Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Additionally, the expansion of connected and autonomous vehicle testing, particularly in cities like Dubai, is creating opportunities for sensor integration to support real-time monitoring and predictive maintenance features. Advancements in sensor miniaturization and reliability - particularly in MEMS and IC-based sensors - are enabling broader applications across powertrain, HVAC, exhaust, and battery systems. Furthermore, the UAE’s extreme climate, with high ambient temperatures, accentuates the importance of accurate temperature sensing to prevent overheating and ensure vehicle reliability and passenger comfort.

Government incentives promoting the adoption of electric vehicles and the increasing inflow of premium and technologically advanced car models further support market expansion. The presence of global automotive OEMs and tier-1 suppliers in the region, coupled with rising aftermarket demand for smart sensor components, is accelerating innovation and local distribution. As consumer preferences shift toward smarter, connected, and safer vehicles, the automotive temperature sensor market in the UAE is expected to maintain strong momentum, fueled by both regulatory compliance and the pursuit of energy-efficient mobility solutions.

Key Market Drivers

Rising Vehicle Electrification and Growing Demand for Electric Vehicles (EVs)

One of the primary drivers of the UAE automotive temperature sensor market is the rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), spurred by both consumer interest and government policy initiatives. As the UAE intensifies its commitment to reducing carbon emissions and shifting toward clean mobility under programs like the UAE Energy Strategy 2050 and the Green Mobility Initiative, demand for EVs is growing steadily. Electric vehicles rely heavily on thermal management systems to regulate the temperature of batteries, motors, inverters, and charging components. Any variation in temperature beyond the optimal range can lead to battery degradation, reduced range, or even safety hazards.This makes the integration of high-precision temperature sensors essential in EV design. Moreover, these sensors are also vital for fast-charging systems, which require accurate thermal feedback to ensure safe and efficient energy transfer. The increasing penetration of EV charging infrastructure in urban hubs like Dubai and Abu Dhabi is further promoting EV adoption.

Major automakers and global EV brands are entering the UAE market, enhancing the competitive landscape and stimulating the demand for advanced automotive electronics. As a result, temperature sensors - especially those embedded in battery management systems (BMS) - are becoming indispensable for ensuring performance, reliability, and safety in electric mobility. This electrification trend is expected to remain a central growth driver for temperature sensors across the vehicle lifecycle, from manufacturing and diagnostics to real-time performance monitoring.

Key Market Challenges

High Dependence on Imports and Limited Local Manufacturing Capabilities

One of the primary challenges constraining the growth of the UAE automotive temperature sensor market is its significant dependence on imported components and limited domestic manufacturing infrastructure. The UAE, while a major re-export hub and technologically progressive market, lacks a robust local ecosystem for semiconductor and sensor manufacturing. This reliance on imports - particularly from regions like East Asia, Europe, and North America - exposes the market to supply chain disruptions, price volatility, and geopolitical tensions.UAE imports automotive parts from over 159 countries, with India (32%), Germany (18%), and Thailand (13%) collectively supplying around 63% of all imports - showcasing heavy reliance on foreign production. Events such as the COVID-19 pandemic and global semiconductor shortages highlighted vulnerabilities in the international supply chain, causing extended lead times and cost escalations. For temperature sensors specifically, many precision components require sophisticated fabrication processes that are not readily available in the region. Additionally, the absence of strong local R&D and production facilities limits the ability to customize sensors to the UAE’s unique environmental conditions, such as extreme heat and dust exposure.

Automotive OEMs and Tier-1 suppliers operating in the UAE must therefore rely heavily on international partners for sensor integration, which can result in increased procurement costs and limited flexibility in product innovation or adaptation. The lack of a homegrown manufacturing base also hampers opportunities for value addition within the country, limiting employment creation and technological spillovers. Unless investments are made in developing regional capabilities in advanced manufacturing and sensor design, this import reliance will continue to be a structural challenge that could hinder long-term market resilience and scalability.

Key Market Trends

Integration of Multi-Sensor Modules and System-on-Chip (SoC) Designs

A significant trend reshaping the UAE automotive temperature sensor market is the increasing adoption of multi-sensor modules and system-on-chip (SoC) designs. As vehicles become more complex and data-driven, automakers are moving beyond standalone temperature sensors toward integrated sensor systems that can measure multiple parameters - such as pressure, humidity, and temperature - within a single unit. This consolidation enhances efficiency, reduces wiring complexity, lowers power consumption, and saves space, all of which are critical in the tightly packed architecture of modern vehicles, particularly electric and hybrid models.System-on-Chip (SoC) designs, which combine processing units and sensors on a single chip, are becoming more popular in luxury vehicles and are gradually trickling down to mid-range segments. These integrated modules not only provide temperature data but also enable intelligent data processing at the source, reducing latency and improving real-time diagnostics. In the UAE, where high-end automotive brands dominate the market, there is a notable preference for such advanced systems due to their performance reliability and support for smart vehicle features.

The harsh climate conditions also demand robust and consolidated sensor networks that can function accurately under high thermal stress. Additionally, these integrated sensor solutions are enabling predictive maintenance applications, which are gaining momentum among fleet operators and commercial vehicle owners looking to reduce downtime and enhance operational efficiency. As a result, multi-sensor modules and SoC designs are setting a new standard in automotive sensor technology, aligning with the UAE’s pursuit of automotive digitalization and intelligent transport infrastructure.

Key Market Players

- Continental

- Delphi

- Panasonic Corporation

- NXP Semiconductors

- Robert Bosch

- Sensata Technologies

- TE Connectivity

- Microchip

- TDK Corporation

- Murata

Report Scope:

In this report, the UAE Automotive Temperature Sensor market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Automotive Temperature Sensor Market, By Vehicle Type:

- Passenger Cars

- Commercial Vehicle

UAE Automotive Temperature Sensor Market, By Product Type:

- Resistance Temperature Detectors (RTD)

- Thermistor

- MEMS

- IC Temperature Sensor

- Thermocouple

- Infrared Temperature

UAE Automotive Temperature Sensor Market, By Technology:

- Contact

- Non-Contact

UAE Automotive Temperature Sensor Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest Of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Automotive Temperature Sensor market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this UAE Automotive Temperature Sensor market report include:- Continental

- Delphi

- Panasonic Corporation

- NXP Semiconductors

- Robert Bosch

- Sensata Technologies

- TE Connectivity

- Microchip

- TDK Corporation

- Murata

Table Information

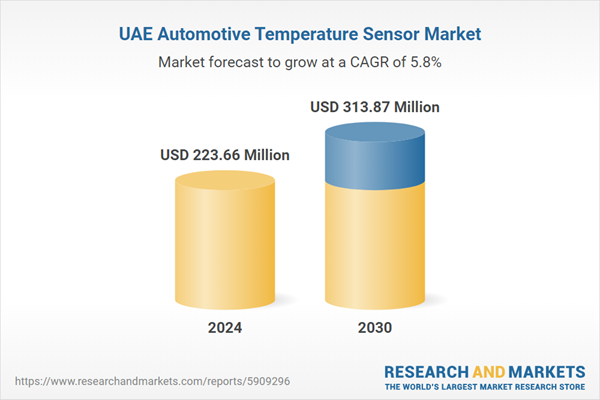

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 223.66 Million |

| Forecasted Market Value ( USD | $ 313.87 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 11 |