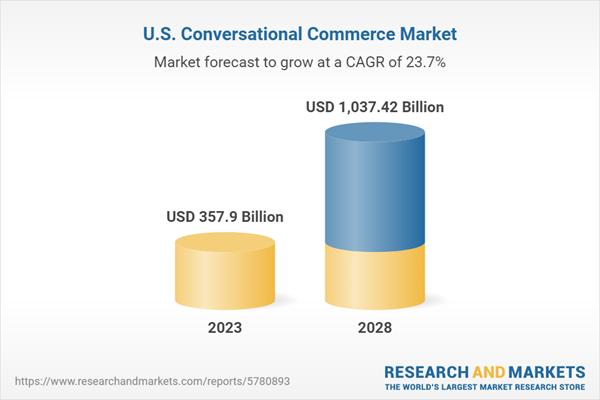

The conversational commerce industry is expected to grow steadily over the forecast period, recording a CAGR of 23.7% during 2022-2028. The conversational commerce transaction value in the country will increase from US$357.9 billion in 2023 to reach US$1,037.4 billion by 2028.

Conversational commerce is gaining strong momentum in the United States and the trend is projected to further continue in 2023. The rise of interactive marketing messages is driving the growth of the industry. Consumers are also inclined towards conversational commerce in the North American market.

With consumers willing to share their personal information in exchange for higher-value, conversational commerce is poised to record strong growth in the United States market over the next three to four years.

Global firms are partnering with US-based conversational commerce providers to drive customer engagement

More and more businesses are seeking to leverage conversational commerce capabilities to drive customer engagement and revenue. To incorporate such capabilities, businesses are forging strategic alliances with United States-based conversational commerce providers.- In November 2022, Razer, one of the leading lifestyle brands for gamers, announced that the firm had entered into a strategic collaboration with Vonage to access its conversational commerce application, Jumper.ai. Through Jumper.ai, Razer is seeking to engage its customers in the Asia Pacific region. Furthermore, it also plans to drive purchases of gaming gear and accessories on social media platforms through its collaboration with Vonage.

Conversational commerce is driving the digital customer base for quick-service restaurants in the United States

With growing digitalization, quick-service restaurants are also leveraging new-age commerce capabilities to drive their revenue and sales growth in the United States. This has led to growing investment in the conversational commerce space over the last few years. This investment in the space is driving positive results for quick-service restaurant giants. For instance,- Yum Brands, the parent firm that operates KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill, announced that its conversational commerce platform Tictuk is driving the digital customer base and sales. With millions of orders processed in 2022, the firm is planning to further launch conversational commerce capabilities in more stores worldwide. At the end of 2022, the technology was live in more than 3,200 stores across 49 markets.

Strategic collaborations between industry giants to boost conversational commerce growth in the United States

With commerce changing at a rapid rate in the United States, firms are constantly innovating with their products and services to deliver more value for their customers. To enhance their value offering, firms are also entering into strategic collaborations in the conversational commerce space.- In September 2022, Meta and Salesforce, two of the leading businesses in their verticals, entered into a strategic collaboration to deliver more value for their customers and drive their business growth. As part of the partnership, all businesses that make use of Salesforce’s platform will be able to use WhatsApp Business messages to run marketing campaigns, answer customer questions, and sell products through messages.

This report provides a detailed data centric analysis of conversational commerce industry, covering market opportunities and risks. With over 50+ KPIs at country level, this report provides a comprehensive understanding of conversational commerce market dynamics, market size and forecast, and market share statistics.

The research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view on emerging business and investment market opportunities.

Scope

This report provides in-depth, data-centric analysis of conversational commerce in United States. Below is a summary of key market segments:United States Conversational Commerce Industry Market Size and Future Growth Dynamics by Key Performance Indicators

- Transaction Value

- Transaction Volume

- Average Value Per Transaction

United States Conversational Commerce Industry Market Size and Forecast by Virtual Assistant Type

- AI-Based Virtual Assistants

- Non-Intelligent Chatbot

United States Conversational Commerce Industry Market Size and Forecast by Virtual Assistant Type

- Chatbots

- Digital Voice Assistants

- OTT Messaging

- RCS Messaging

United States Conversational Commerce Industry Market Size and Forecast by Chatbots

- Web-Based

- App-Based

United States Conversational Commerce Industry Market Size and Forecast by Key Sectors

- Retail Shopping

- Travel & Hospitality

- Online Food Service

- Media and Entertainment

- Healthcare and Wellness

- Financial Services

- Technology Products and Services

- Other Sectors

United States Conversational Commerce Industry Market Size and Forecast in Key Sectors by Product Offering

- Retail Shopping By Chatbots

- Travel & Hospitality By Chatbots

- Online Food Service By Chatbots

- Media and Entertainment By Chatbots

- Healthcare and Wellness By Chatbots

- Financial Services By Chatbots

- Technology Products and Services By Chatbots

- Other Sectors By Chatbots

- Retail Shopping By Digital Voice Assistants

- Travel & Hospitality By Digital Voice Assistants

- Online Food Service By Digital Voice Assistants

- Media and Entertainment By Digital Voice Assistants

- Healthcare and Wellness By Digital Voice Assistants

- Financial Services By Digital Voice Assistants

- Technology Products and Services By Digital Voice Assistants

- Other Sectors By Digital Voice Assistants

- Retail Shopping By OTT Messaging

- Travel & Hospitality By OTT Messaging

- Online Food Service By OTT Messaging

- Media and Entertainment By OTT Messaging

- Healthcare and Wellness By OTT Messaging

- Financial Services By OTT Messaging

- Technology Products and Services By OTT Messaging

- Other Sectors By OTT Messaging

- Retail Shopping By RCS Messaging

- Travel & Hospitality By RCS Messaging

- Online Food Service By RCS Messaging

- Media and Entertainment By RCS Messaging

- Healthcare and Wellness By RCS Messaging

- Financial Services By RCS Messaging

- Technology Products and Services By RCS Messaging

- Other Sectors By RCS Messaging

United States Conversational Commerce Industry Market Size and Forecast by Organization Size

- Large Enterprise

- Medium-Sized Enterprise

- Small Enterprise

United States Total Spend on Conversational Commerce Market

United States Conversational Commerce Industry Market Size and Forecast by Spend on Application

- Software Application

- IT Services

- Consulting Services

United States Conversational Commerce Spend on Key Sectors

- Retail Shopping

- Travel & Hospitality

- Online Food Service

- Media and Entertainment

- Healthcare and Wellness

- Financial Services

- Technology Products and Services

- Other Sectors

Reasons to buy

- In-depth Understanding of United States Conversational Commerce Market Dynamics: Understand market opportunities and key trends along with forecast in United States.

- Insights into Opportunity by end-use sectors: Get market dynamics by end-use sectors to assess emerging opportunity across various end-use sectors.

- Insights into Opportunity by products: Get market dynamics by key products of conversational commerce.

- Develop Market Specific Strategies: Identify growth segments and target specific opportunities.

- Develop proactive and lucrative business strategies through market intelligence and forward-looking analysis of conversational market opportunities in United States.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 357.9 Billion |

| Forecasted Market Value ( USD | $ 1037.42 Billion |

| Compound Annual Growth Rate | 23.7% |

| Regions Covered | United States |