Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The implementation of technology in agriculture is referred to as "agritecture". This is done to improve and optimize the production and utilization of animals and crops. This involves gathering information on soil characteristics, crop growth, and atmospheric conditions using precision farming tools, such as sensors and drones. Agritecture also includes the production of food in urban settings with limited space with controlled environment agriculture, such as hydroponics and vertical farming. Agritecture aims to meet the rising need for food in a world that is becoming more urbanized while simultaneously enhancing sustainability in agriculture through increased productivity, waste reduction, and other strategies.

Precision farming, artificial intelligence, and big data analytics, among other emerging technologies, have made it simpler for farmers to improve their processes and boost productivity. With the assistance of these technologies, farmers may make informed decisions regarding planting, fertilizing, and harvesting by having access to real-time data on soil conditions, crop growth, and weather patterns. Additionally, urban farmers may meet the rising demand for locally grown products by using controlled environmentally friendly agricultural techniques like vertical farming and hydroponics, which require relatively less land.

Government support is another factor strengthening the United States Agritecture sector. The United States government grants tax breaks to farmers that use sustainable farming methods and funds the development of innovative agricultural technologies. Government programmes like the Environmental Quality Incentives Programme (EQIP) and the Farm Bill offer financial support to farmers who use conservation techniques to stop soil erosion, save water, and preserve animal habitat. These regulations encourage farmers to use environmentally friendly farming methods and to spend money on technology to enhance their businesses.

The development of the United States agritecture sector is also being fueled by environmental concerns. A growing demand for sustainable farming methods is being driven by customers' boosted awareness of the environment. By requiring less water, energy, and fertilizer to produce food, technological advances in agriculture can assist farmers in lowering their environmental impact. In addition, modern agricultural techniques like hydroponics and vertical farming utilize a lot less area than conventional farming, which can lessen habitat loss and deforestation.

The United States agricultural architecture market has the potential to transform the agricultural sector by increasing sustainability and optimizing production. However, several challenges are preventing its development. The high initial investment costs associated with implementing agricultural technology are one of the major challenges. The expense of these solutions may be prohibitively costly for small farmers without access to funding, which may limit their capacity to compete with larger farms.

Another challenge is limited access to technology for farmers in remote areas who do not have access to the technology required to execute agricultural solutions. Agritecture solutions can be harder to implement because there is a labor shortage for skilled workers to run and maintain them. Farmers may find it challenging to navigate rules and adhere to necessary standards due to the industry's complex regulatory environment. The adoption of agricultural technology may also be slowed down by some farmers' reluctance to adopt new technologies or modify their old farming methods. Additionally, while using agritecture solutions, farmers still rely on weather patterns to grow their crops and erratic weather can have a negative impact on harvests.

Another development that will have an impact on the development of the United States Agritecture sector is the incorporation of big data and artificial intelligence into agriculture. Farmers can gather information on weather patterns, crop development, and soil conditions by employing sensors and other monitoring tools, which enables them to plan their planting, fertilizing, and harvesting procedures. Farming efficiency can be increased and waste can be decreased by using machine learning algorithms to predict crop yields and optimize crop growth.

The Adoption of Blockchain Technology

The implementation of blockchain technology is expected to revolutionize the United States agritecture industry by enhancing the food supply chain's efficiency, transparency, and traceability. Farmers and other stakeholders can securely communicate data on crop growth, soil characteristics, and weather patterns using blockchain technology, allowing them to make well-informed choices about planting, fertilizing, and harvesting. The ability for consumers to confirm the provenance and quality of their food is another benefit of using blockchain technology in the food supply chain. This may boost consumer and farmer trust and, as a result, raise demand for food produced sustainably. Blockchain technology can assist increase productivity and decrease waste in the agriculture sector by providing a safe and open platform for data sharing and collaboration, which will likely fuel the expansion of the United States agritecture market in the years to come.Adoption of Vertical Farming

In the years to come, the adoption of vertical farming is expected to have a considerable impact on the United States agritecture sector. Food can now be grown in urban locations with little space due to vertical farming, which also improves freshness and lowers transportation costs. Additionally, vertical farming that uses hydroponics and aeroponics uses less water and makes better use of nutrients. Furthermore, year-round production is made possible by vertical farming's use of artificial lighting and climate control, ensuring a steady supply of fresh vegetables. The adoption of vertical farming is poised to fuel the expansion of the United States agritecture market due to the rising demand for locally produced, fresh, and sustainably cultivated food.Changing Consumer’s Preferences

In the years to come, the development of the United States agritecture market is projected to be significantly impacted by the shifting consumer tastes. Consumer demand for items that are cultivated using more environmentally friendly and sustainable agricultural practices is anticipated to increase as there is a growing trend towards healthy, sustainable, and locally sourced food products. Many farmers are implementing fresh techniques and technologies to enhance the quality of their crops while reducing their environmental impact in response to these shifting consumer desires.Additionally, as the public's understanding of their health increases, so does the demand for organic and non-GMO products. It is anticipated that this change in consumer taste would enhance the production of organic crops, which will probably result in expansion of the organic farming in the United States.

Increased Demand for Food with the Rising Population

The expansion of the United States agritecture sector is expected to be greatly influenced by the nation's rising food demand. The demand for food goods rises along with the population, which is likely to result in a rise in crops and other food product production.

According to Worldometer, the population of the United States of America is 336,512,637 as of Monday, May 8, 2023. The United States ranks number 3 in the list of countries by population.

Farmers are likely to use new technology and practices to improve the yield and effectiveness of their farms to fulfil the rising demand for food. This could involve the use of genetically modified crops that can tolerate pests and droughts or precision agriculture methods, which enable farmers to maximize the use of resources like water and fertilizers.

Furthermore, a greater adoption of environmentally friendly and sustainable farming methods is projected to result from the rising global demand for food. This could involve implementing organic agricultural practices to cut back on the usage of synthetic fertilizers and pesticides or using cover crops to promote soil health.

Market Segmentation

The United States agritecture market can be segmented by integration, structure, application, and region. By integration, the United States agritecture market can be segmented into indoor and outdoor. Based on structure, the United States agritecture market is divided into retrofitting, extension, and new building. Based on application, the United States agritecture market is divided into commercial and residential.Market Players

BrightFarms Inc., AeroFarms LLC, Gotham Greens Holdings LLC, Plenty Unlimited Inc., Bowery Farming Inc., Farm.One, Local Roots Farms, and Urban Oasis' are some of the leading companies operating in the market.Report Scope:

In this report, United States agritecture market has been segmented into following categories, in addition to the industry trends which have also been detailed below:United States Agritecture Market, By Integration

- Indoor

- Outdoor

United States Agritecture Market, By Structure

- Retrofitting

- Extension

- New Building

United States Agritecture Market, By Application

- Commercial

- Residential

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in United States agritecture market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BrightFarms Inc.

- AeroFarms LLC

- Gotham Greens Holdings LLC

- Plenty Unlimited Inc.

- Bowery Farming Inc.

- Farm.One

- Local Roots Farms

- Urban Oasis'

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | October 2023 |

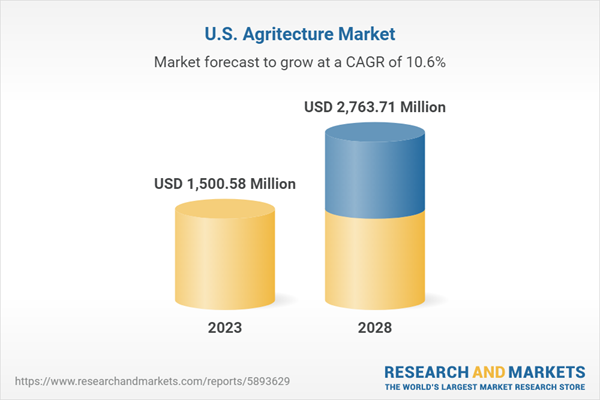

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1500.58 Million |

| Forecasted Market Value ( USD | $ 2763.71 Million |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |