According to a recent study published in Perspectives in Health Information Management, usability and a clear grasp of the benefits of EHRs are among the primary factors driving health IT adoption in the mental healthcare field. Additionally, a study published in PLOS One revealed that psychiatric hospitals using certified EHR technology were having a higher level of overall patient experience and patient satisfaction with care transition. In addition, their implementation resulted in improvements in healthcare information availability for patients. Positive patient perception toward hospitals is boosting the adoption of EHR among behavioral care providers.

According to the National Center for Drug Abuse Statistics, in 2020, around 20 million people were suffering from substance abuse disorders in the U.S. Of these, only 2.5 million people received treatment. Hence, there is a wide scope for improvement in the care delivery of behavioral healthcare. According to the U.S. Department of Health and Human Services, the healthcare budget for drug control was estimated to be around USD 35 billion in 2020. EHR utilization is critical in drug abuse treatment because it promotes improved care coordination and clinical care quality. Improved care coordination is anticipated to result in improved treatment outcomes since a physician can share treatment alternatives and other key clinical information with another physician.Lastly, the use of EHRs provides a wide potential for enhancing the care of those living with this illness. All these factors are expected to drive the market.

The COVID-19 pandemic increased population stress, concern, despair, frustration, and dread, potentially increasing the prevalence of mental care issues. Thus, as mental care problems grow, demand for online diagnostic and treatment platforms will increase, propelling the market growth. Additionally, the COVID-19 pandemic has heightened awareness regarding the need for mental health EHR systems to deal with the crisis. For example, Netsmart (US) collaborated with the California Department of Veterans Affairs in April 2020. (CalVet, US). This collaboration aided CalVet in implementing Netsmart's person-centered EHR platform, myUnity, to improve the clinical and operational performance of its day-to-day care delivery to residents.

U.S. Behavioral Health EHR Market Report Highlights

- Based on product, the web/cloud-based EHR segment held the largest revenue share of over 83.52% in 2024 and is anticipated to grow at the fastest growth rate over the forecast year. Web-based EHR systems specifically designed for behavioral health are increasingly vital in U.S. healthcare.

- Based on end use, the private segment held the largest revenue share in 2024 and is anticipated to grow fastest from 2025 to 2030. Private facilities have gradually advanced their technology to serve mental care patients better by providing high-quality infrastructure and clinical services.

- The market regional expansion level is moderate to high, owing to the increasing demand for mental health services and regulatory initiatives promoting EHR adoption. For instance, in May 2020, Holmusk acquired USD 21.5 million in Series A funding led by Health Catalyst Capital (HCC) and Optum Ventures (OV).

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments

- Competitive Landscape: Explore the market presence of key players worldwide

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

The leading players in the U.S. Behavioral Health EHR market include:

- Core Solutions, Inc.

- Meditab

- Holmusk

- Netsmart Technologies, Inc.

- Qualtrics

- Welligent

- Valant

- TherapyNotes, LLC.

- NextStep Solutions

- Cerner Corporation (Oracle)

- TheraNest

- ICANotes

- Streamline Healthcare Solutions

- Practice Fusion, Inc.

- Opus Behavioral Health Inc.

Table of Contents

Companies Mentioned

- Core Solutions, Inc.

- Meditab

- Holmusk

- Netsmart Technologies, Inc.

- Qualtrics

- Welligent

- Valant

- TherapyNotes, LLC.

- NextStep Solutions

- Cerner Corporation (Oracle)

- TheraNest

- ICANotes

- Streamline Healthcare Solutions

- Practice Fusion, Inc.

- Opus Behavioral Health Inc.

Table Information

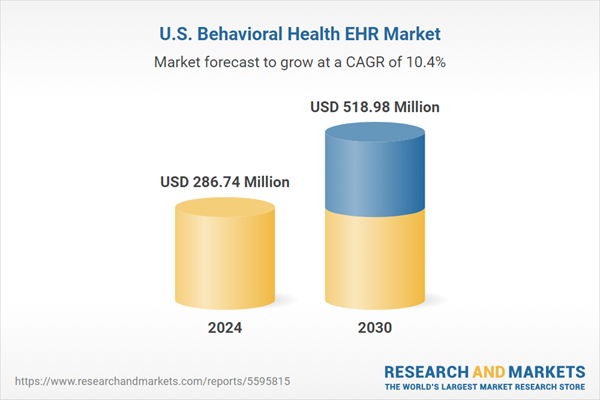

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 286.74 Million |

| Forecasted Market Value ( USD | $ 518.98 Million |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 15 |