Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Changing Consumer Behavior and Rising Awareness

The UAE has witnessed a shift in consumer behavior towards a more grooming-conscious male population. Historically, grooming was seen as a women-centric activity, but now, men in the UAE are increasingly prioritizing personal care. Growing awareness about skincare and wellness has led to the adoption of regular grooming routines, with men becoming more interested in products like facial cleansers, moisturizers, and anti-aging creams.This shift is further augmented by the media, which plays a role in educating men about the benefits of grooming. As a result, the demand for a wide range of grooming products has surged, contributing to market growth. This trend is fueled by both younger men in their 20s and older consumers, who are more inclined to invest in grooming products for self-care and enhancing their appearance. Consequently, men in the UAE are seeking out a broader array of products, from skincare to haircare, further expanding the men's grooming market.

Increasing Disposable Income and Premiumization

The economic landscape of the UAE has seen steady growth, with higher disposable incomes driving an increasing demand for premium grooming products. As the country boasts a high standard of living and tax-free salaries, there is greater purchasing power among consumers, particularly in metropolitan areas like Dubai and Abu Dhabi. This affluence has led to an increasing preference for premium and luxury grooming products, including high-end skincare brands, designer perfumes, and specialized hair care solutions. Many men are opting for products that promise better quality, tailored formulations, and advanced results, leading to the emergence of new product categories such as organic and natural grooming solutions. As a result, established global and local brands have focused on offering premium products, further attracting affluent customers. This shift towards premiumization has been one of the key drivers of the men’s grooming market in the UAE, as more men are willing to invest in products that reflect their status and sophistication.Social Media Influence and Celebrity Endorsements

The role of social media in shaping consumer habits cannot be overstated, especially in the UAE, where platforms like Instagram, Snapchat, and TikTok have become prominent. The power of influencers, digital celebrities, and beauty gurus has significantly affected men’s grooming behaviors. Over the past five years, influencer-generated content in the UAE has experienced significant growth, expanding at a rate of 4.25%. Instagram continues to be a leading platform in the country, boasting a user base of more than 6.21 million. Social media platforms serve as a source of inspiration and education, driving awareness about new products and trends.Influencers and celebrities from the region, including actors, athletes, and musicians, frequently endorse grooming products, further encouraging their followers to invest in similar products. The visual-centric nature of social media also helps normalize the concept of men taking pride in their appearance, reinforcing the importance of skincare and grooming routines. As these social trends continue to gain traction, the exposure to grooming products increases, influencing men to try out and purchase different products. This digital influence plays a crucial role in shaping purchasing decisions, making social media a driving factor in the UAE men's grooming market.

Expanding E-Commerce and Convenience

The UAE's strong e-commerce ecosystem is another vital driver behind the growth of the men’s grooming market. With the rise of online shopping, consumers are increasingly opting for the convenience of purchasing grooming products from the comfort of their homes. In the United Arab Emirates (UAE), nearly the entire population actively engages with the internet, with internet users comprising 99% of the total population. This indicates an exceptionally high level of digital connectivity, with residents having widespread access to online services, social media, e-commerce, and digital communication platforms. E-commerce platforms like Noon, Souq, and Amazon UAE have become primary channels for men seeking a wide variety of grooming products.These platforms provide an expansive range of international and local brands, often with the benefit of home delivery, competitive prices, and easy access to customer reviews and ratings. Additionally, many grooming brands now offer subscription services, allowing men to receive their favorite products regularly without having to make frequent purchases.

The convenience and ease of online shopping have proven particularly appealing for younger consumers and busy professionals, increasing the overall market penetration of grooming products. The e-commerce growth is further fueled by mobile shopping apps, promotional offers, and exclusive online product launches, ensuring that men in the UAE have seamless access to the grooming products they need. This ease of access and convenience has helped shape the market dynamics, making e-commerce a critical factor in the men's grooming industry in the UAE.

Key Market Challenges

Cultural and Societal Barriers

Despite the growing awareness around grooming, some cultural and societal barriers still persist in the UAE, where traditional views of masculinity can inhibit the widespread acceptance of male grooming practices. Although there has been significant progress, there remains a segment of the male population that views grooming as a feminine activity. This perception can prevent some men from embracing a wide range of grooming products, particularly those related to skincare or hair treatments.While the younger generation is becoming more open to personal care routines, older consumers or those from more conservative backgrounds may still perceive grooming beyond basic hygiene as unnecessary or extravagant. Additionally, in the more traditional parts of the country, the marketing of grooming products may need to be more carefully tailored to ensure it aligns with local cultural norms and sensitivities. Overcoming these cultural barriers remains a challenge for brands trying to expand their reach across diverse demographic groups in the UAE.

High Competition and Market Saturation

The UAE men’s grooming market is becoming increasingly competitive, with both international and local brands vying for consumer attention. As the demand for grooming products grows, more companies are entering the market, resulting in market saturation. This intensifies competition, especially among established global brands, which often dominate the premium segment, and local brands, which compete on price and localized offerings.New entrants must differentiate themselves through product innovation, pricing strategies, or unique marketing approaches to capture a share of the market. Moreover, many consumers are now overwhelmed by the sheer volume of choices available, making it challenging for brands to stand out. For businesses to succeed, they must not only offer high-quality products but also engage consumers through targeted advertising, influencer partnerships, and personalized experiences to build brand loyalty. The fierce competition and market saturation may lead to pricing pressure, making it harder for brands to maintain healthy profit margins, particularly in the mid-tier segment.

Regulatory Challenges and Product Safety Concerns

The men’s grooming industry in the UAE is also confronted with regulatory challenges, especially regarding product safety, ingredient transparency, and compliance with local regulations. The UAE’s regulatory framework for cosmetic and personal care products is strict, and brands must navigate complex approval processes to ensure that their products meet health and safety standards before they can be marketed. Products containing ingredients deemed harmful or not compliant with local regulations can face bans or restrictions, causing delays in product launches or withdrawals from the market. This is particularly relevant as global brands expand into the UAE market, where formulations might need to be altered to comply with local requirements.Additionally, concerns around ingredient transparency and the potential for adverse reactions to certain chemicals in grooming products continue to grow among consumers. Brands that do not prioritize safe, natural, or dermatologically-tested ingredients may struggle to gain consumer trust. As a result, companies must invest time and resources to stay ahead of regulatory requirements and ensure their products are both safe and compliant. This regulatory landscape can be burdensome, especially for smaller companies that may not have the resources to navigate these complexities effectively.

Key Market Trends

Rise in Natural and Organic Grooming Products

One of the most significant trends in the UAE men’s grooming market is the increasing demand for natural and organic products. As consumers become more aware of the harmful effects of chemicals and synthetic ingredients in personal care products, there is a growing preference for grooming solutions made with organic, eco-friendly, and cruelty-free ingredients. Products containing natural oils, herbal extracts, and plant-based formulations are gaining popularity, especially among health-conscious men who are keen on reducing their exposure to harmful chemicals.Brands are responding to this demand by introducing natural alternatives in skincare, haircare, and shaving products. The trend is particularly evident in younger generations, who are more inclined to seek out sustainable, environmentally friendly grooming solutions. This shift is also driven by global trends in sustainability and wellness, with many consumers increasingly looking for products that align with their values. As a result, the market has seen a rise in brands that promote eco-conscious packaging, cruelty-free testing, and the use of organic ingredients, further influencing the buying behavior of consumers.

Grooming for Specific Needs and Personalization

Another important trend in the UAE men’s grooming market is the increasing demand for products that cater to specific grooming needs and personalized experiences. Consumers are no longer looking for one-size-fits-all products; instead, they are seeking products tailored to their individual skin types, hair types, and specific concerns such as anti-aging, acne treatment, or beard care. The rise in personalized grooming is driven by an increased awareness of the importance of using products suited to one’s unique features and requirements. As men become more conscious of their grooming routines, brands are stepping up their game by offering customized skincare regimens, hair treatments, and beard grooming solutions.For example, many brands now offer beard oils, balms, and shampoos that are specifically designed for different types of beards, from coarse to fine hair. Additionally, companies are using technology to provide personalized recommendations based on a customer’s preferences, such as through online quizzes or consultation services. The move toward personalization also extends to product packaging, with some companies offering subscription services that deliver tailored grooming kits on a regular basis. This trend reflects a broader shift toward bespoke experiences in the beauty and grooming sectors, where customization is becoming a key point of differentiation for brands.

Beard Grooming and Male Shaving Products

The grooming of facial hair, particularly beards, has become an integral part of the men’s grooming routine in the UAE, aligning with global trends in facial hair popularity. Over the past few years, the demand for specialized beard care products such as beard oils, waxes, balms, and combs has significantly increased. As more men in the UAE embrace facial hair, there has been a growing interest in products designed to maintain, shape, and style beards. The trend toward well-groomed facial hair is being supported by the availability of high-quality grooming products that cater to men’s specific needs, such as nourishing dry skin, preventing beardruff (beard dandruff), and promoting healthy beard growth.Many brands now offer products that cater to the different types of facial hair, from short stubble to full beards. The male shaving market is also evolving, with consumers opting for premium razors and shaving systems that promise a smoother, more comfortable experience. Electric shavers, manual razors, and multi-blade cartridges are increasingly in demand as men look for tools that deliver professional-level grooming at home. The popularity of beards and the growing demand for shaving solutions, combined with the rise of beard-specific care routines, continue to drive the development of specialized products within the UAE men’s grooming market.

Men’s Grooming as Part of a Wellness Routine

The trend of integrating grooming into a broader wellness routine is gaining traction in the UAE. As mental health and self-care become increasingly important, many men are incorporating grooming into their daily wellness rituals. Personal grooming is no longer viewed as a purely aesthetic activity but as an essential part of self-care and maintaining overall well-being. This shift is closely tied to the global rise in mindfulness and self-care trends, with many men focusing on creating routines that promote relaxation, stress relief, and mental clarity. Skincare, haircare, and body care products are increasingly marketed not just for their cosmetic benefits but for their therapeutic and relaxation effects.Products such as soothing face masks, moisturizers with stress-relieving scents, and body scrubs with calming properties are becoming popular in the UAE, as they contribute to both physical and mental wellness. Furthermore, brands are emphasizing the connection between looking good and feeling good, encouraging men to take time for themselves and invest in products that support their holistic well-being. This trend is reflected in the growth of wellness-focused grooming experiences, such as spa treatments and self-care rituals, which are increasingly being integrated into men’s lifestyles. The concept of grooming as part of a larger wellness routine is expected to continue to evolve as more men recognize the importance of self-care in managing both physical appearance and mental health.

Segmental Insights

Sales Channel Insights

The online segment of the UAE men's grooming market was the fastest-growing due to the increasing shift towards e-commerce and digital convenience. With more consumers opting to shop from the comfort of their homes, online platforms provide easy access to a wide range of grooming products, from premium skincare to specialized beard care items. E-commerce giants like Amazon UAE, Noon, and Souq, along with brand-specific websites, offer competitive pricing, home delivery, and the ability to compare products easily. Additionally, subscription models and exclusive online offerings further enhance convenience, driving the rapid expansion of online sales in the grooming sector.Regional Insights

Dubai was the dominant region in the UAE men's grooming market, driven by its status as a global hub for luxury and fashion. The city’s affluent population, high disposable incomes, and exposure to international trends make it the prime location for premium grooming products. Dubai's thriving tourism industry also contributes to the market's growth, with both residents and visitors seeking high-quality grooming solutions. The presence of international brands, luxury malls, and upscale beauty retailers further boosts the demand for advanced grooming products. Additionally, Dubai's progressive mindset and its younger, image-conscious population continue to drive innovation and consumption in the men’s grooming sector.Key Market Players

- Philips Electronics Middle East And Africa B.V.

- Beiersdorf Middle East FZCO

- Panasonic Marketing Middle East & Africa FZE

- Sanford Middle East DWC L.L.C

- Geepas Middle East FZCO

- TASK FZE (Xiaomi)

- National Store L.L.C (Moser)

- Procter And Gamble Middle East FZE (Gillette)

- WAHL Middle East & Africa FZCO

- Badri Electro Supply & Trading Co.(BESTCO)L.L.C. (NOVA)

Report Scope:

In this report, the UAE Men’s Grooming Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Men’s Grooming Market, By Product Type:

- Shaving Foams & Gels

- Trimmers

- Shavers & Clippers

- Razors & Cartridges

- Gel & Wax

- Others

UAE Men’s Grooming Market, By Sales Channel:

- Supermarket/Hypermarket

- Departmental Stores

- Baqala Stores

- Online

- Others

UAE Men’s Grooming Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Men’s Grooming Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Philips Electronics Middle East And Africa B.V.

- Beiersdorf Middle East FZCO

- Panasonic Marketing Middle East & Africa FZE

- Sanford Middle East DWC L.L.C

- Geepas Middle East FZCO

- TASK FZE (Xiaomi)

- National Store L.L.C (Moser)

- Procter And Gamble Middle East FZE (Gillette)

- WAHL Middle East & Africa FZCO

- Badri Electro Supply & Trading Co.(BESTCO)L.L.C. (NOVA)

Table Information

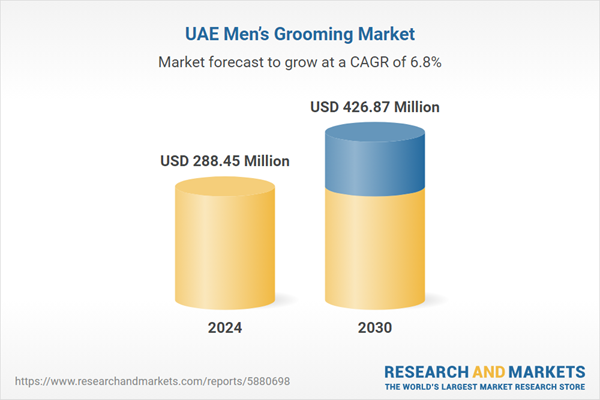

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 288.45 Million |

| Forecasted Market Value ( USD | $ 426.87 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 10 |