The increasing market competition and the launch of innovative solutions based on next generation sequencing in the oncology field are expected to fuel market growth over the forecast period. For instance, in February 2023, Exact Sciences Corp., a cancer screening and diagnostic testing company, introduced the therapy selection test -OncoExTra in the U.S. It is a next-generation sequencing-based genomic test to help in cancer care. It helps in understanding and characterizing cancer tumors. Moreover, to gain a competitive edge in the industry, companies are collaborating and focusing on advancing in the next generation sequencing. For instance, in January 2020, the two key players operating in the market, Illumina, Inc and F. Hoffmann-La Roche Ltd, signed a 15-year agreement to discover NGS's potential to transform cancer detection, diagnosis, risk prediction, treatment, and monitoring.

Moreover, various articles and studies are being published on the use of NGS in oncology and cancer treatments. For instance, in June 2023, the Lancet published an article on real-world outcomes and the usefulness of NGS testing in cancer patients. Furthermore, in June 2023, the American Society Of Clinical Oncology published a study on the clinical impact of NGS tests for managing advanced cancer in the U.S. Such studies help researchers and clinicians increase awareness and knowledge about the use of NGS for cancer treatments.

Furthermore, the growth of the clinical oncology next-generation sequencing market during the forecast period is expected to witness growth due to reduced sequencing costs. The costs of NGS can be reduced by increasing parallel sequencing and running multiple flow cells to increase sequencing capacity without raising the costs associated with it. These factors are anticipated to boost the market demand over the forecast period in the U.S.

U.S. Clinical Oncology Next Generation Sequencing Market Report Highlights

- NGS sequencing accounted for the largest revenue share of 56.65% in 2024 based on the workflow segment. The dominance of the segments is due to the increasing number of cancer sequencing projects and technological advances in the field.

- Based on the technology, targeted sequencing & resequencing dominated the market with a revenue share of 72.51% in 2024. This can be attributed to the rising use of targeted panels and their efficiency in identifying cancer tumors.

- Based on the application, the screening segment dominated the U.S. clinical oncology NGS market with a revenue share of 79.94% in 2024, owing to the growing prevalence of cancer disorder across the country.

- Based on the end-use, the laboratories segment accounted for the largest share of 63.47% in the U.S. clinical oncology NGS market in 2024. This dominance of the segment is due to the rising research and development activities for cancer treatment.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments

- Competitive Landscape: Explore the market presence of key players worldwide

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

The leading players in the U.S. Clinical Oncology Next Generation Sequencing market include:

- Illumina, Inc.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies

- Myriad Genetics

- Beijing Genomics Institute (BGI)

- Perkin Elmer

- Foundation Medicine

- Pacific Bioscience

- Oxford Nanopore Technologies Ltd.

- Macrogen, Inc.

- Qiagen

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Illumina, Inc.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies

- Myriad Genetics

- Beijing Genomics Institute (BGI)

- Perkin Elmer

- Foundation Medicine

- Pacific Bioscience

- Oxford Nanopore Technologies Ltd.

- Macrogen, Inc.

- Qiagen

Table Information

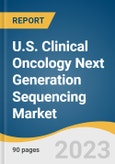

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | October 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 214 Million |

| Forecasted Market Value ( USD | $ 500.4 Million |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 12 |