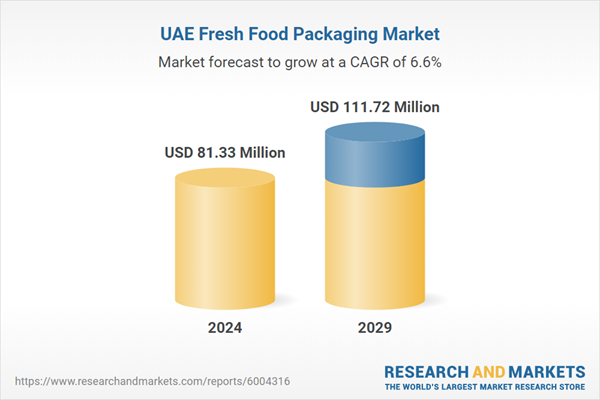

The UAE fresh food packaging market is valued at around US$81.335 million in 2024 and is anticipated to grow to US$111.726 million by 2029 at a CAGR of 6.56%.

Fresh foods are products that are not processed or have any added preservatives. They generally include products like dairy, meats, fruits, vegetables, and fish or seafood. The packaging of food ensures the preparation of food for safe transportation, supply, storage, retailing, and finally, delivery to the end user. Various types of materials are used for packaging the food, like low- and high-density polyethylene, aluminum, tin, and cardboard.Multiple methods of food packaging are available in the market, like aspect packaging, where food products, especially liquids, are packed into previously sterilized containers, and cans, where foods like soups, beans, and mais are packed into cans made of steel, tin, or aluminum. Other methods of food packaging include trays, bags, boxes, wrappers, and cartons.

The fresh food packaging market size of UAE is rapidly growing. In recent years, the market has seen tremendous growth, mainly due to the increasing demand for processed and convenience foods.

UAE is one of the biggest agriculture and food suppliers in the Middle East. One of the major factors that caused an increase in the market of fresh food packaging in the UAE is an increase in the import of fresh food products. In 2022, the nation imported consumer fresh food products, like dairy, poultry meats, tree nuts, and fresh fruits, valued at about US$ 12.5 billion. These imports accounted for 59% of the total agricultural imports by the nation. In 2021, the UAE imported about 199,858 tons of fresh foods, like fruits and fresh & dried dates. The nation also exported fruits like raspberries, blueberries, and mulberries to various nations like Seychelles, Djibouti, and Pakistan, measuring about 22.9 tons, valued at US$ 0.204 million.

The country also experienced a significant increase in its export of agricultural products in recent years. According to the data published by the World Bank, the nation’s export of food products increased to US$9.49 billion in 2021 from US$8.59 billion in 2020. This increase can be credited to the increase in the nation’s food processing and packaging industry.

The Uae Fresh Food Packaging Market Drivers:

An increase in fresh food trade in the nation is expected to increase the demand for fresh food packaging.

The food packaging industry of UAE is based on the heavy imports and exports of the nation. UAE is one of the largest suppliers of food products in the Middle East and African region. In 2021, the nation exported a total of US$9.47 billion worth of food products, the majority being exported to the neighboring Middle Eastern and North African countries, which amounted to a total of US$4.85 billion, and products valued at US$1.122 billion to Sub-Saharan Africa.The nation is also among the biggest importers of food products in the region, importing food products worth US$6.69 billion in 2021. Among these import figures, the nation imported the majority from the European and Central Asia region, valued at US$2.56 billion, followed by the East Asia and Pacific region, valued at US$1.27 billion in 2021. This trade creates a vast opportunity for the industries to operate in the nation’s food processing and packaging market.

The Uae Fresh Food Packaging Market Restraint:

Heavy reliance on the import of fresh foods.

One of the major challenges for the UAE's fresh food packaging industry is the heavy reliance on food and consumer product imports. According to a report published on FAS USA, the nation of UAE has around 568 food processors present in 2022. This processor produces a total of 5.96 million tons of food and beverage products and about 2.3 million tons of staples products. These industries rely on the import of food products as the nation’s agricultural produce is limited.In 2022, the UAE imported about US$12.5 billion worth of fresh food products, which included dairy and dairy products valued at US$1.8 billion, poultry meat and produce valued at US$1.19 billion, and tree nuts valued at US$948 million, among others. This dependence on imports can create a shortage of production in the UAE’s domestic market, which can be caused by external factors like policy changes or disputes with other countries.

The Uae Fresh Food Packaging Major Players And Products:

- Mondi: Mondi’s products include aseptic cartoons, compostable paper packaging, mono-material barrier packaging, and more. Mondi is one of the global leaders in the packaging solution market, that operates in partnership with Mepco Gulf in UAE. Mondi provides products and solutions for the dairy, food, and beverage industries in the nation.

- SealedAir: For the food packaging industry, the company provides products like barrier bags, lid films, forming films, preformed trays, and overwrap films. SealedAir deals with packaging solutions for various industries, including medical and food equipment.

The UAE Fresh Food Packaging Industrial Updates:

- In November 2023, Spinneys became the first retailer in the UAE to transition to recycled plastic packaging and introduced an rPET packaging solution across its stores in partnership with Al Bayader International.

- In February 2022, the UAE signed a food security corridor agreement with India, amounting to US$7 billion, which came into force in May 2022 and aimed to connect India’s farm produce directly to the UAE.

The UAE Fresh Food Packaging market is segmented and analyzed as:

By Materials Type

- Flexible plastic

- Rigid plastic

- Paper and paperboard

By Application

- Poultry & Meat Products

- Dairy Products

- Produce (Vegetables and Fruits)

- Sea Food

Table of Contents

Companies Mentioned

- Mondi

- Sealed Air

- Amber Packaging Industries LLC

- Swiss Pac UAE

- HotPacks

- ENPI Group

- Mascotpack

- Jebelpack

- Exppack

- Amber Packaging Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 76 |

| Published | August 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 81.33 Million |

| Forecasted Market Value ( USD | $ 111.72 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 10 |