The ongoing opioid crisis has intensified the need for comprehensive drug testing services, with both government agencies and private organizations investing in expanded testing capabilities to address this public health emergency. In addition, the rise in recreational drug use, including cannabis, in several states, has increased the demand for testing solutions that can differentiate between legal and illegal substances, contributing to the market expansion.

The regulatory environment in the U.S. continues to support market growth, as stringent workplace drug testing policies and guidelines from organizations like SAMHSA and DOT ensure the widespread adoption of testing services. Employers across industries such as transportation, healthcare, and manufacturing are increasingly implementing drug testing protocols to comply with these regulations and ensure workplace safety. The introduction of new testing technologies, such as rapid testing kits, saliva-based tests, and mobile testing units, has further fueled market growth by providing more convenient, cost-effective, and accurate solutions for drug detection.

Technological innovation is also a major driver of market growth, as advancements in testing technologies are making drug testing more efficient, accurate, and accessible. The introduction of multiplex testing platforms and automation in laboratories has improved turnaround times and reduced human error, while artificial intelligence and machine learning applications offer enhanced data analysis capabilities for better decision-making. These innovations are attracting new market players and investors, fostering competition and further propelling market expansion. In addition, increasing acceptance of at-home drug testing kits and mobile testing services has broadened the market, appealing to both individuals and organizations seeking convenient, non-invasive solutions.

Some key players in the market are Omega Laboratories, Inc., Clinical Reference Laboratory (CRL), Inc., Millennium Health, LLC, Cordant Health Solutions, Psychemedics Corporation, Abbott, DrugScan, Quest Diagnostics, Legacy Medical Services, and Laboratory Corporation of America Holdings. Key players are focusing on new product launches to increase their market presence. For instance, In October 2023, Psychemedics Corporation revealed its Advanced 5- Panel Drug Screen, a U.S. FDA-cleared test designed to identify fentanyl. This new panel addresses the increasing prevalence of fentanyl and includes tests for PCP, cocaine, amphetamines, and opioids. It significantly improves accuracy, being 25 times more effective at detecting opioids, 23 times more for cocaine, and 13 times more for amphetamines compared to conventional tests.

U.S. Drug Of Abuse Testing Services Market Report Highlights

- Based on drug, the cannabis/marijuana accounted for 57.32% revenue share in 2024. With legalization of cannabis in various states across the U.S, the illicit consumption of cannabis has been increasing across age groups. This is the major factor for the segment dominance within the U.S.

- The growing prevalence of substance abuse, particularly opioids and synthetic drugs, has driven the need for expanded testing services in the U.S. This trend is further supported by rising public health concerns and efforts to combat the opioid crisis through early detection and intervention

- Stringent regulatory mandates such as the Drug-Free Workplace Act and Department of Transportation (DOT) regulations have resulted in routine drug testing for safety-sensitive positions, contributing to high demand for testing services

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

Table of Contents

Companies Mentioned

- Quest Diagnostics

- Abbott

- Clinical Reference Laboratory (CRL), Inc

- Laboratory Corporation of America Holdings

- Cordant Health Solutions

- Legacy Medical Services

- DrugScan

- Omega Laboratories, Inc.

- Psychemedics Corporation

- Millennium Health, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 74 |

| Published | November 2024 |

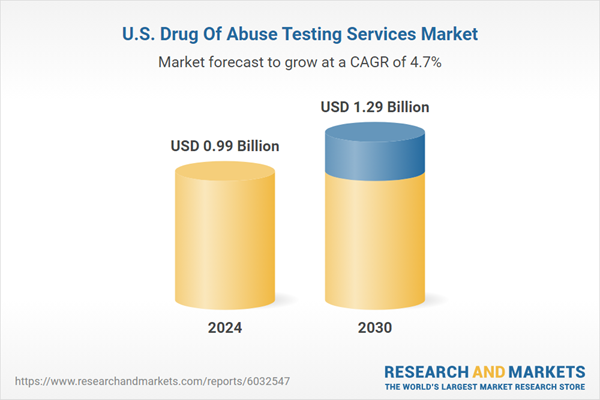

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.99 Billion |

| Forecasted Market Value ( USD | $ 1.29 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |