The growing benefits associated with cannabinoids on health have been showing affirmative results in a number of research and clinical trials, which has led to expansion in the use of cannabinoids, such as CBD, for various conditions, which in turn has increased the demand for cannabinoid products in the country. In addition, the rising prescription of cannabinoids by medical practitioners, mainly CBD, for certain health conditions has further helped in increasing the demand for these products. For instance, according to a survey of dermatologists carried out in the U.S., in 2020, out of 7176 respondents, around 91% were affirmative about prescribing CBD-based products to their patients. However, the major reason for the non-recommendation of cannabis for medical use was due to the lack of or limited knowledge associated with cannabinoids.

Moreover, many studies suggest affirmative results of cannabis use in reducing the instances of nausea and vomiting caused by chemotherapy. Some other adverse effects of cancer treatment are Chemotherapy-induced Peripheral Neuropathy (CIPN). Multiple clinical trials and research studies are ongoing to develop cannabis-based medication for treating CIPN. For instance, in June 2022, a study to assess the efficacy of topical CBD in managing symptoms of CIPN was sponsored by Mayo Clinic in collaboration with National Cancer Institute, and this study is expected to be completed by April 2024.

Furthermore, major companies are collaborating for the development of novel applications linked with cannabinoids to meet the rising demand which enables businesses to use their resources to help with improvements in supply chain and product development. Moreover, a number of players are also focusing on product launches to expand their product portfolio. For instance, in February 2023, SAVO Cannabis received funding from Brightsmith Capital Partners for the development of new cannabis cultivation genetic facility focusing on the development of cannabis for specific effects majorly targeting body and mind for life-enhancing purposes.

U.S. Cannabinoids Market Report Highlights

- In 2022, Cannabidiol (CBD) segment held the largest share of 26.7% owing to the adoption of CBD not only in medication but also in activities such as sports recovery, wellness, beauty, and skincare

- Pain management segment is anticipated to grow at the fastest CAGR due to the increasing prevalence of chronic pain and analgesic properties associated with cannabinoids

- Neurological disorders segment accounted for a significant market share of 22.1% in 2022 due to the growing research associated with the use of cannabinoids in neurological conditions with the increasing prevalence of the conditions

- The increasing availability of minor cannabinoids is expected to drive the growth of the overall market as consumers seek out new and innovative products containing these compounds

- Key players dominating the market include Mile High Labs; Global Cannabinoids; GenCanna; High Purity Natural Products; Rhizo Sciences; CBD Inc.; LaurelCrest; Fresh Bros Hemp Company; Precision Plant Molecules; BulKanna; Zero Point Extraction, LLC

Table of Contents

Companies Mentioned

- Mile High Labs

- Global Cannabinoids

- GenCanna

- CBD Inc.

- Precision Plant Molecules

- Rhizo Sciences

- LaurelCrest

- Fresh Bros Hemp Company

- BulKanna

- High-Purity Natural Products

- Zero Point Extraction, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | June 2023 |

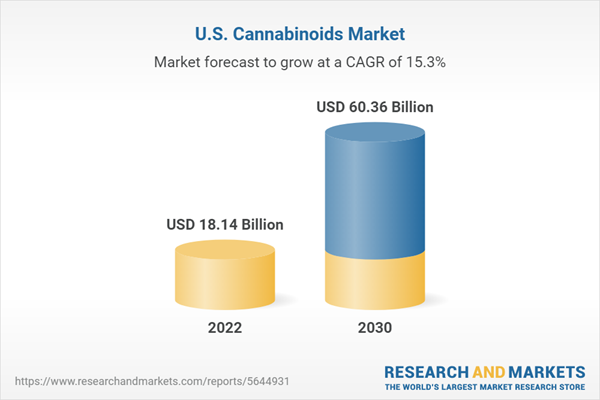

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 18.14 Billion |

| Forecasted Market Value ( USD | $ 60.36 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |