot: Thoracic Surgery Devices Market Growth and Forecast

The thoracic surgery devices market advanced from USD 8.10 billion in 2024 to USD 8.84 billion in 2025 and is anticipated to register a CAGR of 9.61%, achieving USD 16.89 billion by 2032. Robust demand is driven by increasing thoracic disease prevalence, expanding oncology procedures, and a clear need for precisely engineered surgical instruments. Factors such as digitalization of surgery, expanded reimbursement models, and the deployment of digital visualization tools are dynamically shaping market momentum.

Scope & Segmentation: In-Depth View Across Device Categories, Procedures, Users, and Regions

This report offers a comprehensive assessment of core segments and emerging trends within the global landscape for thoracic surgery devices. The analysis distinguishes opportunities and strategies across the following categories:

- Device Type: Clamps, forceps, graspers, needle holders, scissors, spreaders, staplers

- Surgery Type: Minimally invasive thoracic surgery, open thoracic surgery, robotic-assisted thoracic surgery, video-assisted thoracic surgery

- End User: Ambulatory surgical centers, hospitals, research institutions, specialty thoracic surgery centers

- Geographic Coverage: Americas (including North America: United States, Canada, Mexico; Latin America: Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (including United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (including China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Company Coverage: Aesculap, Inc.; Biolitec AG; Biosensors International Group, Ltd.; Boston Scientific Corporation; Cardinal Health, Inc.; ConMed Corporation; Cook Medical LLC; Fujifilm Holdings Corporation; GE Healthcare Technologies, Inc.; Grena Ltd.; Hologic, Inc.; Intuitive Surgical, Inc.; Johnson & Johnson Services, Inc.; Karl Storz SE & Co. KG; Medela AG; Medtronic plc; MicroPort Scientific Corporation; Olympus Corporation; Richard Wolf GmbH; Sinapi Biomedical; Sklar Surgical Instruments; Stryker Corporation; Teleflex Inc.; W. L. Gore & Associates, Inc.

Key Takeaways for Senior Decision-Makers

- Collaborative innovation among engineering, clinical, and regulatory leaders is accelerating the evolution of precision devices and integrated sensor technologies.

- Digital visualization platforms and data analytics are transforming intraoperative workflows, enabling enhanced accuracy and fostering minimally invasive surgical approaches.

- Flexible device architectures and modular platforms are gaining traction as health systems pursue operational agility and cost-efficient care delivery models.

- Material and software advancements, such as bioabsorbable polymers and workflow optimization tools, are addressing both clinical requirements and emerging regulatory standards.

- Partnerships with academic centers and digital health specialists are expediting the validation and adoption of next-generation thoracic surgical equipment.

- Market entry strategies require tailored approaches across developed and emerging healthcare regions, with emphasis on training, regulatory navigation, and supply chain adaptation.

Tariff Impact: Strategic Responses to 2025 U.S. Adjustments

The U.S. tariff revisions implemented in 2025 have created complex cost and supply chain considerations for thoracic device manufacturers and healthcare providers. Many organizations are shifting sourcing strategies, renegotiating agreements, and increasing regional manufacturing capabilities to offset import cost volatility. This environment is fostering localized production, risk-sharing procurement models, and deeper collaboration among device makers, trade associations, and policymakers to enhance resilience and operational continuity.

Methodology & Data Sources

This research is grounded in analysis of peer-reviewed publications, clinical trial data, and industry regulatory filings. Proprietary insights were sourced from structured interviews with surgeons, procurement experts, and engineers, together with reviews by an advisory board of clinical and policy specialists. All findings are validated through best-practice triangulation, including scrutiny of trade association updates and secondary data consistency checks.

Why This Report Matters

- Gain a competitive edge with actionable intelligence on evolving technology, usage trends, and reimbursement developments in the thoracic surgery devices market.

- Identify and benchmark regional opportunities, risk mitigation tactics, and innovation drivers for sustainable market leadership and investment strategy.

- Access insights into the challenges and best practices for navigating regulatory, operational, and supply chain complexities in a dynamic industry landscape.

Conclusion

In a fast-changing landscape, this report delivers critical market insights, technology trends, and strategic imperatives shaping the thoracic surgery devices sector. Senior decision-makers will be equipped to drive growth, efficiency, and enduring value.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Thoracic Surgery Devices market report include:- Aesculap, Inc.

- Biolitec AG

- Biosensors International Group, Ltd.

- Boston Scientific Corporation

- Cardinal Health, Inc.

- ConMed Corporation

- Cook Medical LLC

- Fujifilm Holdings Corporation

- GE Healthcare Technologies, Inc.

- Grena Ltd.

- Hologic, Inc.

- Intuitive Surgical, Inc.

- Johnson & Johnson Services, Inc.

- Karl Storz SE & Co. KG

- Medela AG

- Medtronic plc

- MicroPort Scientific Corporation

- Olympus Corporation

- Richard Wolf GmbH

- Sinapi Biomedical

- Sklar Surgical Instruments

- Stryker Corporation

- Teleflex Inc.

- W. L. Gore & Associates, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 8.84 Billion |

| Forecasted Market Value ( USD | $ 16.89 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |