Remittance outflow market in United Kingdom has increased at 3.5% during 2023 to reach US$ 11.46 billion in 2024. Over the forecast period (2024-2028), market size is expected to record a CAGR of 2.2%, increasing from US$ 11.07 billion in 2023 to reach US$ 12.52 billion by 2028.

The remittance industry is expected to record steady growth over the medium term in the United Kingdom. The growing global diaspora in the United Kingdom will drive the industry growth in 2024. With the market poised to grow over the medium term, new players are entering the market. This trend is projected to gain further momentum in 2024, resulting in new remittance corridors.

Domestic firms, however, are seeking to expand their global footprint to accelerate growth. To strengthen its position in the global market, these firms are either forging strategic partnerships or launching new and innovative products to simplify the remittance process. Overall, the publisher maintains a positive growth outlook for the remittance market in the United Kingdom over the next three to four years.

Payment service providers are launching new products to simplify remittances for their users

Amid the fast-growing competitive landscape in the United Kingdom and the global remittance industry, payment service providers are launching new products to simplify remittances for their users globally.- Revolut, in January 2024, announced the launch of Mobile Wallets offering customers a quick and easy option to send money abroad. The launch of a mobile wallet-powered remittance service is aimed at eliminating the risks associated with traditional transfers. This includes the amount getting stuck with banks.

- Revolut users in the United Kingdom and most European countries within the European Economic Area (EEA) will now have the capability to transfer money to Bangladesh through bKash and to Kenya through M-Pesa using mobile wallets. Additional wallet routes are anticipated to be introduced soon.By offering benefits like instant transfers, greater ease, lesser friction, and wider choice, Revolut seeks to tap into the fast-growing remittance industry in the global market over the medium term.

UK-based firms are entering into strategic partnerships to further strengthen their positions in the global remittance sector

The global remittance market is expected to record strong growth over the next three to four years. To tap into the high-growth sector, UK-based firms are entering into collaborations to strengthen their position in the global market.- Paysend, a platform for card-to-card and international payments, partnered with Western Union in October 2023. This collaboration aims to make cross-border money transfers smoother and more efficient. With Paysend's integration into Western Union, users will have an improved experience when sending money through Western Union's digital solution, directly to Visa and Mastercard debit cards.

- The two firms also launched a test program, allowing people to send money from the United States and the United Kingdom to Pakistan, as well as from the United Kingdom to Spain. Paysend plans to expand this service to more countries over the medium term. The firm, in September 2023, also partnered with Visa to launch remittance services in Mexico, where the market is growing at a rapid rate.

Startups are entering the remittance industry to serve the African diaspora in the United Kingdom

An increasing number of firms are entering the remittance market, with the industry poised to grow steadily over the next five years. This trend is projected to continue further in 2024 in the United Kingdom.- FinREMIT, the Nigerian fintech firm based in the United Kingdom, announced the launch of its app in December 2023. With this, the firm is targeting the market share of the growing remittance corridor between the United Kingdom and Nigeria. The firm, notably, is backed by the UK government and aims to transform the process of sending money, particularly focusing on improving remittances for developing countries in Sub-Saharan Africa.

This report provides a comprehensive analysis of the international inbound and outbound remittance market in United Kingdom. It covers the market opportunity by transaction value, transaction volume, average value per transaction, key market players, market opportunity by channel, consumer profile, and by sending / receiving countries.

The research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view on emerging business and investment market opportunities.

Scope

International Inbound Market Opportunity Trend Analysis in United Kingdom

- By Transaction Value

- By Transaction Volume

- By Average Value Per Transaction

Market Share of Key Players in United Kingdom

International Inbound Market Opportunity Trend Analysis by Channel in United Kingdom

- Digital (transaction value, transaction volume, average value per transaction)

- Mobile (transaction value, transaction volume, average value per transaction)

- Non-Digital (transaction value, transaction volume, average value per transaction)

International Inbound Remittance Analysis of Consumer Profile in United Kingdom

- Analysis by age group of senders

- Analysis by income of senders

- Analysis by occupation of senders

- Analysis by occupation of beneficiaries

- Analysis by purpose

International Inbound Remittance Flow Analysis (Country to State / Region) in United Kingdom

- Market opportunity by key sending countries (transaction value, transaction volume, average value per transaction)

- Market share by transfer channel by key state / regions

International Outbound Market Opportunity Trend Analysis in United Kingdom

- By Transaction Value

- By Transaction Volume

- By Average Value Per Transaction

International Outbound Market Opportunity Trend Analysis by Channel in United Kingdom

- Digital (transaction value, transaction volume, average value per transaction)

- Mobile (transaction value, transaction volume, average value per transaction)

- Non-Digital (transaction value, transaction volume, average value per transaction)

International Outbound Remittance Analysis of Consumer Profile in United Kingdom

- Analysis by age group of senders

- Analysis by income of sender

- Analysis by occupation of sender

- Analysis by occupation of beneficiaries

- Analysis by purpose

International Outbound Remittance Flow Analysis (State / Region to Country) in United Kingdom

- Market opportunity by key sending countries (transaction value, transaction volume, average value per transaction)

- Market share by transfer channel by key state / regions

Reasons to buy

- Comprehensive and Up-to-Date Information: The report provides comprehensive and up-to-date information on the United Kingdom international inbound and outbound remittance market, including market size, growth trends, transaction value, transaction volume, average value per transaction, and market share analysis by transfer channel, consumer demographics, and key countries.

- Understand Competitive Landscape: Get a high-level view of competitive landscape through market share data on key players in the market.

- Actionable Insights for Businesses and Investors: The report provides data centric analysis for businesses and investors operating in the United Kingdom remittance market. It helps them identify new opportunities, assess risks, and make informed business decisions.

- Forecasts for Future Market Growth: The report provides forecasts for future market growth, enabling businesses and investors to plan and strategize effectively.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | April 2024 |

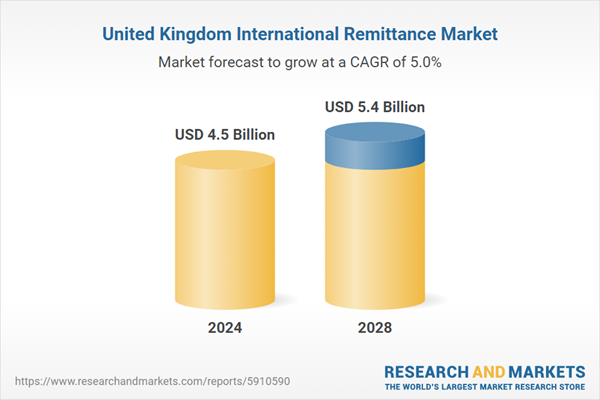

| Forecast Period | 2024 - 2028 |

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | United Kingdom |